Chapter: Business Science : Financial Management : Financing and Dividend Decision

Leverages

Leverages

Leverage refers to ―an increased means of

accomplishing some purpose‖. Leverage allows us to accomplish certain things

which are otherwise not possible, viz lifting of heavy objects with the help of

leverages.

In financial management , the term ‗leverage‘ is

used to describe the firm‘s ability to use fixed cost asset or funds to

increase the return to its owners i.e, Equity shareholders.

The employment of an asset or sources of funds for

which the firm has to pay a fixed cost or fixed return. The fixed cost is also

called as fixed operating cost and the fixed return is called financial cost

remains constant irrespective of the change in volume of output of sales

Higher

the degree of leverage, higher is the risk as well as return to the owner.

1. Financial

leverage or Trading on equity

2. Operating

leverage

3. Combined

leverage or composite leverage

1 Financial leverage

Leverage activities with financing activities is called

financial leverage. Financial leverage represents the relations hip between the

company‘s earnings before interest and taxes (EBIT) or operating profit and the

earning available to equity shareholders.

Financial

leverage is defined as ―the ability of a firm to use fixed financial charges to

magnify the effects of changes in EBIT on the earnings per share‖.

Financial

leverage may be favourable or unfavourable depends upon the use of fixed cost

funds. Favourable financial leverage occurs when the company earns more on the

assets purchased with the funds, then the fixed cost of their use. Hence, it is

also called as positive financial leverage.

Unfavourable

financial leverage occurs when the company does not earn as much as the funds

cost. Hence, it is also called as negative financial leverage.

Financial

leverage can be calculated with the help of the following formula:

Degree of Financial Leverage

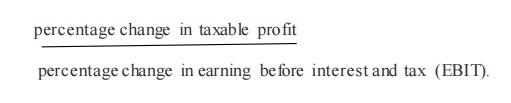

Degree of

financial leverage may be defined as the percentage change in taxable profit as

a result of percentage change in earning before interest and tax (EBIT). This

can be calculated by the following formula

Alternative Definition of Financial Leverage

According

to Gitmar, ―financial leverage is the ability of a firm to use fixed financial

changes

to magnify the effects of change in EBIT and EPS‖.

FL =

Financial Leverage

EBIT =

Earning Before Interest and Tax

EPS = Earning

Per share.

2 Uses of Financial Leverage

Financial leverage helps to

examine the relationship between EBIT and EPS.

Financial leverage measures the

percentage of change in taxable income to the percentage change in EBI T.

Financial leverage locates the

correct profitable financial decision regarding capital structure of the

company.

Financial leverage is one of the

important devices which is used to measure the fixed cost proportion with the

total capital of the company.

If the firm acquires fixed cost

funds at a higher cost, then the earnings from those assets, the earning per

share and return on equity capital will decrease.

The impact of financial leverage

can be understood with the help of the following exercise.

3 Operating leverage

The leverage associated

with investment activities is

called as operating leverage.

Operating leverage can be calculated with the

help of the following formula:

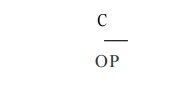

W here,

OL =

Operating Leverage

C =

Contribution

OP =

Operating Profits

Uses of Operating Leverage

Operating

leverage is one of the techniques to measure the impact of changes in sales

which lead for change in the profits of the company.

If any

change in the sales, it will lead to corresponding changes in profit. Operating

leverage helps to identify the position of fixed cost and variable cost.

Operating leverage measures the relationship

between the sales and revenue of the company during a particular period.

Operating leverage helps to understand the

level of fixed cost which is invested in the operating expenses of business

activities.

Operating leverage describes the over all

position of the fixed operating cost.

DISTINGUISH BETWEEN OPERATING LEVERAGE AND

FINANCIAL LEVERAGE

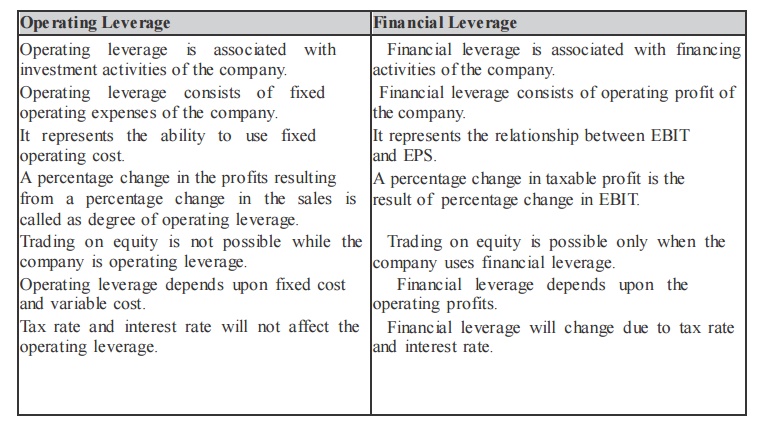

Operating Leverage

Operating

leverage is associated with investment activities of the company.

Operating

leverage consists of fixed operating expenses of the company.

It

represents the ability to use fixed operating cost.

A

percentage change in the profits resulting from a percentage change in the

sales is called as degree of operating leverage.

Trading

on equity is not possible while the company is operating leverage.

Operating

leverage depends upon fixed cost and variable cost.

Tax rate

and interest rate will not affect the operating leverage.

Financial Leverage

Financial

leverage is associated with financing activities of the company.

Financial

leverage consists of operating profit of the company.

It represents

the relationship between EBIT and EPS.

A

percentage change in taxable profit is the result of percentage change in EBIT.

Trading

on equity is possible only when the company uses financial leverage.

Financial

leverage depends upon the operating profits.

Financial

leverage will change due to tax rate and interest rate.

Composite leverage

Combination

of operating &financial leverage is called composite leverage

Working Capital Leverage

One of

the new models of leverage is working capital leverage which is used to locate

the investment in working capital or current assets in the company.

Working capital leverage measures the sensitivity of return in investment of charges in the level of current assets.

Related Topics