Books of Prime Entry | Accountancy - Journal entries: Illustration Problems with solution | 11th Accountancy : Chapter 3 : Books of Prime Entry

Chapter: 11th Accountancy : Chapter 3 : Books of Prime Entry

Journal entries: Illustration Problems with solution

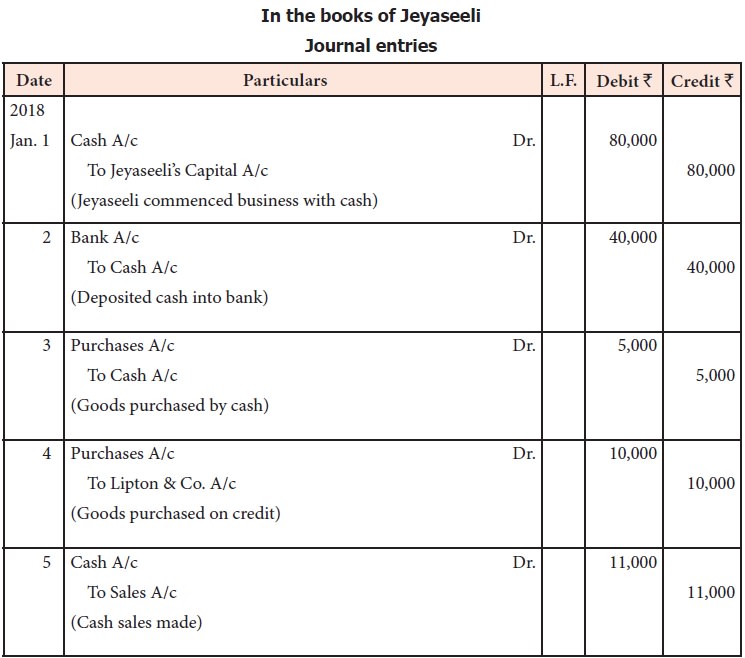

Illustration 8

Jeyaseeli is a sole proprietor having a provisions store. Following are the transactions during the month of January, 2018. Journalise them.

Jan. Rs.

1 Commenced business with cash 80,000

2 Deposited cash with bank 40,000

3 Purchased goods by paying cash 5,000

4 Purchased goods from Lipton & Co. on credit 10,000

5 Sold goods to Joy and received cash 11,000

6 Paid salaries by cash 5,000

7 Paid Lipton & Co. by cheque for the purchases made on 4th Jan.

8 Bought furniture by cash 4,000

9 Paid electricity charges by cash 1,000

10 Bank paid insurance premium on furniture as per standing instructions 300

Solution

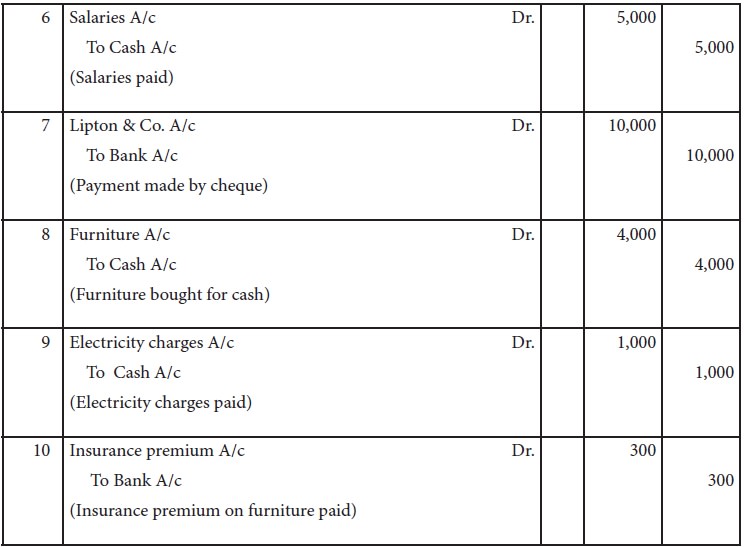

Illustration 9

Ananth is a trader dealing in textiles. For the following transactions, pass journal entries for the month of January, 2018.

Jan. Rs.

