Economics - Consumption Function | 12th Economics : Chapter 4 : Consumption and Investment Functions

Chapter: 12th Economics : Chapter 4 : Consumption and Investment Functions

Consumption Function

Consumption Function

1. Meaning of Consumption Function

The consumption function or propensity to consume refers to income

consumption relationship. It is a “functional relationship between two

aggregates viz., total consumption and gross national income.”

Symbolically, the relationship is represented as

C= f (Y)

Where,

C = Consumption

Y = Income

f = Function

Thus the consumption function indicates a functional relationship

between C and Y, where С is the dependent variable and Y is the independent

variable, i.e., С is determined by Y. This relationship is based on the ceteris

paribus (other things being same) assumption, as only income consumption

relationship is considered and all possible influences on consumption are held

constant.

In fact, consumption function is a schedule of the various amounts of

consumption expenditure corresponding to different levels of income. A

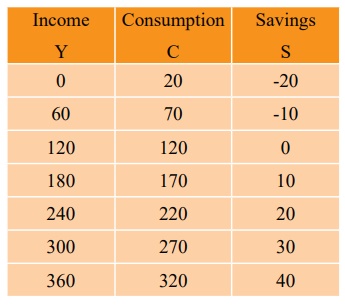

hypothetical consumption schedule is given in Table 1.

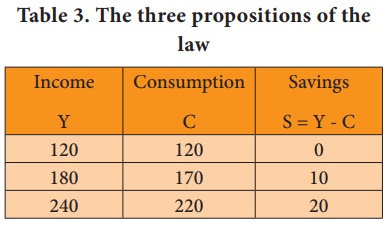

Table : 1 Income - Consumption Schedule (₹Crores)

The above table shows that consumption is an increasing function

of income because consumption expenditure increases with increase in income.

Here it is shown that when income is zero, people spend out of their past

savings on consumption because they must eat in order to live (Autonomous

Consumption).

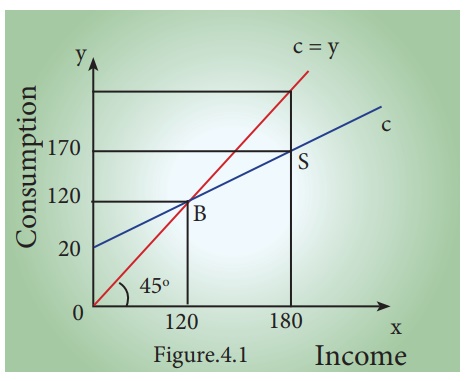

Here, when y = 120, C = 120 (Point B is the diagram)

When y = 180, C = 170, S = 10 (Point S is the diagram)

If Y increases to 360, C = 320, S = 40

In the diagram, income is measured horizontally and consumption is

measured vertically. In 45 line at all levels, income and consumption are

equal. It is a linear consumption function based on the assumption that

consumption changes by the same amount as does income.

Thus the consumption function measures not only the amount spent

on consumption but also the amount saved. This is because the propensity to

save is merely the propensity not to consume. The 45° line may therefore be

regarded as a zero-saving line, and the shape and position of the C curve

indicate the division of income between consumption and saving.

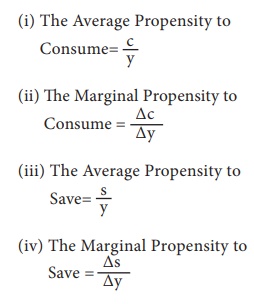

2. Technical Attributes of the Consumption Function

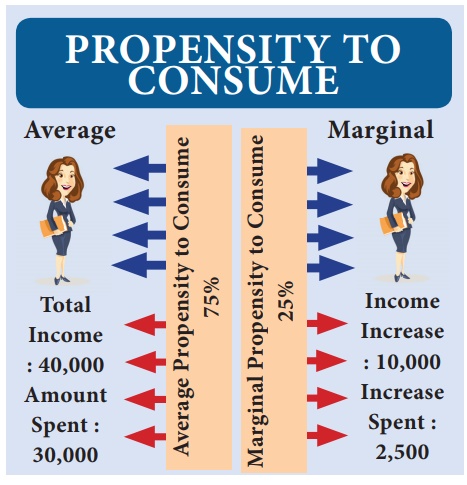

(1) The Average Propensity to Consume:

The average propensity to consume is the ratio of consumption

expenditure to any particular level of income.” Algebraically it may be

expressed as under:

APC = C/Y

C= Consumption

Y = Income

(2) The Marginal Propensity to Consume:

The marginal propensity to consume may be defined as the ratio of

the change in the consumption to the change in income. Algebraically it may be

expressed as under:

MPC = ∆C/∆Y

Where

ΔC= Change in Consumption

ΔY = Change in Income

MPC is positive but less than unity

0 < ∆C/∆Y < 1

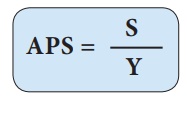

(3) The Average Propensity to Save (APS) :

The average propensity to save is the ratio of saving to income.

