Procedure, Illustration, Solution | Accountancy - Balancing of ledger accounts | 11th Accountancy : Chapter 4 : Ledger

Chapter: 11th Accountancy : Chapter 4 : Ledger

Balancing of ledger accounts

Balancing of ledger accounts

After posting

the transactions, the business person is interested to know the position of

various accounts. For this purpose, the accounts are balanced at the end of the

accounting period or after a certain period to ascertain the net balance in

each account. Balancing means that the debit side and credit side amounts are

totalled and the difference between the total of the two sides is placed in the

amount column as ‘Balance c/d’ on the side having lesser total, so that the

total of both debit and credit columns are equal.

When the

total of the debit side is more than the total of credit side the difference is

debit balance and is placed on the credit side as ‘By Balance c/d’. If the

credit side total is more than the total of debit side, the difference is

credit balance and is placed on the debit side as ‘To Balance c/d’.

1. Procedure for balancing an account

Following is

the procedure for balancing an account:

i.

The debit

and credit columns of an account are to be totalled separately.

ii.

The

difference between the two totals is to be ascertained.

iii.

The

difference is to be placed in the amount column of the side having lesser

total. ‘Balance c/d’ is to be entered in the particulars column against the

difference and in the date column the last day of the accounting period is

entered.

iv.

Now both

the debit and credit columns are to be totalled and the totals will be equal.

The totals of both sides are to be recorded in the same line horizontally. The

total is to be distinguished from other figures by drawing lines above and

below the amount.

v.

The

difference has to be brought down to the opposite side below the total.

‘Balance b/d’ is to be entered in the particulars column against the difference

brought down and in the date column, the first day of the next accounting

period is entered.

vi.

If the

total on the debit side of an account is higher, the balancing figure is debit

balance and if the credit side of an account has higher total, the balancing

figure is credit balance. If the two sides are equal, that account will show

nil balance.

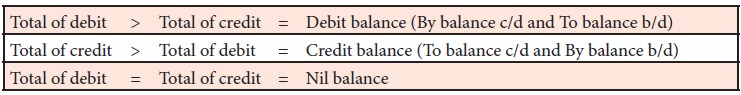

The rules for determining the balance is as

follows:

It may be

noted that totalling of a ledger account is known as casting. At the time of

balancing an account, debit balance is the balancing figure on the credit side

and credit balance is the balancing figure on the debit side. This balance is

known as closing balance. The closing balance of an accounting period is the

opening balance of the next accounting period.

Tutorial

note

i.

Cash

account cannot have a credit balance

ii.

Balances

in real accounts and personal accounts are carried forward to the next

accounting year.

iii.

Balances

in the nominal accounts are not carried forward to next accounting year. They

are closed by transferring to trading and profit and loss account.

iv.

Instead

of the abbreviations c/d and b/d the abbreviations c/o and b/o (carried over

and brought over) may be recorded if the balance is taken to the next

successive page. If the balance is taken to a different non-successive page the

abbreviation c/f and b/f (carried forward and brought forward) may be used.

