Accountancy - Ascertaining profit or loss from incomplete records through statement of affairs | 12th Accountancy : Chapter 1 : Accounts from Incomplete Records

Chapter: 12th Accountancy : Chapter 1 : Accounts from Incomplete Records

Ascertaining profit or loss from incomplete records through statement of affairs

Ascertaining

profit or loss from incomplete records through statement of affairs

Under this method, by

comparing the capital (net worth) at the beginning and at the end of a

specified period profit or loss is found out. Any increase in capital (net

worth) is taken as profit while a decrease in capital is regarded as loss.

Capital at the beginning

and at the end can be found out by preparing statement of affairs in the

beginning and at the end of an accounting year respectively. A statement of

affairs is a statement showing the balances of assets and liabilities on a

particular date. This method of ascertaining profit is also called as statement

of affairs method or networth method or capital comparison method.

1. Calculation of profit or loss through statement of affairs

The difference between

the closing capital and the opening capital is taken as profit or loss of the

business. Due adjustments are to be made for any withdrawal of capital from the

business and for the additional capital introduced in the business.

Take the closing capital

as the base. Drawings made during the year should be added with the closing

capital. This is because drawings would have reduced the closing capital.

Additional capital introduced during the year should be subtracted. This is

because the additional capital introduced would have increased the closing

capital. This will give the adjusted closing capital.

Adjusted closing

capital = Closing capital + Drawings – Additional capital

By comparing adjusted

closing capital with the opening capital the profit or loss can be ascertained.

If the difference is a positive figure it is profit and if it is negative it is

loss.

Closing Capital +

Drawings – Additional Capital – Opening Capital = Profit/ Loss

Tutorial note

Opening capital +

Additional capital + Profit/ – Loss – Drawings = Closing capital

Profit/Loss = Closing

capital + Drawings – Additional capital – Opening capital

2. Steps to be followed to find out the profit or loss by preparing statement of affairs

Following are the steps

to be followed to find out the profit or loss when a statement of affairs is

prepared:

1. Ascertain the opening

capital by preparing a statement of affairs at the beginning of the year by

taking the opening balances of assets and liabilities.

2. Ascertain the closing

capital by preparing a statement of affairs at the end of the accounting period

after making all adjustments such as depreciation, bad debts, outstanding and

prepaid expenses, outstanding income, interest on capital, interest on

drawings, etc.

3. Add the amount of

drawings (both in cash and/in kind) to the closing capital.

4. Deduct the amount of

additional capital introduced, to get adjusted closing capital.

5. Ascertain profit or

loss by subtracting opening capital from the adjusted closing capital.

(a) If adjusted closing

capital is more than the opening capital, it denotes profit

(b) If adjusted closing

capital is lesser than the opening capital, it denotes loss

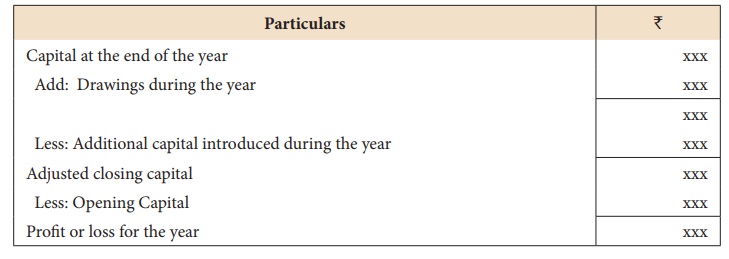

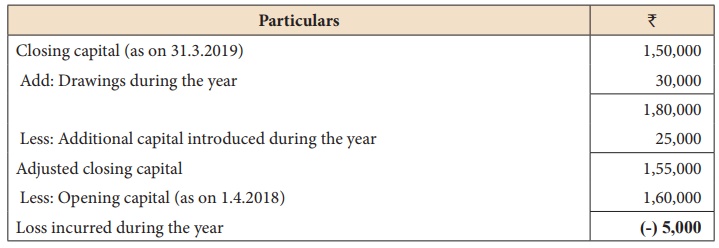

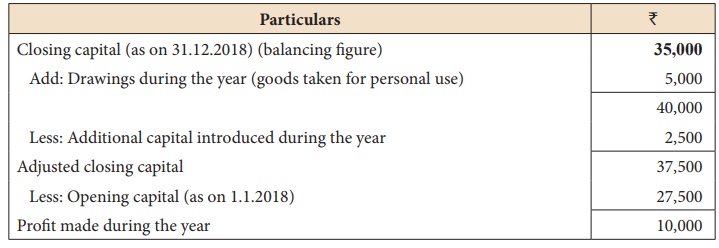

Following format is used

to find out the profit or loss:

Statement of profit or

loss for the year ended …….

