Chapter: Mechanical : Engineering Economics & Cost Analysis : Introduction to Economics

Introduction to Economics

INTRODUCTION TO ECONOMICS

Introduction

Efficient functioning of any

business organization would enable it to provide goods/services at a lower

price.

In the process of managing

organizations, the managers at different levels should take appropriate

economic decisions which will help in minimizing investment, operating and

maintenance expenditures besides increasing the revenue, savings and such other

gains of the organization.

These can be achieved through

Engineering Economics which deals with the methods that enable one to make

economic decisions towards minimizing costs and/or maximizing benefits to

business organizations.

This chapter discusses the elements

of economics and the interaction between its various components.

This is followed by an analysis of

the need and scope of engineering economics. Later, elements of cost and

break-even analysis are presented.

Economics - is a

study of economic problems of the people concerning production, consumption,

exchange and distribution of wealth.

Economics is the science that deals with the

production and consumption of goods and services and the distribution and

rendering of these for human welfare.

The

following are the economic goals.

ü A high level

of employment

ü Price

stability

ü Efficiency

ü An

equitable distribution of income

ü Growth

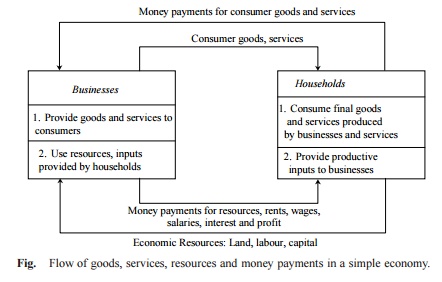

Flow in economy The flow

of goods, services, resources and money payments in a simple economy

Households

and businesses are the two major entities in a simple economy.

Business

organizations use various economic resources

like land, labour

and capital which are provided

by households to produce consumer

goods and services

which will be used

by them.

Business

organizations make payment of

money to the

households for receiving

various resources.

ü The households in turn make payment of money to business

organizations for receiving consumer goods and services.

üThis cycle shows the interdependence between the

two major entities in a simple economy.

Fig. Flow of goods, services, resources and money payments in a

simple economy.

Laws of supply and demand

i.Laws of supply - states

that the quantity of a commodity supplied varies directly with the

price, other determinants of supply remaining constant.

ü If the cost of inputs increases, then naturally, the cost of the

product will go up. In such a situation, at the prevailing price of the product

the profit margin per unit will be less.

ü The producers will then reduce the production quantity, which in

turn will affect the supply of the product.

ü For instance, if the prices of fertilizers and cost of labour

are increased significantly, in agriculture, the profit margin per bag of paddy

will be reduced.

ü So, the farmers will reduce the area of cultivation, and hence

the quantity of supply of paddy will be reduced at the prevailing prices of the

paddy.

ü If there is an advancement in technology used in the manufacture

of the product in the long run, there will be a reduction in the production

cost per unit.

ü This will enable the manufacturer to have a greater profit

margin per unit at the prevailing price of the product. Hence, the producer

will be tempted to supply more quantity to the market.

ü Weather also has a direct bearing on the supply of products. For

example, demand for woollen products will increase during winter. This means

the prices of woollen goods will be incresed in winter.

ü So, naturally, manufacturers will supply more volume of woollen

goods during winter.

Factors influencing supply

The shape of the supply curve is affected by the following

factors:

ü Cost of the inputs

ü Technology

ü Weather

ü Prices of related goods

ii.Law of demand states

that other things being equal demand when price falls and contracts when

price rises.

·

Market demand is the

total quantity demanded by all the purchasers together.

·

Elasticity of Demand -

Elasticity of demand may be defined as the degree of responsiveness of

quantity demanded to a Change in price.

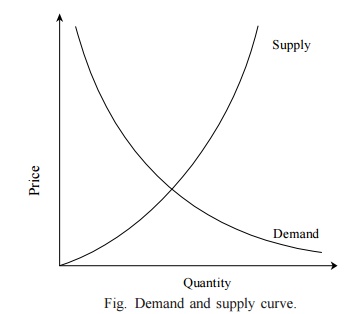

ü An interesting aspect of the economy is that the demand and

supply of a product are interdependent and they are sensitive with respect to

the price of that product. .

ü From Fig. it is clear that when there is a decrease in the price

of a product, the demand for the product increases and its supply decreases.

ü Also, the product is more in demand and hence the demand of the

product increases.

ü At the same time, lowering of the price of the product makes the

producers restrain from releasing more quantities of the product in the market.

ü Hence, the supply of the product is decreased. The point of

intersection of the supply curve and the demand curve is known as the

equilibrium point.