1 Commenced business with cash 70,000

2 Purchased goods from X and Co. on credit 30,000

3 Cash deposited into bank 40,000

4 Bought a building from L and Co. on credit 95,000

5 Cash withdrawn from bank for office use 5,000

6 Cash withdrawn from bank for personal use of Ananthu 4,000

7 Towels given as charities 3,000

8 Shirts taken over by Ananth for personal use 12,000

9 Sarees distributed as free samples 3,000

10 Goods (table clothes) used for office use 200

Solution

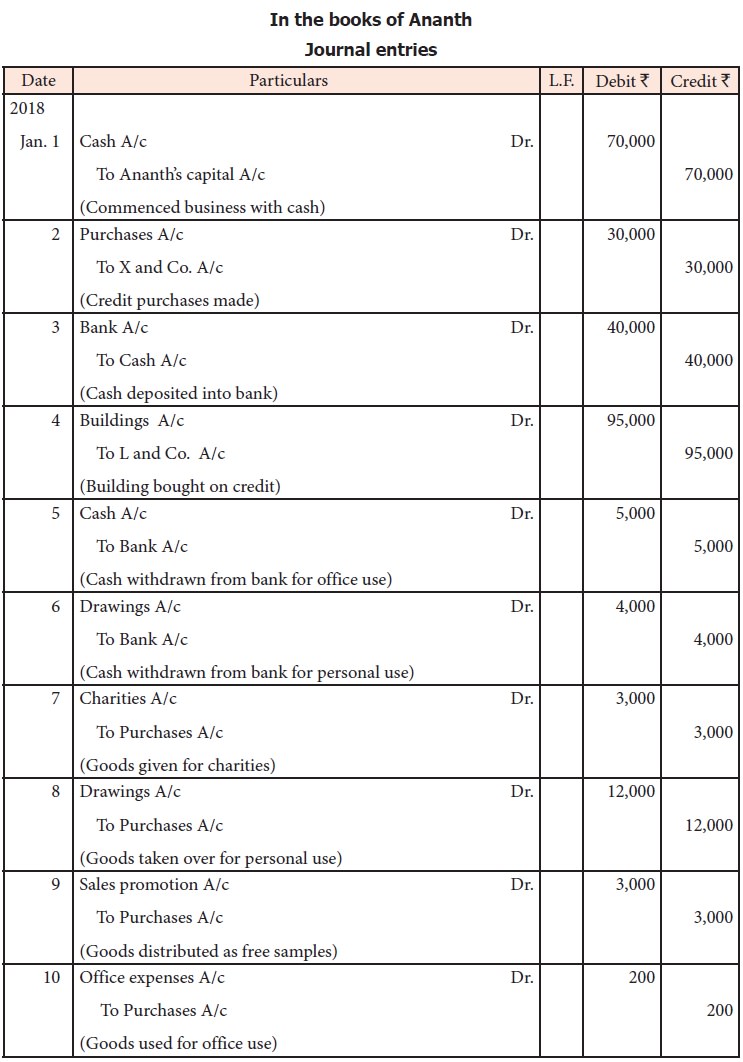

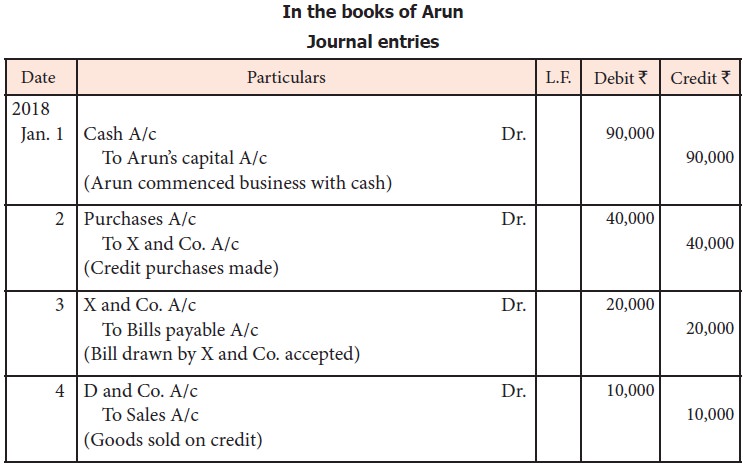

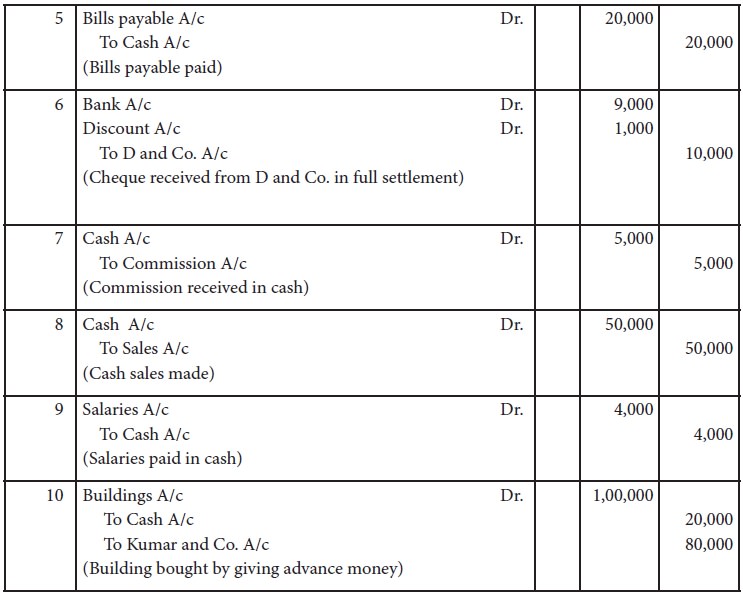

Illustration 10

Arun is a trader dealing in automobiles. For the following transactions, pass journal entries for the month of January, 2018

Jan. Rs.

