Chapter: Business Science : Security Analysis and Portfolio Management : Fundamental Analysis

Applied Valuation Techniques

APPLIED

VALUATION TECHNIQUES:

Although the raw data

of the Financial Statement has some useful information, much more can be

understood about the value of a stock by applying a variety of tools to the

financial data.

2. Price to

Earnings Ratio P/E

3. Projected

Earnings Growth PEG

5. Price to

Book P/B

7. Dividend Yield

8. Book Value

per share

9. Return on

Equity

1. Earnings per Share

The overall

earnings of a company is not in itself a useful indicator of a stock's worth.

Low earnings

coupled with low outstanding shares can be more valuable than high earnings

with a high number of outstanding shares. Earnings per share is much more useful

information than earnings by itself. Earnings per share (EPS) is calculated by

dividing the net earnings by the number of outstanding shares.

EPS

= Net Earnings / Outstanding Shares

For example: ABC company had net earnings of $1

million and 100,000 outstanding shares for an EPS of 10 (1,000,000 / 100,000 =

10). This information is useful for comparing two companies in a certain

industry but should not be the deciding factor when choosing stocks.

2.Price to Earnings Ratio

The Price to Earnings

Ratio (P/E) shows the relationship between stock price and company earnings. It

is calculated by dividing the share price by the Earnings per Share.

P/E

= Stock Price / EPS

In our example above of

ABC company the EPS is 10 so if it has a price per share of $50 the P/E is 5

(50 / 10 = 5). The P/E tells you how many investors are willing to pay for that

particular company's earnings. P/E's can be read in a variety of ways. A high

P/E could mean that the company is overpriced or it could mean that investors expect

the company to continue to grow and generate profits. A low P/E could mean that

investors are wary of the company or it could indicate a company that most

investors have overlooked.

Either way, further analysis is needed to determine

the true value of a particular stock.

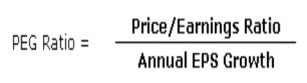

3. Projected

Earnings Growth Rate-PEG Ratio

A ratio used to determine a stock's value while

taking into account earnings growth. The calculation is as follows:

PEG is a widely used indicator of a

stock's potential value. It is favoured by many over the price/earnings ratio

because it also accounts for growth. Similar to the P/E ratio, a lower PEG

means that the stock is more undervalued.

4. Price to Sales Ratio

When a company has no earnings, there

are other tools available to help investors judge its worth. New companies in

particular often have no earnings, but that does not mean they are bad

investments. The Price to Sales ratio (P/S) is a useful tool for judging new

companies. It is calculated by dividing the market cap (stock price times

number of outstanding shares) by total revenues. An alternate method is to

divide current share price by sales per share. P/S indicates the value the

market places on sales. The lower the P/S the better the value.

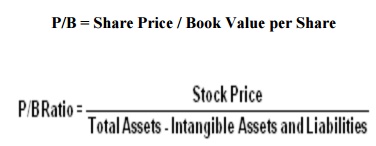

5.Price to Book Ratio

Book value

is determined by subtracting liabilities from assets. The value of a growing

company will

always be more than book value because of the potential for future revenue. The

price to book ratio (P/B) is the value the market places on the book value of

the company. It is calculated by dividing the current price per share by the

book value per share (book value / number of outstanding shares). It is also

known as the "price-equity ratio".

P/B = Share Price / Book Value per Share

6. Dividend Yield

Some investors are looking for stocks that can

maximize dividend income. Dividend yield is useful for determining the

percentage return a company pays in the form of dividends. It is calculated by

dividing the annual dividend per share by the stock's price per share. Usually

it is the older, well-established companies that pay a higher percentage, and

these companies also usually have a more consistent dividend history than

younger companies. Dividend yield is calculated as follows:

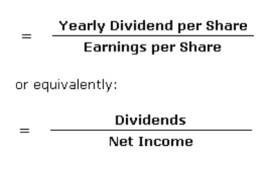

7. Dividend payout ratio

Dividend payout ratio is the fraction of net income a firm pays to its stockholders in

dividends:

The part of

the earnings not paid to investors is left for investment to provide for future

earnings growth. Investors seeking high current income and limited capital

growth prefer companies with high Dividend payout ratio. However investors

seeking capital growth may prefer lower payout ratio because capital gains are

taxed at a lower rate. High growth firms in early life generally have low or

zero payout ratios. As they mature, they tend to return more of the earnings

back to investors. Note that dividend payout ratio is calculated as EPS/DPS.

Calculated as:

The payout ratio provides an idea of how

well earnings support the dividend payments. More mature companies tend to have

a higher payout ratio. In the U.K. there is a similar ratio, which is known as

dividend cover. It is calculated as earnings per share divided by dividends per

share.

8. Return on Equity

Return on

equity (ROE) is a measure of how much, in

earnings a company generates in a time period compared to its

shareholders' equity. It is typically calculated on a full-year basis (either

the last fiscal year or the last four quarters).

Expanded Definition

When

capital is tied up in a business, the owners of the capital want to see a good

return on that capital. Looking at profit by itself is meaningless. I mean, if

a company earns $1 million in net income, that's okay. But its great if the

capital invested to earn that is only $2.5 million (40% return) and terrible if

the capital invested is $25 million (4% return).

Return on investment measures how

profitable the company is for the owner of the investment. In this case, return

on equity measures how profitable the company is for the equity owners,

a.k.a. the shareholders.

The "average" is taken over

the time period being calculated and is equal to "the sum of the beginning

equity balance and the ending equity balance, divided by two."

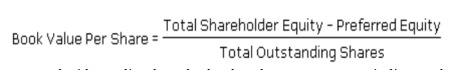

9.Book Value per Share

A measure used by owners of common

shares in a firm to determine the level of safety associated with each

individual share after all debts are paid accordingly.

Should the company decide to dissolve,

the book value per common indicates the dollar value remaining for common

shareholders after all assets are liquidated and all debtors are paid. In

simple terms it would be the amount of money that a holder of a common share would

get if a company were to liquidate.

Grahm and Dodds Investor

ratios:

Eg.,

Earnings per share=

Earnings available for the common shares

/ Weighted average common shares outstanding

Related Topics