Auditing - Vouching of Credit Purchases | 11th Auditing : Chapter 8 : Vouching of Trading Transactions

Chapter: 11th Auditing : Chapter 8 : Vouching of Trading Transactions

Vouching of Credit Purchases

Vouching of Credit Purchases

Transactions relating to credit purchases are

recorded in Purchase Book. The main objective of vouching purchase book is to

ensure that all the goods purchased during the year are being received and the

client makes payment only for the goods being delivered by the supplier. The

auditor before vouching the purchase book should satisfy himself about the

effectiveness of the Internal check and control system relating to purchases.

Auditors Duty

While vouching purchase book the auditor should

consider the following points:

1. The auditor should carefully check the entries

in the Purchase Book with the purchase invoices. While examining the purchase

invoice the auditor should pay attention to the following points:-

a. Invoices are in the name of the client.

b. The date of the invoice should relate to the

period under audit.

c. The name of the creditor in the invoice agrees

with the name entered in the purchases book.

d. Orders should be placed by a responsible officer

and there should be another responsible officer to pass the invoice for

payment.

e. Invoice should be initialed by the Invoice clerk

as being checked.

2. The auditor should vouch the entries in the

Purchase Book with the invoices, copies of orders placed, Goods Inward Book and

delivery notes.

3. He should ensure that only credit purchases are

recorded in the Purchases Book.

4. He should also ensure that purchase of capital

goods, i.e., purchase of plant and machinery or any capital asset are not

entered in Purchase Book. But instead they should be accounted in fixed assets

account.

5. Auditor should check the totalling and casting

of the purchases book and ensure that all taxes, octroi and freight are added

to the purchases and trade discount allowed are deducted.

6. When directors or partners purchase goods for

personal use, auditor should ensure that such purchases are charged to their

personal accounts.

7. Auditor should compare the Gatekeepers Goods

Inward Book and the stock sheets with the purchases book to ensure that all

goods taken into stock have been entered in the purchases book.

Books and Documents to be Vouched:

(1) Purchase Invoice, (2) Purchase

Book, (3) Suppliers ledger account, (4) Gatekeepers Goods Inward Book.

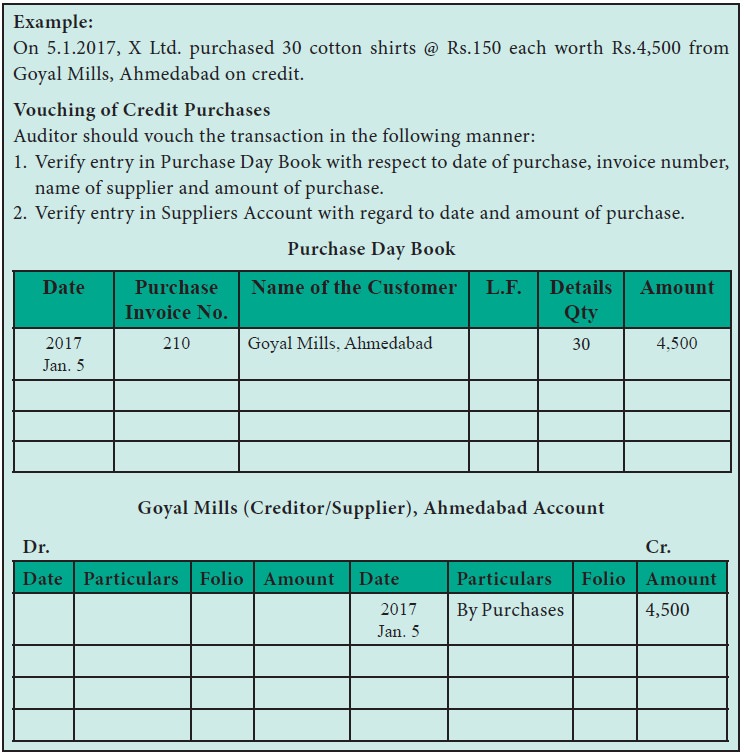

Example:

On 5.1.2017, X Ltd. purchased 30

cotton shirts @ Rs.150 each worth Rs.4,500 from Goyal Mills, Ahmedabad on

credit.

Vouching of Credit Purchases

Auditor should vouch the transaction

in the following manner:

1. Verify entry in Purchase Day Book

with respect to date of purchase, invoice number, name of supplier and amount

of purchase.

2. Verify entry in Suppliers Account

with regard to date and amount of purchase.

Related Topics