APS is the quotient obtained by dividing the total saving by the

total income. In other words, it is the ratio of total savings to total income.

It can be expressed algebraically in the form of equation as under

APS = S/Y

Where

S= Saving

Y=Income

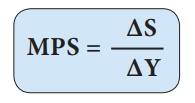

(4) The Marginal Propensity to Save (MPS) :

Marginal Propensity to Save is the ratio of change in saving to a

change in income.

MPS is obtained by dividing change in savings by change in income.

It can be expressed algebraically as

MPS = ∆S/∆Y

ΔS = Change in Saving

ΔY= Change in Income

Since MPC+MPS=1

MPS=1-MPC and MPC = 1 - MPS

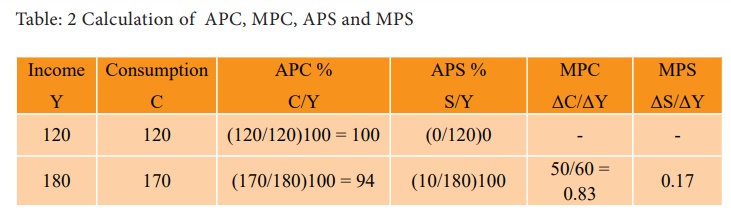

Generally the average ie APC is expressed in percentage and the

MPC in fraction.

3. Keynes’s Psychological Law of Consumption:

Keynes propounded the fundamental Psychological Law of Consumption

which forms the basis of the consumption function. He stated that “The

fundamental psychological law upon which we are entitled to depend with great

confidence both prior from our knowledge of human nature and from the detailed

facts of experience, is that men are disposed as a rule and on the average to

increase their consumption as their income increases but not by as much as the

increase in their income.” The law implies that there is a tendency on the part

of the people to spend on consumption less than the full increment of income.

Assumptions:

Keynes’s Law is based on the following assumptions:

1. Ceteris paribus (constant extraneous variables):

The other variables such as income distribution, tastes, habits,

social customs, price movements, population growth, etc. do not change and

consumption depends on income alone.

2. Existence of Normal Conditions:

The law holds good under normal conditions. If, however, the

economy is faced with abnormal and extraordinary circumstances like war,

revolution or hyperinflation, the law will not operate. People may spend the

whole of increased income on consumption.

3. Existence of a Laissez-faire Capitalist Economy:

The law operates in a rich capitalist economy where there is no

government intervention. People should be free to spend increased income. In

the case of regulation of private enterprise and consumption expenditures by

the State, the law breaks down.

Propositions of the Law:

This law has three propositions:

(1) When income increases, consumption expenditure also increases

but by a smaller amount. The reason is that as income increases, our wants are

satisfied side by side, so that the need to spend more on consumer goods

diminishes. So, the consumption expenditure increases with increase in income

but less than proportionately.

(2) The increased income will be divided in some proportion

between consumption expenditure and saving. This follows from the first proposition

because when the whole of increased income is not spent on consumption, the

remaining is saved. In this way, consumption and saving move together.

(3) Increase in income always leads to an increase in both

consumption and saving. This means that increased income is unlikely to lead to fall in

either consumption or saving. Thus with increased income both consumption and

saving increase.

Proposition (1):

Income increases by ₹ 60 crores and the increase in consumption is

by ₹ 50 crores.

Proposition (2):

The increased income of ₹ 60 crores in each case is divided in

some proportion between consumption and saving respectively. (i.e., ₹ 50crores

and ₹ 10 crores).

Proposition (3):

As income increases consumption as well as saving increase.

Neither consumption nor saving has fallen.

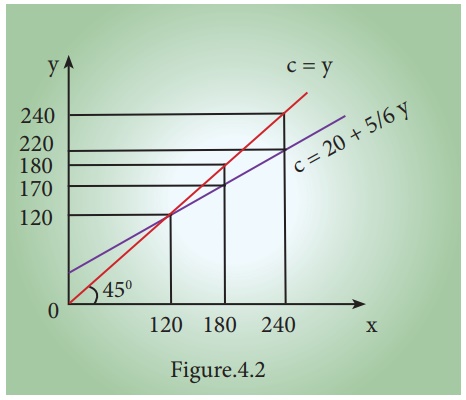

Diagrammatically, the three propositions are explained in Figure

4.2. Here, income is measured horizontally and consumption and saving are

measured on the vertical axis. С is the consumption function curve and 45° line

represents income consumption equality.

