Chapter: Business Science : Financial Management : Financing and Dividend Decision

Designing Capital structure

Designing Capital structure

Capital

structure is the major part of the firm‘s financial decision which affects the

value of the firm and it leads to change EBIT and market value of the shares.

There is a relations hip among the capital structure, cost of capital and value

of the firm. The aim of effective capital structure is to maximize the value of

the firm and to reduce the cost of capital.

There are

two major theories explaining the relations hip between capital struc ture,

cost of capital and value of the fir m.

Traditional Approach

It is the

mix of Net Income approach and Net Operating Income approach. Hence, it is also

called as inter mediate approach. According to the traditional approach, mix of

debt and equity capital can increase the value of the firm by reducing overall

cost of capital up to certain level of debt. Traditional approach states that

the Ko decreases only within the responsible limit of financial leverage and

when reaching the minimum level, it starts increasing with financial leverage.

Assumptions

Capital

structure theories are based on certain assumption to analysis in a single and

convenient manner:

There are only two sources of

funds used by a firm; debt and shares.

The firm pays 100% of its earning

as dividend.

The total assets are given and do

not change.

The total finance re ma ins constant.

The operating profits (EBIT) are

not expected to grow.

The business risk re mains constant.

The firm has a perpetual life.

The investors behave rationally.

Net Income (NI) Approach

Net

income approach suggested by the Dura nd. According to this approach, the

capital structure decision is relevant to the valuation of the firm. In other

words, a change in the capital structure leads to a corresponding change in the

overall cost of capital as well as the total value of the firm.

According

to this approach, use more debt finance to reduce the overall cost of capital and increase the value of fir m.

Net

income approach is based on the following three important assumptions :

There are no corporate taxes.

The cost debt is less than the

cost of equity.

The use of debt does not change

the risk perception of the investor.

where

V = S+B

V = Value

of fir m

S =

Market value of equity

B =

Market value of debt

Market

value of the equity can be ascertained by the following formula:

S =NI/ Ke

where

NI =

Earnings available to equity shareholder

Ke = Cost

of equity/equity capitalization rate

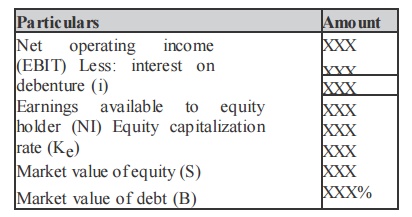

Format

for calculating value of the firm on the basis of NI approach.

Net Operating Income (NOI) Approach

Another

modern theory of capital structure, suggested by Dura nd. This is just the opposite

to the Net Income approach. According to this approach, Capital Structure

decision is irrelevant to the valuation of the firm. The market value of the

firm is not at all affected by the capital structure changes.

According

to this approach, the change in capital structure will not lead to any change

in the total value of the firm and market price of shares as well as the

overall cost of capital.

NI

approach is based on the following important assumptions;

The overall cost of capital remains

constant;

There are no corporate taxes;

The market capitalizes the value

of the firm as a whole;

Value of the firm (V) can be calculated with the help of the following formula

V = E BIT /K0

Modigliani and Miller Approach

Modigliani and Miller approach states that the financing

decision of a firm does not affect the market value of a firm in a perfect

capital market. In other words MM approach maintains that the average cost of

capital does not change with change in the debt weighted equity mix or capital

structures of the fir m.

Modigliani and Miller

approach is based on the

following important assumptions:

v There is a perfect

capital market.

v There are no

retained earnings.

v There are no corporate taxes.

v The investors act

rationally.

v The dividend payout ratio

is 100%.

v The business consists of the same level of business risk.

Related Topics