Features (or) Characteristics, Advantages, Disadvantages | Auditing - Periodical (or) Final (or) Complete Audit | 11th Auditing : Chapter 2 and 3 : Classifications of Audit

Chapter: 11th Auditing : Chapter 2 and 3 : Classifications of Audit

Periodical (or) Final (or) Complete Audit

Periodical (or) Final (or) Complete Audit

Annual or Periodical audit is conducted after

closing the books of accounts and preparing the financial statements. In such a

case, the auditor visits the clients only once in a year and checks the

accounts in one visit. The auditor makes a detailed or random check of the

transaction which has taken place in the books of accounts and examines the

correctness and fairness of the financial statements. This type of audit is

free from the defects of continuous audit and carries other advantages with it,

but detailed checking is not possible. Hence, errors and frauds cannot be

detected easily and quickly.

Features (or) Characteristics

1. Periodical

audit work is done and completed in a continuous session.

2. The

auditor visits the clients only once in a year and checks the accounts in one

visit.

3. Auditor

makes a detailed or random check of the transactions and examines the

correctness and fairness of the financial statements.

4. Detailed

checking is not possible and hence errors and frauds cannot be detected easily

and quickly.

5.

Periodical audit is suitable in case of small

business concerns where there are only limited transactions.

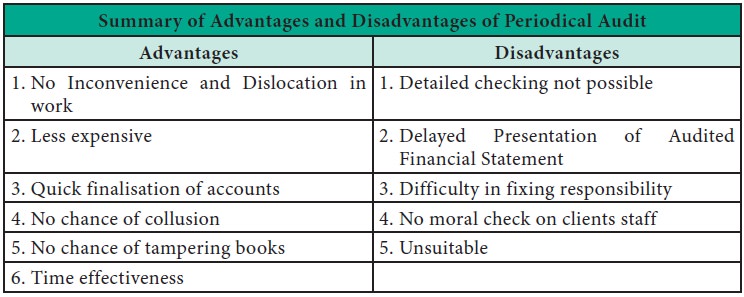

Advantages

1.

No

Inconvenience and Dislocation in Work: The work of audit does not present any inconvenience and

dislocation in the work of the concern as the auditor comes only once in a

year.

2.

Less

Expensive: Periodical audit is less expensive and more useful for small business concern than

continuous audit.

3.

Quick Finalisation of Accounts: In periodical

audit, the work of the auditor can be finished quickly and within a reasonable

time. The auditor ensures quick completion of work in one session due to

continuity.

4.

No Chance

of Collusion: In periodical

audit there is no undue collusion between the auditor and the clerk as in

the case of continuous audit.

5.

No Chance

of Tampering Books: The possibility

of tampering with the books of accounts during the audit is reduced as the

audit work starts only after the books are closed.

6. Time Effectiveness: The auditor uses statistical sampling methods and techniques which lead to time effectiveness.

Disadvantages

1. Detailed Checking not Possible: In periodical audit, detailed checking of

accounts is not possible and hence there are chances of errors and frauds which

remain undetected.

2. Delayed Presentation of Audited Financial

Statements: The work of an

auditor starts only after the close of the financial period, therefore

there is undue delay in finalising the financial statements and in preparing

the audit report.

3. Difficulty in Fixing Responsibility: Another

major drawback is that all the errors and frauds are found at the end of the

accounting year, which makes it very difficult to fix responsibility for

defalcations.

4. No Moral Check on Clients Staff: There is

no sense of moral check on the employees in clients organisation as the auditor

visits the company only after the end of the financial period.

5.

Unsuitable:

For big

concerns, periodical audit is rarely

practicable and it is not much popular for them.

Related Topics