Accountancy - Microsoft Office - MS Excel Practical - Computerised Accounting | 11th Accountancy : Chapter 14 : Computerised Accounting

Chapter: 11th Accountancy : Chapter 14 : Computerised Accounting

Microsoft Office - MS Excel Practical - Computerised Accounting

MS-Excel

i) Functions

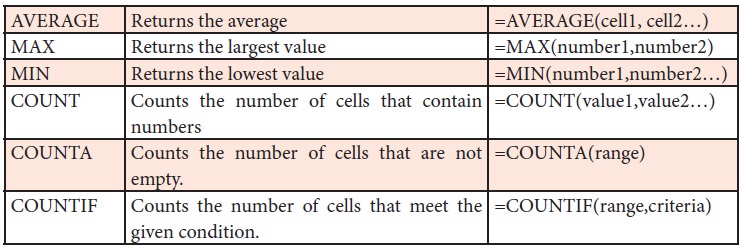

a. Statistical functions

There are several statistical

functions such that are inbuilt in MS Excel. The following are explained.

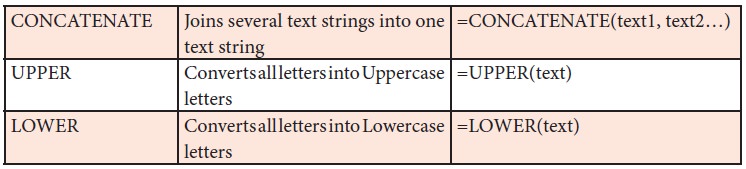

b. Text functions

There are several text functions

such that are inbuilt in MS Excel. The following are explained.

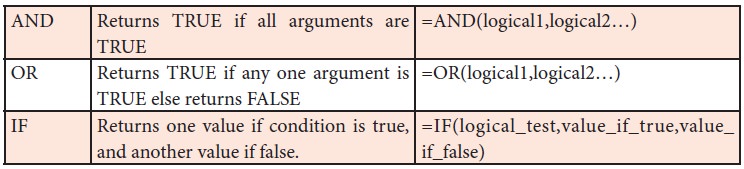

c. Logical functions

There are several logical

functions such that are inbuilt in MS Excel. The following are explained.

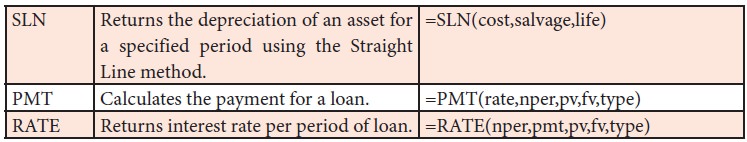

d. Financial functions

There are several financial

functions such that are inbuilt in MS Excel. The following are explained.

MS-Excel practical

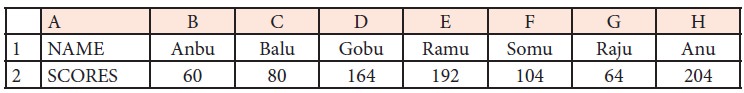

Illustration 3

The following are the scores

obtained by some students in a competitive examination. Find out the average,

the highest and the lowest score using appropriate function in spreadsheet.

Solution

Procedure

i.

Open a

new spreadsheet in MS-Excel

ii.

Enter all

given values as given in the question.

iii.

To find the Average mark in cell B5 give the

formula =AVERAGE(B2:H2)

iv.

To calculate the highest score, in cell B3 give the

formula =MAX(B2:H2)

v.

To find the lowest rank in cell B4 give the formula

=MIN(B2:H2)

Answer:

The average score is 124, the highest score is 204 and the lowest score

is 60.

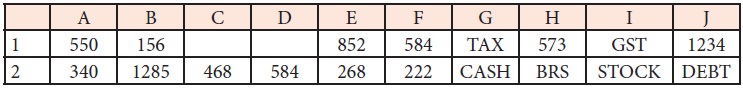

Illustration 4

The following table is given to

you. Find solution for the following questions.

A.

How many

cells contain numbers only?

B.

Count the

number of cells that contain any value.

C.

Count the

number of cells containing the value exceeding 1000.

Solution

Procedure

i.

Open a new spread sheet in MS-Excel.

ii.

Enter the data in cells from A1 to J2 as in the

question

iii.

To get the Number of cells containing numbers only,

write the formula in B3 =COUNT(A1:J2)

iv.

