Accounts from Incomplete Records | Accountancy - Preparation of final accounts from incomplete records | 12th Accountancy : Chapter 1 : Accounts from Incomplete Records

Chapter: 12th Accountancy : Chapter 1 : Accounts from Incomplete Records

Preparation of final accounts from incomplete records

Preparation

of final accounts from incomplete records

When books of accounts

are incomplete, information regarding revenues, expenses assets and liabilities

is not known fully. Hence, it becomes difficult to prepare trading and profit

and loss account and balance sheet. But with the available data, the missing

figures can be found out and then the final accounts can be prepared.

1. Steps to be followed to prepare final accounts from incomplete records

Following are the steps

to be followed to prepare final accounts from incomplete records:

1. Opening statement of

affairs is to be prepared, to ascertain the opening capital.

2. Missing figures must

be found out with the available data.

This can be done by

preparing memorandum accounts or by making necessary adjustments to the

existing figures. For example,

(a) It may become

necessary to prepare a cash book to find out the missing items such as cash

purchases, cash sales, etc.

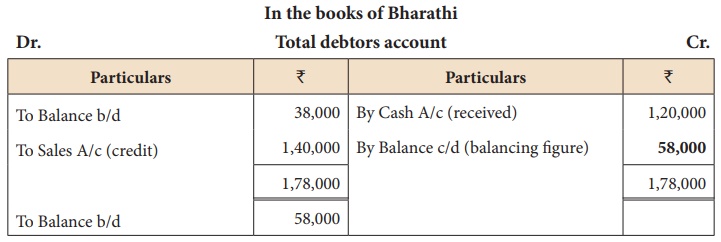

(b) By preparing total

debtors account and total creditors account, credit sales and credit purchases

can be ascertained respectively.

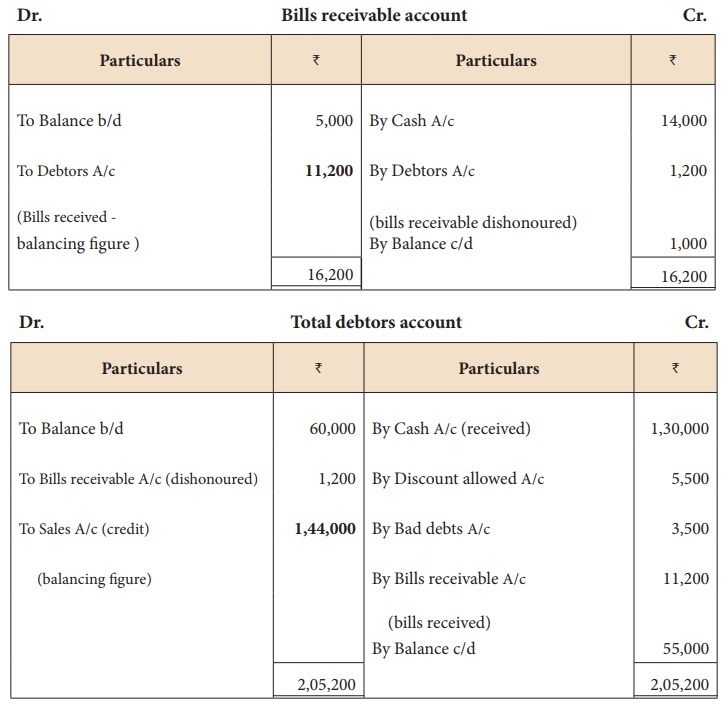

(c) Bills receivable account and bills payable account are to be prepared to find out the balances of bills receivable received and bills payable accepted respectively.

3. The final step is to

prepare trading and profit and loss account and balance sheet.

