Chapter: Automation, Production Systems, and Computer Integrated Manufacturing : Manufacturing Operations

Costs of Manufacturing Operations

COSTS OF MANUFACTURING OPERATIONS

Decisions on automation and production systems

are usually based on the relative costs of alternatives. In this section we

examine how these costs and cost factors are determined.

1

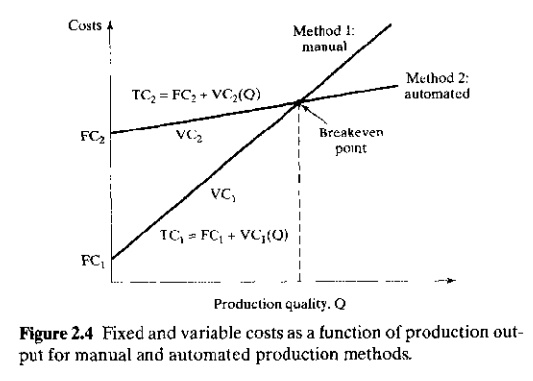

Fixed and Variable Costs

Manufacturing costs can be classified into two

major categories: (1) fixed costs and (2) variable costs. A fixed cost is one that remains constant

for any level of production output. Examples include the cost of the factory

building and production equipment, insurance, and property taxes. All of the

fixed costs can be expressed as annual amounts. Expenses such as insurance and

property taxes occur naturally as annual costs. Capital investments such as

building and equipment can be converted to their equivalent uniform annual

costs using interest rate factors.

A variable cost is one that varies in proportion to the level of

production output. As output increases, variable cost increases. Examples

include direct labor, raw materials, and electric power to operate the

production equipment. The ideal concept of variable cost is that it is directly

proportional to output level. When fixed cost and variable cost are added, we

have the following total cost equation:

|

TC=FC+VC(Q) |

(2.27) |

where TC=total annual cost ($

yr), FC=fixed annual cost ($ yr), VC=variable cost ($ pc), and Q=annual

quantity produced (pc yr).

When comparing automated and

manual production methods (Section 1.4), it is typical that the fixed cost of

the automated method is high relative to the manual method, and the variable

cost of automation is low relative to the manual method, as pictured in Figure

2.4. Consequently, the manual method has a cost advantage in the low quantity

range, while automation has an advantage for high quantities. This reinforces

the arguments presented in Section 1.4.1 on the appropriateness of manual labor

for certain production situations.

2

Direct Labor, Material, and Overhead

Fixed versus variable are not the only possible

classifications of costs in manufacturing. An alternative classification

separates costs into: (1) direct labor, (2) material, and (3) overhead. This is

often a more convenient way to analyze costs in production. The direct labor cost is the sum of the wages and benefits paid to the workers who

operate the production equipment and

perform the processing and assembly tasks. The material cost is the cost of all raw materials used to make the

product. In the case of a stamping plant, the raw material consists of the

steel sheet stock used to make stampings. For the rolling mill that made the

sheet stock, the raw material is the iron ore or scrap iron out of which the

sheet is rolled. In the case of an assembled product, materials include

component parts manufactured by supplier firms. Thus, the definition of “raw

material” depends on the company. The final product of one company can be the

raw material for another company. In terms of fixed and variable costs, direct

labor and material must be considered as variable costs.

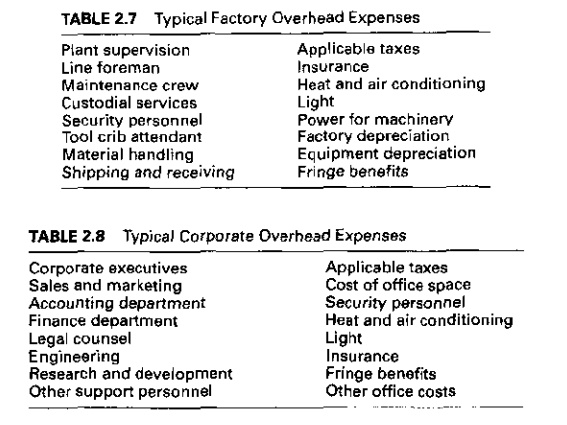

Overhead costs are all

of the other expenses associated with running the manufacturing firm. Overhead

divides into two categories: (1) factory overhead and (2) corporate overhead. Factory overhead consists of the costs

of operating the factory other than direct labor and materials. The types of

expenses included in this category are listed in Table 2.7. Factory overhead is

treated as fixed cost, although some of the items in our list could be correlated

with the output level of the plant. Corporate

overhead is the cost of running the company other than its manufacturing

activities. A list of typical corporate overhead expenses is presented in Table

2.8. Many companies operate more than one factory, and this is one of the

reasons for dividing overhead into factory and corporate categories. Different

factories may have significantly different factory overhead expenses.

