Accountancy - Methods of preparing trial balance | 11th Accountancy : Chapter 5 : Trial Balance

Chapter: 11th Accountancy : Chapter 5 : Trial Balance

Methods of preparing trial balance

Methods of preparing trial balance

A trial balance can be prepared in the following

methods:

i. Balance method

In this

method, the balance of every ledger account either debit or credit, as the case

may be, is recorded in the trial balance against the respective accounts. The

balance method is widely used, as it helps in the preparation of financial

statements.

ii. Total method

Under this

method, the total amounts on the debit side of the ledger accounts and the

total amounts on the credit side of the ledger accounts are ascertained and

recorded in the trial balance. This method is not commonly used as it cannot

help in the preparation of financial statements.

iii. Total and Balance method

This method

is a combination of both total method and balance method. Under this method,

four columns are provided, namely, a) totals of debit side of the ledger

accounts, totals of the credit side of the

ledger accounts c) debit balances of ledger accounts and credit balances of the ledger accounts. This method

is not in practice.

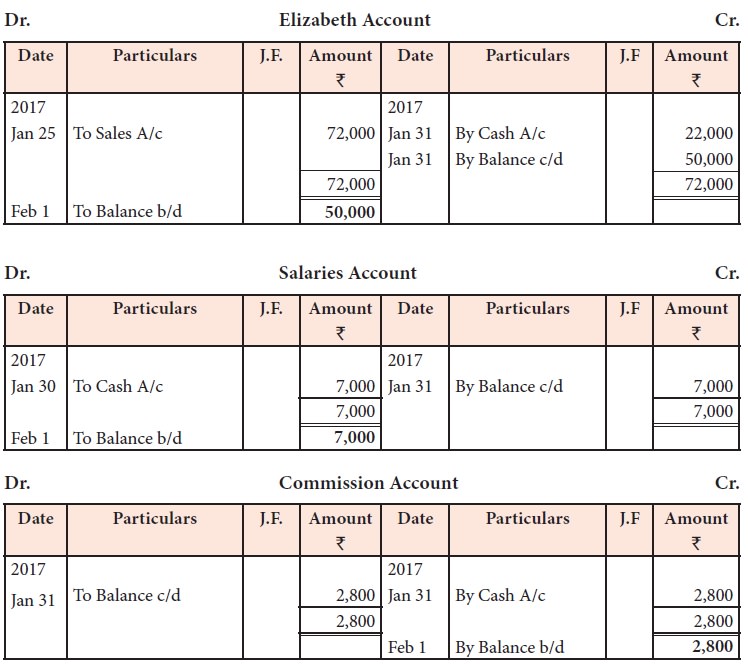

1. Balance method

Following are

the steps to be followed to prepare trial balance under this method:

Step 1: Calculate the

balances of all ledger accounts including the cash book.

Step 2: Record the

names of the accounts in the particulars column and the amounts of debit balances

in the debit column and credit balances in the credit column.

Step 3: Enter the

page number of ledger from which the balance is taken in the Ledger Folio column.

Step 4: Total the

debit and credit columns. It must be equal. If not equal, locate the errors and make

the trial balance agree.

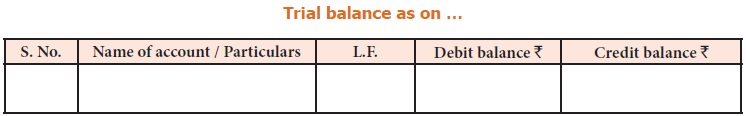

Trial balance is prepared in the following format

under the balance method:

Specimen of a trial balance

Tutorial note

i. If the

value of closing stock is known on the day when trial balance is prepared, then

opening stock and closing stock are adjusted with purchases. Hence, opening

stock will not appear in the trial balance. Closing stock and adjusted

purchases will appear in the trial balance. If the value of closing stock is

not known then opening stock and purchases will appear in the trial balance.

Thus, either opening stock and purchases or closing stock and adjusted

purchases will appear in the trial balance.

ii. Under balance method, if an account does not

have a balance, it is excluded.

