Meaning, Format, Steps, Different types, Application, Example, Advantages | Accountancy - Journal entries | 11th Accountancy : Chapter 3 : Books of Prime Entry

Chapter: 11th Accountancy : Chapter 3 : Books of Prime Entry

Journal entries

Journal entries

The word

journal has been derived from the French word ‘Jour’ which means day. So,

journal means daily. Transactions are recorded daily in the journal as and when

the transactions take place. As soon as a transaction takes place, its debit

and credit aspects are analysed and recorded in the journal together with a

short description called narration. This facilitates making entries in the

ledger. Since transactions are first recorded in the journal, it is called book

of original entry or prime entry or primary entry or preliminary entry, or

first entry. Journalising is the beginning of the accounting process for the

financial transactions.

Meaning

Journal is

the book of original entry in which business transactions are recorded in

chronological order, that is, in the order of occurrence. Transactions are

recorded for the first time in the journal. Entries are made in the journal

based on source documents. Record of business transactions in the journal is

known as Journal entry. The process of recording the transactions in journal is

called as journalising.![]()

According to

Professor Carter, “The journal as originally used, is a book of prime entry in

which transactions are copied in order of date from a memorandum or waste book.

The entries as they are copied are classified into debits and credits, so as to

facilitate their being correctly posted, afterwards in the ledger”.

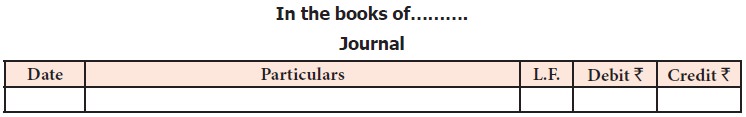

Format of Journal

The format of journal is given below:

In the books of……….Journal

A journal

contains five columns; Date, Particulars, L.F., Debit and Credit.

Date column: In this column the date

of the transaction is recorded.

Particulars column: The accounts involved

in the transaction are recorded in this column. The account debited is recorded first with the word ‘Dr.’ entered

towards the end of the row and the account credited is entered in the next line

after leaving a little space on the left and preceded by the word ‘To’.

Leder Folio column (L.F.): The page

number of ledger in which the accounts debited and credited are maintained is recorded here. Folio means page and ledger folio

means page number of ledger. This L.F. helps in cross verification of accounts

in the ledger and helps in audit of accounts.

Debit column: The amount to be

debited is recorded in this column. The unit of measurement, that is, amount expressed in the

currency of the country is recorded in this column. For example, in India

amount is recorded in rupees (Rs.).

Credit column: The amount to be

credited is recorded in this column. The unit of measurement, that is, the currency of the country

is written in this column. For example, in India amount is recorded in rupees (Rs.).

Narration: A short description of

each transaction is written under each entry which is called narration.

Tutorial note

·

While entering the date, the year may be written at

the top, then the month and then the particular date.

·

The

narration must be simple and complete. The words ‘Being’ or ‘For’ may also be

prefixed before the narration.

·

It is

customary to write ‘Dr’ and ‘To’ in the journal entries.

·

L.F.

column is filled when the transaction is posted to the ledger. In computerised

accounting, it is the reference number.

· The amount columns of a journal may be totalled at the end of the each page and the grand total may be given at the end of the month.

·

To show

each journal entry separately, a line may be drawn after narration in

particulars column.

· When transactions of similar nature take place on the same date, they may be combined while they are journalised.

Steps in journalising

The process of analysing the business transactions

under the heads of debit and credit and recording them in the journal is called

journalising. An entry made in the journal is called a journal entry. The

following steps are followed in journalising:

• Analyse

the transactions and identify the accounts (based on aspects) which are involved

in the transaction.

• Classify

the above accounts under Personal account, Real account or Nominal account

• Apply the

rules of debit and credit for the above two accounts.

• Find which

account is to be debited and which account is to be credited by the application

of rules of double entry system Record the date of transaction in the date

column.

• Enter the

name of the account to be debited in the particulars column very close to the

left hand side of the particulars column followed by the abbreviation ‘Dr.’ at

the end in the same line. Against this, the amount to be debited is entered in

the debit amount column in the same line.

• Write the

name of the account to be credited in the second line starting with the word

‘To’ prefixed a few spaces away from the margin in the particulars column.

Against this, the amount to be credited is entered in the credit amount column

in the same line.

• Write the

narration within brackets in the next line in the particulars column.

Different types of journal entries

The journal entries may be of the following types:

a. Single entry

b. Compound entry

c. Opening entry

d. Closing entry

e. Rectifying entry

f. Adjusting entry

g. Transferring entry

Single entry: Single entry

is an entry in which only two accounts are involved, one account is debited and another

is credited.

Compound entry: Compound

entry is an entry in which more than two accounts are involved. Either more than one

account is debited or more than one account is credited or both.

Opening entry: Through

opening entry the balances of assets and liabilities at the end of the

previous accounting year are brought forward to the current accounting year.

This is dealt in chapter 6.

Closing entry: At the end of

the accounting period, the nominal accounts are closed by transferring to trading account

or profit and loss account. All direct expenses and direct revenues are

transferred to Trading Account. All indirect expenses and indirect revenues are

transferred to Profit and Loss Account. This is dealt in chapter 6.