To get Number of cells that contain any value,

write the formula in B4 =COUNTA(A1:J2)

v.

To get the Number of cells which have values

exceeding 1000, write the formula in B5=COUNTIF(A1:J2,”>1000”)

Answer

A) 12 B) 18 C) 2 b) Text functions

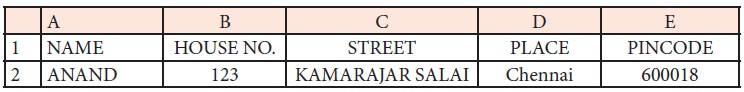

Illustration 5 (CONCATENATE)

From the data given below

Fill the

address in B3 using CONCATENATE Function.

Change KAMARAJAR SALAI given in C2 as lower case in C3

Change Chennai given in D2 as upper case in D3

Solution

Procedure

i. To

fill the address

a.

Open a

new spreadsheet in MS-Excel

b.

Enter all

given values as given in the question

c.

Enter the formula in the cell B3 as

=CONCATENATE(A2,” “,B2,” “,C2,” “,D2,” “,E2)

Answer

ANAND 123 KAMARAJAR SALAI Chennai 600018

ii. To change KAMARAJAR SALAI given in C2 as lower case in C3 Enter the

formula in the cell C3 as=LOWER(C2)

Answer

kamarajar salai

iii. To change Chennai given in D2 as upper case in D3 Enter the formula

in the cell D3 as=UPPER(D2)

Answer

CHENNAI

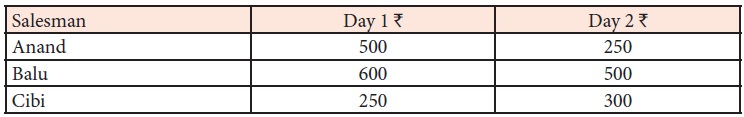

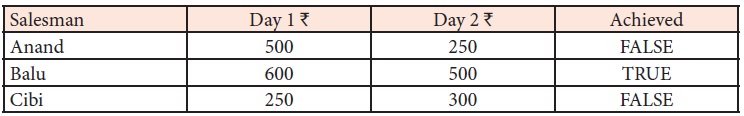

Illustration 6 (AND function)

There are three salesmen. Two days of sales achievement is given. You

are required to find out the salesmen who have achieved a minimum sale of Rs. 400 on each day.

Solution

Procedure

i.

Open new excel sheet.

ii.

Input the table as given in the question.

iii.

Enter the data “Achieved” in Cell D1.

iv.

Type the following in Cell D2:

=AND(B2>=400,C2>=400)

v.

Copy the formula in D2 into D3 and D4

Output

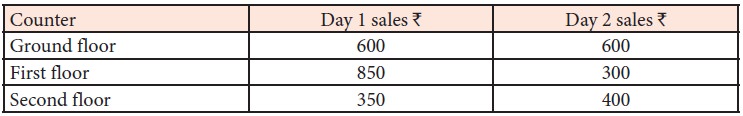

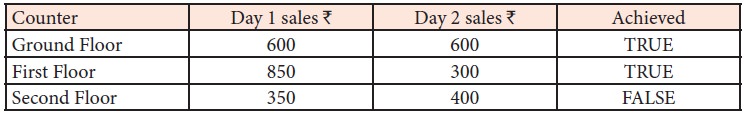

Illustration 7 (OR function)

Find out from the following data,

minimum collection of Rs. 500 on any one

day achieved by the sales counters.

Solution

Procedure

i.

Open new excel sheet.

ii.

Input the table as given in the question.

iii.

Enter the data “Achieved” in Cell D1.

iv.

Type the following in Cell D2:

=OR(B2>=500,C2>=500)

v.

Copy the formula from D2 into D3 and D4

Output

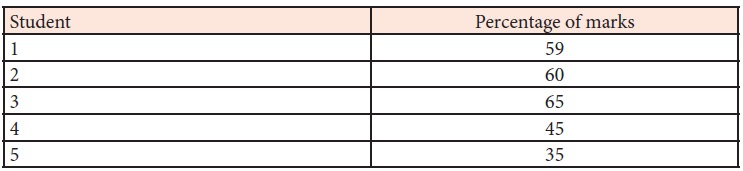

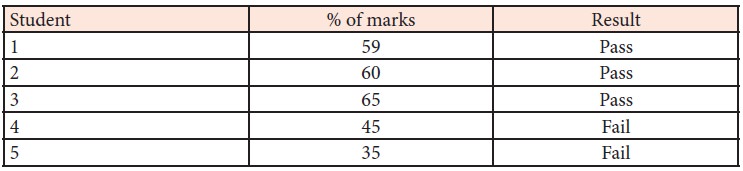

Illustration 8 (IF function)

Following is the list of students

and percentage of marks obtained by them. If a student has secured a minimum of

50%, he is declared pass, else fail.

