Economics - Investment Function | 12th Economics : Chapter 4 : Consumption and Investment Functions

Chapter: 12th Economics : Chapter 4 : Consumption and Investment Functions

Investment Function

Investment Function

The investment function refers to investment -interest rate

relationship. There is a functional and inverse relationship between rate of

interest and investment. The investment function slopes downward.

I = f (r)

I= Investment (Dependent variable)

r = Rate of interest (Independent variable)

1. Meaning of investment

The term investment means purchase of stocks and shares,

debentures, government bonds and equities. According to Keynes, it is only

financial investment and not real investment. This type of investment does

result in an addition to the stock of real capital of the nation.

In the views of Keynes, Investment includes expenditure on

capital investment.

2. Types of investment

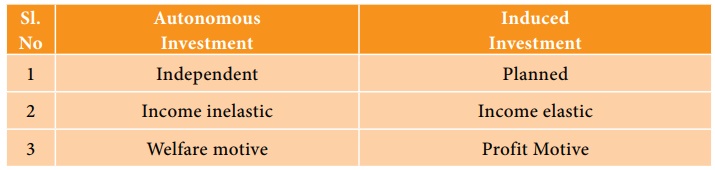

Autonomous Investment and Induced Investment

Autonomous Investment

● Investment that is not dependent on the national income

● Mainly done with the welfare motive and not for making

profits

● Examples : Construction of road, bridges, School,

Charitable houses

● Not affected by rise in raw materials or wages of workers

● Essential to development of nation and out of depression

i) Autonomous investment: Autonomous investment is the expenditure

on capital formation, which is independent of the change in income, rate of

interest or rate of profit.

This investment is independent of economic activity. Autonomous

investment is income-inelastic, the volume of autonomous investment is the same

at all levels.

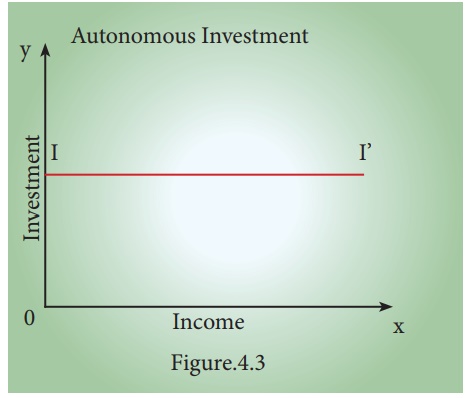

The autonomous investment curve is horizontal, parallel to X axis.

In the times of economic depression, the governments try to boost

the autonomous investment. Thus, autonomous investment is one of the key

concepts in welfare economics.

Generally, Government makes autonomous investment because of the

welfare consideration.

ii) Induced investment:

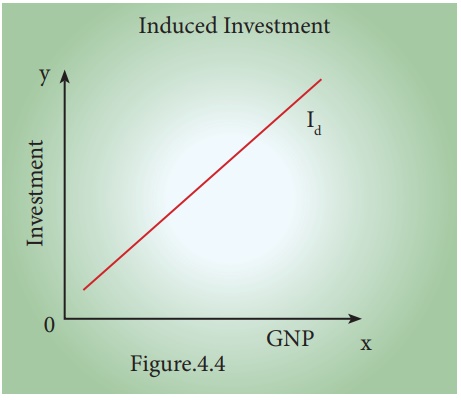

Induced investment is the expenditure on fixed assets and stocks

which are required when level of income and demand in an economy goes up.

Induced investment is profit motivated. It is related to the

changes of national income. The relationship between the national income and

induced investment is positive; decreases in national income leads to decrease

in induced investment and vice versa. Induced investment is income elastic. It

is positively sloped as shown here.

3. Determinants of Investment Function

The classical economists believed that investment depended

exclusively on rate of interest. In reality investment decision depends on a

number of factors. They are as follows:

1.

Rate of interest

2.

Level of uncertainty

3.

Political environment

4.

Rate of growth of population

5.

Stock of capital goods

6.

Necessity of new products

7.

Level of income of investors

8.

Inventions and innovations

9.

Consumer demand

10. Policy of the state

11. Availability of capital

12. Liquid assets of the

investors

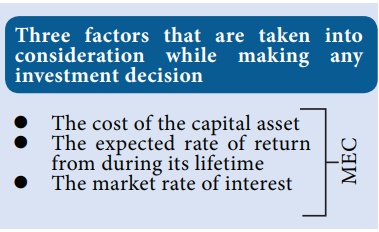

However, Keynes contended that business expectations and

profits are more important in deciding investment. He also pointed out that

investment depends on MEC (Marginal Efficiency of Capital) and rate of interest.

i. Private investment is an increase in the capital stock such as

buying a factory or machine.

The marginal efficiency of capital (MEC) states the rate of return

on an investment project. Specifically, it refers to the annual percentage

yield (output) earned by the last additional unit of capital.

ii. If the marginal efficiency of capital is 5% and interest rates

is 4%, then it is worth borrowing at 4% to get an expected increase in output

of 5%.

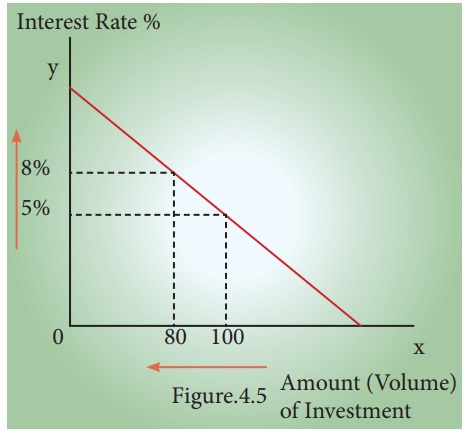

4. Relationship between rate of interest and Investment:

An explanation of how the rate of interest influences the level of

investment in the economy. Typically, higher interest rates reduce investment,

because higher rates increase the cost of borrowing and require investment to

have a higher rate of return to be profitable.