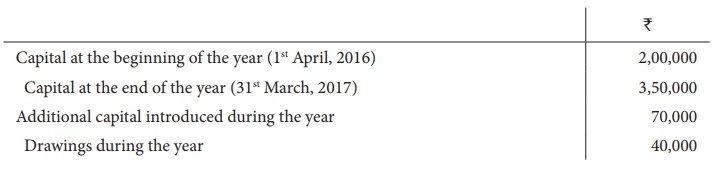

Illustration 1

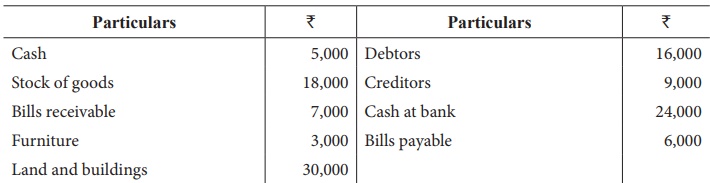

From the following

particulars ascertain profit or loss:

Solution

Statement of profit or

loss for the year ended 31st March, 2017

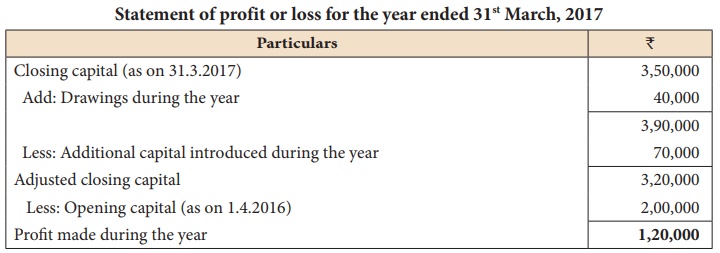

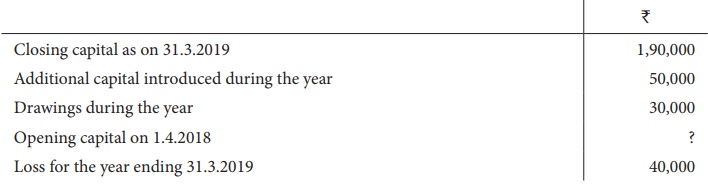

Illustration 2

From the following

particulars ascertain profit or loss:

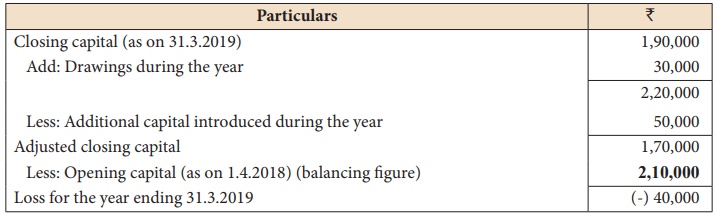

Solution

Statement of profit or

loss for the year ended 31st March, 2019

Illustration 3

From the following

details, calculate the missing figure.

Solution

Statement of profit or

loss for the year ended 31st March, 2019

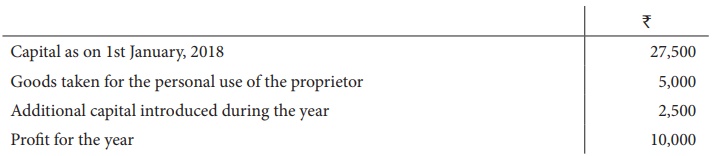

Illustration 4

From the following

details, calculate the capital as on 31st December 2018:

