Economics - Marginal Productivity Theory of Distribution | 11th Economics : Chapter 6 : Distribution Analysis

Chapter: 11th Economics : Chapter 6 : Distribution Analysis

Marginal Productivity Theory of Distribution

Marginal

Productivity Theory of Distribution

Introduction

Marginal

Productivity Theory of distribution was developed by Clark, Wickseed and

Walras. This theory explains how the prices of various factors of production

are determined. This theory explains how rent, wages, interest and profit are

determined. This theory is also known as “General Theory of Distribution” or

“National Dividend Theory of Distribution”.

Assumptions

This

theory is based on the following assumptions:

1.

All the factors of production are homogenous.

2.

Factors of production can be substituted for each

other.

3.

There is perfect competition both in the factor

market and product market.

4.

There is perfect mobility of factors of production.

5.

There is full employment of factors.

6.

This theory is applicable only in the long-run.

7.

The entrepreneurs aim at profit maximization.

8.

There is no government intervention in fixing the

price of a factor.

9.

There is no technological change.

Explanation of the Theory

According

to the Marginal Productivity Theory of Distribution, the price or the reward

for any factor of production is equal to the marginal productivity of that

factor. In short, each factor is rewarded according to its marginal

productivity.

Marginal Product

The

Marginal product of a factor of production means the addition made to the total

product by employment of an additional unit of that factor. The Marginal

Product may be expressed as MPP, VMP and MRP.

1. Marginal Physical Product (MPP)

The

Marginal Physical Product of a factor is the increment in the total product

obtained by the employment of an additional unit of that factor.

2. Value of Marginal Product (VMP)

The Value

of Marginal Product is obtained by multiplying the Marginal Physical Product of

the factor by the price of product.

Symbolically

VMP = MPP x Price

3. Marginal Revenue Product (MRP)

The

Marginal Revenue Product of a factor is the increment in the total revenue

which is obtained by the employment of an additional unit of that factor.

MRP = MPP x MR

Statement of the Theory

An

employer employs a factor of production because it is productive. So, the price

he wants to pay for the factor depends upon its productivity. The greater the

productivity of a factor, the higher will be its reward. If the price of a

factor of production is less

than its

marginal revenue product, the employer will use more of this factor, because

his profit will be increased.

When more

of a factor is employed, its marginal revenue product diminishes. But the

employer will gain by using additional units of the factor until the marginal

revenue product of the factor is equal to its price. The employer’s profit will

be maximum at this point. Beyond the point, the marginal revenue product is

less than the price of the factor. Hence, employer will suffer loss when he

uses more of the factor. Therefore, the conclusion is that the employer will so

adjust the price of the factor of production so as to equalize the marginal

revenue product of that factor.

In short,

the Marginal Productivity Theory of Distribution states that

a.

The price of a factor of production depends upon

its productivity.

b.

The price of a factor is determined by and will be

equal to marginal revenue product of that factor.

c.

Under certain conditions, the price of a factor

will be equal to both the average and marginal products of that factor.

The

Marginal Productivity Theory of

Distribution can be represented

diagrammatically

as follows:

Marginal Productivity under Perfect Competition

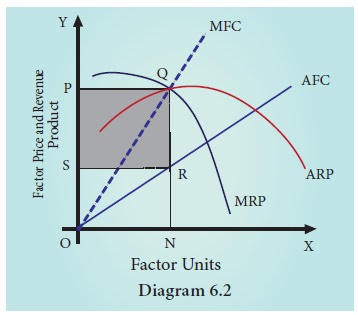

The

diagram 6.1 refers to the factor pricing under perfect competition in the

factor market. X axis represents factor units and Y axis represents the factor

price and revenue product. MRP is the Marginal Revenue Product Curve and ARP is

the Average Revenue Product curve. AFC is the Average Factor Cost curve and MFC

is the Marginal Factor Cost curve. AFC is horizontal under perfect competition

and MFC coincides with it.

When

there is perfect competition in the factor market, the firm is in equilibrium

(i.e., earning maximum profits) only when MFC = MRP. Hence, in the diagram, the

firm reaches equilibrium at point Q by employing ON units of factors and paying

OP price (NQ) where MFC = MRP. At the point Q, MRP = ARP. The price paid to the

factor (NQ) is also equal to marginal revenue product (NQ) and average revenue

product (NQ). This means that there is no exploitation of factors under perfect

competition. Beyond the point Q, no employer will employ factors, because after

that point, the price paid to the factor is more than marginal revenue product

and average revenue product.

Marginal Productivity Theory under Imperfect Competition

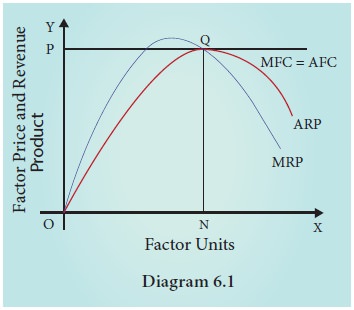

In

diagram 6.2 the factor pricing under imperfect competition is represented. AFC

is Average Factor Cost curve. It represents the price paid to the factors. It

increases as the number of factors demanded by the employer increases. As AFC

rises, MFC lies above AFC. It represents the marginal cost paid to the factors.

At the point Q, MFC = MRP, where the employer attains his maximum profit and so

he stops employment of the factors

at the

point. But the average cost paid is NRSO and the average revenue obtained is NQ

or OP. Total revenue obtained is NQPO. Therefore, exploitation per unit of

factor is RQ. But the total number of factors is ON. Thus, the total

exploitation of factor by the employer is RQ X SR = “PQRS” (shaded area). Thus,

under imperfect competition, factor is exploited at the equilibrium position.

Criticisms

This

theory is subject to a few criticisms

a.

In reality, the factors of production are not

homogenous.

b.

In practice, factors cannot be substituted for each

other.

c.

This theory is applicable only in the long–run. It

cannot be applied in the short-run.

Related Topics