Company Management - Remuneration of Director | 12th Commerce : Chapter 27 : Company Law and Secretarial Practice : Company Management

Chapter: 12th Commerce : Chapter 27 : Company Law and Secretarial Practice : Company Management

Remuneration of Director

Remuneration of Director

Managerial Persons covered are Managing Director,

Whole-time Director, Part time Directors and managers who shall be paid

remuneration in accordance with provisions of Section 197 of the Companies Act,

2013.

Managerial Remuneration

The Managerial remuneration is payable to a

person's appointed u/s 196 of the Act. The Term remuneration means any money or

its equivalent given or passed to any person for services rendered by him and

includes perquisites.

1. Value of rent-free or concession accom modation

2. Value any other items provided at free of cost

or at concessional rate. .

3. value of securities / sweat equity shares

allotted or transferred by the employer or former employer to the employee.

4. a contribution made by an employer to an

approved superannuation fund.

5. Value of any other fringe benefit or amenity.

6. Stock options would be part of remuneration for

all directors.

Forms of Managerial Remuneration

1. Based on Profit of the company

2. Based on Shareholders’ recommendations

3. Based on Shareholders’ and Central Government

recommendations.

Remuneration Allowed to Managerial Person in case of Company’s having adequate profits:

A Public Company can pay remuneration to its directors

including Managing Director and Whole-time Directors, and its managers which

shall not exceed 11% of the net profit and it may also be noted, when a Company

has only one Managing Director or Whole-time Director or manager the

remuneration payable shall not exceed 5% of net profits if it is more than one

11% as calculated in a manner laid down in section 198 of the Companies Act,

2013.

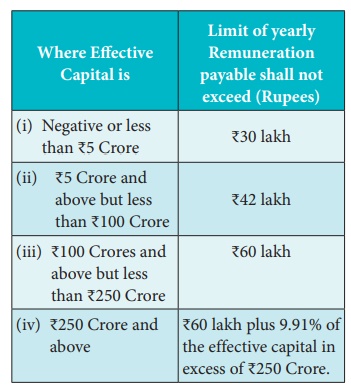

Remuneration Payable by a company in case where is

no profit or inadequacy of profit without Central Government and to pay

remuneration in excess of the above limit is detailed below:

Related Topics