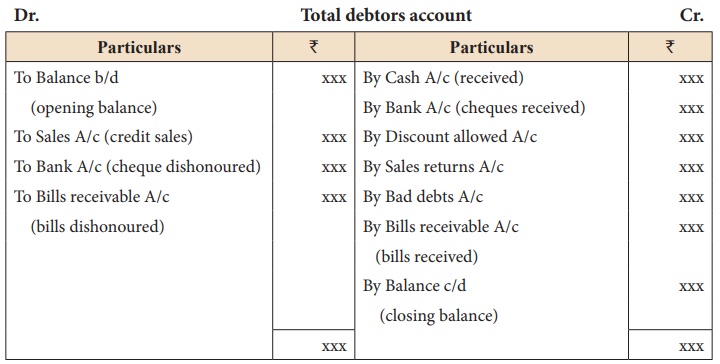

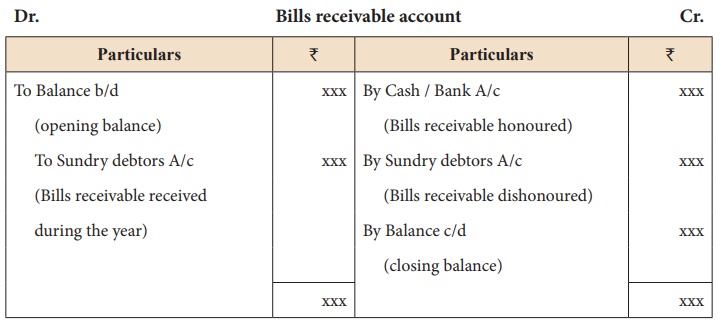

Formats of important

accounts, that is, total debtors account, bills receivable account, total

creditors account and bills payable account are given below:

(i) Format of total debtors account

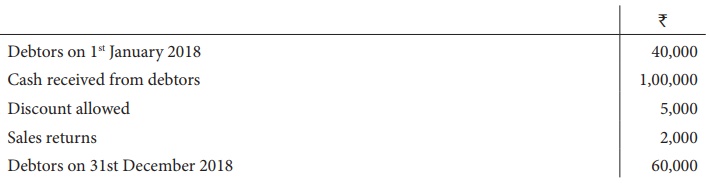

Illustration 10

Find out credit sales

from the following information:

Solution

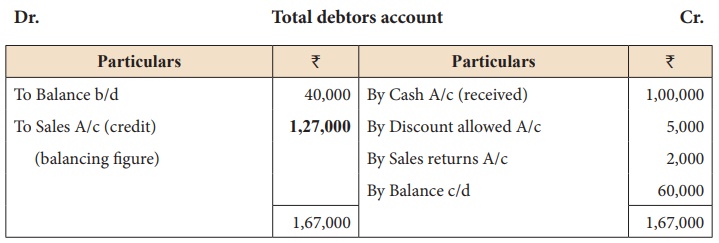

Illustration 11

From the following

details find out total sales made during the year.

= ₹ 1,40,000 + ₹ 1,90,000

= ₹ 3,30,000

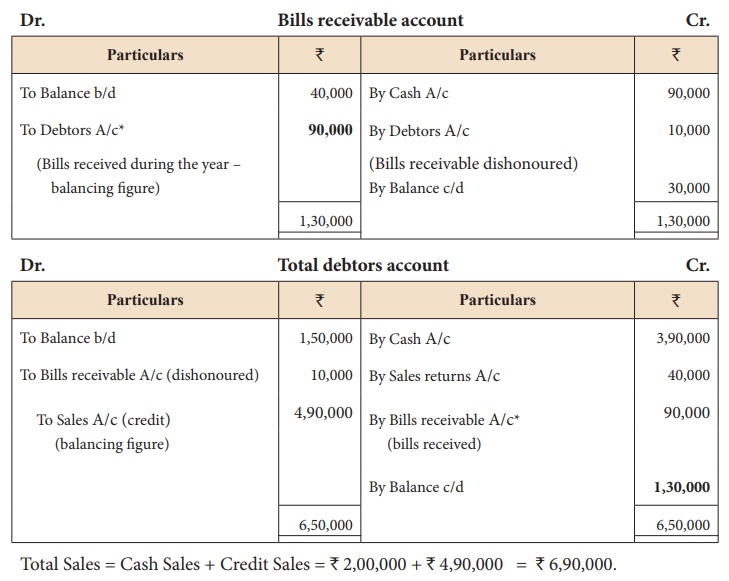

(ii) Format of bills receivable account

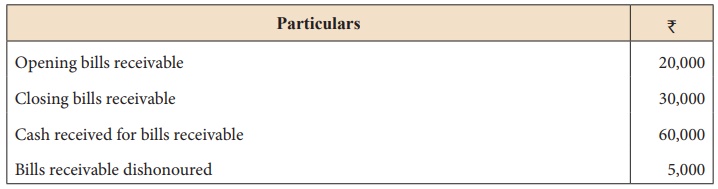

Illustration 12

From the following

particulars, prepare bills receivable account and compute the bills received

from the debtors.

