Chapter: 11th Accountancy : Chapter 1 : Introduction to Accounting

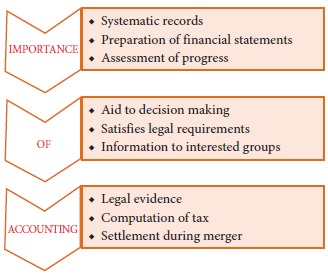

Importance of Accounting

Importance of Accounting

Accounting is

a basic necessity for all enterprises.

Importance of accounting is enumerated as below:

(i) Systematic records

All the

transactions of an enterprise which are financial in nature are recorded in a

systematic way in the books of accounts. The records are classified under

common heads and summaries are prepared.

(ii) Preparation of financial statements

Results of

business operations and the financial position of the concern can be

ascertained from accounting periodically through the preparation of financial

statements namely, income statement or trading and profit and loss account and

balance sheet. This helps in distribution of profits to the owners and to

provide funds for future growth of the business.

(iii) Assessment of progress

Analysis and interpretation of financial data can be done to assess the progress made in different areas and to identify the areas of weaknesses. Management is provided with a complete picture of the liquidity, profitability and solvency of the business.

(iv) Aid to decision making

Management of

a firm has to make routine and strategic decisions while discharging its

functions. Accounting provides the relevant data to make appropriate decisions.

Future policies and programmes can be planned by the management based on the

accounting data provided.

(v) Satisfies legal requirements

Various legal

requirements like maintenance of Provident Fund (PF) for employees, Employees

State Insurance (ESI) contributions, Tax Deducted at Source (TDS), filing of

tax returns are properly fulfilled with the help of accounting. Preparation of

accounts and financial statements as per the legal requirements is also

facilitated.

(vi) Information to interested groups

Accounting

supplies appropriate information to different interested groups like owners,

management,creditors, employees, financial institutions, tax authorities and

the government.

(vii) Legal evidence

Accounting

records are generally accepted as evidence in courts of law and other legal

authorities in the settlement of disputes.

(viii) Computation of tax

Accounting

records are the basic source for computation and settlement of income tax and

other taxes.

(ix) Settlement during merger

When two or

more business units decide to merger, accounting records provide information

for deciding the terms of merger and any compensation payable as a consequence

of merger.

Related Topics