Chapter: 12th Computer Applications : Chapter 16 : Electronic Payment Systems

Electronic Account Transfer

Electronic

Account Transfer

Apart from card based payment systems there are

many alternative electronic payment systems. With the advent of computers,

network technologies and electronic communications a large number of

alternative electronic payment systems have emerged. These include ECS

(Electronic Clearing Services), EFT (Electronic funds transfers), Real Time

Gross Settlement system (RTGS) etc. These Electronic Payment systems are used

in lieu of tendering cash in domestic and international transactions.

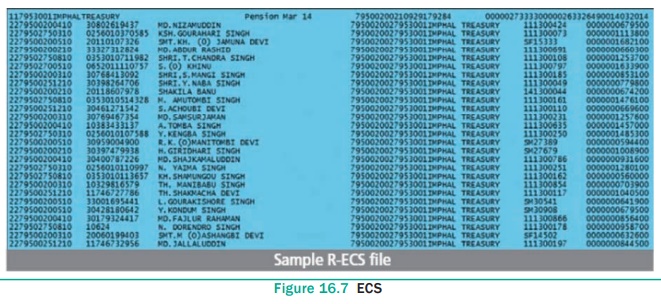

1. Electronic Clearing Services (ECS)

Electronic Clearing Service can be defined as

repeated transfer of funds from one bank account to multiple bank accounts or

vice versa using computer and Internet technology. The payer instructs the bank

to debit from his bank account and credit it to one or more payee bank account

provided amounts and dates of the payments earlier. This system provides the

convenience of paperless payments.

Advantages of this system are bulk payments,

guaranteed payments and no need to remember payment dates. It can be used by

institutions for making payments such as disbursing of salary, pension or

dividend interest among shareholders. Similarly, individual bank customers also

can make small value repetitive payments such as paying EMI of a loan,

electricity bills, telephone bills, insurance premium, as well as SIP

investments. See Figure 16.7

ECS can be used for both credit and debit purposes

i.e. for making bulk payments or bulk collection of amounts.

● ECS credit: ECS credit is used for making bulk

payment of amounts. In this mode, a single account is debited and multiple

accounts are credited. This type of transactions are Push transactions.Example:

if a company has to pay salary to its 100 employees it can use ECS credit

system than crediting every employees’ account separately.

● ECS debit: ECS debit is an inverse of ECS credit.

It is used for bulk collection of amounts. In this mode, multiple accounts are

debited and then a single account is credited. This type of transactions are

Pull transactions. Example: The insurance premium of bulk number of customers

is debited from customer’s bank account on their prior consent and paid to

insurance company.

EFT is known by a

number of names across countries. In India, it is called as N-EFT (National

Electronic Fund Transfer), in the United States, they may be referred to as

“electronic cheques” or “e-cheques”. National Electronic Funds Transfer (NEFT)

is an electronic funds transfer system initiated by the Reserve Bank of India

(RBI) in November 2005. It is established and maintained by Institute for

Development and Research in Banking Technology (IDRBT). NEFT enables a bank

customer to transfer funds between any two NEFT-enabled bank accounts on a

one-to-one basis. It is done via electronic messages. Unlike RTGS, fund

transfers through the NEFT do not occur in real-time basis.

2. Electronic Funds Transfer

Electronic Funds Transfer (EFT) is the “electronic

transfer” of money over an online network. The amount sent from the sender’s

bank branch is credited to the receiver’s bank branch on the same day in

batches. Unlike traditional processes, EFT saves the effort of sending a demand

draft through post and the inherent delay in reaching the money to the

receiver. Banks may charge commission for using this service. EFT is a widely

used method for moving funds from one account to another in B2B business

models.

3. Real Time Gross Settlement:

Real Time Gross Settlement system (RTGS) is a payment

system particularly used for the settlement of transactions between financial

institutions, especially banks. As name indicates, RTGS transactions are

processed at the real-time. RTGS payments are also called as push payments that

are initiated (“triggered”) by the payer. RTGS payments are generally

large-value payments, i.e. high-volume transactions.

The development and

maintenance of NEFT or RTGS systems worldwide is driven primarily by the

central bank of a country. (RBI in India)

Real-time gross settlement transactions are:

● Unconditional - the beneficiary will receive

funds regardless of whether he fulfills his obligations to the buyer or whether

he would deliver the goods or perform a service of a quality consistent with

the order.

● Irrevocable - a correctly processed transaction

cannot be reversed and its money cannot get refunded (the so-called settlement

finality).

4. Electronic wallets

Electronic wallets (e-wallets) or electronic purses

allow users to make electronic transactions quickly and securely over the

Internet through smartphones or computers. The electronic wallet functions

almost the same as a physical wallet in term that it holds our money.

Electronic wallets were first recognized as a method for storing money in

electronic form, and became popular because it provides a convenient way for

online shopping.

With the development of advanced Internet, the use

of electronic wallets turned out as an efficient transaction tool. This is

evidenced by the many E-Commerce websites that use electronic wallets as a

transaction tool. There are several electronic wallet services that are now

widely used. e.g. :PayPal, SBI Buddy. See Figure 16.8

Related Topics