Solution

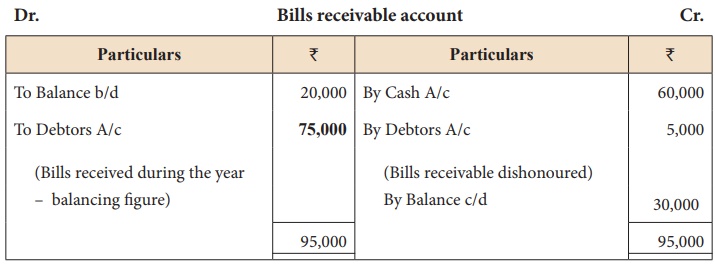

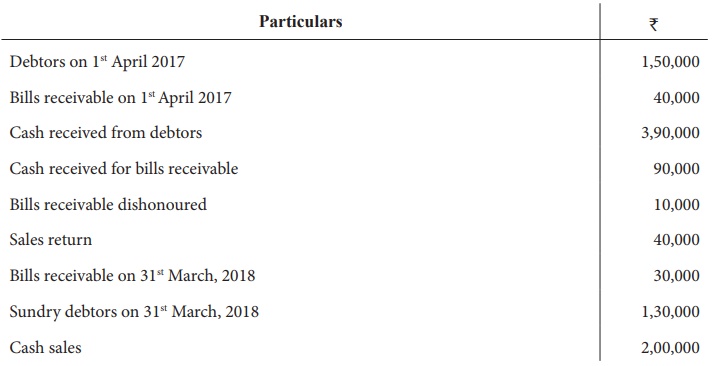

Illustration 13

From the following

particulars, calculate total sales.

Solution

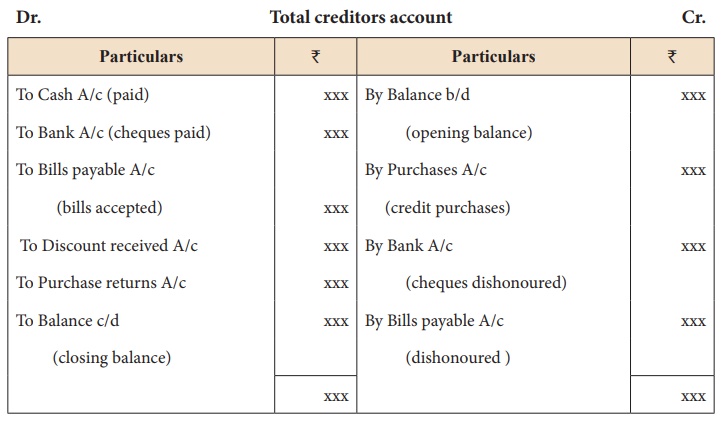

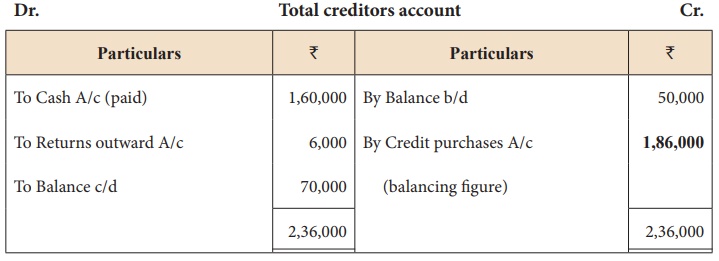

(iii) Format of total creditors account

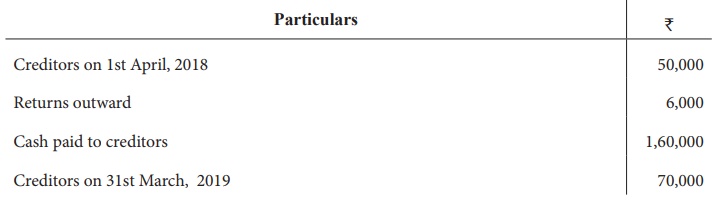

Illustration 14

From the following

details, calculate credit purchases.

