Electronic Payment Systems - Mobile Banking and Internet Banking | 12th Computer Applications : Chapter 16 : Electronic Payment Systems

Chapter: 12th Computer Applications : Chapter 16 : Electronic Payment Systems

Mobile Banking and Internet Banking

Mobile

Banking and Internet Banking

As smartphones have already usurped the place of

digital camera and voice recorders, soon it will double up as virtual debit

cards. It enables to send or receive money instantly without any plastic cards.

Mobile Banking

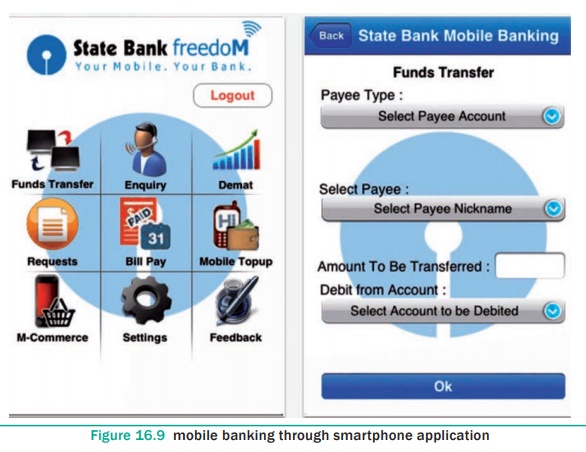

Mobile banking is another form of net banking. The

term mobile banking (also called m-banking) refers to the services provided by

the bank to the customer to conduct banking transactions with the aid of mobile

phones. These transactions include balance checking, account transfers,

payments, purchases, etc. Transactions can be done at anytime and anywhere. See

Figure 16.9

Some of the latest

mobile banking applications even have a cash withdrawal menu. The menu will

create a specific code that can be used instead of an ATM card to operate an

ATM. However, this can only be done at a special ATM (ATM with no card

service).

The WAP protocol installed on a mobile phone

qualifies the device through an appropriate application for mobile session

establishment with the bank’s website. In this way, the user has the option of

permanent control over the account and remote management of his own finances.

Mobile Banking operations can be implemented in the

following ways:

● contacting the call center.

● automatic IVR telephone service.

● using a mobile phone via SMS.

● WAP technology.

● Using smartphone applications.

Internet banking

Internet banking is a collective term for

E-banking, online banking, virtual banking (operates only on the Internet with

no physical branches), direct banks, web banking and remote banking.

Internet banking allows customers of a financial institution to conduct various financial transactions on a secure website operated by the banking institutions.

This is a very fast and convenient way of

performing any banking transactions. It enables customers of a bank to conduct

a wide range of financial transactions through its website. In fact, it is like

a branch exclusively operating of an individual customer. The online banking

system will typically connect to the core banking system operated by customers

themselves (Self-service banking).

Advantages:

● The advantages of Internet banking are that the

payments are made at the convenience of the account holder and are secured by

user name and password. i.e. with Internet access it can be used from anywhere

in the world and at any time.

● Any standard browser (e.g. Google Chrome) is

adequate. Internet banking does not need installing any additional software.

● Apart from regular transactions, Internet banking

portal provides complete control over all banking demands such as available

balance, transaction statements, recent transactions, bill payment, blocking a

card in case of theft or loss, information about other bank products like

payment cards, deposits, loans etc.

Out of 7.7 billion

world population roughly 3.2 billion have the Internet access. There by more

than 50% of world population are accessed to Internet banking.

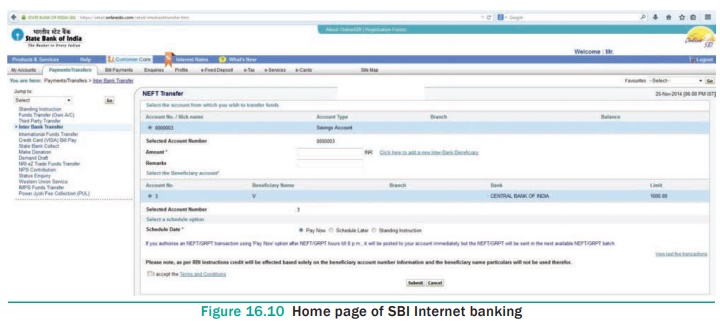

The following are the steps to transfer fund using

net banking.

Step 1: Login to

net banking account using unique

user name and password provided by the bank earlier.

Step 2: Add the beneficiary as a payee to enable transfer of fund. The following details like Account Number, Name, IFSC about the beneficiary are to be filled in the ‘Add New Payee’ section.

Step 3: Once the

beneficiary is added, choose RTGS /

NEFT / IMPS as mode of Fund Transfer.

Step 4: Select

the account to transfer money from,

select the payee, enter the amount to be transfered and add remarks (optional).

Step 5: Click on

submit.

Step 6: Enter

the OTP received to mobile number linked to the corresponding account to

complete the transaction.

Modern Electronic funds transfers are secured by a

personal identification number (PIN), one -time password (OTP) etc. An

automated clearing house (ACH) processes the payment then. See Figure 16.10

Indian Financial System

Code (IFSC) is an 11 digit alpha -numeric code issued by Reserve Bank of India to

uniquely identify individual bank’s branch in India. It is used for domestic

e-payments. SWIFT code is used for international bank transactions.

Related Topics