Economics - The Accelerator Principle | 12th Economics : Chapter 4 : Consumption and Investment Functions

Chapter: 12th Economics : Chapter 4 : Consumption and Investment Functions

The Accelerator Principle

The Accelerator Principle

The origin of accelerator principle can be traced back in the

writings of Aftalion (1909), Hawtrey (1913) and Bickerdike(1914). However, the

systematic development of the simple accelerator model was made by J.M.Clark,

in 1917. It was further developed by Hicks, Samuelson and Harrod in relation to

the business cycles.

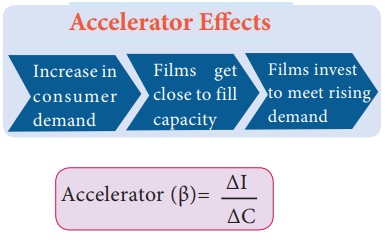

1. Meaning

A given increase in the demand for consumption goods in the

economy generally leads to an accelerated demand for machineries (investment

goods). Accelerator is the numerical value of the relation between an increase

in consumption and the resulting increase in investment.

Accelerator (β)= ΔI/ΔC

ΔI = Change in investment outlays (Say 100)

ΔC = Change in consumption demand (Say 50)

The accelerator expresses the ratio of the net change in

investment to change in consumption.

2. Definition

“The accelerator coefficient is the ratio between induced

investment and an initial change in consumption.”

Assuming the expenditure of ₹50crores on consumption goods, if

industries lead to an investment of ₹ 100 crores in investment goods

industries, we can say that the accelerator is 2.

Accelerator = 100/50 = 2

3. Assumptions

1.

Absence of excess capacity in consumer goods industries.

2.

Constant capital - output ratio

3.

Increase in demand is assumed to be permanent

4.

Supply of funds and other inputs is quite elastic

5.

Capital goods are perfectly divisible in any required size.

4. Operation of the Acceleration Principle

Let us consider a simple example. The operation of the accelerator

may be illustrated as follows.

Let us suppose that in order to produce 1000 consumer goods, 100

machines are required. Also suppose that working life of a machine is 10 years.

This means that every year 10 machines have to be replaced in order to maintain

the constant flow of 1000 consumer goods.

This might be called replacement demand.

Suppose that demand for consumer goods rises by 10 percent (ie

from 1000 to 1100). This results in increase in demand for 10 more machines. So

that total demand for machines is 20. (10 for replacement and 10 for meeting

increased demand). It may be noted here a 10 percent increase in demand for

consumer goods causes a 100 percent increase in demand for machines (from 10 to

20). So we can conclude even a mild change in demand for consumer goods will

lead to wide change in investment.

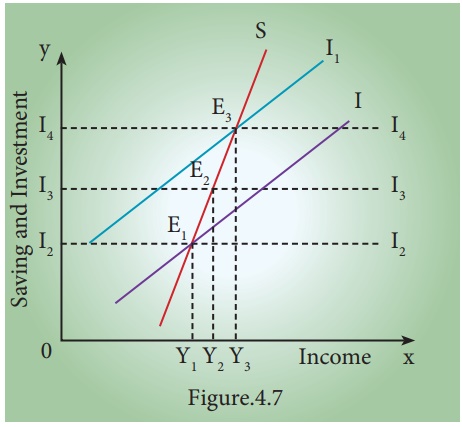

Diagrammatic illustration:

Operation of Accelerator.

SS is the saving curve. II is the investment curve. At point E1, the economy is in

equilibrium with OY1 income. Saving and investment are equal at OI2. Now, investment is

increased from OI2 to OI4. This increases income from OY1 to OY3, the equilibrium point being E3. If the increase in

investment by I2 I4 is purely exogenous, then the increase in income by Y1 Y3 would have been due to

the multiplier effect. But in this diagram it is assumed that exogenous

investment is only by I2 I3 and induced investment is by I3 I4. Therefore, increase in income by Y1 Y2 is due to the

multiplier effect and the increase in income by Y2 Y3 is due to the

accelerator effect.

5. Limitations

1.

The assumption of constant capital-output ratio is unrealistic.

2.

Resources are available only before full employment.

3.

Excess capacity in capital goods industries is assumed.

4.

Accelerator will work only if the increased demand is permanent.

5.

Accelerator will work only when credit is available easily.

6.

If there is unused or excess capacity in the consumer goods industry,

the accelerator principle would not work.

Related Topics