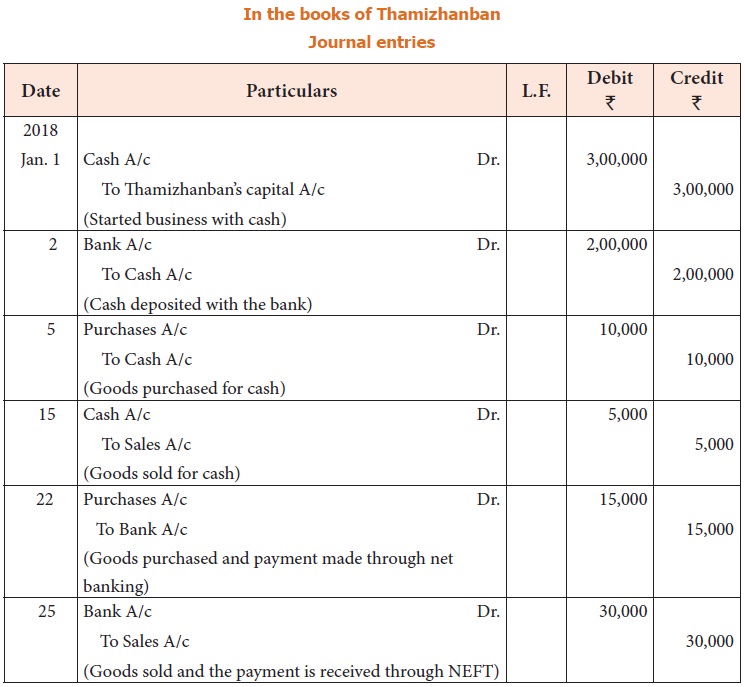

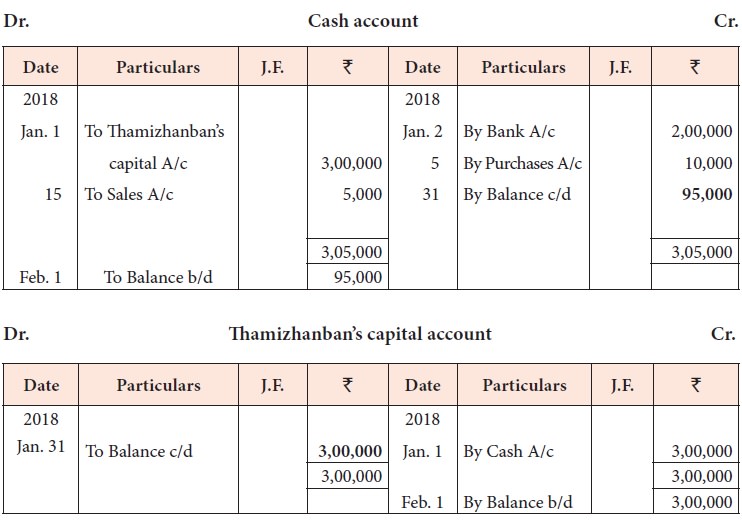

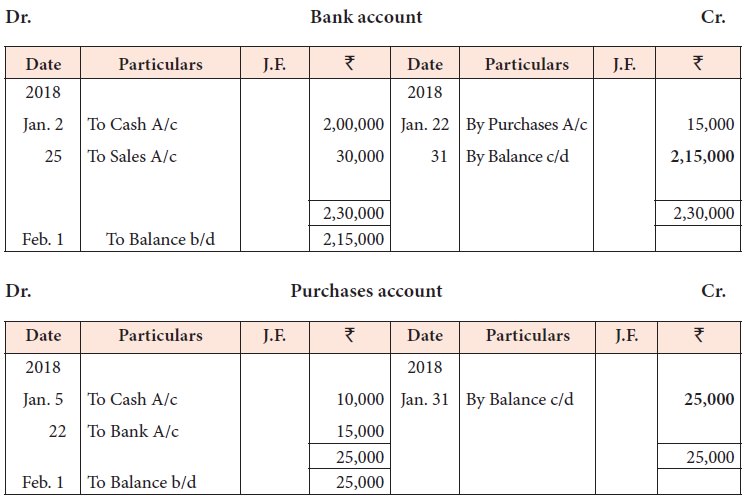

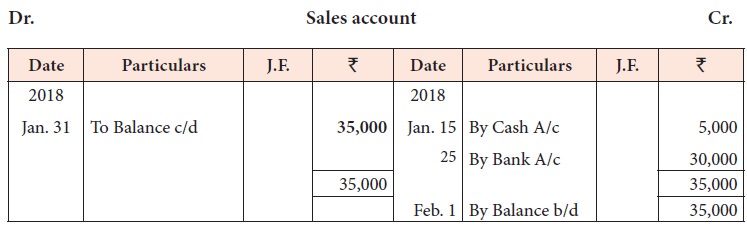

Illustration 5

Thmizhanban

started book selling business on 1st January, 2018. Following are the transac-tions

took place in his business for the month of January, 2018. Pass journal entries

and pre-pare ledger accounts.

2018

Jan. 1 Started business with cash Rs. 3,00,000

Jan. 2 : Opened

bank account by depositing Rs. 2,00,000

Jan. 5

: Goods bought from Tamilnadu Textbook

Corporation for cash Rs. 10,000

Jan. 15 : Sold goods to MM Traders for cash Rs. 5,000

Jan.

22 : Purchased goods from X and

Co. for Rs. 15,000 and the payment is made through net

banking.