1 Commenced business with cash 90,000

2 Purchased goods from X and Co. on credit 40,000

3 Accepted bill drawn by X and Co. 20,000

4 Sold goods to D and Co. on credit 10,000

5 Paid by cash the bill drawn by X and Co.

6 Received cheque from D and Co. in full settlement and deposited the same in bank 9,000

7 Commission received in cash 5,000

8 Goods costing Rs. 40,000 was sold and cash received 50,000

9 Salaries paid in cash 4,000

10 Building purchased from Kumar and Co. for Rs. 1,00,000 and an advance of Rs. 20,000 is given in cash

Solution

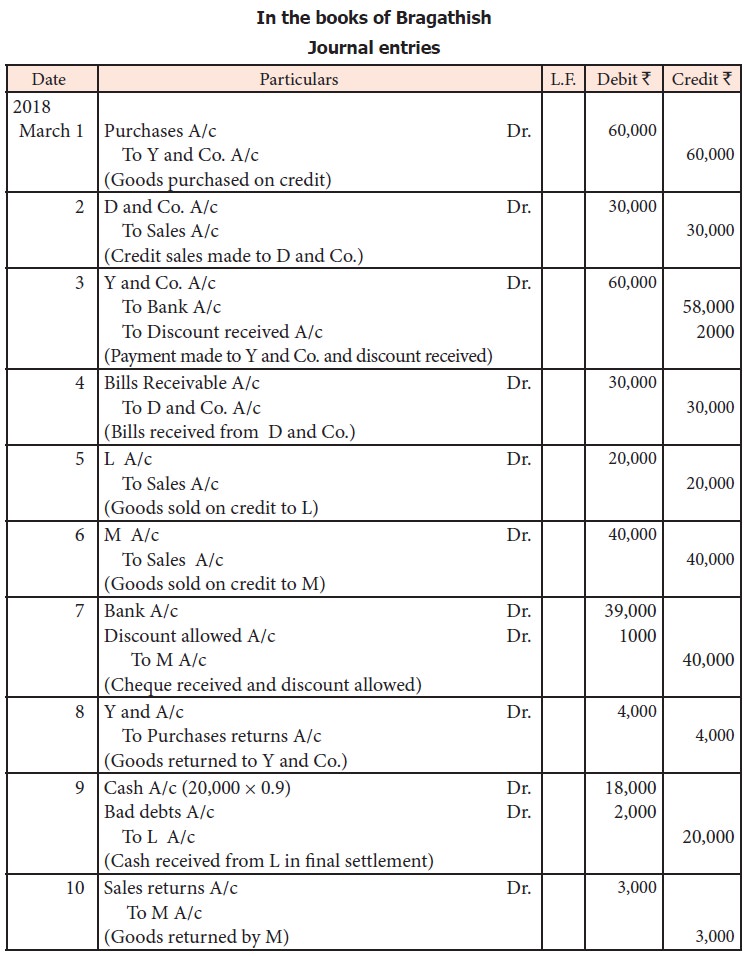

Illustration 11

Bragathish is a trader dealing in electronic goods who commenced his business in 2015. For the following transactions took place in the month of March 2018, pass journal entries.