Rectifying entry: Rectifying

entries are passed to make correction of errors in accounting. This

is dealt in chapter 9.

Adjusting entry: Adjusting

entry is the entry made for the transactions which remain unrecorded or require

adjustment after closing the accounts for the accounting year. This is dealt in

chapter 13.

Transfer entry: Transfer

entry is the entry through which amount is transferred from one account to another account.

Application of rules of double entry system

Rules of

double entry system of book-keeping are applied for business transactions as

follows:

i. Personal account

‘Debit the

receiver and Credit the giver’. In case of personal accounts, the rule is debit

the account of the person who receives the benefit and credit the account of

the person who gives the benefit.

Example : Paid Anbu Rs. 10,000 by cheque

Accounts

affected : Anbu account and Bank account

Nature of

accounts : Both are personal

accounts in nature

Rule :

Debit the receiver and credit the giver

Applying the

rule : Anbu is the receiver and the Bank

is the giver

Debit : Anbu account

Credit : Bank account

ii. Real account

‘Debit what comes in and Credit what goes out’. In

case of real accounts, the rule is debit what comes in and credit what goes

out.

Example : Furniture

purchased for cash Rs. 5,000

Accounts

affected : Furniture

account and Cash account

Nature of

accounts : Both are real accounts in nature

Rule : Debit

what comes in and credit what goes out

Applying the

rule : Furniture

comes in and cash goes out

Debit : Furniture account

Credit : Cash

account

iii .Nominal account

‘Debit all

expenses and losses and Credit all incomes and gains’. For nominal accounts,

the rule is debit all expenses and losses and credit all incomes and gains.

Example : Paid rent of Rs. 5,000 in cash

Accounts

affected : Rent

account and cash account

Nature of

accounts : Rent is a nominal account and cash account is a real account

Rule : Debit

all the expenses and losses and credit all the incomes and gains

Applying the

rule : Rent

is an expense and cash goes out

Debit Rent account

Credit Cash account

Analysis of transactions

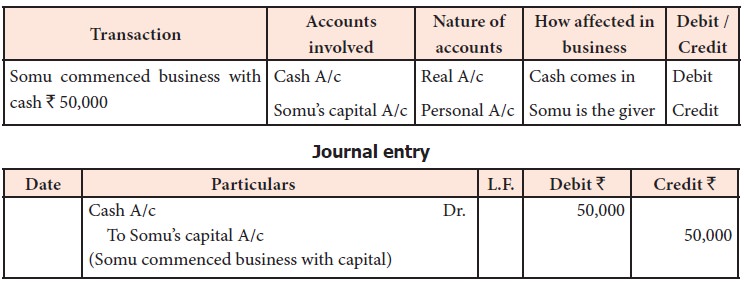

Example 1

Transaction: Somu commenced printing

business with cash Rs. 50,000.

Analysis: This is a cash transaction as cash is involved.

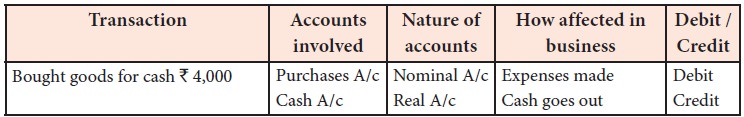

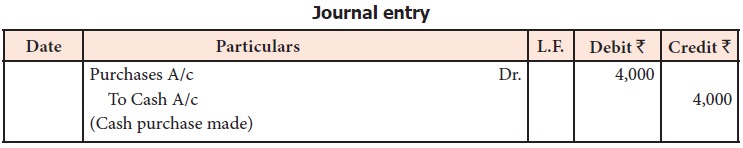

Example 2

Transaction: Bought goods for cash Rs. 4,000

Analysis: This is a cash transaction as cash is involved.

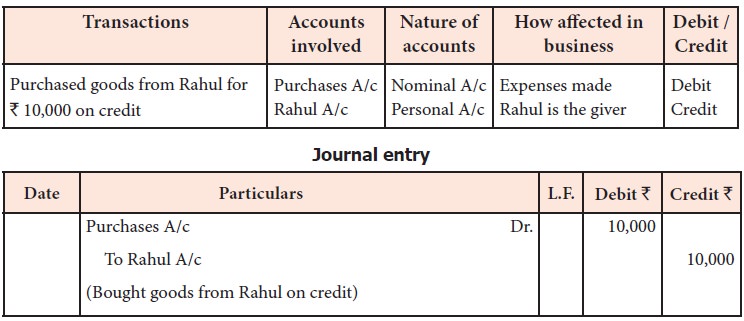

Example 3

Transaction: Purchased goods from Rahul for Rs. 10,000 on

credit

Analysis: This is a credit transaction.