Jan. 25 : Sold

goods to Y and Co. for Rs. 30,000

and the payment is received through NEFT

Solution

In the books of Thamizhanban

Journal entries

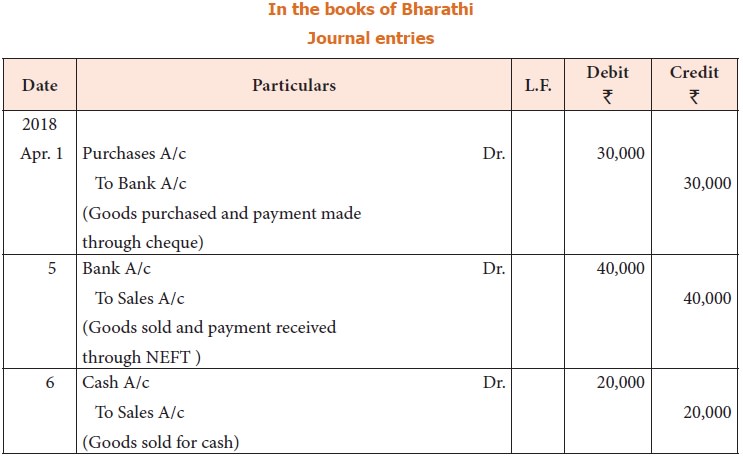

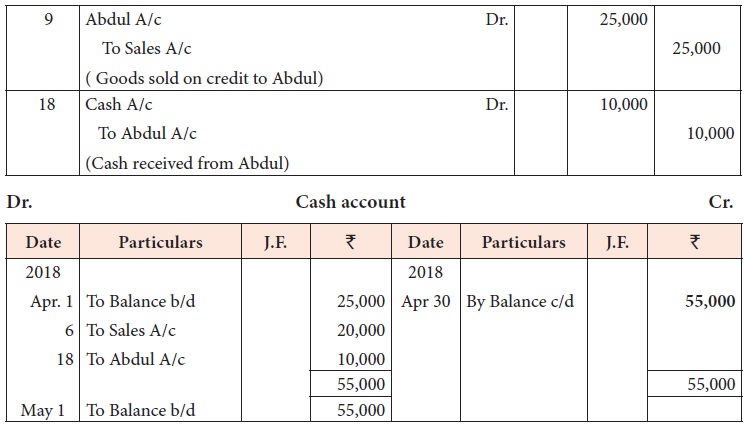

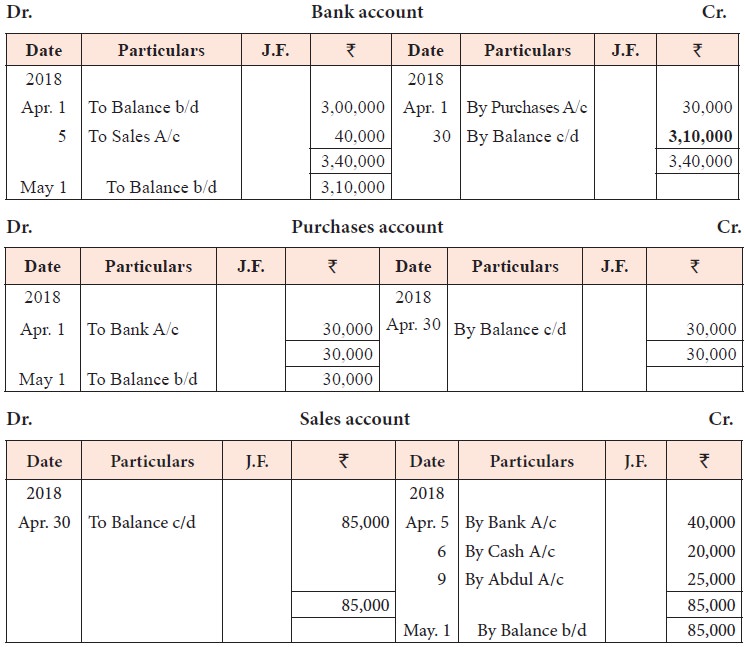

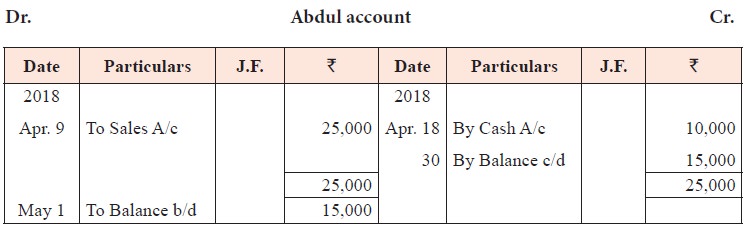

Illustration 6

Bharathi is a

sole trader dealing in oil products for the past five years. The books of

accounts showed the following balances on 1st April, 2018:

Cash in hand Rs. 25,000; Cash

at bank 3,00,000. The following transactions took place for the month of April

2018.

April 1 : Goods bought by giving cheque Rs. 30,000

April 5 : Goods sold to Naveen and payment received

through NEFT Rs. 40,000

April 6 : Goods sold to Xavier for cash Rs. 20,000

April 9 : Goods sold on credit to Abdul for Rs. 25,000

April 18 : Cash received from Abdul Rs. 10,000

Pass Journal entries for the above transactions and prepare ledger accounts.

Solution

In the books of Bharathi

Journal entries

2. Direct ledger posting

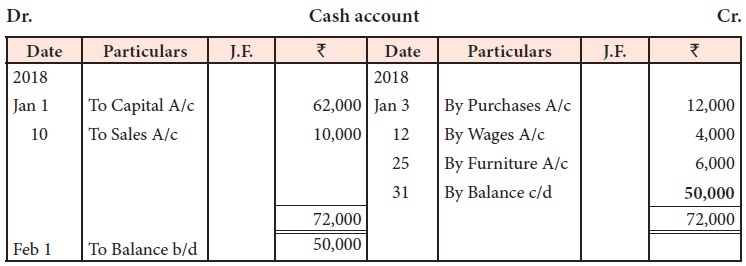

Illustration 7

Prepare cash

account from the following transactions for the month of January 2018.