Solution

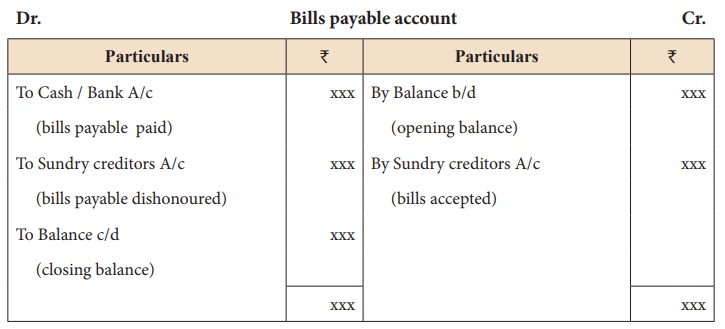

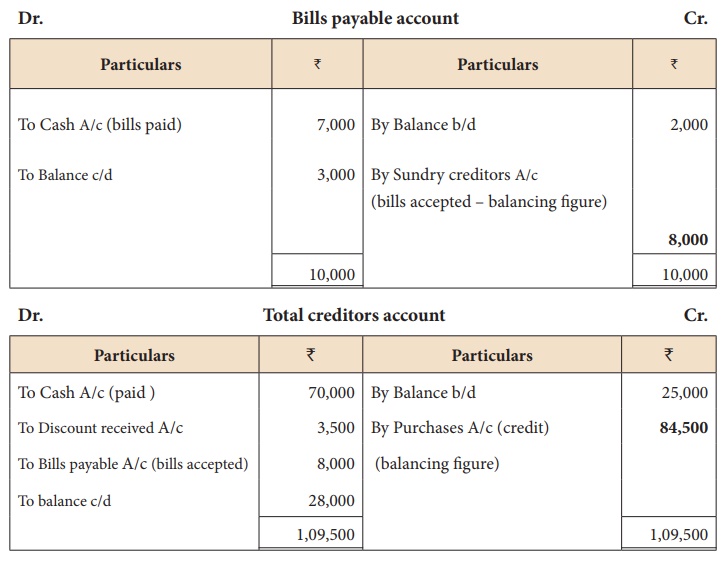

(iv) Format of bills payable account

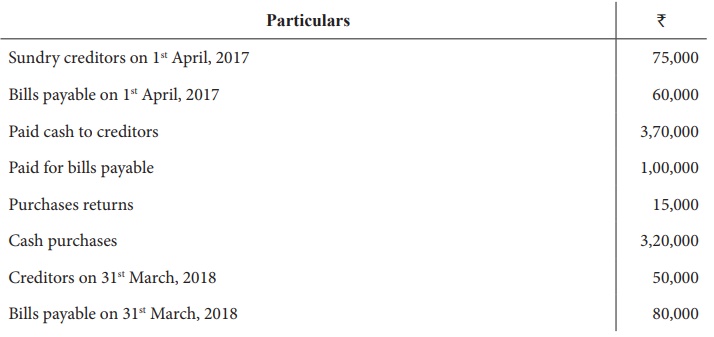

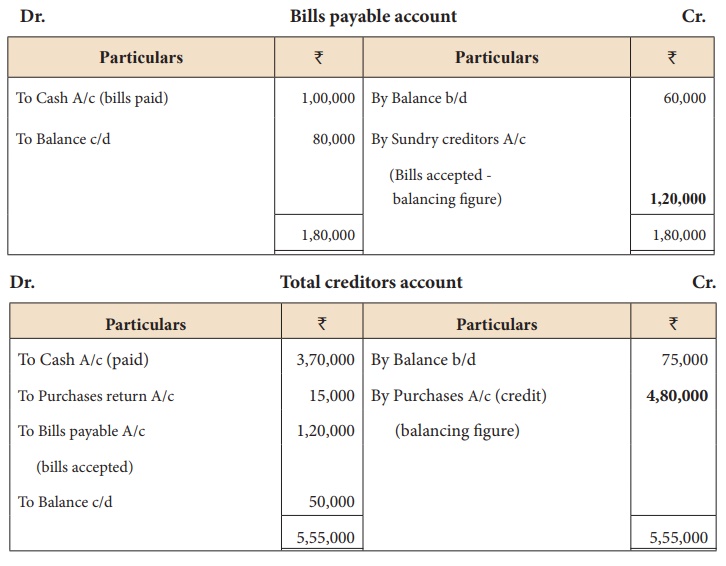

Illustration 15

From the following

particulars calculate total purchases.