March Rs.

1. Purchased goods from Y and Co. on credit 60,000

2. Sold goods to D and Co. on credit 30,000

3. Paid Y and Co. through bank in full settlement 58,000

4. D and Co. accepted a bill drawn by Bragathish 30,000

5. Sold goods to L on credit 20,000

6. Sold goods to M on credit 40,000

7 Received a cheque from M in full settlement and deposited the same to the bank 39,000

8. Goods returned to Y and Co. 4,000

9. L became insolvent and only 90 paise per rupee is received by cash in final settlement

10. Goods returned by M 3,000

Solution

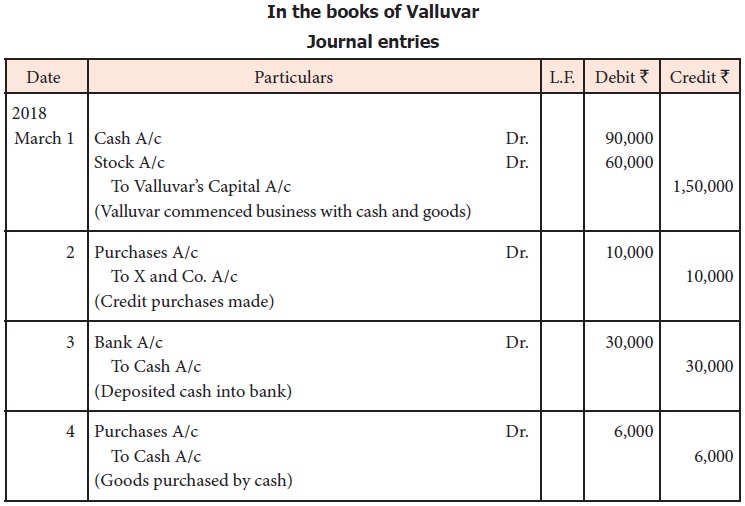

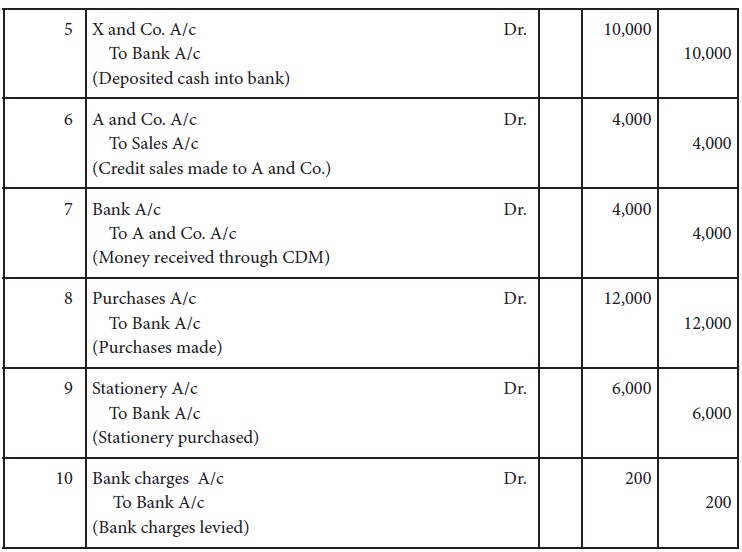

Illustration 12

Valluvar is a sole trader dealing in textiles. From the following transactions, pass journal entries for the month of March, 2018.

March Rs.