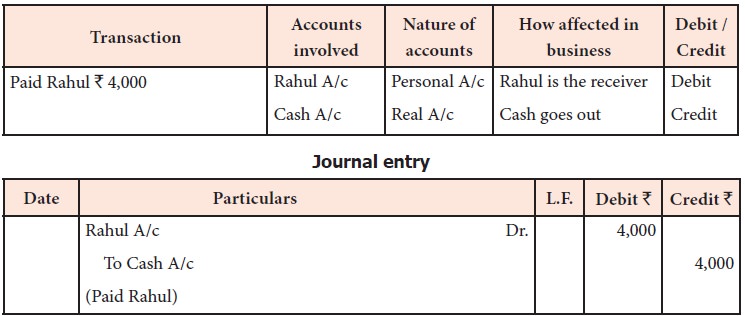

Example 4

Transaction: Cash paid to Rahul Rs. 4,000

Analysis: This is a cash transaction as cash is involved.

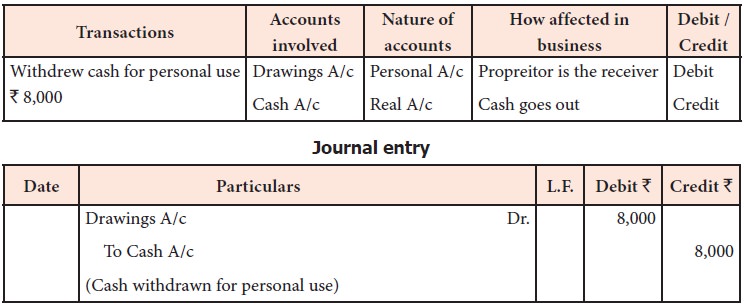

Example 5

Transaction: Withdrew cash for personal use Rs. 8,000

Analysis: This is a cash transaction as cash is involved.

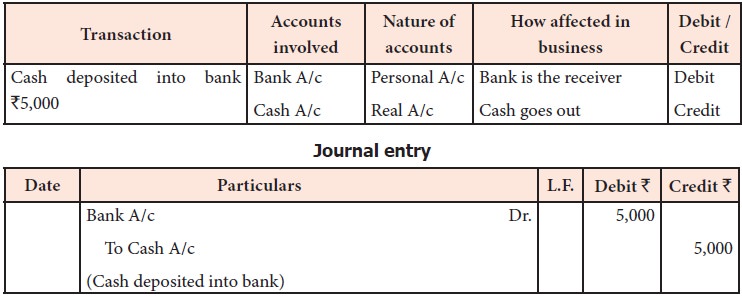

Example 6

Transaction: Cash deposited into bank Rs. 5,000

Analysis: This is a cash transaction as cash is involved.

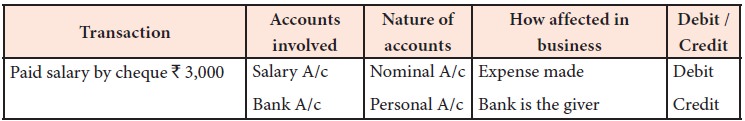

Example 7

Transaction: Paid salary by cheque Rs. 3,000

Analysis: This is a bank transaction as bank is involved.

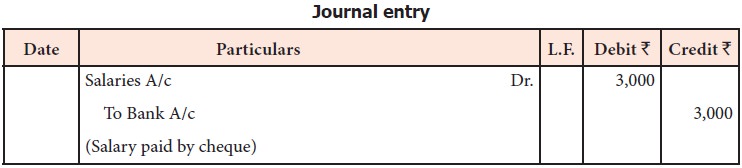

Example 8

Transaction: Sold goods to Mahesh on credit Rs. 9,000

Analysis: This is a credit transaction.

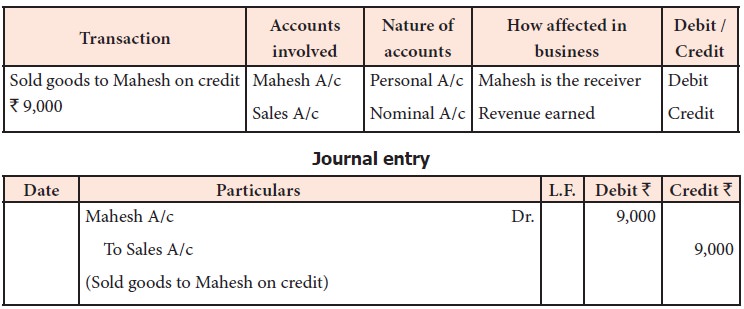

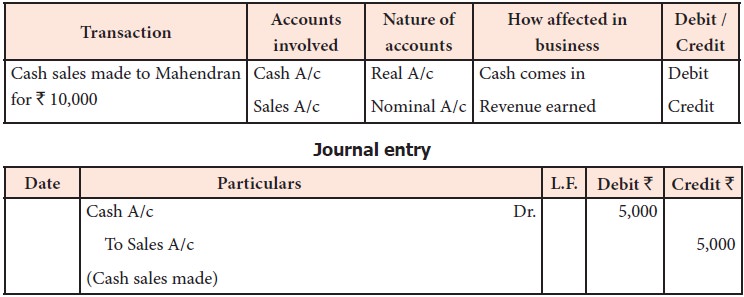

Example 9

Transaction: Goods sold to Mahendran for cash Rs. 5,000

Analysis: This is a cash transaction as cash is involved.

