Auditing - Valuation: Meaning, Definition, Objectives, Methods | 12th Auditing : Chapter 4 : Verification and Valuation of Fixed Assets

Chapter: 12th Auditing : Chapter 4 : Verification and Valuation of Fixed Assets

Valuation: Meaning, Definition, Objectives, Methods

Valuation

Meaning

Valuation

means finding out correct value of the assets on a particular date. It is an

act of determining the value of assets and critical examination of these values

on the basis of normally accepted accounting standard. Valuation of assets is

to be made by the authorized officer and the duty of auditor is to see whether

they have been properly valued or not. For ensuring the proper valuation,

auditor should obtain the certificates of professionals, approved values and

other competent persons. Valuation is the primary duty of company officials.

Auditor can rely upon the valuation of concerned officer but it must be clearly

stated in the report because an auditor is not a technical person. Without

valuation, verification of assets is not possible.

If the

valuation of assets is not correct, both the financial statements such as

Balance Sheet and Profit and Loss Account cannot be correct. Hence, the auditor

must take utmost care while valuing the assets to show true and fair view of

the state of affairs of the financial position of the concern.

Definition

R.Batliboi, “A company’s Balance Sheet is not drawn for the

purpose of showing what the capital would be worth if the assets were realized

and liabilities paid -off, but to show how the capital stands invested”.

Joseph Lancaster, “The valuation of assets is therefore an

attempt to equitable distribution of the original outlay on the period of the

assets usefulness”.

Objectives of Valuation

1.

To assess the correct financial position of the

concern.

2.

To enquire about the mode of investment of the

capital of the concern.

3.

To assess the goodwill of the concern.

4.

To evaluate the differences in the value of the

asset as on the date of purchase and on the date of Balance Sheet.

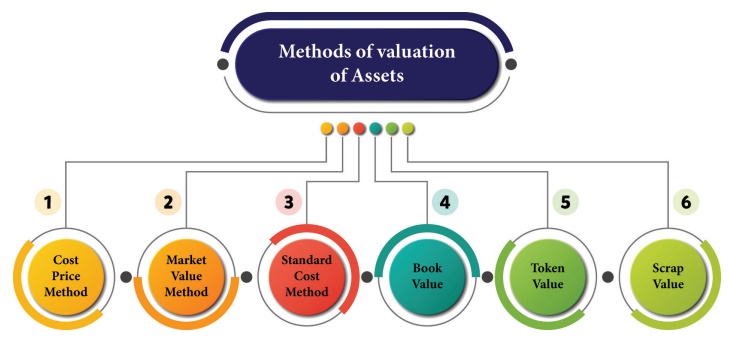

Methods Of Valuation

Valuation

of various assets can be made by using different methods of valuation of fixed

assets. Some of the major methods are as follows:

1. Cost Price Method

In this

method, valuation of assets is made on the basis of purchase price of the

assets. This price refers to the price at which an asset is acquired plus

expenses incurred in connection with the acquisition of an asset. It is a very

simple method of valuing assets.

2. Market Value Method

Valuation

of assets can be made on the basis of market price of such assets. But if same

nature of assets is not available in the market, it is very difficult to

determine the value of such assets. So, there are two methods related to it.

They are:

i. Replacement Value Method

It

represents the value at which a given asset can be replaced. This method of

valuation of assets can be done only in the case of replacement of the same

asset.

ii. Net Realizable Value

It

refers to the price in which such asset can be sold in the market. But

expenditure incurred at the sale of such asset should be deducted.

3. Standard Cost Method

Some of

the business organizations fix the standard cost on the basis of their past

experience. On the basis of standard cost, they make valuation of assets and

present in the Balance Sheet.

4. Book Value

This is

the value at which an asset appears in the books of accounts. It is usually the

cost less depreciation written off so far.

5. Going concern or Historical Value or

Conventional Value or Token Value

It is

equivalent to the cost less a reasonable amount of depreciation written off. No

notice is taken of any fluctuation in the price of the assets. Reason for this

is that these assets are acquired for use in the business and not for resale.

6. Scrap Value

This

method shows the value realized from sale of an asset as scrap. In other words,

it refers to the value, which may be obtained from the assets if it is sold as

scrap.

Auditor’s Duty as Regards Valuation

In a

legal case against Kingston Cotton Mills Co: It was held that “although it is

no part of an Auditor's’ duty to value the assets and liabilities, yet he must

exercise reasonable skill and care in scrutinizing the basis of valuation. He

should test the accuracy of the values put by the officers of the business. In

any case, the auditor cannot guarantee the accuracy of the valuation”.

It is

not an auditor's duty to determine the values of various assets. It has been

judicially held that he is not a valuer or a technical man to estimate the

value of an asset. But he is definitely concerned with values set against the

assets. He has to certify that the profit and loss account shows true profit or

loss for the year and Balance Sheet shows a true and fair view of the state of

affairs of the company at the close of the year. Therefore he should exercise

reasonable care and skill, analyse all the figures critically, inquire into the

basis of valuation from the technical experts and satisfy himself that the

different classes of assets have been valued in accordance with the generally

accepted assumptions and accounting principles. If the market value of the

assets are available i.e., in the case of share investment then he should verify

the market value with the stock exchange quotations. If there is any change in

the mode of the valuation of an asset, he should seek proper explanation for

it. If he is satisfied with the method of valuation of the assets he is free

from his liability.

Related Topics