Economics - Theories of Profit | 11th Economics : Chapter 6 : Distribution Analysis

Chapter: 11th Economics : Chapter 6 : Distribution Analysis

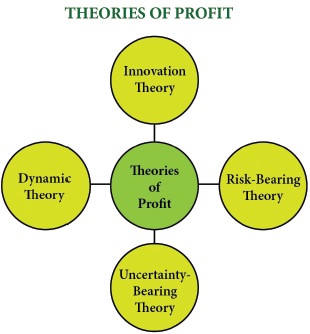

Theories of Profit

Theories

of Profit

1. Dynamic

Theory of Profit

This

theory was propounded by the American economist J.B.Clark in 1900. To him,

profit is the difference between price and cost of production of the commodity.

Hence, profit is the reward for dynamic changes in society. Further he points

out that, profit cannot arise in a static society. Static society is one where

everything is stationary or stagnant and there is no change at all. Therefore,

there is no role for an entrepreneur in a static society. The price of the

commodities in a static society would be equal to their cost of production. So,

there would be no profit for the entrepreneur. The entrepreneur only gets wages

for management and interest on his capital.

At

present several changes are taking place in a dynamic society. Changes are

permanent. According to Clark, the following five main changes are taking place

in a dynamic society.

1.

Population is increasing

2.

Volume of Capital is increasing.

3.

Methods of production are improving.

4.

Forms of industrial organization are changing.

5.

The wants of consumer are multiplying.

2. Innovation

Theory of Profit

Innovation

theory of profit was propounded by Joesph. A.Schumpeter. To Schumpeter, an

entrepreneur is not only an undertaker of a business, but also an innovator in

the process of production. To him, profit is the reward for “innovation”.

Innovation means invention put into commercial practice.

According

to Schumpeter, an innovation may consist of the following:

1.

Introduction of a new product.

2.

Introduction of a new method of production.

3.

Opening up of a new market.

4.

Discovery of new raw materials

5.

Reorganization of an industry / firm.

When any

one of these innovations is introduced by an entrepreneur, it leads to

reduction in the cost of production and thereby brings profit to an

entrepreneur. To obtain profit continuously, the innovator needs to innovate

continuously. The real innovators do so. Imitative entrepreneurs cannot

innovate.

3. Risk

Bearing Theory of Profit

Risk

bearing theory of profit was propounded by the American economist F.B.Hawley in

1907. According to him, profit is the reward for “risk taking” in business.

Risk taking is an essential function of the entrepreneur and is the basis of

profit. It is a well known fact that every business involves some risks.

Since the

entrepreneur undertakes the risks, he receives profits. If the entrepreneur

does not receive the reward, he will not be prepared to undertake the risks.

Thus, higher the risks, the greater are the profit.

Every

entrepreneur produces goods in anticipation of demand. If his anticipation of

demand is correct, then there will be profit and if it is incorrect, there will

be loss. It is the profit that induces the entrepreneurs to undertake such

risks.

4. Uncertainty Bearing Theory of Profit

Uncertainty

theory was propounded by the American economist Frank H.Knight. To him, profit

is the reward for “uncertainty bearing”. He distinguishes between “insurable”

and “non-insurable” risks.

Insurable Risks

Certain

risks are measurable or calculable. Some of the examples of these risks are the

risk of fire, theft and natural disasters. Hence, they are insurable. Such

risks are compensated by the Insurance Companies.

Non-Insurable Risks

There are

some risks which are immeasurable or incalculable. The probability of their

occurrence cannot be anticipated because of the presence of uncertainty in

them. Some of the examples of these risks are competition, market condition,

technology change and public policy. No Insurance Company can undertake these

risks. Hence, they are non-insurable. The term “risks” covers the first type of

events (measurables - insurable) and the term “uncertainty” covers the second

type of events (unforeseeable or incalculable or not measurable or

non-insurable).

According

to Knight, profit does not arise on account of risk taking, because the entrepreneur

can guard himself against a risk by taking a suitable insurance policy. But

uncertain events cannot be guarded against in that way. When an entrepreneur

takes himself the burden of facing an uncertain event, he secures remuneration.

That remuneration is “profit”.

Related Topics