Ledger | Accountancy - Procedure for posting | 11th Accountancy : Chapter 4 : Ledger

Chapter: 11th Accountancy : Chapter 4 : Ledger

Procedure for posting

Procedure for posting

The process

of transferring the debit and credit items from the journal to the ledger

accounts is called posting. The procedure of posting from journal to ledger is

as follows:

·

Locate the ledger account that is debited in the

journal entry. Open the respective account in the ledger, if already not

opened. Write the name of the account in the top middle. If already opened,

locate the account from the ledger index. Now entries are to be made on the

debit side of the account.

·

Record the date of the transaction in the date column

on the debit side of that account.

·

Record the name of the account credited in the

journal with the prefix ‘To’ in particulars column.

·

Record the amount of the debit in the ‘amount

column’.

·

Locate the ledger account that is credited in the

journal entry. Open the respective account in the ledger, if already not

opened. Write the name of the account in the top middle. If already opened,

locate the account from the ledger index. Now entries are to be made on the

credit side of the account. Record the date of the transaction in the date

column. Record the name of the account debited in the journal entry in the

particulars column with the prefix ‘By’ and write the amount in the amount

column.![]()

Tutorial note

The name of the account in the top never appears in

the particulars column. In the particulars column the account entered is the

other account in the journal entry.

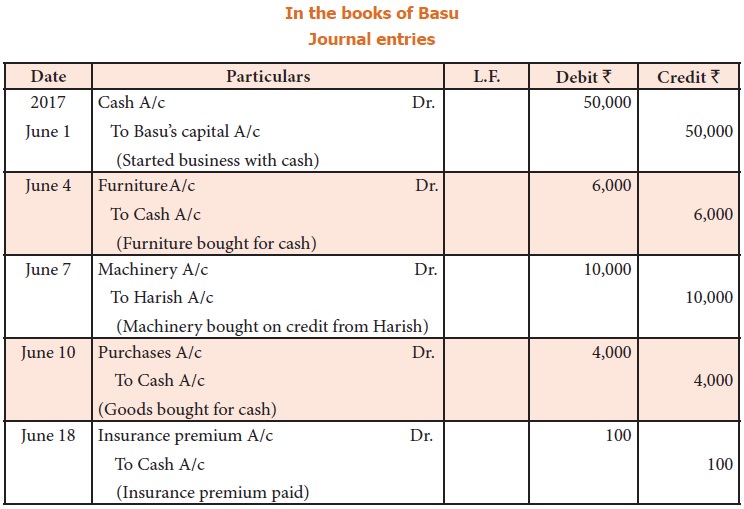

Illustration 1

Pass journal entries for the following transactions

and post them in the ledger accounts.