Solution

Procedure

i.

Open new excel sheet.

ii.

Input the table as given in the question.

iii.

Enter the data “Result” in Cell A3.

iv.

Type the following in Cell B3

B3=IF(B1>=50,”Pass”,”Fail”)

v.

Copy the formula from B3 to C3, D3 and E3![]()

Output

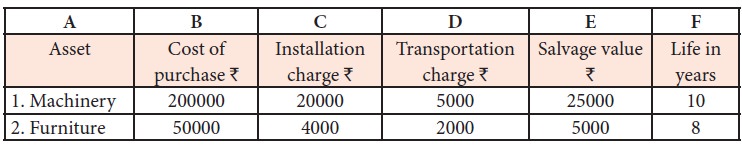

Illustration 9 (Depreciation – SLN

method)

Calculate depreciation under

Straight Line Method using Spreadsheet based on the details given below.

Solution

Procedure and answer

i.

Open a new spreadsheet in MS-EXCEL

ii.

Enter labels and values in the cells as given above

iii.

Write total cost in G1 and annual depreciation in

H1

iv.

Calculate total cost in the cell G2 by the formula

=Sum(B2:D2) and copy formula to cell G3

v.

Calculate annual depreciation in the cell H2 by the

formula=SLN(G2,E2,F2) and copy formula to cell H3

Output

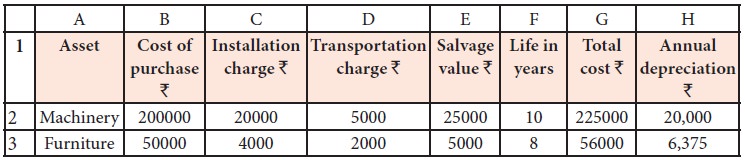

Illustration 10 (PMT)

Consider the following information:

Loan amount Rs. 3,00,000

Number of payment periods 48

months

Annual rate of interest 10%

Calculate periodic payment using

PMT function.

Solution

Procedure

i.

Open a new spreadsheet in MS-Excel

ii.

Enter

values in the cells as given below

Compute PMT in the cell B6 by the

formula=PMT(B1/12,B2,B3,B4,B5)

Answer Rs. 7,608.78

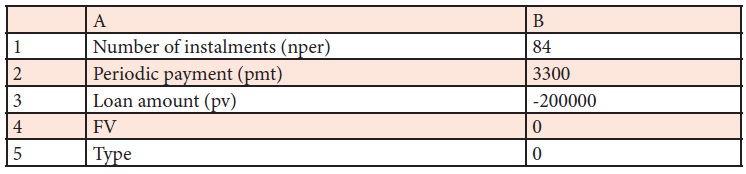

Illustration 11 (RATE)

Mr. Vivek took a loan of Rs. 2,00,000

from State Bank of India, Chennai and number of installments is 84 months.

Calculate the rate assuming payments Rs. 3,300 per

month using appropriate function.

Solution

Procedure

i.

Open a new spreadsheet in MS-Excel

ii.

Enter

values in the cells as given below

iii. Compute RATE in the cell B6

by the formula=RATE(B1,B2,B3,B4,B5)*12

Answer 10%

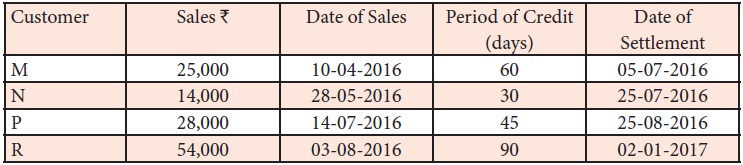

Illustration 12 (Computation of interest

on overdue)

Sara Ltd., sells goods on credit basis. Their policy is to charge

interest @ 2% p.a., for the period of default. From the following data, find

out the amount to be collected from each customer. Assume 365 days in the year.

Solution

Procedure

i.

Open a new spreadsheet in MS-Excel

ii.