ü At the price corresponding to this point, the quantity of supply

is equal to the quantity of demand. Hence, this point is called the equilibrium

point.

Fig.

Demand and supply curve.

Factors influencing demand

The shape of the demand curve is influenced by the following

factors:

ü Income of the people

ü Prices of related goods

ü Tastes of consumers

Concept of Engineering Economics

ü Science is a field of study where the basic principles of

different physical systems are formulated and tested.

ü Engineering is the application of science. It establishes varied

application systems based on different scientific principles.

ü From the discussions in the previous section, it is clear that

price has a major role in deciding the demand and supply of a product.

ü Hence, from the organization’s point of view, efficient and

effective functioning of the organization would certainly

help it to provide goods/services at a lower cost which in turn will enable it

to fix a lower price for its goods or services.

ü The following section discusses the different types of

efficiency and their impact on the operation of businesses and the definition

and scope of engineering economics.

.

Types of Efficiency

Efficiency of a

system is generally defined as the ratio of its output to input. The efficiency

can be classified into technical efficiency and economic efficiency.

1. Technical efficiency

It is the ratio of the output to input of a physical system. The

physical system may be a diesel engine, a machine working in a shop floor, a

furnace, etc.

Technical

efficiency (%) = Output/ Input × 100

The technical efficiency of a diesel engine is as follows:

Technical

efficiency (%) =

[ Heat

equivalent of mechanical energy produced / Heat equivalent of fuel used ] x 100

In practice, technical efficiency can never be more than 100%.

This is mainly due to frictional

loss and incomplete combustion of fuel, which are considered to be unavoidable

phenomena in the working of a diesel engine.

2. Economic efficiency

Economic efficiency is the ratio of output to input of a

business system.

Economic efficiency (%) = Output/Input × 100 = Worth/Cost × 100

‘Worth’ is the annual revenue generated by way of operating the business and ‘cost’ is the total annual expenses incurred in carrying out the

business.

For the survival and growth of any

business, the economic efficiency should be more than 100%.

Economic efficiency is also called ‘productivity’. There are several ways

of improving productivity.

§ Increased output for the same input

§ Decreased input for the same output

§ By a proportionate increase in the output which is more than the

proportionate increase in the input

§ By a proportionate decrease in the input which is more than the

proportionate decrease in the output

§ Through simultaneous increase in the output with decrease in the

input.

Definition and

Scope of Engineering Economics

As stated earlier, efficient functioning

of any business organization would enable it to provide goods/services at a

lower price.

In the process of managing

organizations, the managers at different levels should take appropriate

economic decisions which will help in minimizing investment, operating and

maintenance expenditures besides increasing the revenue, savings and other

related gains of the organization.

Definition

Engineering economics deals with the methods

that enable one to take economic decisions towards minimizing costs and/or

maximizing benefits to business organizations.

Scope

The issues that are covered in this

book are elementary economic analysis, interest formulae, bases for comparing

alternatives, present worth method, future worth method, annual equivalent

method, rate of return method, replacement analysis, depreciation, evaluation

of public alternatives, inflation adjusted investment decisions, make or buy

decisions, inventory control, project management, value engineering, and linear

programming.

Elements Of Costs

Cost can be broadly classified into variable

cost and overhead cost. Variable cost varies with the volume of

production while overhead cost is fixed, irrespective of the production volume.

Variable cost can be further

classified into direct material cost, direct labour cost, and direct expenses.

The overhead cost can be classified into factory overhead, administration

overhead, selling overhead, and distribution overhead.

Direct material costs are those

costs of materials that are used to produce the product. Direct labour cost is

the amount of wages paid to the direct labour involved in the production

activities.

Direct expenses are those expenses

that vary in relation to the production volume, other than the direct material

costs and direct labour costs.

Overhead cost is the aggregate of

indirect material costs, indirect labour costs and indirect expenses.

Administration overhead includes all the costs that are incurred in

administering the business.

Selling overhead is the total

expense that is incurred in the promotional activities and the expenses

relating to sales force. Distribution overhead is the total cost of shipping

the items from the factory site to the customer sites.

The selling price of a product is derived as shown below:

(a) Direct material costs + Direct

labour costs + Direct expenses = Prime cost

(b) Prime cost + Factory

overhead = Factory cost

(c) Factory cost

+ Office and

administrative overhead

= Costs of production

(d) Cost of production + Opening finished stock – Closing finished stock = Cost of

goods sold

(e)

Cost of goods sold + Selling and

distribution overhead = Cost of sales

(f) Cost of sales + Profit = Sales

(g) Sales/Quantity sold = Selling price per unit

In the above

calculations, if the opening finished stock is equal to the closing finished

stock, then the cost of production is equal to the cost of goods sold.