Example 10

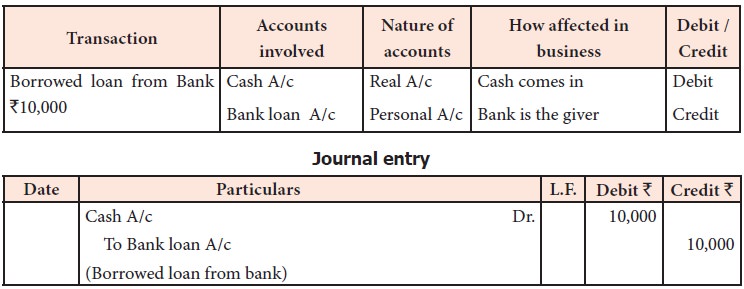

Transaction: Borrowed loan from Bank Rs. 10,000

Analysis: This is a cash transaction as cash is involved.

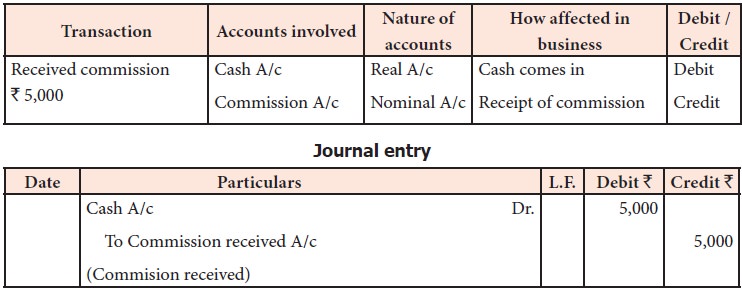

Example 11

Transaction: Received commission of Rs. 5,000 by cash

Analysis: This is a cash transaction as cash is involved.

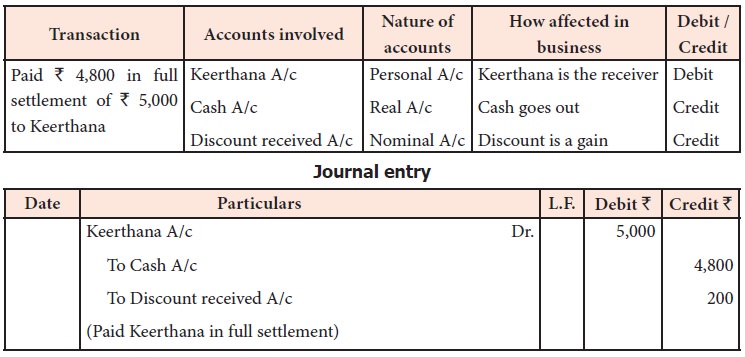

Example 12

Transaction:

Paid Rs. 4,800 in full settlement of Rs. 5,000 due to the creditor, Keerthana.

Analysis: This is a cash transaction as cash is involved.

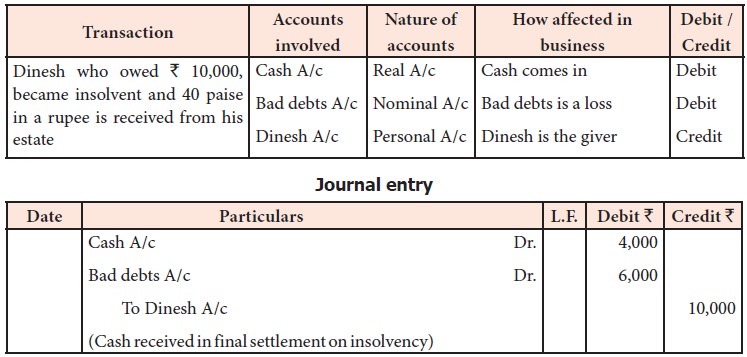

Example 13

Transaction:

Dinesh, a customer is declared

insolvent and 40 paise in a rupee is received from the estate for his due Rs. 10,000.

Analysis: This is a cash transaction as cash is involved.

Tutorial note

Though the

procedure for analysis of transactions, classification of accounts and rules

for recording transactions under accounting equation approach and traditional

approach are different, the accounts affected and entries in affected accounts

remain the same under both approaches. In other words, accounts to be debited

and credited to record the dual aspect remain the same under both the

approaches.

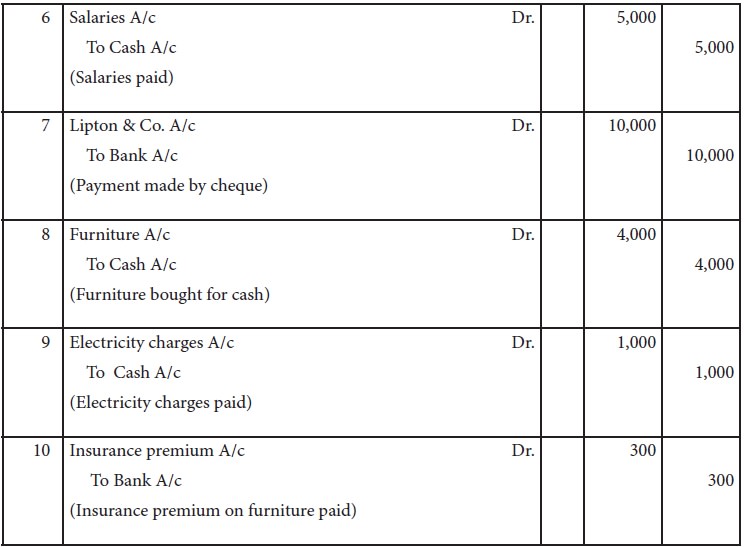

Illustration 8

Jeyaseeli is a sole proprietor having a provisions

store. Following are the transactions during the month of January, 2018.