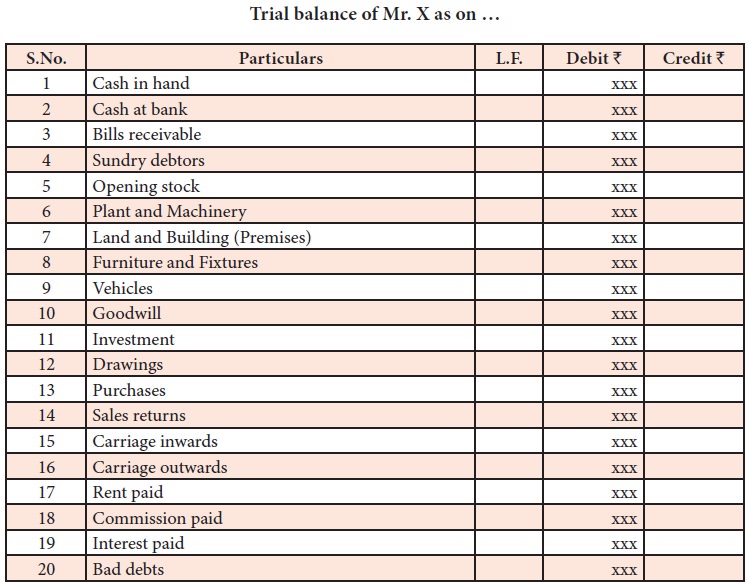

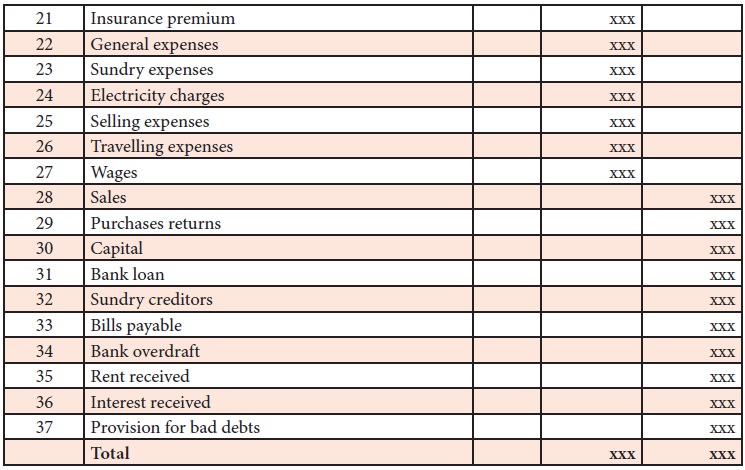

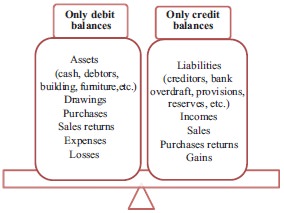

Tutorial note

There are certain accounts which have only debit

balances. Similarly, certain accounts have only credit balances. The following

chart gives examples of such accounts:

