Commerce - Money Market Instruments | 12th Commerce : Chapter 6 : Financial Markets : Money Market

Chapter: 12th Commerce : Chapter 6 : Financial Markets : Money Market

Money Market Instruments

Money Market Instruments

There are many kinds of Instruments available in

Money Market. In India, till 1986, only a few instruments were available. They

were as follows:

(i) Treasury Bills in the Treasury Market

(ii) Money at Call and Short Notice in the Call

Loan Market

(iii) Commercial Bills and Promissory Notes in the

Bill Market

Now in addition to the above, the following new

instruments come into existence:

(i) Commercial Papers

(ii) Certificate of Deposits

(iii) Inter-Bank participation Certificates.

(iv) Repo Instruments.

These instruments are brieflty highlighted in this

chapter.

Treasury Bill Market

A market for the purchase and sale of Treasury

Bills is known as a “Treasury Bills Market”.

1. Treasury Bills

Treasury bills are very popular and enjoy a higher

degree of liquidity since they are issued by the Government. A Treasury bill is

nothing but a promissory note issued for a specified period stated therein. The

Government promises to pay the specified amount mentioned therein to the bearer

of the instrument on the due date. The period does not exceed a period of one

year.

General Features

Treasury Bills incorporate the following general

features.

1. Issuer

2. Finance Bills

3. Liquidity

4. Vital Source

5. Monetary Management

Types of Treasury Bills

Treasury Bills are issued to the public and other

financial institutions for meeting the short-term financial requirements of the

Central Government. These bills are freely marketable and they can be bought

and sold at any time and these bill are tradable in secondary market as well.

On the basis of periodicity, Treasury Bills may be

classified into three. They are:

1) 91 days Treasury Bills

2) 182 days Treasury Bills and

3) 364 days Treasury Bills

Ninety one days Treasury Bills are issued at a

fixed discount rate of 4 per cent as well as through auctions. The RBI holds 91

days and 182 Treasury Bills and they are issued on tap basis throughout the

week. 364 days Treasury Bills do not carry any fixed rate. The discount rate on

these bills are quoted in auction by the participants and accepted by the

authorities. Such a rate is called cut off rate.

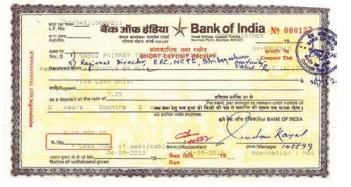

2. Certificate of Deposits

Specimen Copy of Certificate of Deposit

Certificate of Deposits are short-term deposit

instruments issued by banks and financial institutions to raise large sums of

money. Certificate of Deposits are issued in the form of usance promissory

notes. They are easily convertible in nature and are in marketable form having

particular face value and maturity. The Certificate of Deposit is transferable

from one party to another. Due to their negotiable feature, they are also known

as negotiable certificate of deposit.

Issuers

The Issuers of Certificate of Deposits are

Commercial Banks, Financial Institutions, etc.,

Subscribers

Certificate of Deposits are available for

subscription by individuals, corporations, trusts, associations and NRIs. It is

a document of title to a time deposit. It is a bearer certificate and is

negotiable in the market.

Features of Certificate of Deposit

1. Document of title to time deposit

2. It is unsecured negotiable instruments.

3. It is freely transferable by endorsement and

delivery.

4. It is issued at discount to face value.

5. It is repayable on a fixed date without grace

days.

3. Commercial Bills

A bill of exchange issued by a commercial

organization to raise money for short- term needs. These bills are of 30 days,

60 days and 90 days maturity.

The Commercial Bill is an instrument drawn by a

seller of goods on a buyer of goods. It possesses the advantages like

self-liquidating in nature, recourse to two parties, knowing exact date of

transactions, transparency of transactions etc.,

Specimen Copy of Commercial Bill

Features

The features of the Commercial Bills are as

follows:

1. Drawer

2. Acceptor

3. Payee

4. Discounter

5. Endorser

6. Assessment

7. Maturity

8. Credit Rating

Types

a. Demand

Bills

A demand bill is one wherein no specific time of

payment is mentioned. So, demand bills are payable immediately when they are

presented to the drawee.

b. Clean

bills and documentary Bills

Bills that are accompanied by documents of title to

goods are called documentary bills. Clean bills are drawn without accompanying

any document.