Solution

Total purchases = Cash purchases + Credit purchases

= ₹ 3,20,000 + ₹ 4,80,000 = ₹ 8,00,000

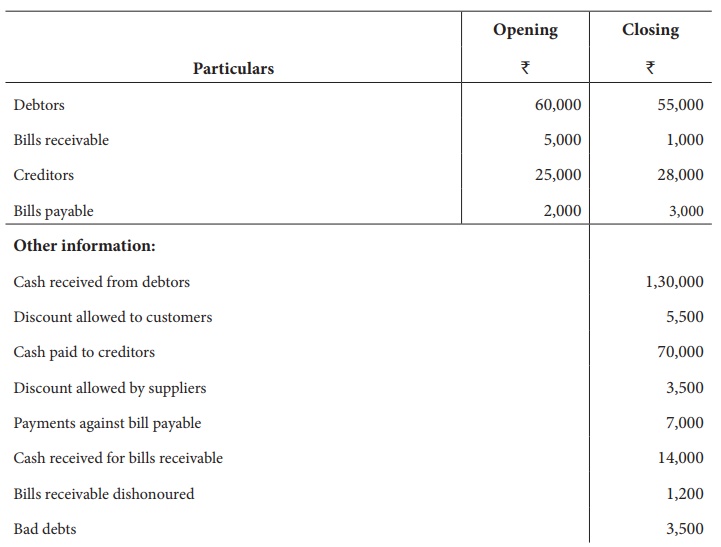

Illustration 16

From the following

details you are required to calculate credit sales and credit purchases by

preparing total debtors account, total creditors account, bills receivable

account and bills payable account.