Journalise them.

Jan. Rs.

1 Commenced business with cash 80,000

2 Deposited cash with bank 40,000

3 Purchased goods by paying cash 5,000

4 Purchased goods from Lipton & Co. on

credit 10,000

5 Sold goods to Joy and received cash 11,000

6 Paid salaries by cash 5,000

7 Paid Lipton & Co. by cheque for the purchases

made on 4th Jan.

8 Bought furniture by cash 4,000

9 Paid electricity charges by cash 1,000

10 Bank paid insurance premium on furniture as per

standing instructions 300

Solution

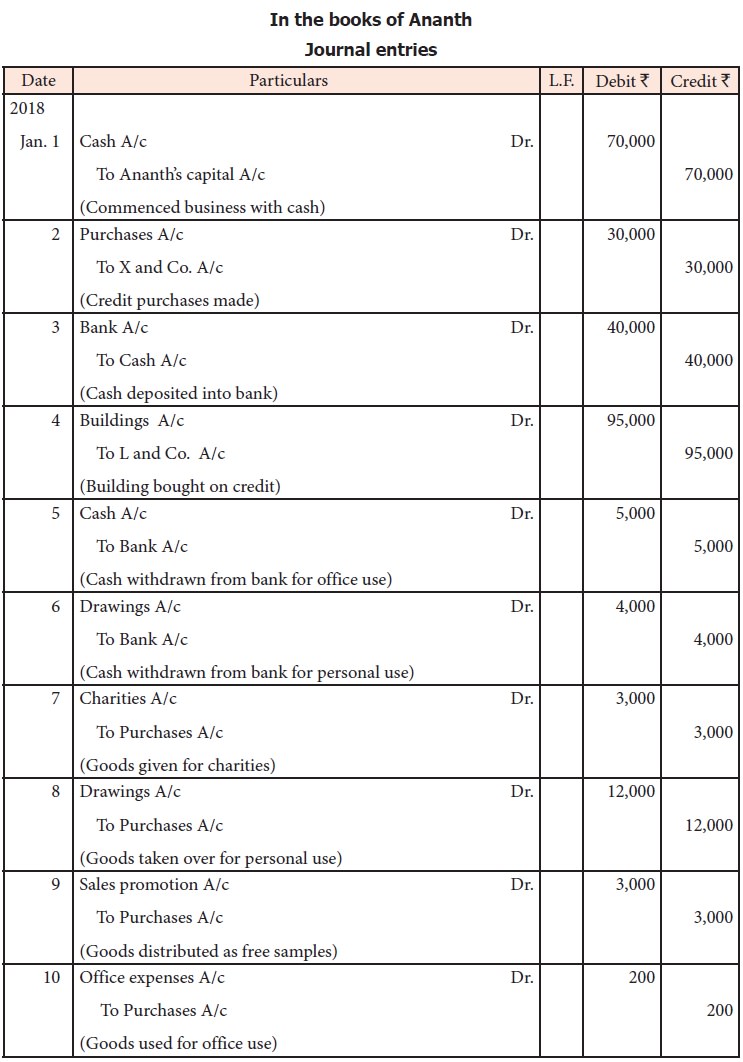

Illustration 9

Ananth is a trader dealing in textiles. For the

following transactions, pass journal entries for the month of January, 2018.

Jan. Rs.