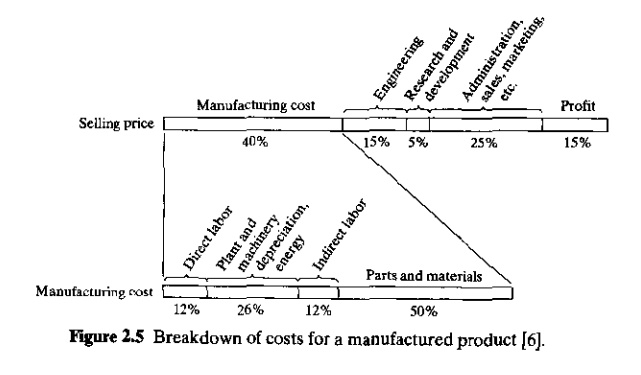

J. T. Black [6] provides some

typical percentages for the different types of manufacturing and corporate

expenses. These are presented in Figure 2.5. We might make several observations

about these data. First, total manufacturing cost represents only about 40% of

the product’s selling price. Corporate overhead expenses and total

manufacturing cost are about equal. Second, materials (and parts) make up the

largest percentage of total manufacturing cost, at around 50%.And third, direct

labor is a relatively small proportion of total manufacturing cost: 12% of

manufacturing cost and only about 5% of final selling price.

Overhead costs can be

allocated according to a number of different bases, including direct labor

cost, material cost, direct labor hours, and space. Most common in industry is

direct labor cost, which we will use here to

illustrate how overheads are allocated and subsequently used to compute factors

such as selling price of the product.

The allocation procedure

(simplified) is as follows. For the most recent year (or most recent several

years), all costs are compiled and classified into four categories: (1) direct

labor, (2) material, (3) factory overhead, and (4) corporate overhead. The

objective is to determine an overhead

rate (also called burden rate)

that could be used in the following year to allocate overhead costs to a

process or product as a function of the direct labor costs associated with that

process or product. In our treatment, separate overhead rates will be developed

for factory and corporate overheads. The factory

overhead rate is calculated as the ratio of factory overhead expenses

(category 3) to direct labor expenses (category 1); that is,

where FOHR=factory overhead rate, FOHC=annual

factory overhead costs ($ yr); and DLC=annual direct labor costs ($ yr).

The corporate overhead rate is the ratio of corporate overhead expenses

(category 4) to direct labor expenses:

where COHR=corporate overhead rate, COHC=annual

corporate overhead costs ($ yr), and DLC=annual direct labor costs ($ yr). Both

rates are often expressed as percentages. If material cost were used as the

allocation basis, then material cost would be used as the denominator in both

ratios. Let us present two examples to illustrate (1) how overhead rates are

determined and (2) how they are used to estimate manufacturing cost and

establish selling price.

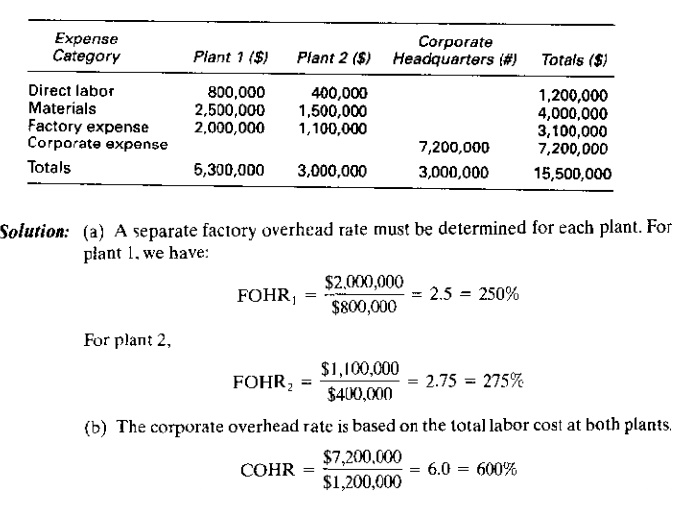

EXAMPLE 2.7 Determining Overhead Rates

Suppose that all costs have been compiled for a

certain manufacturing firm for last year. The summary is shown in the table

below. The company operates two different manufacturing plants plus a corporate

headquarters. Determine: (a) the factory overhead rate for each plant and (b)

the corporate overhead rate. These rates will be used by the firm in the

following year.

EXAMPLE 2.8 Estimating Manufacturing Costs and

Establishing Selling Price

A customer order of 50 parts is to be processed

through plant 1 of the previous example. Raw materials and tooling are supplied

by the customer. The total time for processing the parts (including setup and

other direct labor) is 100 hr.

Direct labor cost is $10.00 hr. The factory

overhead rate is 250% and the corporate overhead rate is 600%. Compute the cost

of the job.

Solution: (a) The direct

labor cost for the job is (100 hr)($10.00 hr)=$1000.

(b) The allocated factory overhead charge, at 250%

of direct labor, is ($1000)(2.50)=$2500.

(c) The allocated corporate overhead charge, at

600% of direct labor, is ($1000)(6.00)=$6000.