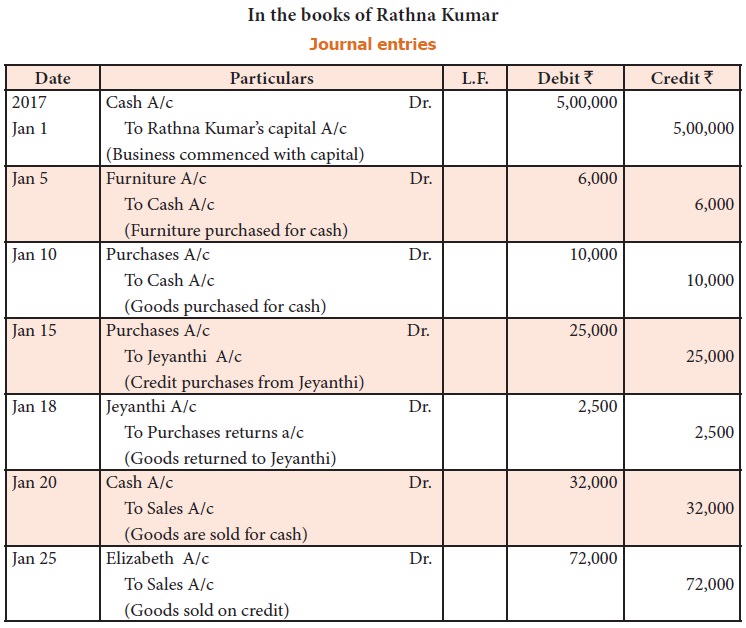

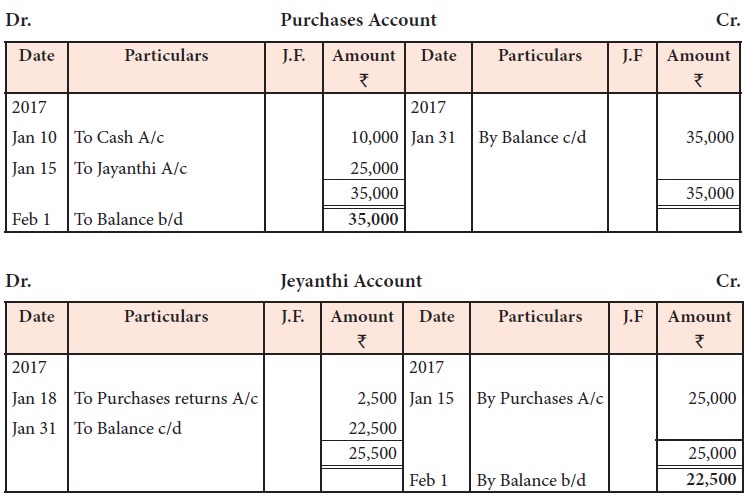

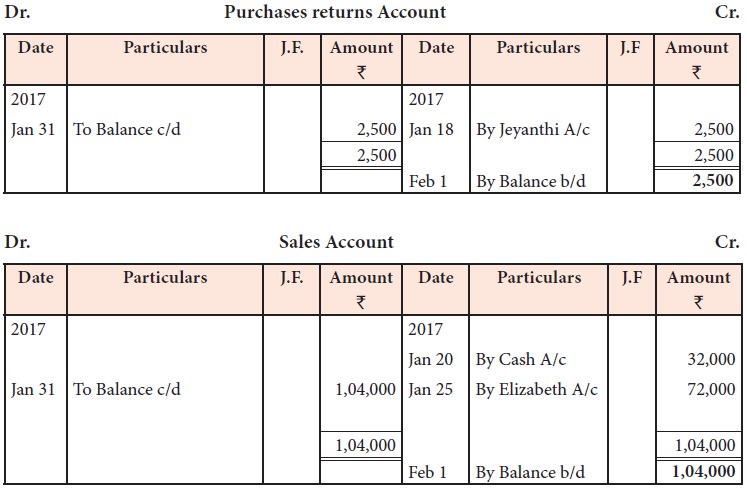

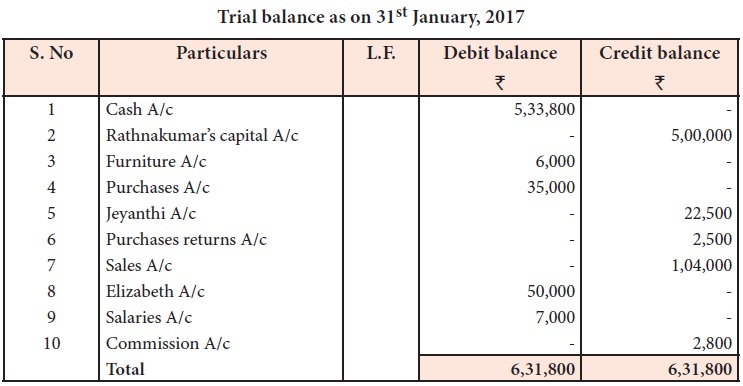

For example, the following transactions took place

in the business of Rathna Kumar, who deals in textiles.

2017

January Rs.