1 Commenced business with cash 70,000

2 Purchased goods from X and Co. on credit 30,000

3 Cash deposited into bank 40,000

4 Bought a building from L and Co. on credit 95,000

5 Cash withdrawn from bank for office use 5,000

6 Cash withdrawn from bank for personal use of

Ananthu 4,000

7 Towels given as charities 3,000

8 Shirts taken over by Ananth for personal use 12,000

9 Sarees distributed as free samples 3,000

10 Goods (table clothes) used for office use 200

Solution

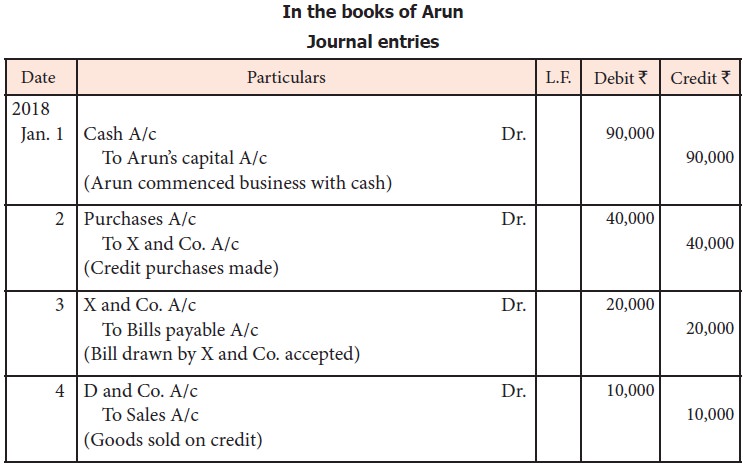

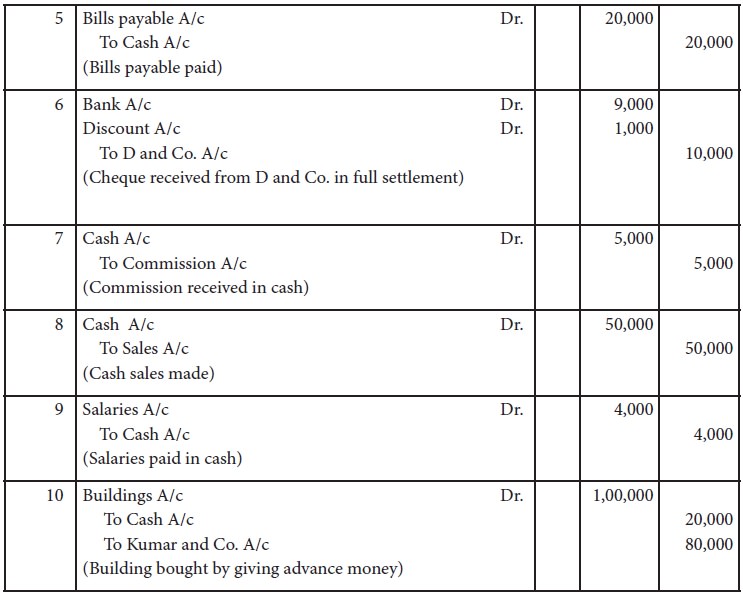

Illustration 10

Arun is a trader dealing in automobiles. For the

following transactions, pass journal entries for the month of January, 2018

Jan. Rs.

1 Commenced business with cash 90,000

2 Purchased goods from X and Co. on credit 40,000

3 Accepted bill drawn by X and Co. 20,000

4 Sold goods to D and Co. on credit 10,000

5 Paid by cash the bill drawn by X and Co.

6 Received cheque from D and Co. in full

settlement and deposited the same in bank 9,000

7 Commission received in cash 5,000

8 Goods costing Rs. 40,000 was sold and cash

received 50,000

9 Salaries paid in cash 4,000

10 Building purchased from Kumar and Co. for Rs.

1,00,000 and an advance of Rs. 20,000 is given in cash

Solution

Illustration 11

Bragathish is a trader dealing in electronic goods

who commenced his business in 2015. For the following transactions took place

in the month of March 2018, pass journal entries.

March Rs.

1. Purchased goods from Y and Co. on credit 60,000

2. Sold goods to D and Co. on credit 30,000

3. Paid Y and Co. through bank in full settlement 58,000

4. D and Co. accepted a bill drawn by Bragathish 30,000

5. Sold goods to L on credit 20,000

6. Sold goods to M on credit 40,000

7 Received a cheque from M in full settlement and deposited the same to the bank 39,000

8. Goods

returned to Y and Co. 4,000

9. L became insolvent and only 90 paise per rupee

is received by cash in final settlement

10. Goods returned by M 3,000

Solution

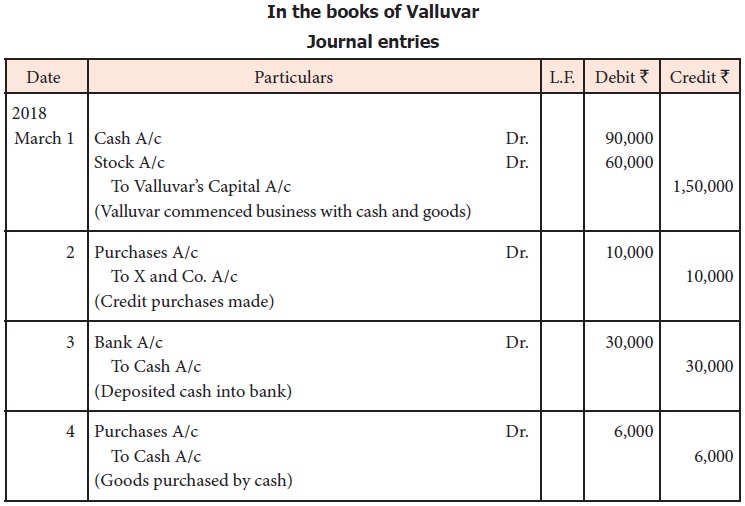

Illustration 12

Valluvar is a sole trader dealing in textiles. From

the following transactions, pass journal entries for the month of March, 2018.

March Rs.