Enter the

table headings as given below in different cells

A1 Customer

B1 Sales (Rs. )

C1 Date of sales

D1 Period of credit (days)

E1 Date of settlement

F1 Credit period availed (days)

G1 Days of default

H1 Interest

I1 Amount collected

iii. Enter customer names in A2:A5

iv. Enter sales figures in B2:B5

v. Enter date of sales in C2:C5

vi. Enter period of credits in

D2:D5

vii. Enter date of settlements in

E2:E5

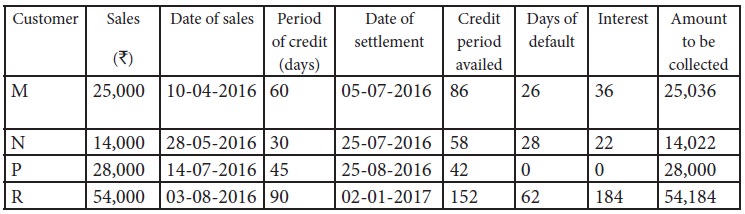

viii. In the cell F2 enter the

formula =E2-C2 to calculate the period of credit availed in days.

ix. In the cell G2 enter the

formula=IF(F2-D2>0,F2-D2,0) to calculate the default days. (IF condition is

used to avoid negative values in the case of payment before due date)

x. In the cell H2 enter the formula

=ROUNDUP((B2*2%)*(G2/365),0) to calculate interest for the default days and to

round it to the nearest rupee.

xi. In the cell I2 enter the

formula =B2+H2 to add the amount of Sales and Interest.

xii. Select the range F2:I2 and

copy these cells down to the last customer.

Output

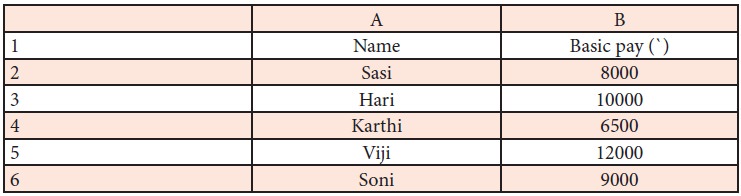

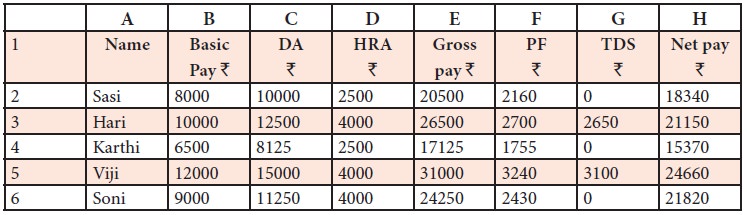

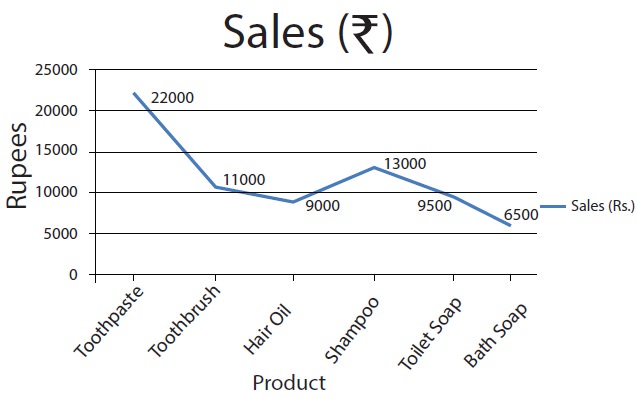

Illustration 13 (Payroll preparation)

Prepare payroll of the following

employees.

Additional information:

a. DA: 125% of basic pay

b. HRA: Rs. 4,000 for employees basic pay greater than Rs. 8,000, for others Rs. 2,500.

c. PF Contribution: 12% of basic

pay and DA

d. TDS: 10% for Gross pay greater

than Rs. 25,000,

otherwise NIL.

Procedure

i.

