Difference between, Features of Capital Market and Money Market - Money Market vs. Capital Market | 12th Commerce : Chapter 6 : Financial Markets : Money Market

Chapter: 12th Commerce : Chapter 6 : Financial Markets : Money Market

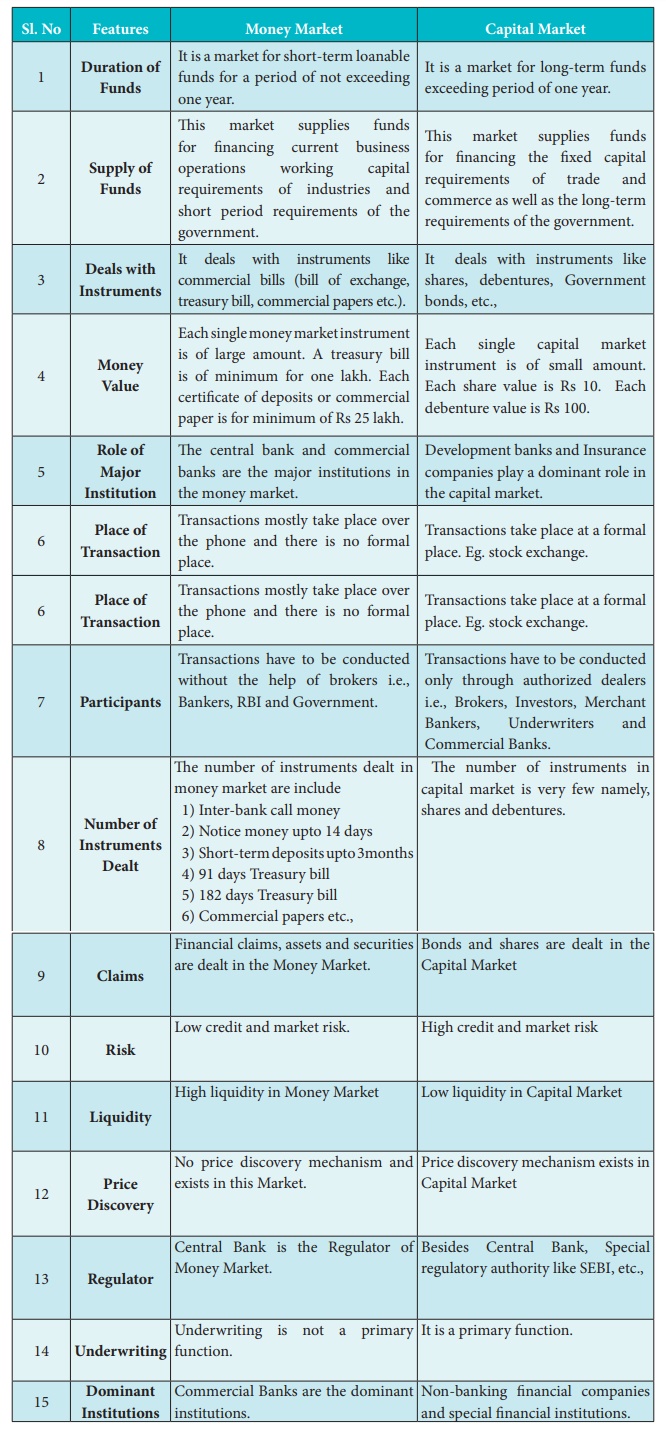

Money Market vs. Capital Market

Money Market vs. Capital Market

The difference between a money market and capital

market is briefly stated in the following table.

Features of Money Market

1.

Duration of Funds

It is a market for short-term loanable funds for a

period of not exceeding one year.

2. Supply

of Funds

This market supplies funds for financing current

business operations working capital requirements of industries and short period

requirements of the government.

3. Deals

with Instruments

It deals with instruments like commercial bills

(bill of exchange, treasury bill, commercial papers etc.).

4. Money

Value

Each single money market instrument is of large

amount. A treasury bill is of minimum for one lakh. Each certificate of

deposits or commercial paper is for minimum of Rs 25 lakh.

5. Role of Major Institution

The central bank and commercial banks are the major

institutions in the money market.

6. Place

of Transaction

Transactions mostly take place over the phone and

there is no formal place.

7.

Participants

Transactions have to be conducted without the help

of brokers i.e., Bankers, RBI and Government.

8. Number

of Instruments Dealt

The number of instruments dealt in money market are

include

1) Inter-bank call money

2) Notice money upto 14 days

3) Short-term deposits upto 3months

4) 91 days Treasury bill

5) 182 days Treasury bill

6) Commercial papers etc.,

9. Claims

Financial claims, assets and securities are dealt

in the Money Market.

10. Risk

Low credit and market risk.

11.

Liquidity

High liquidity in Money Market

12. Price

Discovery

No price discovery mechanism and exists in this

Market.

13.

Regulator

Central Bank is the Regulator of Money Market.

14.

Underwriting

Underwriting is not a primary function.

15.

Dominant Institutions

Commercial Banks are the dominant institutions.

Features of Capital Market

1.

Duration of Funds

It is a market for long-term funds exceeding period

of one year.

2. Supply

of Funds

This market supplies funds for financing the fixed

capital requirements of trade and commerce as well as the long-term requirements

of the government.

3. Deals

with Instruments

It deals with instruments like shares, debentures,

Government bonds, etc.,

4. Money

Value

Each single capital market instrument is of small

amount. Each share value is Rs 10. Each debenture value is Rs 100.

5. Role

of Major Institution

Development banks and Insurance companies play a

dominant role in the capital market.

6. Place

of Transaction

Transactions take place at a formal place. Eg.

stock exchange.

7.

Participants

Transactions have to be conducted only through

authorized dealers i.e., Brokers, Investors, Merchant Bankers, Underwriters and

Commercial Banks.

8. Number

of Instruments Dealt

The number of instruments in capital market is very

few namely, shares and debentures.

9. Claims

Bonds and shares are dealt in the Capital Market

10. Risk

High credit and market risk

11.

Liquidity

Low liquidity in Capital Market

12. Price

Discovery

Price discovery mechanism exists in Capital Market

13.

Regulator

Besides Central Bank, Special regulatory authority

like SEBI, etc.,

14.

Underwriting

It is a primary function.

15.

Dominant Institutions

Non-banking financial companies and special

financial institutions.

Related Topics