1 Commenced business with cash 90,000

with goods 60,000

2 Purchased 20 readymade shirts from X and Co.

on credit 10,000

3 Cash deposited into bank through Cash Deposit

Machine 30,000

4 Purchased 10 readymade sarees from Y and Co.

by cash 6,000

5 Paid X and Co. through NEFT

6 Sold 5 sarees to A and Co. on credit 4,000

7 A and Co. deposited the amount due in Cash

Deposit Machine

8 Purchased 20 sarees from Z & Co. and paid

through debit card 12,000

9 Stationery purchased for and paid through net

banking 6,000

10 Bank charges levied 200

Solution

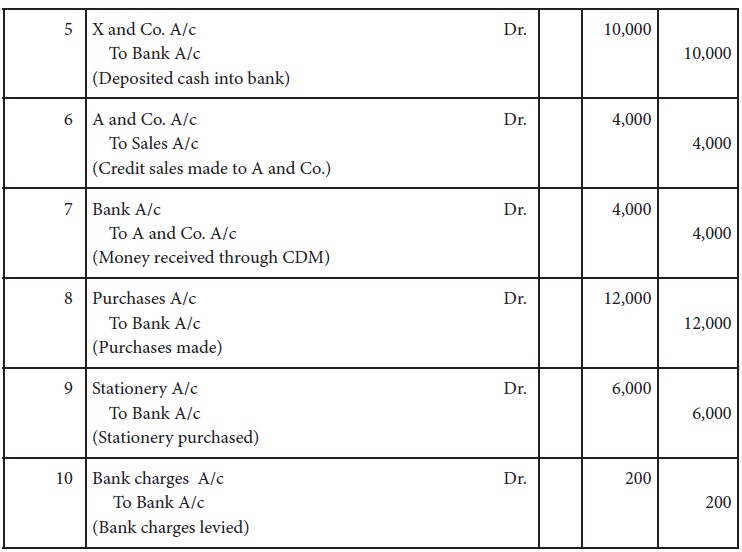

Illustration 13

Deri is a sole trader dealing in automobiles. From

the following transactions, pass journal entries for the month of January,

2018.

Jan. Rs.