Other Costs/Revenues

The following are

the costs/revenues other than the costs which are presented in the previous

section:

ü Marginal cost

ü Marginal revenue

ü Sunk cost

ü Opportunity cost

1. Marginal Cost

Marginal cost of a

product is the cost of producing an additional unit of that product. Let the

cost of producing 20 units of a product be Rs. 10,000, and the cost of

producing 21 units of the same product be Rs. 10,045. Then the marginal cost of

producing the 21st unit is Rs. 45.

2. Marginal Revenue

Marginal revenue of

a product is the incremental revenue of selling an additional unit of that

product. Let, the revenue of selling 20 units of a product be Rs. 15,000 and

the revenue of selling 21 units of the same product be Rs. 15,085. Then, the

marginal revenue of selling the 21st unit is Rs. 85.

3. Sunk Cost

This is known as

the past cost of an equipment/asset. Let us assume that an equipment has been

purchased for Rs. 1,00,000 about three years back. If it is considered for

replacement, then its present value is not Rs. 1,00,000. Instead, its present

market value should be taken as the present value of the equipment for further

analysis.

So, the purchase

value of the equipment in the past is known as its sunk cost. The sunk cost

should not be considered for any analysis done from now onwards.

4. Opportunity Cost

In practice, if an

alternative (X ) is selected from a set of competing alternatives (X,Y

), then the corresponding investment in the selected alternative is not

available for any other purpose. If the same money is invested in some other

alternative (Y ), it may fetch some return. Since the money is invested

in the selected alternative (X ), one has to forego the return from the

other alternative (Y ).

The amount that is

foregone by not investing in the other alternative (Y ) is known as the

opportunity cost of the selected alternative (X ). So the opportunity

cost of an alternative is the return that will be foregone by not investing the

same money in another alternative.

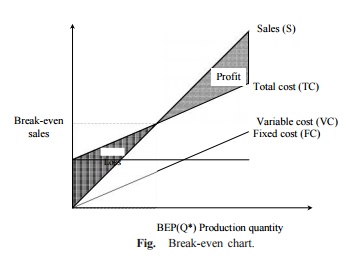

Break-Even Analysis

The main objective of break-even

analysis is to find the cut-off production volume from where a firm will make

profit.

Let

s = selling price per unit v

= variable cost per unit FC

= fixed cost per period Q =

volume of production

The total sales revenue (S) of the firm is given by the

following formula:

S = s Q

The total cost of the firm for a

given production volume is given as

TC = Total variable cost + Fixed cost

= v Q + FC

·

The linear plots of the above two equations are

shown in Fig. .

·

The intersection point of the total sales revenue

line and the total cost line is called the

break-even point.

·

The corresponding volume of

production on the X-axis is known as the

break-even sales quantity.

·

At the intersection point, the total cost is equal

to the total revenue. This point is also called the no-loss or no-gain

situation.

·

For any production quantity which is less than the

break-even quantity, the total cost is more than the total revenue.

·

Hence, the firm will be making loss.

For any production

quantity which is more than the break-even quantity, the total revenue will be

more than the total cost. Hence, the firm will be making profit.

Profit = Sales – (Fixed cost + Variable costs)

= s Q – (FC + v Q)

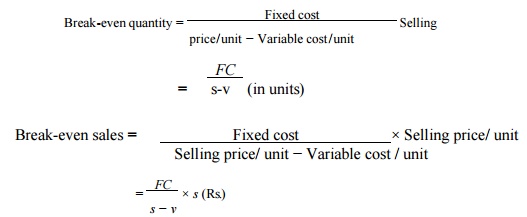

The formulae to find the break-even quantity and

break-even sales quantity

Break-even quantity = [ Fixed cost ] / [

price/unit − Variable cost/unit ] Selling

= FC/ s-v (in

units)

Break-even sales = [ Fixed cost × Selling price/ unit − Variable cost / unit ] x Selling price/

unit

= [ FC /

s − v ] × s (Rs.)

The contribution is

the difference between the sales and the variable costs. The margin of safety

(M.S.) is the sales over and above the break-even sales. The formulae to

compute these values are

Contribution = Sales – Variable costs

Contribution/unit =

Selling price/unit – Variable cost/unit

M.S. =

Actual sales – Break-even sales

= [ Profit / Contribution ] x sales

M.S. as a per cent of sales = (M.S./Sales) 100

P/V ratio is a valid ratio

which is useful for further analysis.