Open a

new spreadsheet in MS-EXCEL

ii. Enter labels and values in the cells as given above

iii. To calculate DA in Cell C =B2*125%

iv. To calculate HRA in Cell D2 = IF(B2>8000,4000,2500)

v. To calculate Gross Pay in Cell E2 =SUM(B2:D2)

vi. To calculate PF in Cell F2 =(B2+C2)*12%

vii. To calculate TDS in Cell G2 =IF(E2>25000,E2*10%,0)

viii. To calculate Net Pay in Cell H2=E2-(F2+G2)

Output

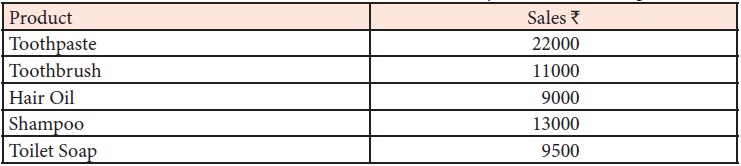

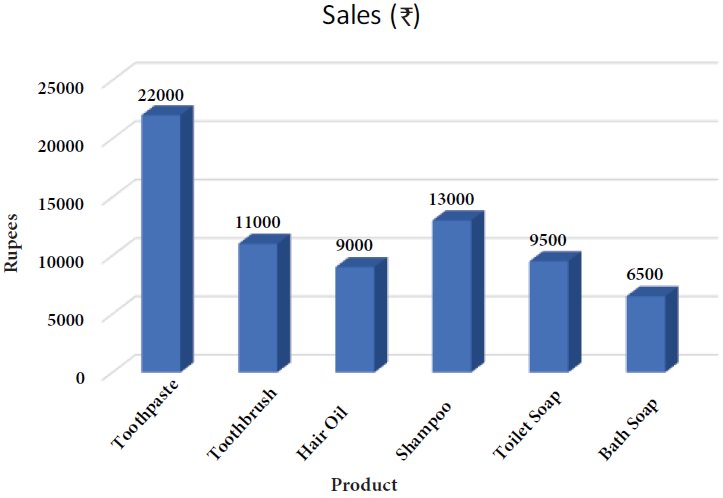

Illustration 14 (Column chart and

Line chart)

The total sales volume (Product

wise) of TECH Ltd for the year 2016-2017 is given below:

i.

Present

the data in a column chart

ii.

Change

the chart type to line chart.

Procedure

Column chart

i.

Enter the

data given in the table in a new spreadsheet.

ii.

Select

the data range from A1 to B7.

iii.

Go to

Insert menu and select Column Chart (3D)

iv.

Right

click column chart and select ‘Add Data Labels’

v.

Choose

layout tab under Chart tools.

vi.

Select

Axis title and name them.

Line Chart

i.

Select

the data range from A1 to B7.

ii.

Go to

Insert menu and select Line Chart (2D)

iii.

Right

click chart and select ‘Add Data Labels’

iv.

Choose

layout tab under Chart tools.

v.

Select

Axis title and name them.

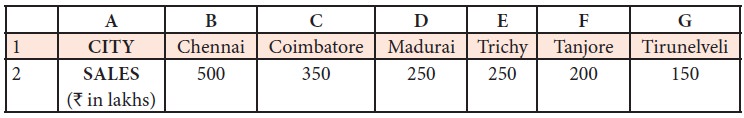

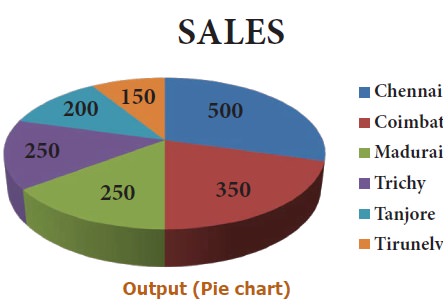

Illustration 15 (Pie Chart and

Doughnut)

Sales volume of Moon Ltd during

2017 is given below.

Draw

a. Pie

chart

b. Doughnut

Procedure

(a) Pie chart

i. Enter the

data given in the table in a new spreadsheet.

ii. Select the data range from A1 to G2.

iii.

Go to

Insert menu and select Pie Chart (3D Type)

iv.

Right

click pie chart and select ‘Add Data Labels’

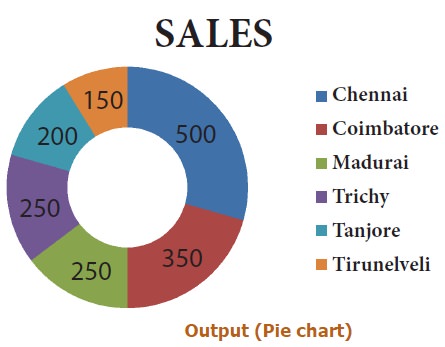

(b) Doughnut

i.

Go to

Insert menu -> Other Charts and select Doughnut

ii.

Right

click doughnut chart and select ‘Add Data Labels’

Related Topics