Solution

Statement of profit or loss for the year ended 31st December, 2018

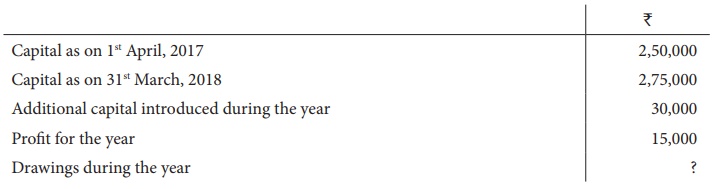

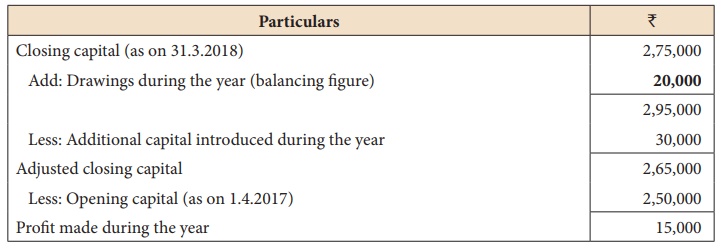

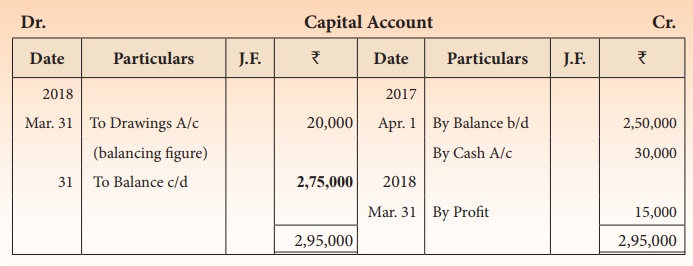

Illustration 5

From the following

details, calculate the missing figure:

Solution

Statement of profit or

loss for the year ended 31st March, 2018

3. Statement of affairs

A statement of affairs is a statement showing the balances of assets and liabilities on a particular date. The balances of assets are shown on the right side and the balances of liabilities on the left side. It is prepared from incomplete records to find out the capital of a business unit on a particular date. This statement resembles a balance sheet. The difference between the total of assets and total of liabilities is taken as capital.

Capital = Assets –

Liabilities

Although the statement

of affairs is a list of assets and liabilities, it is not called balance sheet

because the values of all assets and liabilities shown in the statement of

affairs are not fully based on the ledger balances. Some items are taken from

accounts maintained, some items from relevant documents and some balances are

mere estimates based on memory.

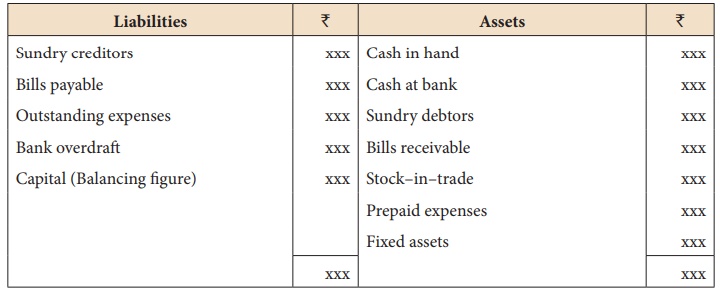

4. Format of statement of affairs

In the books of --------

Statement of affairs as

on --------

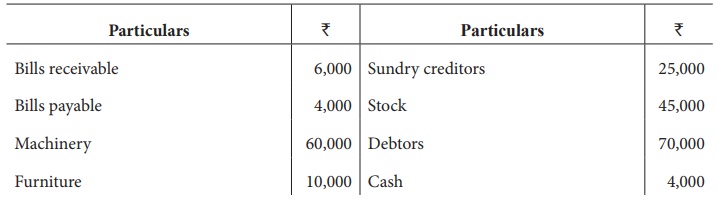

Illustration 6

Following are the

balances of Shanthi as on 31st December 2018.

