Accountancy - Users of Accounting information | 11th Accountancy : Chapter 1 : Introduction to Accounting

Chapter: 11th Accountancy : Chapter 1 : Introduction to Accounting

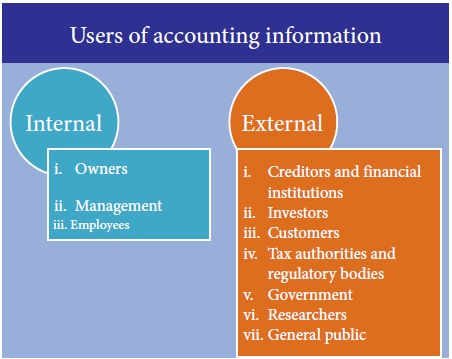

Users of Accounting information

Users of Accounting information

There are several persons who need the accounting

information for various purposes. They can be classified into two:

A. Internal users and

B. External users

A) Internal Users

The internal users are owners, management and

employees who are within the organisation.

(i) Owners

The owners of a business provide capital to be used

in the business. They are interested to know whether the business has earned

profit or not during a particular period and also its financial position on a

particular date. They want accounting reports in order to have an appraisal of

performance and also for an assessment of future prospects to ensure that they

will get their expected returns from the business and get back their capital

safely.

(ii) Management

Accounting data are the basis for most of the

decisions made by the management. The trends in sales and purchases,

relationship of expenses to the sales, efficiency of employees, comparative

profitability of different departments, capital structure and solvency position

are some of the vital data required by management for planning and controlling

the business operations. Financial statements and other reports prepared under

financial accounting provide this information to the management.

(iii) Employees

The employees

are interested in the profit earning capacity of the business which will affect

their remuneration, working conditions and retirement benefits and stability

and growth of the enterprise.

B) External users

External

users are the persons who are outside the organisation but make use of

accounting information for their purposes. They are:

(i) Creditors and financial institutions

Suppliers of

goods and services, commercial banks, public deposit holders and

debentureholders are included in this category. They are interested in knowing

the liquidity position and repaying capacity of the business to ensure the

safety of getting the amount due to them or interest and the principal amount.

(ii) Investors

Persons who

are interested in investing their funds in an organisation should know about

the financial condition of a business unit while making their investment

decisions. They are more concerned about future earnings and risk bearing capacity

of the organisation which will affect the return to the investors.

(iii) Customers

Customers who

buy and use the products and services of business enterprises are interested in

knowing the details of the products and the prices charged to them. They are

interested in knowing the stability and profitability of an enterprise to

ensure continued supply of the products or services by the enterprise.

(iv) Tax authorities and other regulatory bodies

Accounting

information helps the tax authorities in computing income tax and taxes on

goods and services and other taxes to be collected from business units. Other

regulatory bodies also ![]() require information about revenues, expenses and other financial aspects

of business to ensure that the enterprises comply with statutory requirements.

require information about revenues, expenses and other financial aspects

of business to ensure that the enterprises comply with statutory requirements.

(v) Government

The scarce

resources of the country are used by business enterprises. Information about

performance of business units in different industries helps the government in

policy formulation for development of trade and industry, allocation of scarce

resources, grant of subsidy, etc. Government also administers prices of certain

commodities. In such cases, government agencies have to ensure that the

guidelines for pricing are followed.

(vi) Researchers

Researchers

to carry out their research can use accounting information and make use of the

published financial statements for analysis and evaluation.

(vii) General public

From

accounting information, the general public at large can get a view of the

earning capacity and stability of the enterprise as well as the social

responsibility measures undertaken by the enterprise particularly in its area

of operation and also the employment opportunities provided to the local

people.

Related Topics