Interest rates and investment

As the real cost of borrowing rises, fewer investment projects are

profitable.

If interest rates rise from 5% to 8 %, then we get a fall in the

amount of investment from ₹ 100 cr to ₹ 80 cr.

If interest rates are increased then it will tend to discourage

investment because investment has a higher opportunity cost.

1. With higher rates, it is more expensive to borrow money from a

bank.

2. Saving money in a bank gives a higher rate of return. Therefore,

using savings to finance investment has an opportunity cost of lower interest

payments.

If interest rates rise, firms will need to gain a better rate of

return to justify the cost of borrowing using savings.

5. Marginal Efficiency of Capital.

MEC was first introduced by J.M Keynes in 1936 as an important

determinant of autonomous investment. The MEC is the expected profitability of

an additional capital asset. It may be defined as the highest rate of return

over cost expected from the additional unit of capital asset.

Meaning of Marginal Efficiency of Capital (MEC) is the rate of

discount which makes the discounted present value of expected income

stream equal to the cost of capital.

MEC depends on two factors:

1. The prospective yield from a capital asset.

2. The supply price of a capital asset.

Factors Affecting MEC:

The marginal efficiency of capital is influenced by short - run as

well as long-run factors. These factors are discussed in brief:

a) Short - Run Factors

(i) Demand for the product: If the market for a particular good is

expected to grow and its costs are likely to fall, the rate of return from

investment will be high. If entrepreneurs expect a fall in demand for goods and

a rise in cost, the investment will decline.

(ii) Liquid assets: If the entrepreneurs are holding large

volume of working capital, they can take advantage of the investment

opportunities that come in their way. The MEC will be high.

(iii) Sudden changes in income: The MEC is also influenced by sudden

changes in income of the entrepreneurs. If the business community gets windfall

profits, or tax concession the MEC will be high and hence investment in the

country will go up. On the other hand, MEC falls with the decrease in income.

(iv) Current rate of investment: Another factor

which influences MEC is the current rate of investment in a particular

industry. If in a particular industry, much investment has already taken place

and the rate of investment currently going on in that industry is also very

large, then the marginal efficiency of capital will be low.

(v) Waves of optimism and pessimism: The marginal efficiency

of capital is also affected by waves of optimism and pessimism in the business

cycle. If businessmen are optimistic about future, the MEC will be likely to be

high. During periods of pessimism the MEC is under estimated and so will be

low.

b)Long - Run Factors

The long run factors

which influence the marginal efficiency of capital are as follows:

(i) Rate of growth of population: Marginal efficiency of

capital is also influenced by the rate of growth of population. If population

is growing at a rapid speed, it is usually believed that the demand of various

types of goods will increase. So a rapid rise in the growth of population

will increase the marginal efficiency of capital and a slowing down in its rate

of growth will discourage investment and thus reduce marginal efficiency of

capital.

(ii) Technological progress: If investment and technological development

take place in the industry, the prospects of increase in the net yield

brightens up. For example, the development of automobiles in the 20th

century has greatly stimulated the rubber industry, the steel and oil

industry etc. So we can say that inventions and technological improvements encourage investment in various

projects and increase marginal efficiency of capital.

(iii) Monetary and Fiscal policies: Cheap money policy and

liberal tax policy pave the way for greater profit margin and so MEC is likely

to be high.

(iv) Political environment: Political stability, smooth administration,

maintenance of law and order help to improve MEC.

(v) Resource availability: Cheap and abundant supply of natural

resources,efficient labour and stock of capital enhance the MEC.

6. Marginal Efficiency of Investment

MEI is the expected rate of return on investment as

additional units of investment are made

under specified conditions and

over a period of time. When cost of borrowing is high, businesses are less

motivated to borrow money and make investment on different projects because

high cost of borrowing

reduces profit margin of the

business firms;

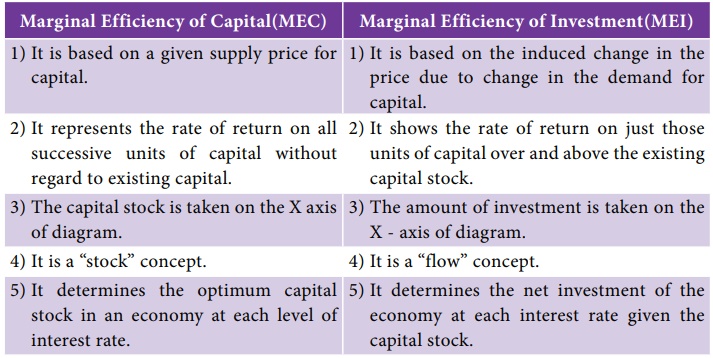

Marginal Efficiency of Capital(MEC)

1) It is based on a given supply price for capital.

2) It represents the rate of return on all successive units of

capital without regard to existing capital.

3) The capital stock is taken on the X axis of diagram.

4) It is a “stock” concept.

5) It determines the optimum capital stock in an economy at each

level of interest rate.

Marginal Efficiency of Investment(MEI)

1) It is based on the induced change in the price due to change in

the demand for capital.

2) It shows the rate of return on just those units of capital over

and above the existing capital stock.

3) The amount of investment is taken on the X - axis of diagram.

4) It is a “flow” concept.

5) It determines the net investment of the economy at each

interest rate given the capital stock.

Related Topics