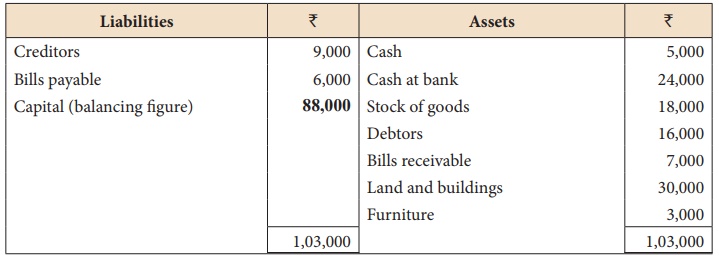

Solution

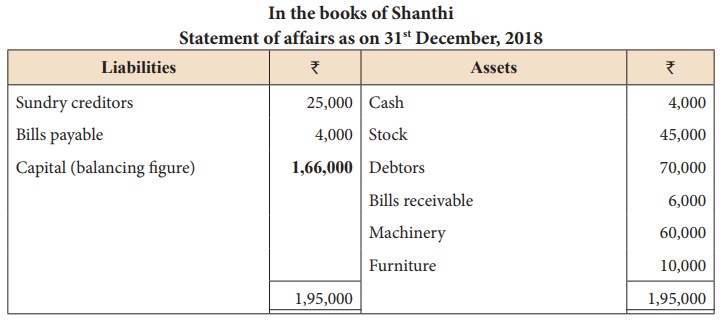

In the books of Shanthi

Statement of affairs as

on 31st December, 2018

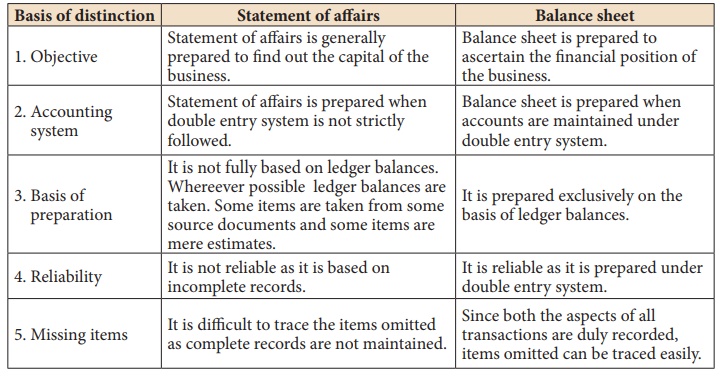

5.

Differences between Statement of affairs and Balance sheet

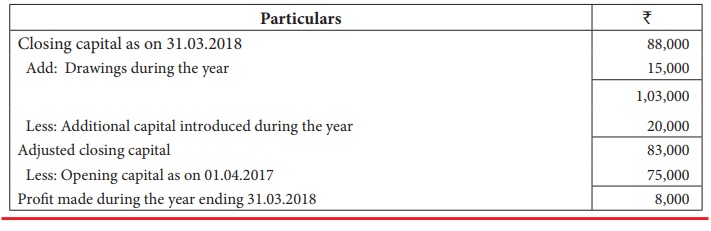

Illustration 7

On 1st April 2017,

Ganesh started his business with a capital of ₹ 75,000. He did not maintain proper book of

accounts. Following particulars are available from his books as on 31.03.2018.

Solution

Statement of affairs of

Ganesh as on 31st March, 2018

Tutorial note

For finding out the

closing capital, Statement of affairs as on 31st March, 2018 is prepared.

Statement of profit or

loss for the year ending 31st March, 2018

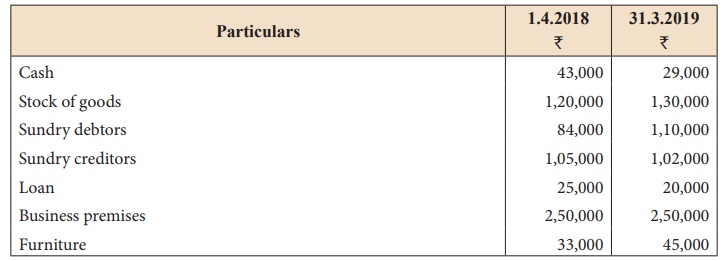

Illustration 8

David does not keep

proper books of accounts. Following details are given from his records.

During the year he

introduced further capital of ₹

45,000 and withdrew ₹

2,500 per month from the business for his personal use. Prepare statement of

profit or loss with the above information.