Solution

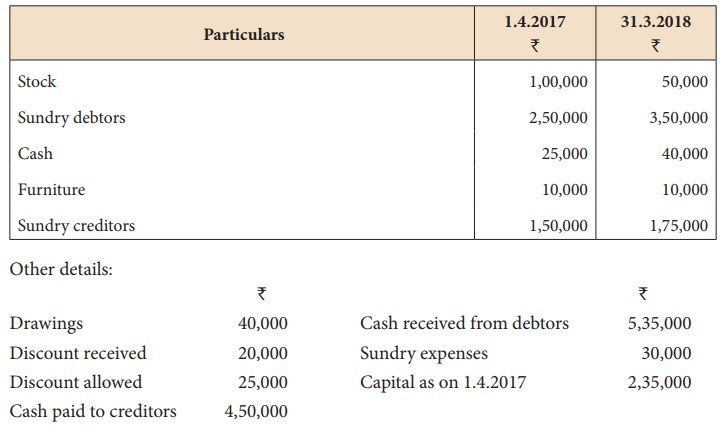

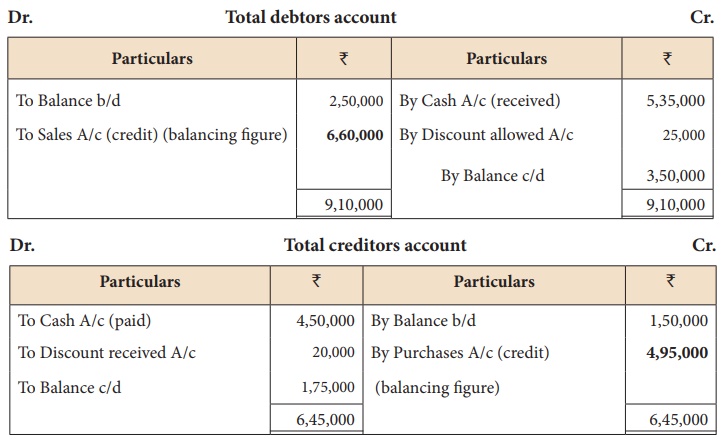

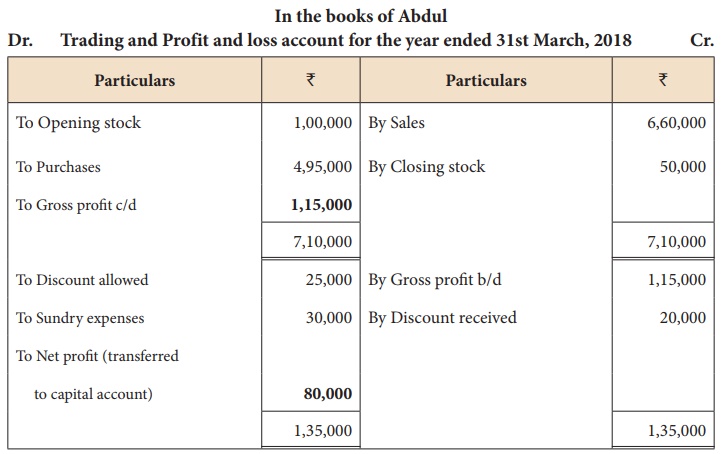

Illustration 17

From the following

details of Abdul who maintains incomplete records, prepare Trading and Profit

and Loss account for the year ended 31st March, 2018 and a Balance Sheet as on

the date.

Solution

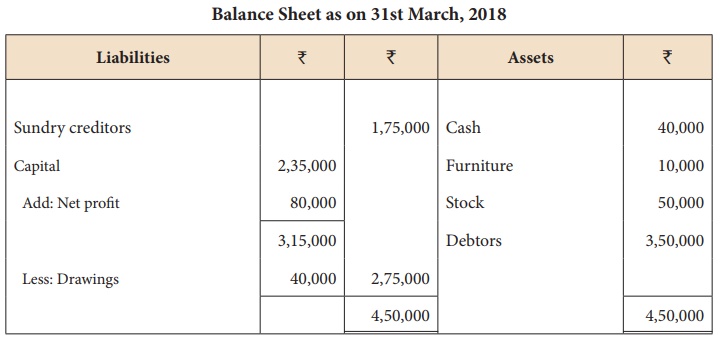

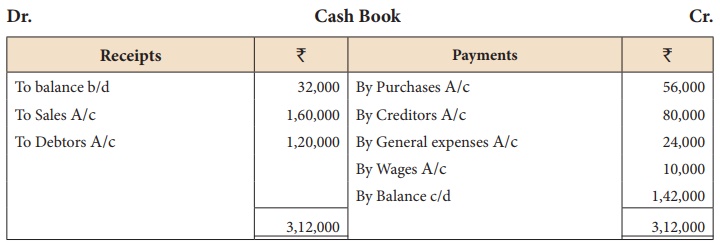

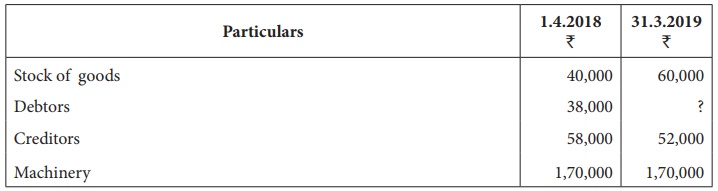

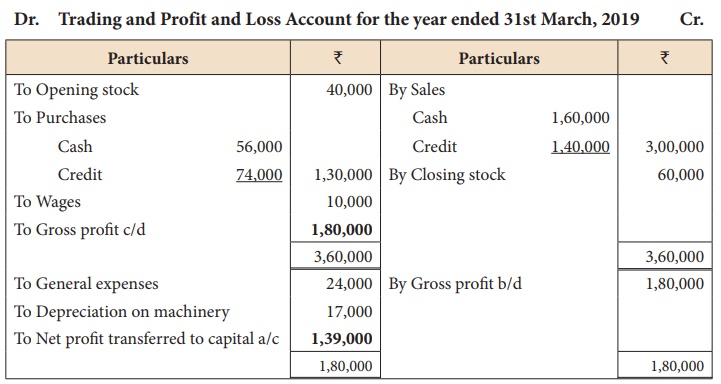

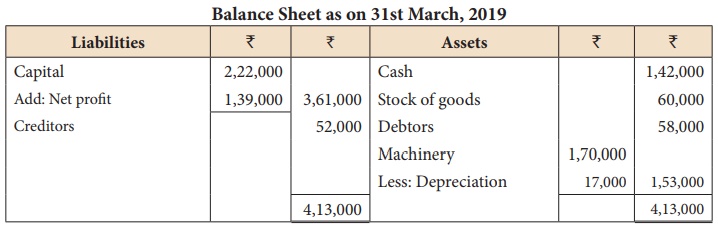

Illustration 18

Bharathi does not

maintain her books of accounts under double entry system. From the following

details prepare trading and profit and loss account for the year ending 31st

March, 2019 and a balance sheet as on that date.