1 Commenced business with cash 90,000

with goods 60,000

2 Purchased 20 readymade shirts from X and Co. on credit 10,000

3 Cash deposited into bank through Cash Deposit Machine 30,000

4 Purchased 10 readymade sarees from Y and Co. by cash 6,000

5 Paid X and Co. through NEFT

6 Sold 5 sarees to A and Co. on credit 4,000

7 A and Co. deposited the amount due in Cash Deposit Machine

8 Purchased 20 sarees from Z & Co. and paid through debit card 12,000

9 Stationery purchased for and paid through net banking 6,000

10 Bank charges levied 200

Solution

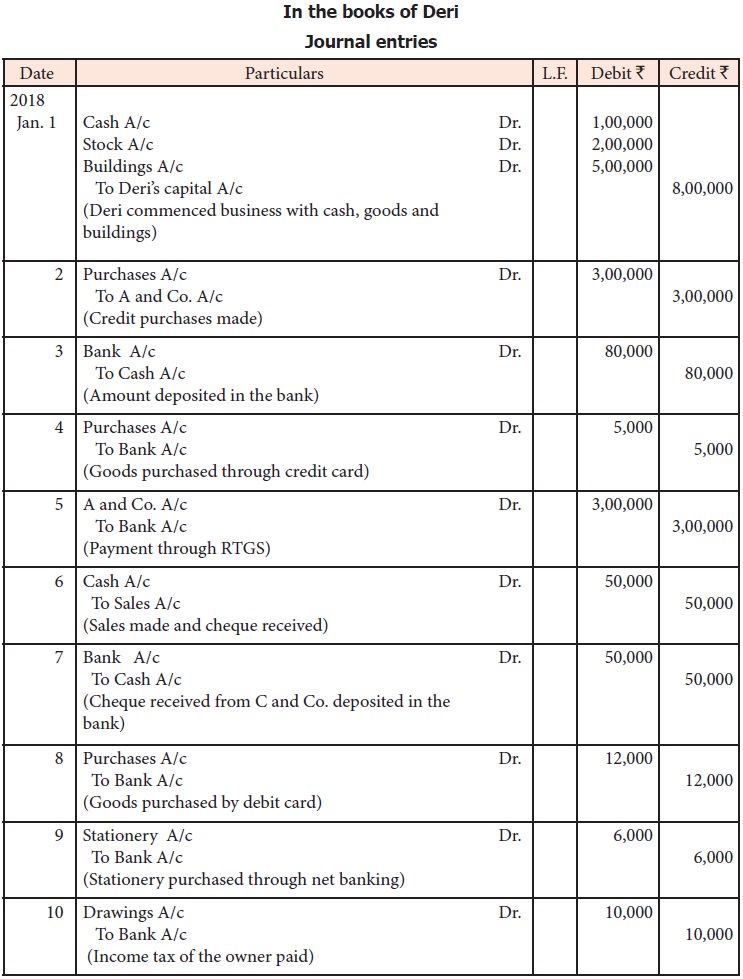

Illustration 13

Deri is a sole trader dealing in automobiles. From the following transactions, pass journal entries for the month of January, 2018.

Jan. Rs.

1 Commenced business with cash 1,00,000

with goods 2,00,000

with buildings 5,00,000

2 Purchased goods from A and Co. on credit 3,00,000

3 Cash deposited into bank 80,000

4 Purchased goods from B and Co. and payment made through credit card 5,000

5 Paid A and Co. through RTGS

6 Sold goods to C and Co. and cheque received 50,000

7 Deposited the cheque received from C and Co. with the bank

8 Purchased goods from Z & Co. and paid through debit card 12,000

9 Stationery purchased for and paid through net banking 6,000

10 Income tax of Deri is paid by cheque 10,000

Solution

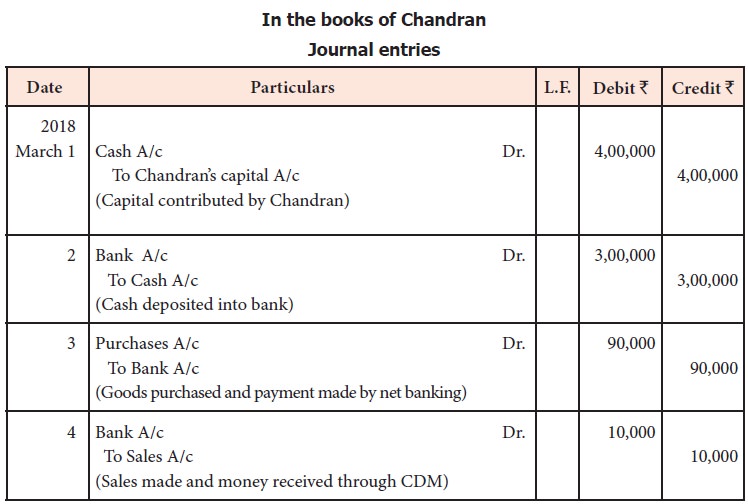

Illustration 14

Chandran is a sole trader dealing in sports items. From the following transactions, pass journal entries for the month of March, 2018.

