Features (or) Characteristics, Advantages, Disadvantages | Auditing - Interim Audit | 11th Auditing : Chapter 2 and 3 : Classifications of Audit

Chapter: 11th Auditing : Chapter 2 and 3 : Classifications of Audit

Interim Audit

Interim Audit

Interim audit is an audit which is conducted in

between two annual audits to find out interim profits to enable the company to

declare an interim dividend. It involves complete and detailed examination of

transactions and review of records and accounts upto the date of interim audit.

It is an audit which is conducted in between two balance sheet audits. It is

conducted for a specific period with an object of declaring interim dividend or

to determine value of shares at a certain date.

Features (or) Characteristics

1.

It is an audit which is conducted in between two

annual audits i.e., audit for a period of six months or half yearly audit.

2.

It involves complete and detailed examination of

transactions and accounts upto the date of interim audit.

3.

It is conducted for a specific period with an

object of declaring interim dividend or to determine value of shares at a

certain date.

4.

The objective of conducting interim audit is to

know the reliability and accuracy of financial statements of a business for a

part of the year.

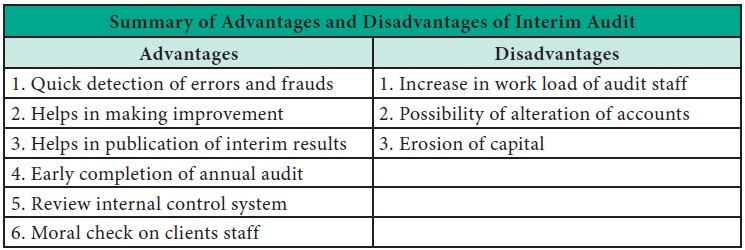

Advantages

1. Quick Detection of Errors and Frauds: Errors

and frauds can be detected quickly and easily.

2. Helps in making Improvement: It helps the management to assess the financial

position of business for a part of the year. Any deficiency noticed during

first part of the year can be rectified during later part of the accounting

year.

3. Helps in Publication of Interim Results: Interim

audit helps in finalisation of

interim results for the purpose of declaring interim dividend.

4.

Early

Completion of Annual Audit: It helps the auditor to complete the annual audit within a short

period and submit the report as early as possible.

5.

Review Internal Control System: It enables the external auditor to review the internal

control system in detail as to their effectiveness and continuity.

6.

Moral

Check on Clients Staff: It helps in

exercising moral check on the staff of the client.

Disadvantages

· Increase in Work load of Audit Staff: Interim audit involves finalisation of accounting statements for some specific period of time which increases the work load of audit staff.

·

Possibility

of Alteration of Accounts: An inherent danger of interim audit is alteration

of figures that are already checked and finalised.

·

Erosion

of Capital: Wrong assessment of profit may lead to erosion of capital through interim dividend.

Related Topics