Auditing - Verification and Valuation of Other Fixed Assets | 12th Auditing : Chapter 4 : Verification and Valuation of Fixed Assets

Chapter: 12th Auditing : Chapter 4 : Verification and Valuation of Fixed Assets

Verification and Valuation of Other Fixed Assets

Verification and Valuation of Other Fixed Assets

Verification

and valuation of other fixed nature assets are classified into two categories

such as wasting assets and fictitious assets.

The

wasting assets are also known as depleting assets and it has both physical and

legal existence. The fictitious asset does not have market value but it has

legal existence. The procedure for verification and valuation of both these

assets are discussed below.

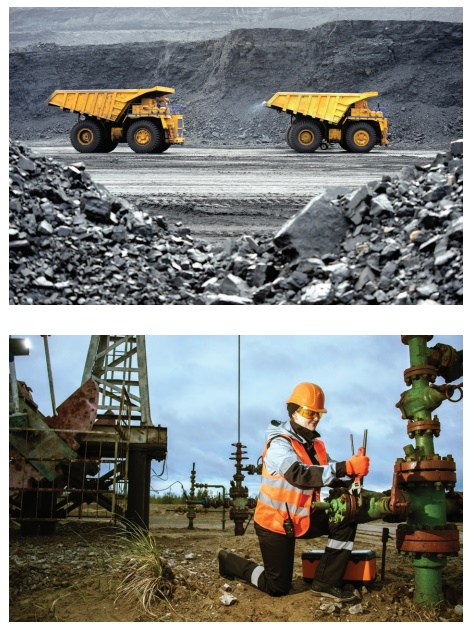

Wasting Asset

It is

also known as depleting assets, wasting assets are of a fixed nature but

depleted or consumed gradually. The process of earning income causes depletion

or exhaustion in the value of the assets. Mines, Oil wells, Quarries are some of

the examples of wasting assets.

There is

a difference between fixed assets and wasting assets.

1. The

Fixed assets are replaceable, whereas wasting assets is irreplaceable after its

useful life is over.

2. The

value of fixed assets decreases due to normal wear and tear, i.e., depreciates

with time and use or due to obsolescence while the value of wasting assets

declines as a result of gradual exhaustion or reducing stock.

Auditor’s Duty

The

auditor should confirm in this regard, the value of the wasting assets in the

Balance Sheet is reduced by the estimated amount of yearly depletion. In other

words, a wasting asset appears in the Balance Sheet as its estimated diminished

value.

Fictitious Asset

The

assets which do not have physical existence are called as Fictitious Asset.

Examples of fictitious assets are - Preliminary Expenses incurred at the time

of formation of the company, Development Expenses, Debenture Discount, Amount

spent on special advertisement campaign, Brokerage, Underwriting Commission and

deferred revenue expenditure.

Auditor's Duties

1. Auditor

should verify that expenses incurred are properly authorised by a responsible

person.

2. He

should ensure that fictitious assets are treated as deferred revenue

expenditure. Deferred Revenue Expenditure means temporary capitalization of

revenue expenditure with the ultimate object of spreading the amount over

several future years to which benefit of such expenditure will be available.

3. The

auditor should confirm that the asset is disclosed in the Balance Sheet at the

amount of expenditure incurred less amount written off.

Related Topics