2017

June 1 Basu

started business with cash Rs. 50,000

June 4 Purchased

furniture by paying cash for Rs. 6,000

June 7 Purchased

machinery on credit from Harish Rs. 10,000

June 10 Bought

goods for cash Rs. 4,000

June 18 Paid

insurance premium Rs. 100

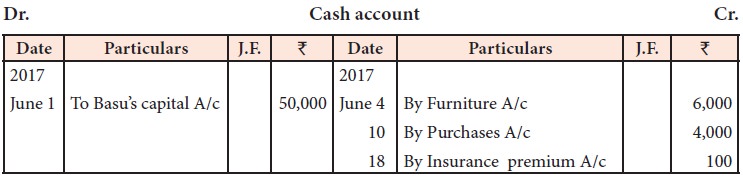

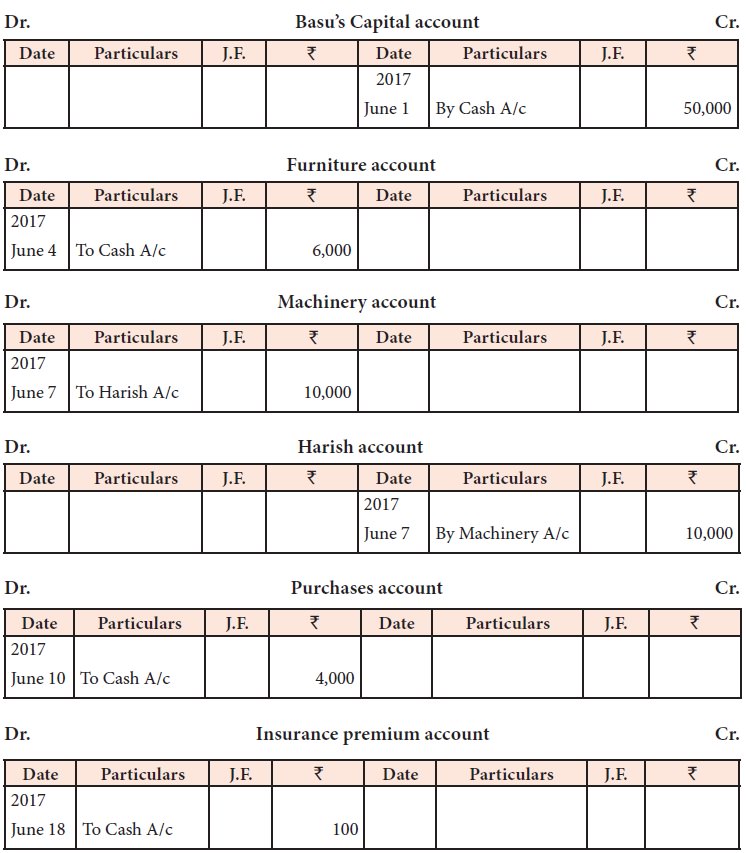

Solution

Ledger accounts

Posting of opening journal entry

In case of existing business enterprises, opening

entry is made at the beginning of the accounting period to bring into account

the balances of accounts which were not closed in the preceding accounting

period. The accounts not closed are capital, liabilities and assets appearing

in the balance sheet of the previous year. The entry passed is as follows:

Assets A/c

(individually) Dr. xxx

To

Liabilities A/c (individually) xxx

To Capital

A/c xxx

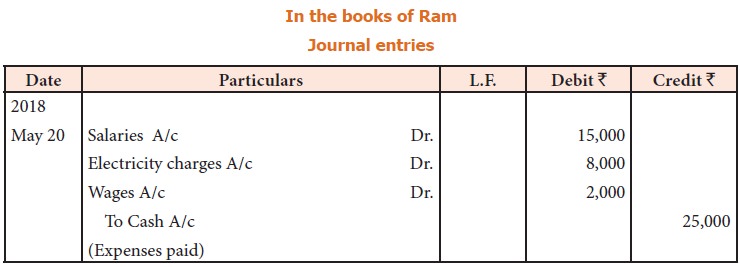

While posting the opening entry in the individual

ledgers, the term balance brought down (balance b/d) is used. The steps

involved in posting the opening entry are as follows:

Step 1: The items

debited in the opening entry are entered on the debit side of respective

accounts. The words ‘To Balance b/d’ are written in the particulars

column with respective amounts in the amount column, date being the first day

of the accounting period.

Step 2: The items

credited in the opening entry are entered on the credit side of respective accounts.

The words ‘By Balance b/d’ are written in the particulars column with

respective amounts in the amount column, date being the first day of the

accounting period.

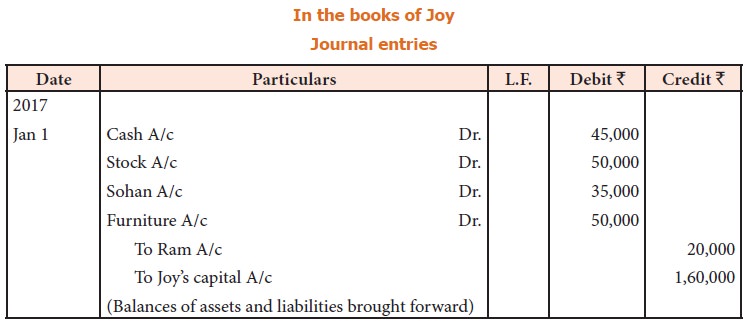

Illustration 2

Prepare

necessary ledger accounts in the books of Joy from the following opening entry:

In the books of Joy Journal entries

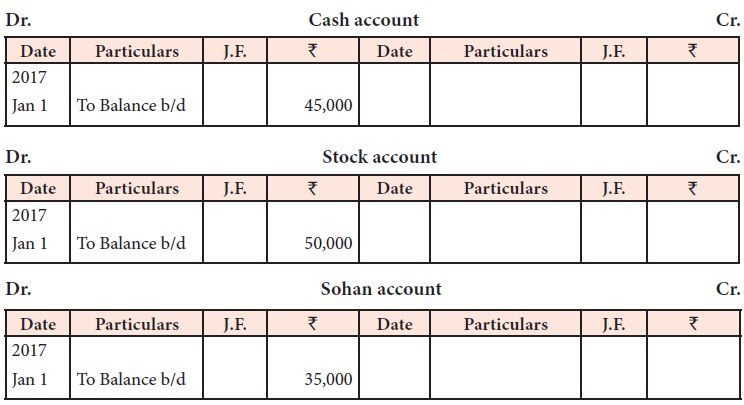

Solution

Ledger accounts

Posting of compound journal entry

When a

journal entry has more than one debit or more than one credit or both, it is

called a compound entry. For items debited in the compound entry, entries are

made on the debit side in the respective accounts with the respective amount

debited. For items credited in the compound entry, entries are made on the

credit side in the respective accounts with the respective amount credited.

Posting of such entries to ledger accounts is explained in illustrations 3 and

4.

