Books of Prime Entry | Accountancy - Source documents | 11th Accountancy : Chapter 3 : Books of Prime Entry

Chapter: 11th Accountancy : Chapter 3 : Books of Prime Entry

Source documents

Source documents

Source

documents are the authentic evidences of financial transactions. These

documents show the nature of transaction, the date, the amount and the parties

involved. Source documents include cash receipt, invoice, debit note, credit

note, pay-in-slip, salary bills, wage bills, cheque record slips, etc. They are

the bases of recording transactions in the books of accounts. They also serve

as legal evidence in case of any legal dispute. The source documents commonly

used are discussed below:![]()

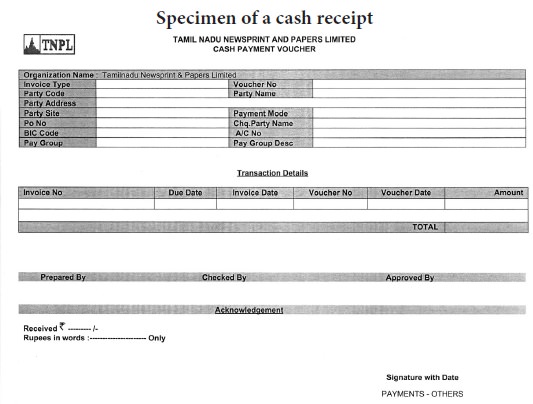

(i) Cash receipt/voucher

It is a

document that shows the date, amount and details of cash purchases and cash

sales or other cash transactions. Business persons receive cash receipt for

cash purchases and issue cash receipt for cash sales.

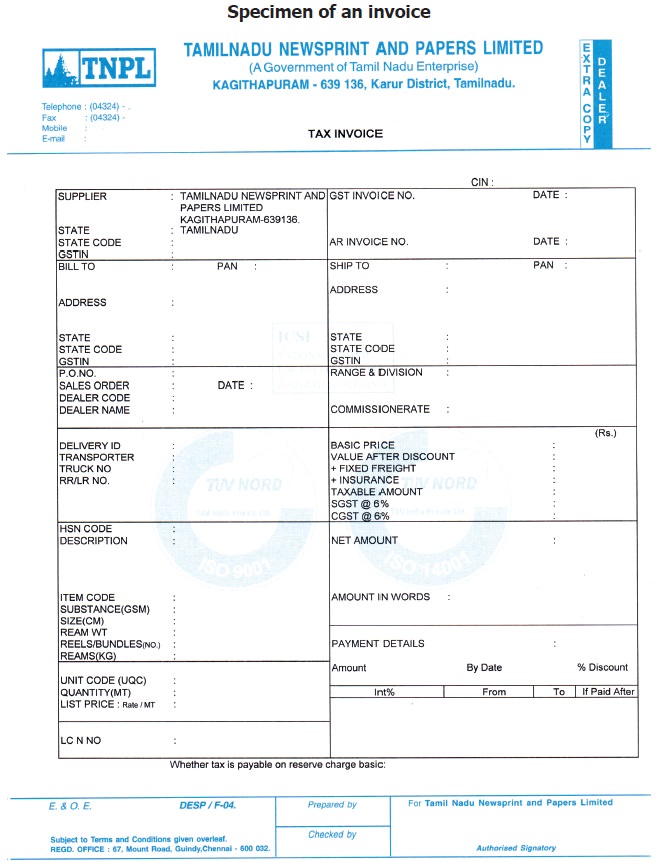

(ii) Invoice

Invoice is

used for credit purchases and credit sales. The date, amount and details of

credit purchases and credit sales are given in the invoices. Invoice is

generally prepared by the seller in three copies. The first copy is given to

the purchaser, the second copy is sent along with the goods for checking and

the third is retained by the seller and used as the source document for

recording the transaction.