Interpretation: (a) The direct labor cost of the job, representing

actual cash spent on the customer’s order=$1000. (b) The

total factory cost of the job, including allocated factory

overhead=$1000+$2500=$3500. (c) The total cost of the job including corporate

overhead=$3500+$6000=$9500. To price the job for the customer and to earn a

profit over the long run on jobs like this, the price would have to be greater

than $9500. For example, if the company uses a 10% markup, the price quoted to

the customer would be (1.10)($9500) = $10,450.

3

Cost of Equipment Usage

The trouble with overhead rates as we have

developed them here is that they are based on labor cost alone. A machine

operator who runs an old, small engine lathe whose book value is zero will be

costed at the same overhead rate as an operator running a new CNC turning

center just purchased for $500,000. Obviously, the time on the machining center

is more productive and should be valued at a higher rate. If differences in

rates of different production machines are not recognized, manufacturing costs

will not be accurately measured by the overhead rate structure.

To deal with this difficulty, it is appropriate

to divide the cost of a worker running a machine into two components: (1)

direct labor and (2) machine. Associated with each is an applicable overhead

rate. These costs apply not to the entire factory operations, but to individual

work centers. A work center is a

production cell consisting of (1) one worker and one machine, (2) one worker

and several machines, (3) several workers operating one machine, or (4) several

workers and machines. In any of these cases, it is advantageous to separate the

labor expense from the machine expense in estimating total production costs.

The direct labor cost

consists of the wages and benefits paid to operate the work center. Applicable

factory overhead expenses allocated to direct labor cost might include state

taxes, certain fringe benefits, and line supervision.The machine annual cost is

the initial cost of the machine apportioned over the life of the asset at the appropriate

rate of return used by the firm. This is done using the capital recovery

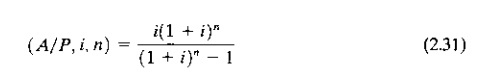

factor, as follows:

where UAC=equivalent uniform

annual cost ($ yr); IC=initial cost of the machine ($); and (A P,i,n)=capital

recovery factor that converts initial cost at year 0 into a series of

equivalent uniform annual yearend values, where i=annual interest rate and

n=number of years in the service life of the equipment. For given values of i

and n, (A P,i,n) can be computed as follows:

Value of (A P, i, n) can also be found in

interest tables that are widely available. The uniform annual cost can be

expressed as an hourly rate by dividing the annual

cost by the number of annual

hours of equipment use. The machine overhead rate is based on those factory

expenses that are directly assignable to the machine. These include power to

drive the machine, floor space, maintenance and repair expenses, and so on. In

separating the factory overhead items in Table 2.7 between labor and machine,

judgment must be used; admittedly, the judgment is sometimes arbitrary. Total

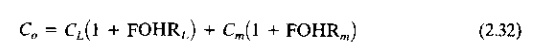

cost rate for the work center is the sum of labor and machine costs. This can

be summarized as follows:

where Co=hourly

rate to operate the work center ($ hr), CL=direct

labor wage rate ($ hr), FOHRL=factory overhead rate for labor, Cm=machine hourly rate ($

hr), and FOHRm=factory overhead rate applicable to machines.

It is the author’s opinion

that corporate overhead expenses should not be included in the analysis when

comparing production methods. Including them serves no purpose other than to

dramatically increase the costs of the alternatives. The fact is that these

corporate overhead expenses are present whether or not either or none of the

alternatives is selected. On the other hand, when estimating costs for pricing

decisions, corporate overhead should be included because over the long run,

these costs must be recovered through revenues generated from selling products.

EXAMPLE 2.9 Hourly Cost of a Work Center

The following data are given:

direct labor rate=$10.00 hr; applicable factory overhead rate on labor=60%;

capital investment in machine=$100,000; service life of the machine=8 yr; rate

of return=20%; salvage value in 8 yr=0; and applicable factory overhead rate on

machine=50%. The work center will be operated one 8hr shift, 250 day yr.

Determine the appropriate hourly rate for the work center.

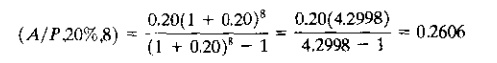

Solution: Labor cost per hour=CLA 1+FOHRLB =$10.00(1+0.60)= $16.00 hr. The investment

cost of the machine must be annualized, using an 8yr service life and a rate of

return=20%. First we compute the capital recovery factor:

Now the uniform annual cost for the $100,000

initial cost can be determined:

UAC=$100,000(A P, 20%, 8)=100,000(0.2606)=$26,060.00

yr

The number of hours per year=(8 hr day)(250 day

yr)=2000 hr yr. Dividing this into UAC gives 26,060 2000=$13.03 hr. Then

applying the factory overhead rate, we have

CmA 1+FOHRmB =$13.03(1+0.50)=$19.55 hr Total

cost rate is

Co=16.00+19.55=$35.55 hr.

Related Topics