March Rs.

1 Commenced business with cash 4,00,000

2 Cash deposited into bank 3,00,000

3 Purchased goods from Ravi and payment made through net banking 90,000

4 Sales made to Kumar, who deposited the money through CDM 10,000

5 Sales made to Vivek, who made the payment by debit card 60,000

6 Sold goods to Keerthana, who made the payment through credit card 50,000

7 Dividend directly received by bank 2,000

8 Money withdrawn from ATM 3,000

9 Salaries paid through ECS 6,000

10 Cricket bats donated to a trust 10,000

Solution

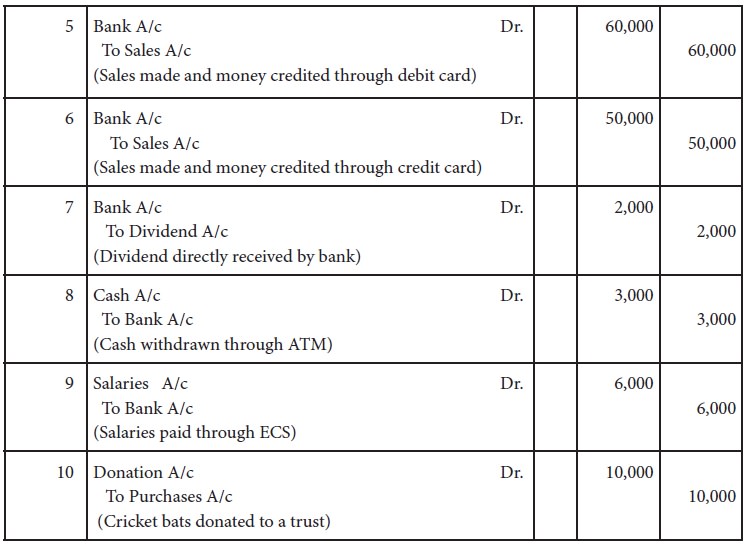

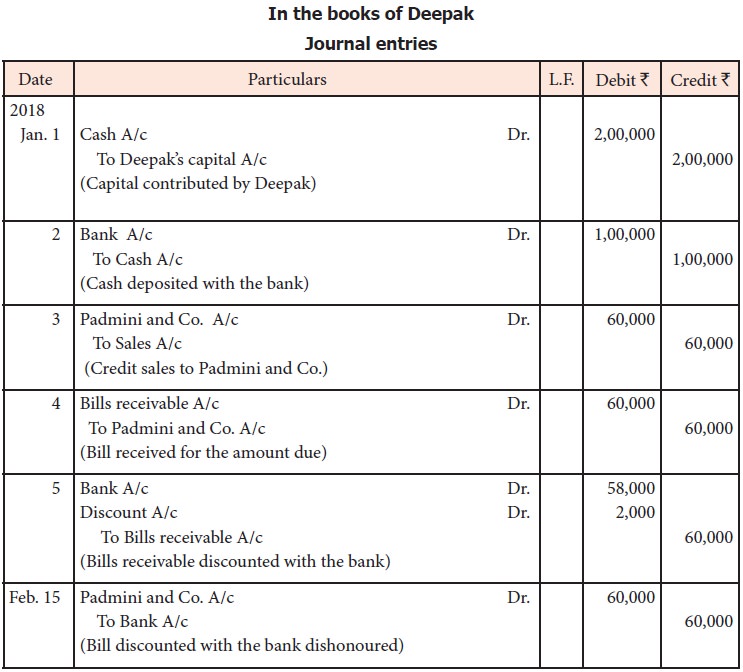

Illustration 15

Deepak is a dealer in stationery items. From the following transactions, pass journal entries for the month of January and February, 2018.

Jan. Rs.

1 Commenced business with cash 2,00,000

2 Opened a bank account by depositing cash 1,00,000

3 ‘A 4 papers’ sold on credit to Padmini and Co. 60,000

4 Bills received from Padmini and Co. for the amount due

5 Bills received from Padmini and Co. discounted with the bank 58,000 Feb.

15 Bills of Padmini and Co. dishonoured

Solution

Related Topics