Chapter: Business Science : Financial Management : Financing and Dividend Decision

Uses and Distinguish Between Operating Leverage and Financial Leverage

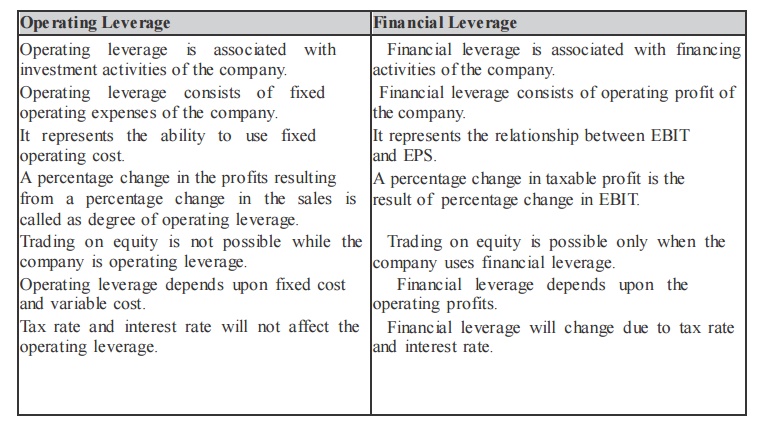

DISTINGUISH BETWEEN OPERATING LEVERAGE AND FINANCIAL LEVERAGE

Operating Leverage

Operating leverage is associated with investment activities of the company.

Operating leverage consists of fixed operating expenses of the company.

It represents the ability to use fixed operating cost.

A percentage change in the profits resulting from a percentage change in the sales is called as degree of operating leverage.

Trading on equity is not possible while the company is operating leverage.

Operating leverage depends upon fixed cost and variable cost.

Tax rate and interest rate will not affect the operating leverage.

Financial Leverage

Financial leverage is associated with financing activities of the company.

Financial leverage consists of operating profit of the company.

It represents the relationship between EBIT and EPS.

A percentage change in taxable profit is the result of percentage change in EBIT.

Trading on equity is possible only when the company uses financial leverage.

Financial leverage depends upon the operating profits.

Financial leverage will change due to tax rate and interest rate.

Uses of Operating Leverage

Operating leverage is one of the techniques to measure the impact of changes in sales which lead for change in the profits of the company.

If any change in the sales, it will lead to corresponding changes in profit. Operating leverage helps to identify the position of fixed cost and variable cost.

Operating leverage measures the relationship between the sales and revenue of the company during a particular period.

Operating leverage helps to understand the level of fixed cost which is invested in the operating expenses of business activities.

Operating leverage describes the over all position of the fixed operating cost.

Uses of Financial Leverage

Financial leverage helps to examine the relationship between EBIT and EPS.

Financial leverage measures the percentage of change in taxable income to the percentage change in EBI T.

Financial leverage locates the correct profitable financial decision regarding capital structure of the company.

Financial leverage is one of the important devices which is used to measure the fixed cost proportion with the total capital of the company.

If the firm acquires fixed cost funds at a higher cost, then the earnings from those assets, the earning per share and return on equity capital will decrease.

The impact of financial leverage can be understood with the help of the following exercise.

Related Topics