E.g. Railway Receipt and Lorry Receipt

c. Inland

bills and Foreign Bills

Bills that are drawn and payable in India on a

person who is resident in India are called inland bills. Bills that are drawn

outside India and are payable either in India or outside India are called

foreign bills.

d. Indigeneous

Bills

The drawing and acceptance of indigenous bills are

governed by native custom or usage of trade.

e. Accommodation

Bills

Accommodation bills are those which do not arise

out of genuine trade of transactions.

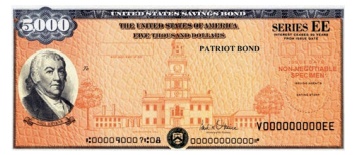

4. Government or Gilt-Edged Securities Market

A market whereby the Government or gilt-edged

securities can be bought and sold is called ‘Government Securities Market’.

Government or Gilt-Edged Securities

Government securities are issued for the purposes

of refunding the maturing securities, for advance refunding securities, which

have not yet matured and for cash financing, i.e., raising fresh cash

resources.

Specimen Copy of Government or Gilt-Edged Securities

Characteristics

Government Securities plays a significant role in

the Indian Money Market. The characteristics of Government Securities are

discussed below:

1. Agencies

Government securities are issued by agencies such

as Central Government, State Governments, semi-government authorities like

local Government authorities, e.g. municipalities, autonomous institution such

as metropolitan authorities, port trusts etc.,

2. RBI

Special Role

RBI takes a special and an active role in the

purchase and sale of these securities as part of its monetary management

exercise.

3. Nature

of Securities

Securities offer a safe avenue of investment

through guaranteed payment of interest and repayment of principal by the

Government.

4. Liquidity

Profile

The liquidity profile of gilt-edged securities

varies. Accordingly liquidity profile of securities issued by Central

Government is high.

5. Tax

Rebate

A striking feature of these securities is that they

offer wide-range of tax incentives to investors. This has made these securities

very popular for this benefit.

6. Market

As each sale and purchase has to be negotiated

separately, the Gilt-Edged Market is an Over-The-Counter Market. The Government

securities market in India has two segments namely primary market and secondary

market.

7. Forms

The securities of Central and State Government take

such forms as inscribed stock or stock certificate, promissory note and bearer

bond.

8. Participants

The participants in Government securities market

include the Government sector comprising Central and State Governments whose

holdings represent governmental transfer of resources.

9. Trading

Although the secondary market for Government

securities is narrow, small and less active, banks and corporate holders who

purchase and sell Government securities on the stock exchanges participate in

trading.

10. Issue

Mechanism

The Public Debt Office (PDO) of the RBI undertakes

to issue government securities.

11. Issue

opening

A notification for the issue of the securities is

made a few days before the public subscription is open.

12. Grooming

Gradual

Acquisition of securities nearing maturity through

the stock exchanges by the RBI in order to facilitate redemption is described

as ‘grooming’.

13. Switching

The purchase of one security against the sale of

another security carried out by the RBI in the secondary market as part of its

open market operations is described as ‘Switching’.

14. Auctioning

A method of trading whereby merchants bid against

one another and where the securities are sold to the highest bidder is known as

‘auctioning’

London Money Market is the oldest, most

developed and leading MoneyMarket in the world.

New York Money Market is ranked as the

second well-developed Money Market in the world next only to the London Money

Market.

For Own Thinking

If you earn money, which investment plan

would you like?

1. Mutual Funds

2. Shares

3. Debentures

4. Treasury Bill

5. Commercial Bill

6. Certificate of Deposit Why? Give

reasons.

Key words

Treasury Bills

Commercial Bills

Commercial Papers

Government Bonds

Money Market

Capital Markets

Certificate of Deposits

Auctioning

For Future Learning

How to Invest Money in Money Market

Funds?

Gathering information about Money Market

Funds

Learn about money market

Understand the goal of money market

funds.

Learn the disadvantages of money market

funds.

Investing in Money Market Funds

Understand the different types of Money

Market Funds

Understand the purpose of Money Market

Funds

Compare past yields

Buying and Tracking of Money Market Funds

Related Topics