Auditing - Verification and Valuation of Fixed Assets | 12th Auditing : Chapter 4 : Verification and Valuation of Fixed Assets

Chapter: 12th Auditing : Chapter 4 : Verification and Valuation of Fixed Assets

Verification and Valuation of Fixed Assets

Verification and Valuation of Fixed Assets

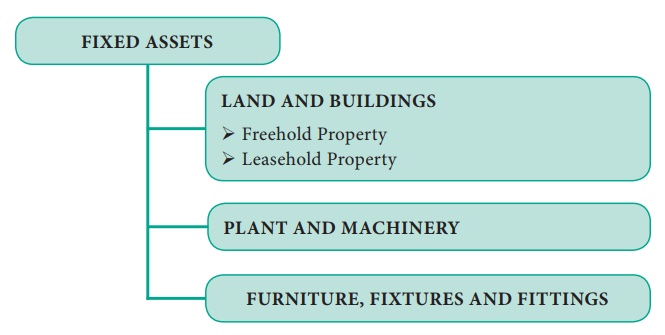

Fixed

assets of are a permanent nature with which the business is carried on and

which are held for earning income and not for re-sale in the ordinary course of

the business. It is a long-term tangible property that a firm owns and uses in

its operations to generate income. Fixed assets are not converted into cash or

consumed within a year. They are also called as Capital Assets. Example: land

and buildings, plant and machinery, furniture etc. These assets are to be

valued at cost price less total depreciation in their value by constant use.

Additions by way of purchase and deletions by way of sales should be taken into

account.The mode of valuation of different types of assets differs depending

upon the nature of the business and the purpose for which the assets are held.

Verification of Fixed Assets can be explained as follows:

1. Land and Buildings

Land

means a long -term asset that refers to the cost of real property exclusive of

the cost of any constructed assets on the property. The value of land has an

appreciated value and is not subject to depreciation. A building is a

noncurrent or long-term asset which shows the cost of a building (excluding the

cost of the land) . Buildings will be depreciated over their useful life of the

asset.

·

Classified

into two types

Land and

Buildings can further be classified as –

A Freehold

property.

B Leasehold

property

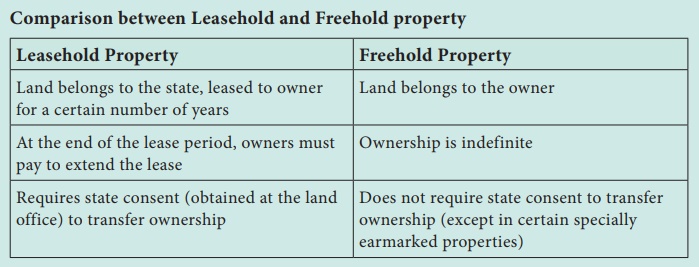

(A) Freehold Property

A

property which is free from hold (Possession/Rights) is called as freehold

property. This means that the property is free from the hold of anybody besides

the owner who enjoys complete ownership.

Auditor’s Duty

1. Where

Freehold property has been purchased, the auditor should examine the title

deeds e.g., purchase deed, certificate of registration, the broker’s note and

auctioneer’s account etc., to verify the correct position.

2. When the

property has been mortgaged, the auditor should obtain a certificate from the

mortgagee regarding the possession of title deed and outstanding amount of

loan.

3. When

the property has been acquired in the current year, then the cost may be

verified with the help of the bank passbook. He should vouch all the payments

made in this connection.

4. He

should see that the property account should be shown in the Balance Sheet at

cost price including the legal and registration charges less depreciation

up-to-date.

5. He

should also see that a separate account for building and land on which it is

constructed is maintained. It is necessary because depreciation is provided for

building and not for the land.

(B) Leasehold Property

Leasehold

is an accounting term for an asset being leased. The asset is typically

property such as a building or space in a building.

·

The property which is on lease (rent).

·

The property (plot/flat/villa/mall/ factories)

which is leased by the landlord for a certain period of time to the lessee (tenant

/leaseholder/renter/ occupant/dweller).

·

The (tenants) have been given the right to use

during that specified time by the landlord.

·

The ownership of the property returns to the

landlord when the lease comes to an end.

Auditor’s Duty

1. The auditor should verify this by inspecting the

lease agreement or contract to find out value and duration. He should see that

the terms and conditions of lease are properly complied with.

2. In case

property has been mortgaged, the auditor should obtain a certificate from the

mortgagee regarding the possession of title deed.

3. Where

the leasehold property has been sub-let, the counter part of the tenant’s

agreement should also be examined.

4. The

auditor should physically inspect the properties.

5. The

auditor should also note that proper provision has been made for depreciation

of lease problem and for any possible claims arising there under.

