Chapter: 12th Computer Applications : Chapter 16 : Electronic Payment Systems

Introduction to Electronic Payment systems

Electronic Payment

Systems

Introduction

to Electronic Payment systems

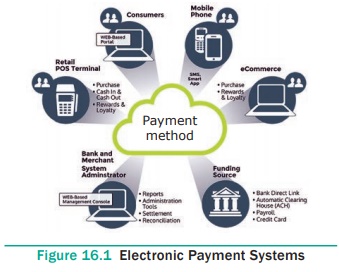

Everyday people buy or sell goods and services for

money. Money becomes the major medium of exchange. Later some payment systems

were developed out of a need to facilitate the growth of commerce and economic

development.

The media used for transferring the value of money

is very diversified, ranging from the use of simple payment instruments (e.g.

cash) to the use of complex systems (e.g. cryptocurrency). Physical money

(cash), is the traditional and most widely used payment instrument that

consumers use, in their daily lives to buy goods and services.

As the volume and variety of transactions expands,

the volume of money also expand. Using cash for each of large transactions is

neither feasible nor practically possible. Security and transportation problems

arise in cases where large amounts of cash transactions are involved.

Banks would support in such cases by offering other

payment methods. The cashless society has been discussed for long time. The

demise of cash and cheques could not be sudden. Though old habits hardly die,

people do not hesitate adapting new things.

Definition

An Electronic payment system is a financial

arrangement that consists of an intermediator to facilitate transfer of money-substitute

between a payer and a receiver. Sometimes it is also called liquidation,

clearing system or clearing service. It ensures the transfer of value from one

subject of the economy to another and plays an important role in modern

monetary systems.

Modern payment systems may be physical or

electronic and each has its own procedures and protocols that guide the

financial institution with payment mechanisms and legal systems.

Standardization has allowed some of these systems to grow globally.

The term electronic payment refers to

a payment made from one bank account to another bank account using electronic

methods forgoing the direct intervention of bank employees.

Payment system is an essential part of a company’s

financial operations. But it becomes complex, when many different payment

systems are used. Further challenges come from the continuous introduction of

newer payment systems such as paytm, UPI, bitcoin and various mobile payment

options. As a result there are more than 750 payment systems throughout the

world. See Figure 16.1

Related Topics