Proposition (1):

When income increases from 120 to 180 consumption also increases

from 120 to 170 but the increase in consumption is less than the increase in

income, 10 is saved.

Proposition (2):

When income increases to 180 and 240, it is divided in some

proportion between consumption by 170 and 220 and saving by 10 and 20

respectively.

Proposition (3):

Increases in income to 180 and 240 lead to increased consumption

170 and 220 and increased saving 20 and 10 than before. It is clear from the

widening area below the С curve and the saving gap between 45° line and С

curve.

4. Determinants of Consumption function: Subjective and Objective Factors

J.M Keynes has divided factors influencing the consumption

function into two namely: Subjective factors and Objective factors

A) Subjective Factors

Subjective factors are the internal factors related to

psychological feelings. Major subjective factors influencing consumption

function are given below.

Keynes lists eight motives which lead individuals to

refrain from spending, they are:

1. The motive of precaution: To build up a reserve against unforeseen

contingencies. Eg. Accidents, sickness

2. The motive of foresight: The desire to provide for anticipated

future needs. Eg. Old age

3. The motive of calculation: The desire to enjoy interest and

appreciation.

4. The motive of improvement: The desire to enjoy for improving

standard of living.

5. The motive of financial independence.

6. The motive of enterprise (desire to do forward trading).

7. The motive of pride.(desire to bequeath a fortune)

8. The motive of avarice.(purely miserly instinct)

![]()

Keynes sums up the motives as Precaution, Foresight, Calculation,

Improvement, Independence, Enterprise, Pride and Avarice.

The Government, institutions and business corporations and

firms may also consume mainly because of the following four motives:

1. The motive of enterprise: The desire to obtain resources to carry

out further capital investment without incurring debt.

2. The motive of liquidity: The desire to secure liquid resources to

meet emergencies, and difficulties.

3. The motive of improvement: The desire to secure a rising income and

to demonstrate successful management.

4. The motive of

financial prudence:

The desire to ensure adequate financial provision against

depreciation and obsolescence and to discharge debt.

According to Keynes, the subjective factors do not change in the

short run and hence consumption function remains stable in the short period.

B) Objective Factors

Objective factors are the external factors which are real and

measurable. These factors can be easily changed in the long run. Major

objective factors influencing consumption function are:

1) Income Distribution

If there is large disparity between rich and poor, the consumption

is low because the rich people have low propensity to consume and high

propensity to save. The community with more equal distribution of income tends

to have high propensity to consume. This view has been corroborated by V.K.R.V.

Rao.

2) Price level

Price level plays an important role in determining the consumption

function. When the price falls, real income goes up; people will consume more

and propensity to save of the society increases.

3) Wage level

Wage level plays an important role in determining the consumption

function and there is positive relationship between wage and consumption.

Consumption expenditure increases with the rise in wages. Similar is the effect

with regard to windfall gains.

4) Interest rate

Rate of interest plays an important role in determining the

consumption function. Higher rate of interest will encourage people to save

more money and reduces consumption.

5) Fiscal Policy

When government reduces the tax the disposable income rises and

the propensity to consume of community increases. The progressive tax system

increases the propensity to consume of the people by altering the income

distribution in favour of poor.

6) Consumer credit

The availability of consumer credit at easy installments will

encourage households to buy consumer durables like automobiles, fridge,

computer. This pushes up consumption.

7) Demographic factors

Ceteris paribus, the larger the size of the family, the grater is

the consumption. Besides size of family, stage in family life cycle, place of

residence and occupation affect the consumption function. Families with

children of college education stage spend more than those of primary education

and urban families spend more than rural families.

8) Duesenberry hypothesis

Duesenberry has made two observations regarding the factors

affecting consumption.

a) The consumption expenditure depends not only on his current

income but also past income and standard ofliving.Astheindividuals are

accustomed to a particular standard of living, they continue to spend the same

amount on consumption even though the current income is reduced.

b) Consumption is influenced by demonstration effect. The

consumption standards of low income groups are influenced by the consumption

standards of high income groups. In other words, the poor people want to

imitate the consumption pattern of rich. This results in spending beyond their

income level.

9) Windfall Gains or losses

Unexpected changes in the stock market leading to gains or losses

tend to shift the consumption function upward or downward.

Related Topics