Other information:

Additional information: ₹₹

(i) Credit purchases 74,000

(ii) Credit sales 1,40,000

(iii) Opening capital 2,22,000

(iv) Depreciate machinery by 10% p.a.

Solution

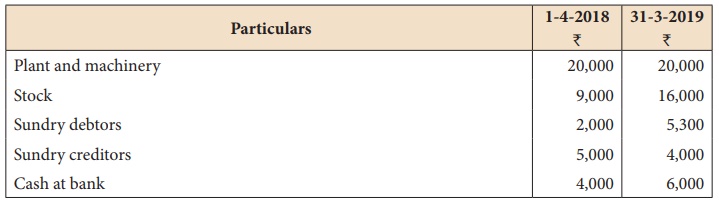

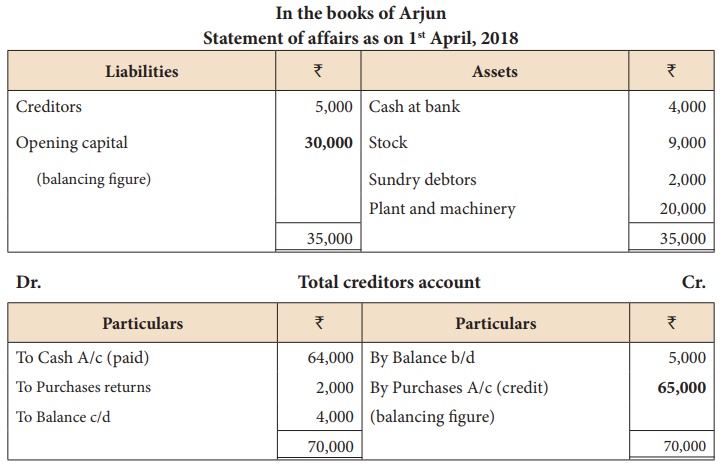

Illustration 19

Arjun carries on grocery

business and does not keep his books on double entry basis.

The following

particulars have been extracted from his books:

Other information for the year

ending 31-3-2019 showed the following:

Advertising ₹ 4,700

Carriage inwards ₹ 8,000

Cash paid to creditors ₹ 64,000

Drawings ₹ 2,000

Total sales during the year were

₹85,000. Purchases returns during the year were ₹ 2,000 and sales returns were

₹ 1,000. Depreciate plant and machinery by 5%. Provide ₹ 300 for doubtful

debts. Prepare trading and profit and loss account for the year ending 31st

March, 2019 and a balance sheet as on the date.