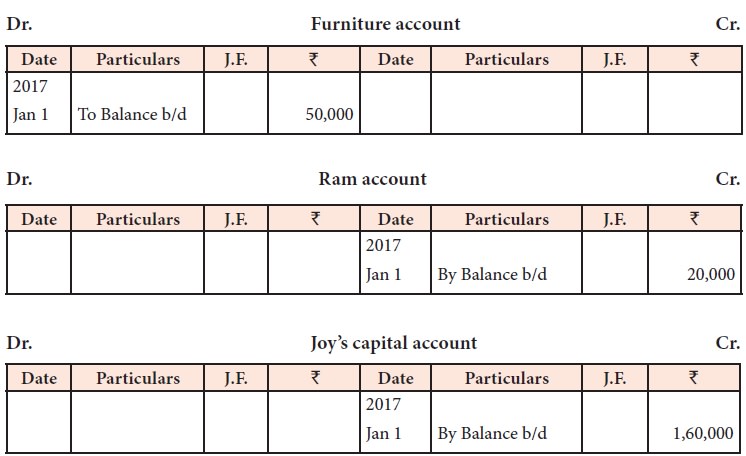

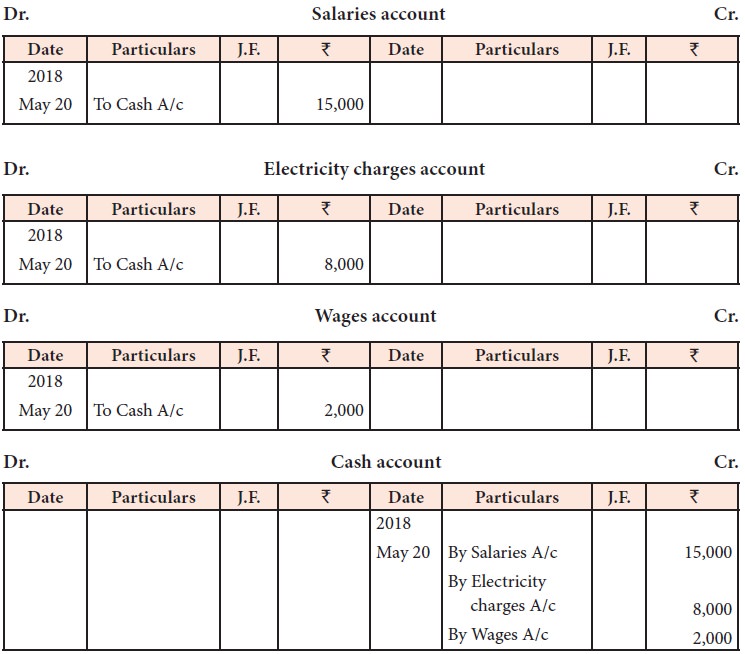

Illustration 3

Journalise

the following transactions and post them to ledger. On May 20, 2018, Ram paid

salaries Rs. 15,000;

Electricity charges Rs. 8,000 and

wages Rs. 2,000.

Solution

Ledger accounts

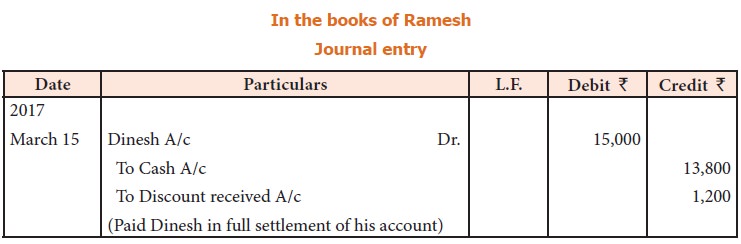

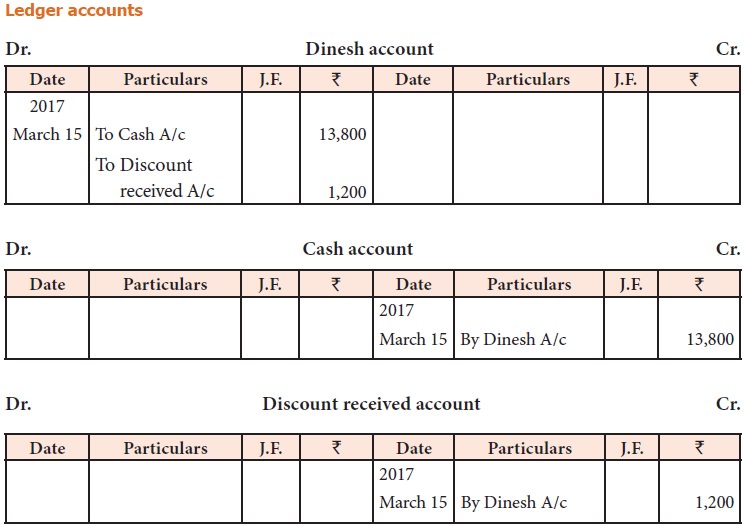

Illustration 4

On 15th

March, 2017, Ramesh paid Rs. 13,800 in full settlement of his account Rs. 15,000 due to his

creditor Dinesh. Pass journal entry and prepare ledger accounts.

Solution

In the books of Ramesh

Ledger accounts

Related Topics