Chapter 1 | Economics | 8th Social Science - Savings in Banks and Investments | 8th Social Science : Economics : Chapter 1 : Money, Savings and Investments

Chapter: 8th Social Science : Economics : Chapter 1 : Money, Savings and Investments

Savings in Banks and Investments

Savings in Banks and Investments

Savings

Savings are defined as the part of consumer’s

disposable income which is not used for current consumption, rather kept aside

for future use. There are several ways through which a person can save money.

The banking facilitates saving money through various forms of accounts.

1. Student Savings Account

Some banks offer saving accounts

specifically for young people enrolled in high schools or colleges. The main

features of these account is to maintain zero Balance.

2. Savings Deposits

Savings deposits are opened by

customers to save the part of their current income. The customers can withdraw

their money from their accounts when they require it. The bank also gives a

small amount of interest to the money in the saving deposits.

3. Current Account Deposit

Current accounts are generally

opened by business firms, traders and public authorities. The current accounts

help in frequent banking transactions as they are repayable on demand.

4. Fixed Deposits

Fixed deposits accounts are meant

for investors who want their principle to be safe and yield them fixed yields.

The fixed deposits are also called as Term deposit as, normally, they are fixed

for specified period.

Benefits of Savings

*

You will be financially independent sooner.

*

You would not have to worry any unforeseen expenses.

*

In future, you will have financial backup in place if you lose your job.

* You will be prepared if your

circumstances change.

* You will be more comfortable in

retirement.

* Save today for better tomorrow

Intensity to save among the

students

* Teach them about taxes and

accounting.

* Involve them in grown-up money

decisions.

* Encourage them to apply for

scholarship.

* Help them budget and apply for

student loans.

* Teach them personal savings.

Encourage them to open a student

Sanchayeka Scheme.

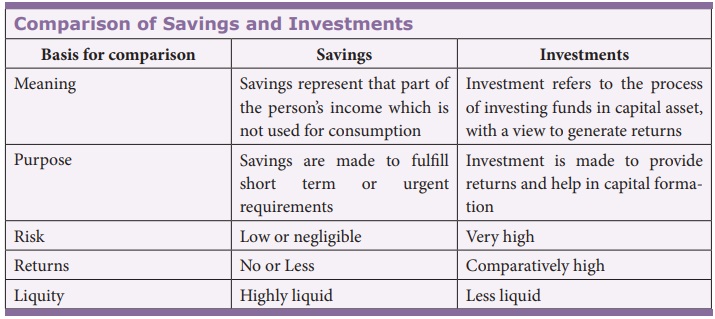

Investments

The process of investing something

is known as an investment. It could be anything, i.e. money, time efforts or

other resources that you exchange to earn returns in future.

Investment can be made in different

investment vehicles like,

1. Stock

2. Bonds

3. Mutual funds

4. Insurance

5. Annuities

6. Deposit account or any other

securities or assets

An investment always comes with

risks of losing money, but it is also true that you can reap more money with

the same investment vehicle. It has a productive nature that helps in the

economic growth of the country.

Related Topics