Auditing - Vouching of Purchase Returns | 11th Auditing : Chapter 8 : Vouching of Trading Transactions

Chapter: 11th Auditing : Chapter 8 : Vouching of Trading Transactions

Vouching of Purchase Returns

Vouching of Purchase Returns

Goods returned by the client to the suppliers due

to poor quality, defective goods and goods not according to the sample are

recorded in the Purchase Returns Book. When the goods are returned, the

supplier’s account should be debited. The debit is made through the purchase

returns book on the basis of a Debit Note. The supplier, on receipt of the

debit note issues a Credit Note indicating the acceptance of the debt.

Auditors Duty

Auditor before vouching purchase returns, should

ascertain that a proper system of internal check is in existence and should

ensure that full credit is obtained for all goods returned. Further, the

auditor should proceed to vouch purchase returns in the following manner:

1. When goods are returned, auditor should verify

whether it is properly recorded in the Purchase Returns Book or Returns Outward

Register.

2. Auditor should verify the debit note issued by

the client to the supplier or the credit note issued by the supplier.

3. He should vouch the quantity returned with the

Purchase Returns Book, Gatekeepers Outward Register, storekeepers record and

credit notes received from the supplier.

4. The auditor should verify the purchase returns

of the first and last month of the year to avoid manipulation of accounts.

5. The auditor should ensure that current year’s

returns are not accounted in the subsequent year.

Books and Documents to be Vouched: (1) Debit Note, (2)

Purchase Returns Book or Returns

Outward Register, (3) Suppliers Account, (4) Gatekeepers Outward Register.

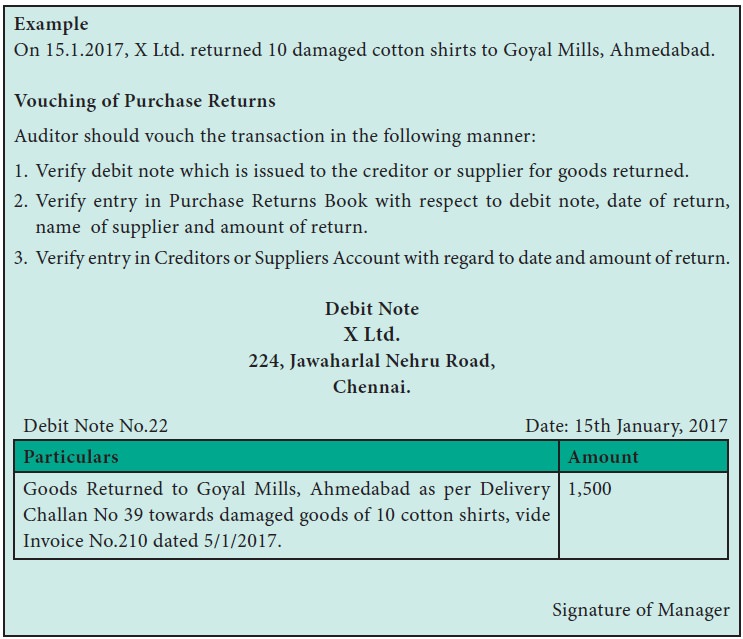

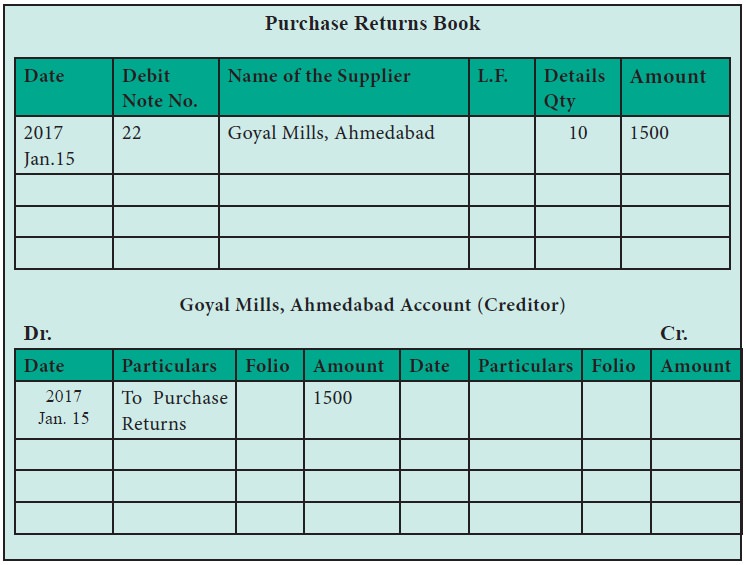

Example

On 15.1.2017, X Ltd. returned 10

damaged cotton shirts to Goyal Mills, Ahmedabad.

Vouching of Purchase Returns

Auditor should vouch the transaction

in the following manner:

1. Verify debit note which is issued

to the creditor or supplier for goods returned.

2. Verify entry in Purchase Returns

Book with respect to debit note, date of return, name of supplier and amount of

return.

3. Verify entry in Creditors or

Suppliers Account with regard to date and amount of return.

Related Topics