Solution

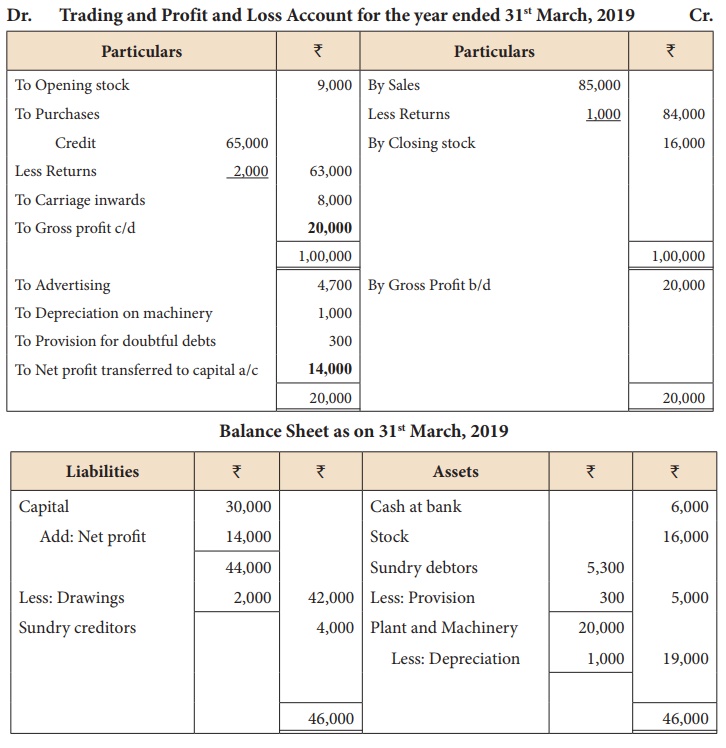

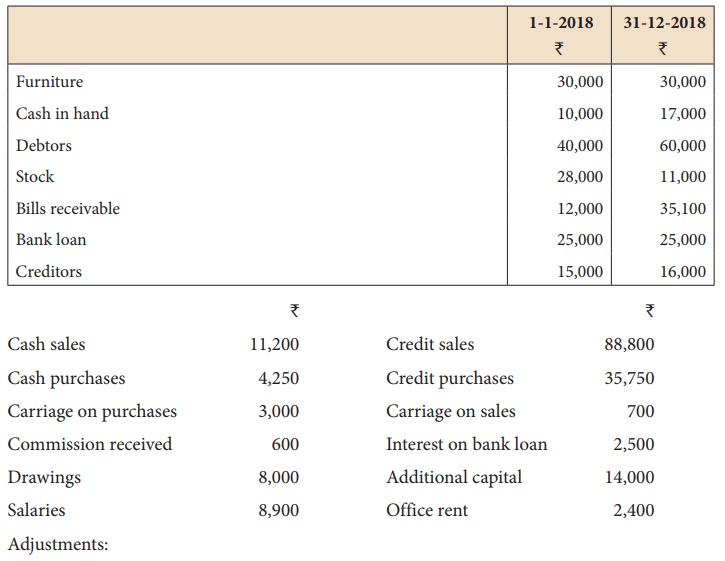

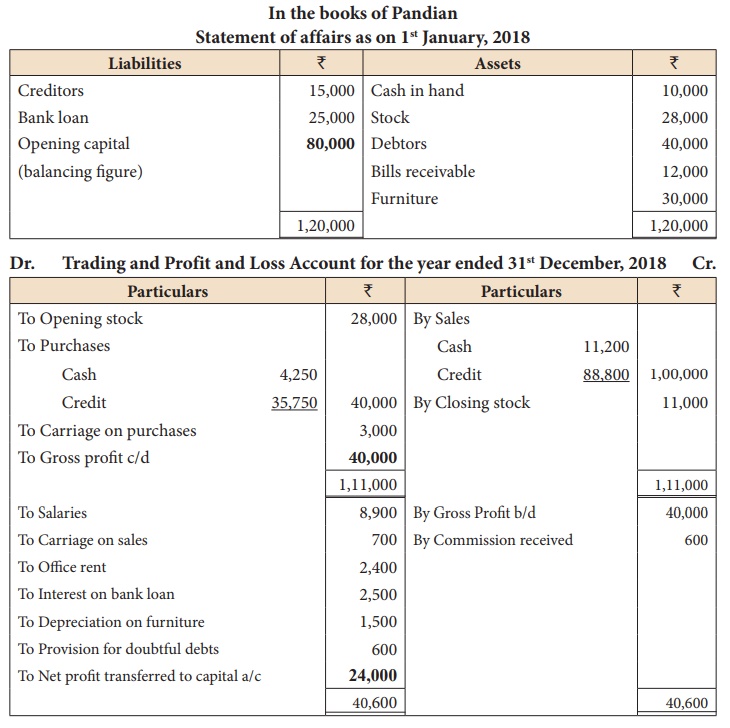

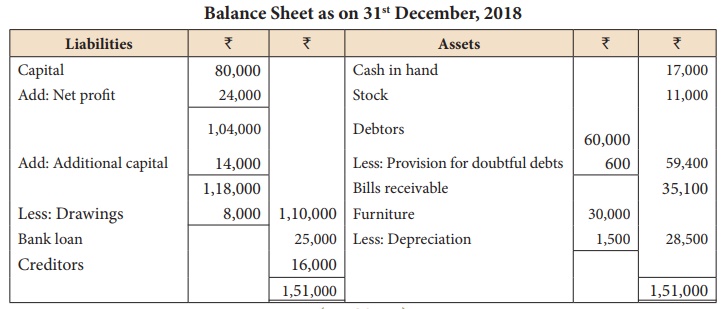

Illustration 20

Pandian does not keep

his books under double entry system. From the following information prepare

trading and profit and loss account and balance sheet as on 31-12-2018.

Write off depreciation of 5% on furniture. Create a provision of 1% on debtors for doubtful debts.

Solution

Related Topics