The different formulae for the P/V ratio are as

follows:

P/V ratio = Contribution

/ Sales = Sales − Variable

costs / Sales

The relationship between BEP and P/V

ratio is as follows:

BEP = Fixed

cost / P/V ratio

Elementary Economic Analysis

Whether it is a business situation

or a day-to-day event in somebody’s personal life, there are a large number of economic decision

making involved. One can manage many of these decision problems by using simple

economic analysis.

For example, an industry can source

its raw materials from a nearby place or from a far-off place. In this problem,

the following factors will affect the decision:

ü Price of the raw material

ü Transportation cost of the raw material

ü `Availability of the raw material

ü Quality of the raw material

Consider the alternative of sourcing

raw materials from a nearby place with the following characteristics:

ü The raw material is more costly in the nearby area.

ü The availability of the raw material is not sufficient enough to

support the operation of the industry throughout the year.

ü The raw material requires pre-processing before it is used in the production process. This would certainly

add cost to the product.

ü The cost of transportation is minimal under this

alternative.

On the other hand, consider another

alternative of sourcing the raw materials from a far-off place with the

following characteristics:

ü The raw material is less costly at the far off place.

ü The cost of transportation is very high.

ü The availability of the raw material at this site is abundant

and it can support the plant throughout the year.

ü The raw material

from this site

does not require

any pre processing before using it for production.

Material Selection For A

Product/Substitution Of Raw Material

The cost of a product can be reduced greatly by substitution of

the raw materials.

Among various elements of cost, raw material

cost is most significant and it forms a major portion of the total cost of any

product.

So, any attempt to find a suitable

raw material will bring a reduction in the total cost in any one or

combinations of the following ways:

ü Reduced machining/process time

ü Enhanced durability of the product

ü Cheaper raw material price

Therefore, the process of raw

material selection/substitution will result in finding an alternate raw

material which will provide the necessary functions that are provided by the

raw material that is presently used.

In this process, if the new raw

material provides any additional benefit, then it should be treated as its

welcoming feature. This concept is demonstrated with numerical problem given

below

Example

In the design of a jet engine part,

the designer has a choice of specifying either an aluminium alloy casting or a

steel casting. Either material will provide equal service, but the aluminium

casting will weigh 1.2 kg as compared with 1.35 kg for the steel casting.

The aluminium can be cast for Rs.

80.00 per kg. and the steel one for Rs. 35.00 per kg. The cost of machining per

unit is Rs. 150.00 for aluminium and Rs. 170.00 for steel. Every kilogram of

excess weight is associated with a penalty of Rs. 1,300 due to increased fuel

consumption. Which material should be specified and what is the economic

advantage of the selection per unit?

Solution (a) Cost of using aluminium metal for the jet engine

part:

Weight of aluminium casting/unit = 1.2 kg

Cost of making aluminium casting = Rs. 80.00 per kg

Cost of machining aluminium casting per unit = Rs. 150.00

Total cost of jet engine part made of aluminium/unit

= Cost of making aluminium casting/unit + Cost

of machining aluminium casting/unit

= 80 1.2 + 150 = 96 + 150

= Rs. 246

(b) Cost of jet engine part made of steel/unit:

Weight of steel casting/unit = 1.35 kg

Cost of making steel casting = Rs. 35.00 per kg

Cost of machining steel casting per unit = Rs.

170.00 Penalty of excess weight of steel casting = Rs. 1,300 per kg

Total cost of jet engine part made of steel/unit

= Cost of making steel casting/unit

+ Cost of machining steel casting/unit

+ Penalty for excess weight of steel

casting

= 35 1.35 + 170 +

1,300(1.35 – 1.2)

= Rs. 412.25

DECISION The total cost/unit of a jet engine part made of aluminium

is less than that for an engine made of steel. Hence, aluminium is suggested

for making the jet engine part. The economic advantage of using aluminium over

steel/unit is Rs.

412.25

– Rs. 246 = Rs. 166.25

i.Design Selection

for a Product

a. The design modification of a product may result in reduced raw

material requirements, increased machinability of the materials and reduced

labour.

b. Design is an important factor which decides the cost of the

product for a specified level of performance of that product.

Example

(Design selection for a process

industry). The chief engineer of refinery operations

is not satisfied with the preliminary design for storage tanks to be used as

part of a plant expansion programme. The engineer who submitted

the design was called in and asked to reconsider

the overall dimensions in the light of an article in the Chemical Engineer, entitled “How to size future

process vessels?”