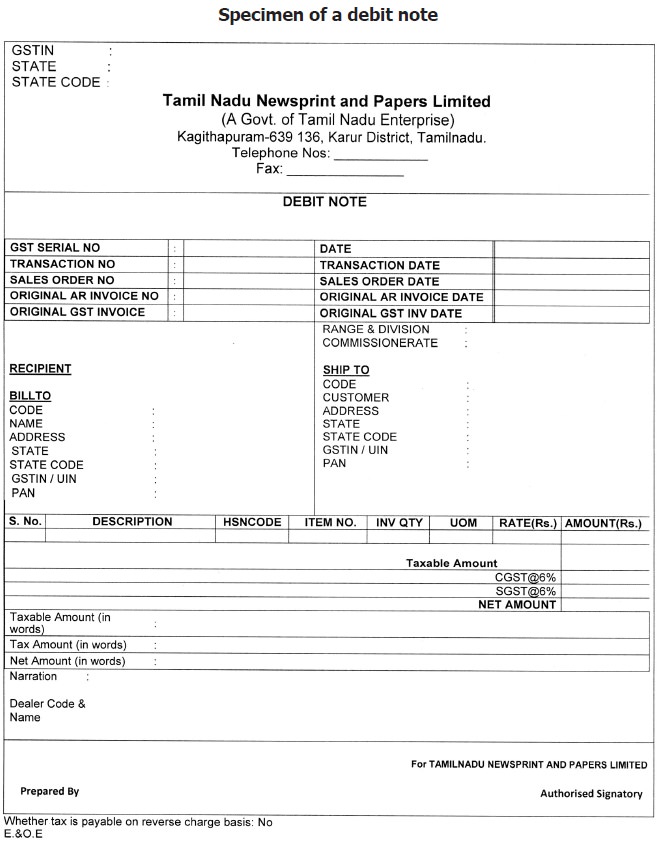

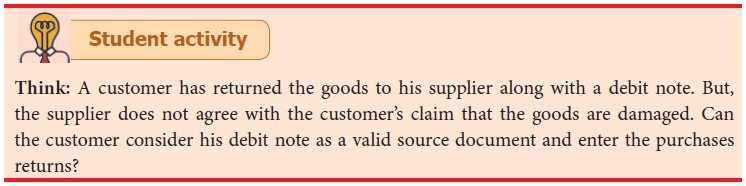

(iii) Debit note

A buyer may

return the goods to the seller in various situations such as when goods are

defective or damaged, goods do not meet the specifications, etc. When goods are

returned by a buyer, the buyer prepares a debit note and sends it to the

seller. It contains details such as the description of the goods, quantity returned

and also their value. Two copies are prepared in general, one copy is sent to

the seller and another one is retained by the buyer. It is a document issued by

a buyer stating the amount owed by the seller. A debit note is also called as

debit memo.

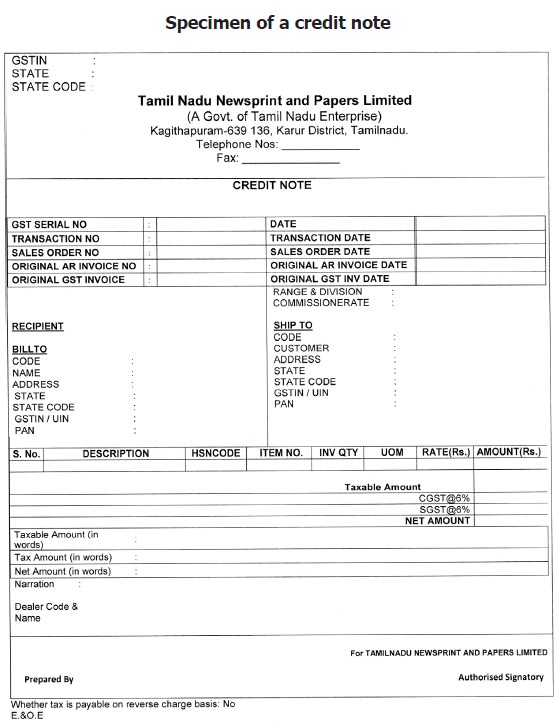

(iv) Credit note

It is a

statement prepared by the seller who receives back from his customer the goods

sold. It contains details such as the description of the goods, quantity

returned and also their value. It is a document sent by a seller to the buyer,

stating that a certain amount is owed to the buyer. It is also called as credit

memo.

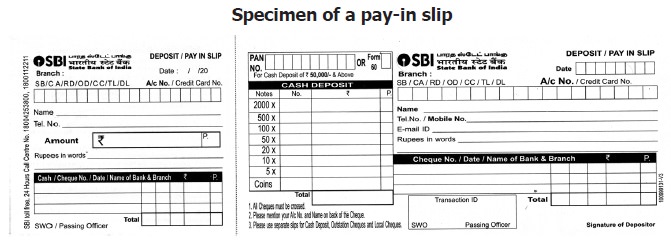

(v) Pay-in slip

When cash or cheque is deposited in bank, a form is

to be filled by a customer and submitted to the banker along with cash or

cheque. This is called as pay-in slip or deposit slip. The main part of this

will be retained by the bank and the counterfoil duly stamped and signed by the

banker is returned to the customer.

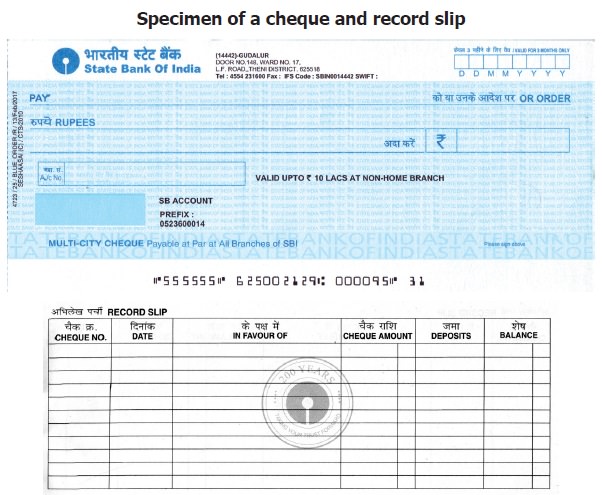

(vi) Cheque

Cheque is a

negotiable instrument. Cheque book is issued by a bank to its customers for

withdrawing money for own use or for making payment to others. By issue of

cheque, a bank is directed to pay a specific amount of money from a person’s

account either to the same person or to the person in whose favour the cheque

has been issued. Each cheque book has record slips for entering the details of

cheques issued. It remains with the account holder for future reference.

Related Topics