Chapter: Business Science : Security Analysis and Portfolio Management : Fundamental Analysis

Fundamental Analysis

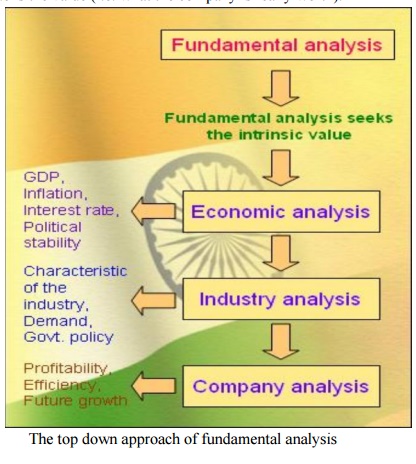

FUNDAMENTAL ANALYSIS:

Fundamental

analysis is used to determine the intrinsic value of the share by examining the

underlying forces that affect the well being of the economy, Industry groups

and companies. Fundamental analysis is to first analyze the economy, then the

Industry and finally individual companies. This is called as top down approach.

¸ The actual value of a

security, as opposed to its market price or book value is called intrinsic value. The

intrinsic value includes other variables such as brand name, trademarks, and

copyrights that are often difficult to calculate and sometimes not accurately

reflected in the market price. One way to look at it is that the market

capitalization is the price (i.e. what investors are willing to pay for the

company and intrinsic value is the value (i.e. what the company is really

worth).

The top down approach of fundamental analysis

At the economy level, fundamental analysis focus on economic data

(such as GDP, Foreign exchange and Inflation etc.) to assess the present and

future growth of the economy.

At the industry level, fundamental

analysis examines the supply and demand forces for the products offered.

At the company level, fundamental

analysis examines the financial data (such as balance sheet, income statement

and cash flow statement etc.), management, business concept and competition.

Related Topics