Rural Life and Society | Chapter 3 | History | 8th Social Science - The Land Revenue Policy under the British | 8th Social Science : History : Chapter 3 : Rural Life and Society

Chapter: 8th Social Science : History : Chapter 3 : Rural Life and Society

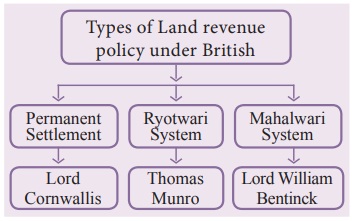

The Land Revenue Policy under the British

The Land Revenue Policy under the

British

Permanent Settlement

When Robert Clive obtained the

Diwani of Bengal, Bihar and Orissa in 1765, there used to be an annual

settlement (of land revenue). Warren Hastings changed it from annual to

quinquennial (five- yearly) and back to annual again. During the time of

Cornwallis, a ten years’ (decennial) settlement was introduced in 1793 and it

was known Permanent Settlement.

Permanent settlement were made in

Bengal, Bihar, Orissa, Varanasi division of U.P., and Northern Karnataka, which

roughly covered 19 percent of the total area of British India. It was known by

different names like Zamindari, Jagirdari, Malguzari and Biswedari.

Salient Features of the Permanent

Settlement

* The Zamindars were recognised as the

owners of land as long as they paid the revenue to the East India Company

regularly.

* The Zamindars acted as the agent

of the Government for the collection of revenue from the cultivators.

* The amount of revenue that the

Zamindars had to pay to the Company was firmly fixed and would not be raised

under any circumstances.

* They gave 10/11 of the revenue

collected by them from the cultivator to the Government.

* The Zamindars would grant patta

(written agreements) to the ryots. The ryots became tenants since they were

considered the tillers of the soil.

* All judicial powers were taken

away from the Zamindars.

Merits

* Under this system many of the

waste lands and forests became cultivable lands.

* The Zamindars became the owner of

the land.

* The Zamindars were made free from

the responsibility of providing justice.

* The Zamindars remained faithful to

the British Government.

* This system secured a fixed and

stable income for the British Government.

Demerits

*

The British Government had no direct contact with the cultivators.

*

The rights of the cultivators were ignored and they were left at the mercy of

the Zamindars.

* The peasants were almost treated

as serfs.

*

This system was made the Zamindars lethargic and luxurious.

*

Many conflicts between the Zamindars and the peasants arose in rural Bengal.

Ryotwari

system

Ryotwari

system was introduced by Thomas Munro and Captain Read in 1820. Major areas of

introduction of Ryotwari system included Madras, Bombay, parts of Assam, and

Coorg provinces of British India. By Ryotwari system the rights of ownership

was handed over to the peasants. British government collected taxes directly

from the peasants. Initially, one-half of the estimated produce was fixed as

rent. This assessment was reduced to one -third of the produce by Thomas Munro.

The revenue was based on the basis of the soil and the nature of the crop.

Rents would be periodically revised,

generally after 20 to 30 years. The position of the cultivators became more

secure. In this system the settlement was made between the Government and the

Ryots. Infact, the Government later claimed that the land revenue was rent and

not a tax.

Salient Features of the Ryotwari

system

* Revenue settlement was done

directly with the ryots.

* Measurement of field and an estimate of

produce was calculated.

*

Government fixed the demand at 45% to 55% of the produce.

Effects of

the Ryotwari Settlement

* In most areas the land revenue

fixed was excessive; the ryots were hardly left with bare maintenance even in

the best of seasons.

*

Under this system the government exploited the farmers instead of Zamindars.

Mahalwari

system

Mahalwari

system, a brain child of Holt Mackenzie was modified version of the Zamindari

settlement introduced in the Ganga valley, the North-West Province, parts of

the Central India and Punjab in 1822. Lord William Bentinck was to suggest

radical changes in the Mahalwari system by the guidance of Robert Martins Bird

in 1833. Assessment of revenue was to be made on the basis of the produce of a

Mahal or village. All the proprietors of a Mahal were severally and jointly

responsible for the payment of revenue. Initially the state share was fixed

two-thirds of the gross produce. Bentinck, therefore, reduced to fifty percent.

The village as a whole, through its headman or Lambardar, was required to pay

the revenue. This system was first adopted in Agra and Awadh, and later

extended to other parts of the United Provinces. The burden of all this heavy

taxation finally fell on the cultivators.

Salient

Features of the Mahalwari Settlement

* The Lambardar acted as intermediaries

between the Government and the villagers.

* It was a village-wise assessment.

One person could hold a number of villages.

* The village community was the

owner of the village common land.

* The village land belonged to the village

community.

Effects of the Mahalwari Settlement

* The Lambardar enjoyed privileges

which was misused for their self-interest.

* This system brought no benefit to the

cultivators.

* It was a modified version of the

Zamindari system and benefited the upper class in villages.

Impact of the British land revenue system on

the cultivators

* A common feature of all the

settlements was the assessment and the maximize income from land. It resulted

in increasing land sales and dispossession.

*

The peasants were overburdened with taxation. Due to the tax burden and

famines, in general, the people suffered in poverty and burdened with debts.

They had to seek the moneylenders who became rich and acquired lands from the

peasants.

* The Zamindars, money-lenders and

lawyers exploited the poor peasants.

* The stability and continuity of

the Indian villages was shaken.

* Cottage industries disappeared on

account of the import of British goods and the peasants had nothing to

supplement their income.

* The old body of custom was

replaced by new apparatus of law, courts, fees, lawyers and formal procedures.

*

The British policy proved advantageous only to the government of a privileged section

of the society at the cost of the cultivators who were the rightful owners of

their lands and claimants of the larger share of the produce.

Related Topics