1 Commenced business with cash 1,00,000

with goods 2,00,000

with buildings 5,00,000

2 Purchased goods from A and Co. on credit 3,00,000

3 Cash deposited into bank 80,000

4 Purchased goods from B and Co. and payment made through credit card 5,000

5 Paid A and Co. through RTGS

6 Sold goods to C and Co. and cheque received 50,000

7 Deposited the cheque received from C and Co.

with the bank

8 Purchased goods from Z & Co. and paid

through debit card 12,000

9 Stationery

purchased for and paid through net banking 6,000

10 Income

tax of Deri is paid by cheque 10,000

Solution

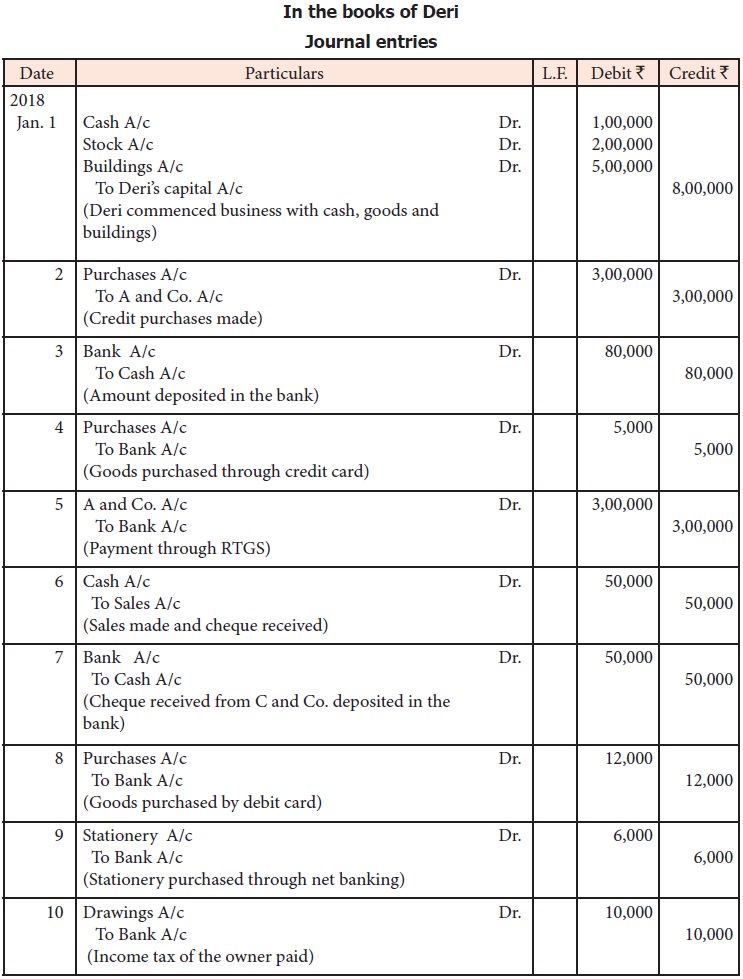

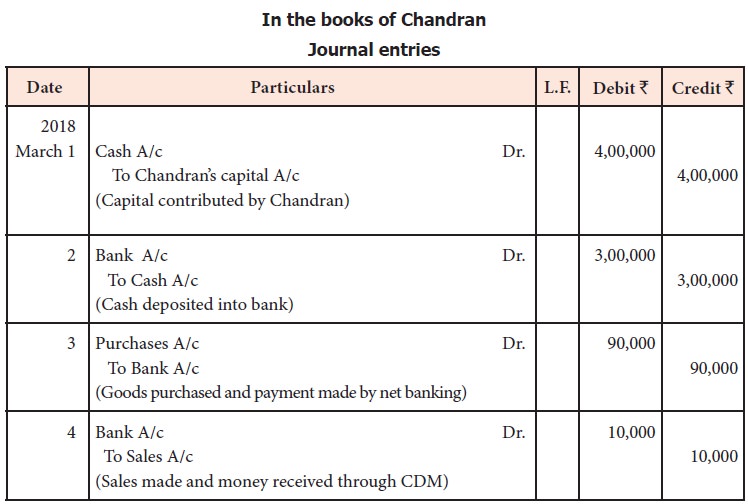

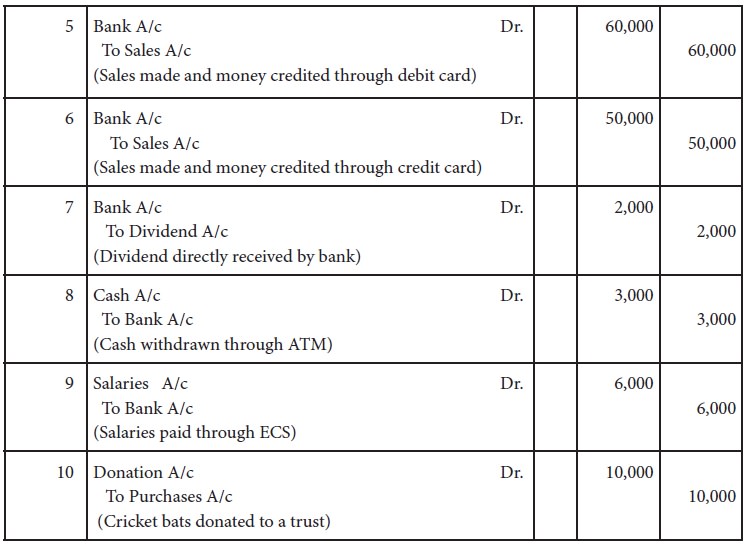

Illustration 14

Chandran is a sole trader dealing in sports items.

From the following transactions, pass journal entries for the month of March,

2018.

March Rs.

1 Commenced business with cash 4,00,000

2 Cash deposited into bank 3,00,000

3 Purchased goods from Ravi and payment made

through net banking 90,000

4 Sales made to Kumar, who deposited the money

through CDM 10,000

5 Sales made to Vivek, who made the payment by

debit card 60,000

6 Sold goods to Keerthana, who made the payment

through credit card 50,000

7 Dividend directly received by bank 2,000

8 Money withdrawn from ATM 3,000

9 Salaries paid through ECS 6,000

10 Cricket bats donated to a trust 10,000

Solution

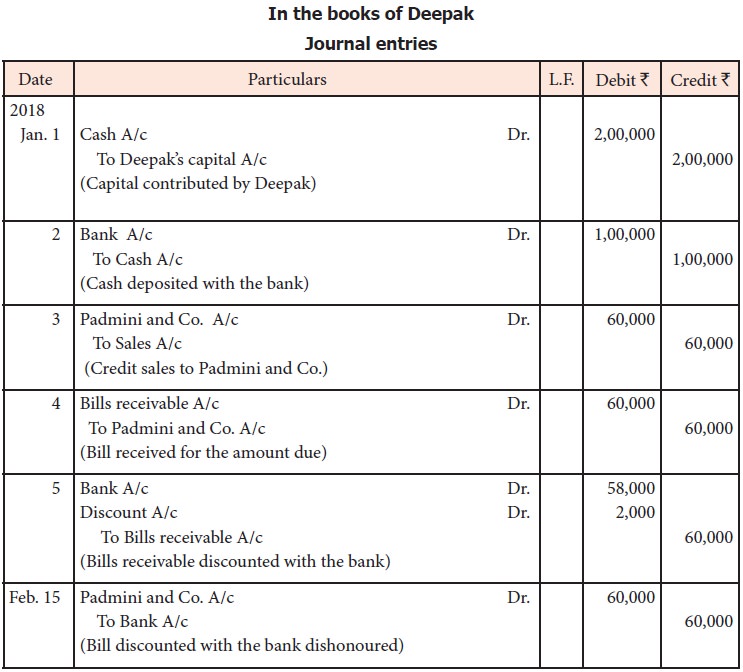

Illustration 15

Deepak is a dealer in stationery items. From the

following transactions, pass journal entries for the month of January and

February, 2018.

Jan. Rs.

1 Commenced business with cash 2,00,000

2 Opened a bank account by depositing cash 1,00,000

3 ‘A 4 papers’ sold on credit to Padmini and

Co. 60,000

4 Bills received from Padmini and Co. for the

amount due

5 Bills received from Padmini and Co.

discounted with the bank 58,000 Feb.

15 Bills of Padmini and Co. dishonoured

Solution

Advantages of journal

Following are the advantages of journal:

• Complete information about the business

transactions can be obtained on time basis as the transactions are recorded in

chronological order.

• Correctness of the entry can be checked

through narration.

• Journal forms the basis for posting the

entries in the ledger.

Related Topics