1 Commenced business with capital 5,00,000

5 Bought furniture for cash 6,000

10 Purchased goods for cash 10,000

15 Bought goods on credit from Jeyanthi 25,000

18 Returned goods to Jeyanthi 2,500

20 Sold goods for cash 32,000

25 Sold goods to Elizabeth on credit 72,000

30 Paid salaries to Krishnan by cash 7,000

31 Received commission from Kumar by cash 2,800

31 Received cash from Elizabeth 22,000

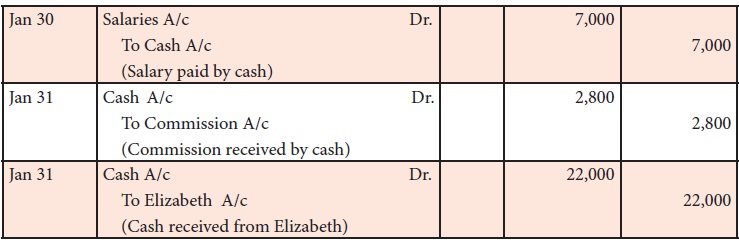

The journal entries, ledger postings and trial

balance for the transactions will appear as below in the books of Rathna Kumar.

In the

books of Rathna Kumar

Ledger

Trial balance under balance method

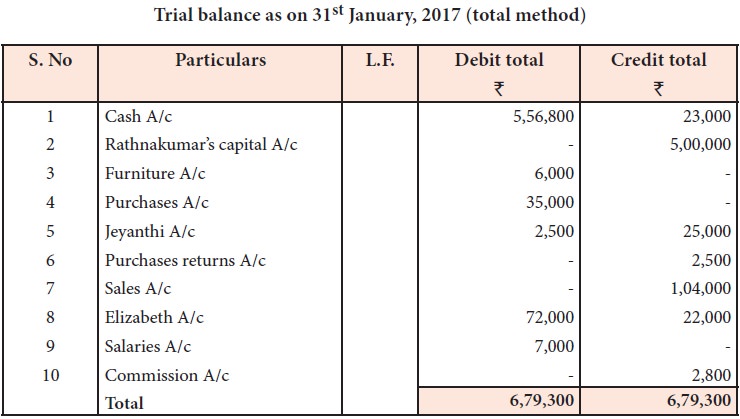

2. Total method

Steps to be

followed to prepare trial balance under total method are given below:

Step 1: Calculate the

totals of debit side and credit side of all the ledger accounts including cash

book individually.

Step 2: Enter the

name of the account in the particulars column and enter the debit total in the debit

column and credit total in the credit column for each account separately.

Step 3: Enter the

page number of ledger from which the balance is taken in the Ledger Folio column.

Step 4: Find the sum

of the debit total and credit total columns. It must be equal. If not equal, locate

the errors and make the trial balance agree.

For the above example, trial balance will be

prepared under total method as follows:

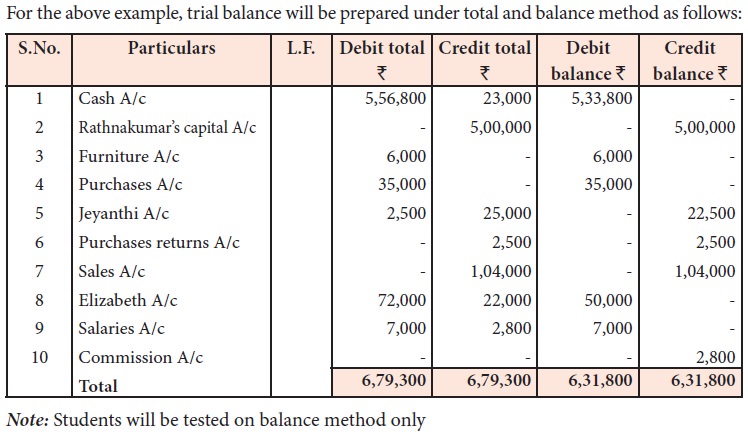

3. Total and Balance method

Steps to be followed to prepare trial balance under

total and balance method are given below:

Step 1: Calculate the

totals of debit and credit columns of all ledger accounts and calculate the balances

in each ledger account.

Step 2: Enter the

name of the account in the particulars column and enter the debit total in the debit

total column and credit total in the credit total column for each account

separately. Also enter the debit balances in the debit balance column and

credit balances in the credit balance column for each account.

Step 3: Enter the page number of ledger from which the balance is taken in the

Ledger Folio column

Step 4: Total all the

amount columns. Total of debit total column and total of credit total column

must be equal. Also total of debit balance column and total of credit balance

column must be equal. If not equal, locate the errors and make the trial

balance agree.

For the above

example, trial balance will be prepared under total and balance method as

follows:

Related Topics