Solution

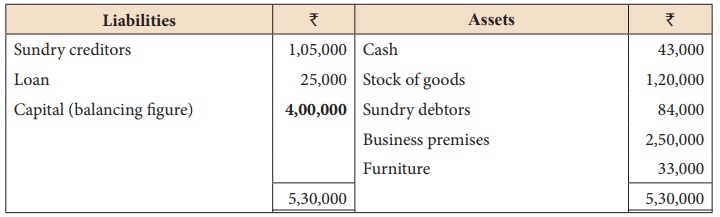

In the books of David

Calculation of opening

capital

Statement of affairs as

on 1st April, 2018

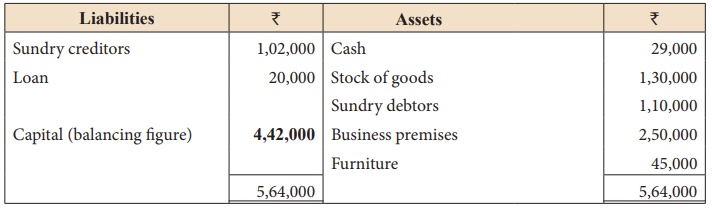

Calculation of closing

capital

Statement of affairs as

on 31st March, 2019

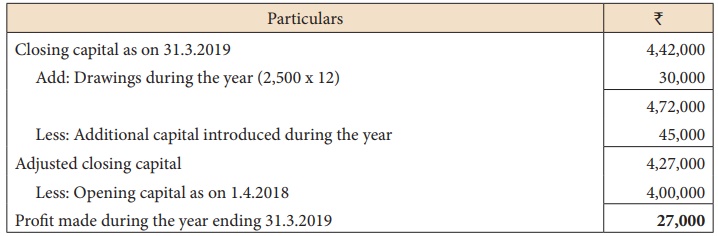

Statement of profit or

loss for the year ending 31st March, 2019

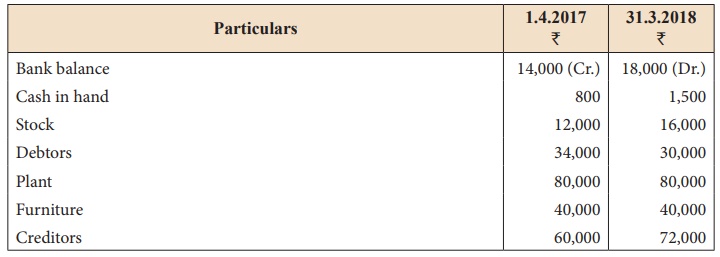

Illustration 9

Ahmed does not keep

proper books of accounts. Find the profit or loss made by him for the year

ending 31st March, 2018.

Ahmed had withdrawn ₹ 40,000 for his personal

use. He had introduced ₹

16,000 as capital for expansion of his business. A provision of 5% on debtors

is to be made. Plant is to be depreciated at 10%.

Solution

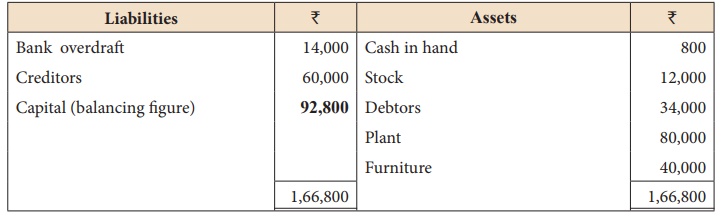

In the books of Ahmed

Calculation of opening

capital

Statement of affairs as

on 31st March, 2017

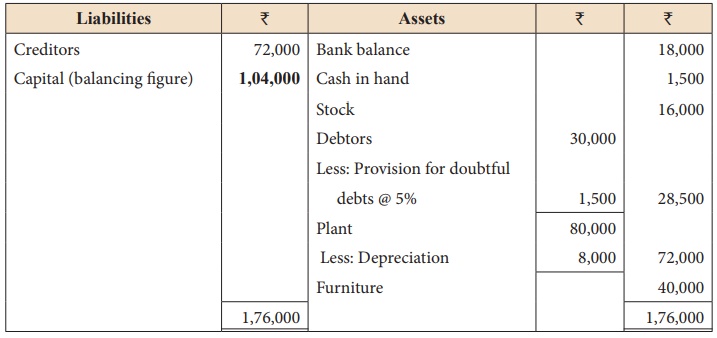

Calculation of closing

capital

Statement of affairs as

on 31st March, 2018

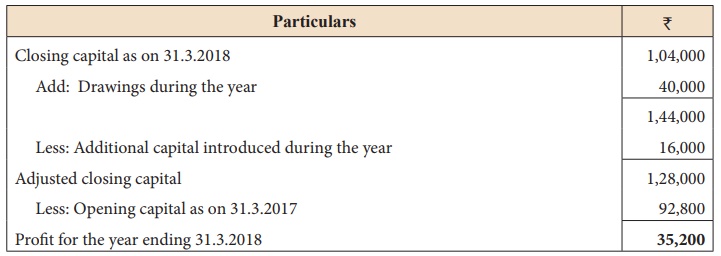

Statement of profit or

loss for the year ending 31st March, 2018

Related Topics