The original design

submitted called for 4 tanks 5.2 m in diameter and 7 m in height. From a graph

of the article, the engineer found that the present ratio of height to diameter

of 1.35 is 111% of the minimum cost and that the minimum cost for a tank was

when the ratio of height to diameter was 4 : 1. The cost for the tank design as

originally submitted was estimated to be Rs. 9,00,000. What are the optimum

tank dimensions if the volume remains the same as for the original design? What

total savings may be expected through the redesign?

Solution

(a) Original design

Number of tanks = 4 Diameter of the tank = 5.2 m

Radius of the tank = 2.6 m Height of the tank = 7 m

Ratio of height to diameter = 7/5.2 = 1.35

Volume/tank = (22/7)r 2h = (22/7)(2.6)2 7

= 148.72 m3

(b) New design

Cost of the old design = 111% of the

cost of the new design (optimal design)

Optimal ratio of

the height to diameter = 4:1

h : d =

4 : 1

4d = h

d = h/4

r = h/8

Volume = (22/7)r2h

= 148.72 (since, the volume remains the same)

(22/7)(h/8)2h =

148.72

h = 14.47 m

r = h/8

= 14.47/8 = 1.81 m

Therefore,

Diameter of the new design = 1.81 2

= 3.62 m

Cost of the new design = 9,00,000 (100/111)

= Rs. 8,10,810.81

Expected savings by the redesign =

Rs. 9,00,000 – Rs. 8,10,810.81 = Rs. 89,189.19

Process Planning /Process

Modification

While planning for a new component,

a feasible sequence of operations with the least cost of processing is to be

considered.

The process sequence of a component

which has been planned in the past is not static.

It is always subject to modification

with a view to minimize the cost of manufacturing the component.

So, the objective of process

planning/process modification is to identify the most economical sequence of

operations to produce a component.

The steps in process planning are as follows:

1. Analyze the part drawing to get an overall picture of what is

required.

2. Make recommendations to or consult with product engineers on

product design changes.

3. List the basic operations required to produce the part to

the drawing or specifications.

4. Determine the most practical and economical manufacturing method

and the form or tooling required for each operation.

5. Devise the best way to combine the operations and put them in

sequence.

6. Specify the gauging required for the process.

Steps 3–5 aim to determine the most

practical and economical sequence of operations to produce a component. This

concept is demonstrated with a numerical problem.

Example

The process planning engineer of a

firm listed the sequences of operations as shown in Table to produce a

component.

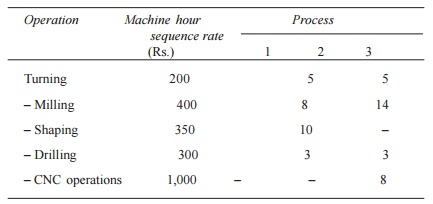

Table Data for Example

Sequence

Process

sequence

1 Turning

– Milling – Shaping – Drilling

2 Turning

– Milling – Drilling

3 All

operations are performed with CNC machine

The details of processing times of

the component for various operations and their machine hour rates are

summarized in Table below

Machine Hour Rates and Processing

Times (minutes) for Example

Find the most

economical sequence of operations to manufacture the component.

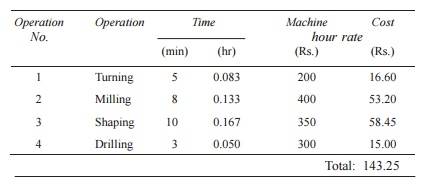

Solution (a) Cost of component using process sequence 1. The process sequence 1 of the component is as

follows:

Turning – Milling – Shaping – Drilling

The calculations for the cost of the above process sequence are

summarized in Table.

Table Workings for

Process Sequence 1

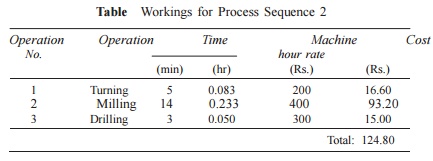

(b) Cost of

component using process sequence 2. The process

sequence 2 of the component is as follows:

Turning – Milling – Drilling

The calculations

for the cost of the above process sequence are given in Table

Table Workings for

Process Sequence 2

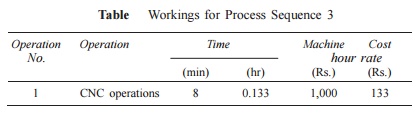

(c) Cost of

component using process sequence 3. The process

sequence 3 of the component is as follows:

Only CNC operations

The calculations

for the cost of the above process sequence are summarized in Table

Table Workings for Process Sequence 3

The process

sequence 2 has the least cost. Therefore, it should be selected for

manufacturing the component.

Related Topics