Chapter: 11th Accountancy : Chapter 5 : Trial Balance

Introduction to trial balance

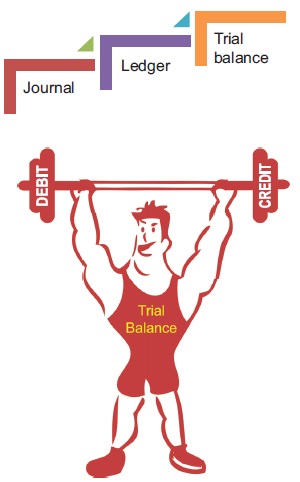

TRIAL BALANCE

Introduction to trial balance

Trial balance

is a statement containing the debit and credit balances of all ledger accounts

on a particular date. It is arranged in the form of debit and credit columns

placed side by side and prepared with the object of checking the arithmetical

accuracy of entries made in the books of accounts and to facilitate preparation

of financial statements.

The fundamental principle of the double-entry system of book-keeping is that every debit has a corresponding and equal credit and vice-versa. Therefore, the total of the debit balances must be equal to the total of the credit balances. When such an agreement between the total of all debit balances and the total of all credit balances takes place, it offers an immediate and apparent proof of arithmetical accuracy of the book-keeping work on a particular day. At the same time, it should not be taken as the conclusive proof of arithmetical accuracy as certain errors such as error of principle, compensating errors and complete omission of a transaction are not disclosed by the trial balance.

Though the trial balance can be prepared on any day (at the end of the month, quarter, etc.), it is normally prepared at the end of the accounting period.

The

preparation of trial balance is the third step in the accounting process. The

first step is recording the

business transactions in subsidiary books or journal.The second step is

preparing ledger accounts on the basis of subsidiary books or journal.

Related Topics