Jan 1 Commenced

business with cash Rs. 62,000

Goods

purchased for cash Rs. 12,000

Goods

sold for cash Rs. 10,000

Wages

paid Rs. 4,000

Furniture purchased for cash Rs. 6,000

Solution

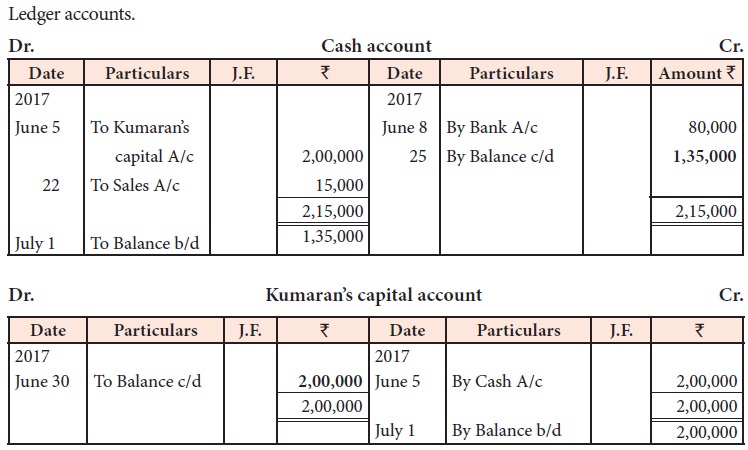

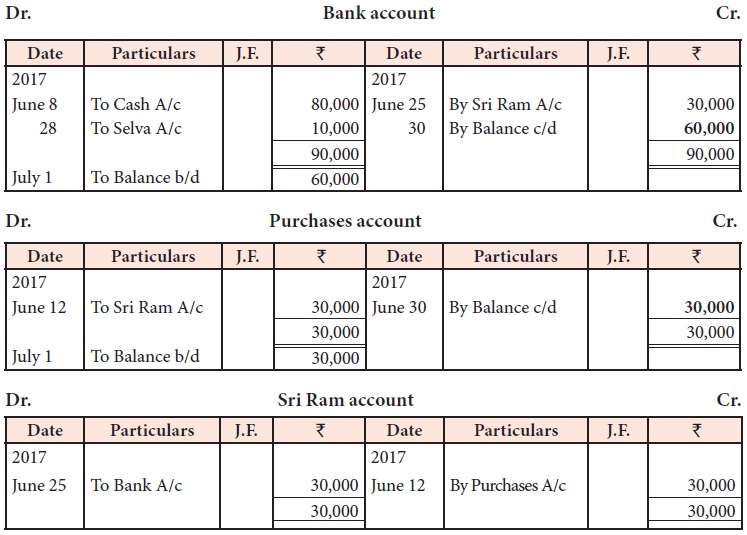

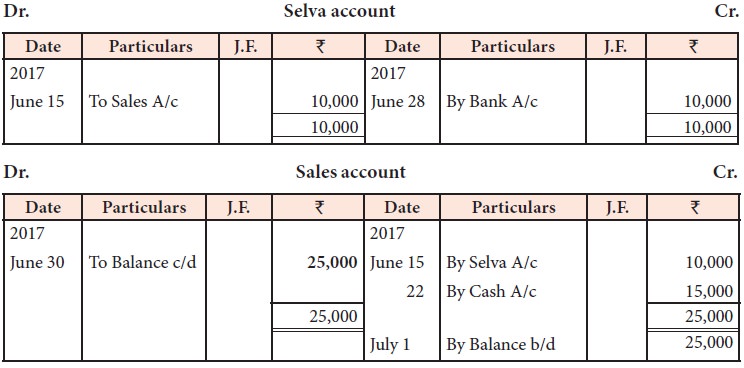

The following

are the transactions of Kumaran, dealing in stationery items. Prepare ledger

accounts.

2017

June 5 : Started business with cash Rs. 2,00,000

June 8 : Opened bank account by depositing Rs. 80,000

June 12 : Bought goods on credit from Sri Ram for Rs. 30,000

June 15 : Sold goods on credit to Selva for Rs. 10,000

June 22 : Goods sold for cash Rs. 15,000

June 25 : Paid Sri Ram Rs. 30,000

through NEFT

June 28 : Received a cheque from Selva and

deposited the same in bank Rs. 10,000

After posting

the journal entries to ledger accounts and extracting the balance of ledger

accounts, the trial balance is prepared. Trial balance is a statement which

shows debit and credit balances of all accounts in the ledger. It helps to test

the arithmetical accuracy of entries made in the journal and ledger.

Related Topics