2. Plant and Machinery

A plant

is an asset with a useful life of more than one year that is used in producing

revenues in a business’s operations. Plant is recorded at cost and depreciation

is reported during their useful life.

Auditor's Duty

1. When the

machines are purchased in the current accounting period, the invoices and the

agreement with the vendors should be verified.

2. The

auditor should ` examine the plant register in which particulars about the

cost, records about sales, provision for depreciation, etc., are available.

3. He

should prepare a list of each machine from the plant register and should get

the list certified by the works manager as he is not a technical person and

therefore he has to depend upon the advice of the works manager regarding their

valuation, etc.

4. He

should see that plant and machinery account is shown in the Balance Sheet at cost

less depreciation after making proper adjustment for purchases and sales during

the year under audit.

5.

In case any plant and machinery has been

scrapped, destroyed or sold, he should ascertain that the profit or loss

arising thereon has been correctly determined.

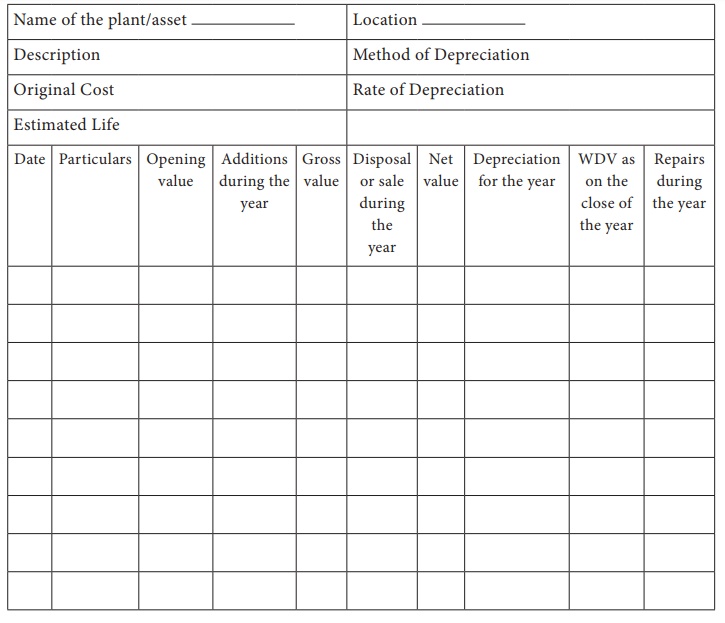

A proforma of plant & machine register is given below

3. Furniture, Fixtures and Fittings

They are

items of movable equipment that are used to furnish an office. Examples are

chairs, desks, shelves, book cases, filing and other similar items.

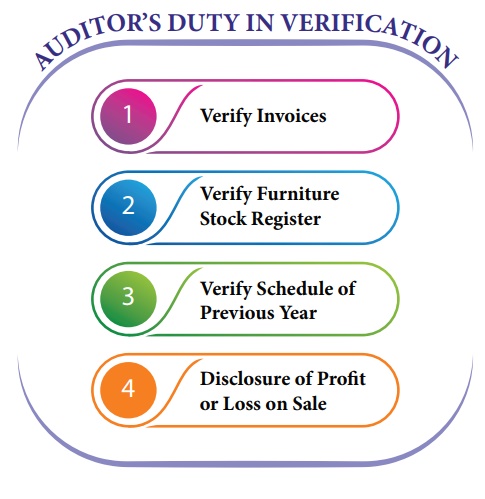

Auditor's Duty

1. Verify Invoices: When

assets have been acquired during the

current accounting period, the auditor should examine the purchase invoice of

the dealers.

2. Verify Furniture Stock Register: He should verify furniture stock register

and ask the management to prepare an inventory to reconcile it with the stock

register.

3. Verify Schedule of Previous Year: He

should compare furniture schedule of previous year with that of current year to

ascertain the existence, purchase or sales of asset during the year.

4. Disclosure of Profit or Loss on Sale: He

should examine that any profit or loss on sale of furniture during the year is

properly disclosed in books of accounts.

VALUATION OF FIXED ASSETS

1.

Valuation

of Land: Land which does not have

depreciated value, is valued at cost price.

2.

Valuation

of Other Fixed Assets: Other fixed assets like Buildings, Plant,

machinery, office equipment, furniture and fixtures should be valued at going

concern value.

3.

Depreciation:

Auditor should ensure that

adequate amount of depreciation has been provided, taking into account the

working life and usage of the asset.

4.

Disclosure

in Balance Sheet: He should

verify that furniture, fittings and fixtures are disclosed in Balance Sheet at

cost less depreciation.

Related Topics