Chapter: Business Science : Enterpreneurship Development : Launching of Small Business

Financial Planning - Launching of Small Business

Financial Planning

Working Capital Management

•

Working capital management is concerned with making

sure we have exactly the right amount of money and lines of credit available to

the business at all times

•

Working Capital is the money used to make goods and

attract sales

•

The less Working Capital used to attract sales, the

higher is likely to be the return on investment

•

Working Capital = Current Assets − Current

Liabilities

Working Capital Management

•

Cash Management

•

Receivables Management

•

Inventory Management

Cash Management

•

Identify the cash balance which allows for the

business to meet day to day expenses reduces cash holding costs

Receivables Management

•

Money which is owed to a company by a customer for

products and services provided on credit

•

Identify the appropriate credit policy

•

Inventory

Management

•

Identify the level of inventory which allows for

uninterrupted production

•

Reduces the investment in raw materials, minimizes

reordering costs and hence increases cash flow

Inventory Management

A

company's merchandise, raw materials, and finished and unfinished products

which have not yet been sold. These are considered liquid assets, since they

can be converted into cash quite easily.

Policies,

procedures, and techniques employed in maintaining the optimum number or amount

of each inventory item. The objective of inventory management is to provide

uninterrupted production, sales, and/or customer-service levels at the minimum

cost.

Techniques: -

•

ABC

•

JIT

•

FSN

•

VED

•

BILLS OF MATERIAL

•

BIN CARDS

•

EOQ-ECONOMIC RE-ORDER QUANTITY

•

INVENTORY/TURNOVER

Inventory Management

Importance:-

– TRANSCATIONS

MOTIVE:

It emphasizes the need to maintain inventories to facilitate smooth

production and sales operations

– PRECAUTIONARY

MOTIVE: -

It necessitates holding of inventories to guard against the risk of

unpredictable changes in demand and supply forces and other factors

– SPECULATIVE

MOTIVE: -

It influences the decision to increase or reduce inventory levels to

take the advantage of price level fluctuations

Conflicting

needs : -

– To maintain a large size of inventories of raw

materials and WIP for efficient and smooth production and of finished goods for

uninterrupted sales operations

– To maintain a minimum investment in

inventories to maximize profitability

Objective: -

– determine and maintain optimum level of

inventory investment

– to maintain sufficient inventory for the

smooth production and sales operations

– to avoid excessive and inadequate levels of

inventories

– Making adequate inventories available for production

& sales when required.

Benefits of holding inventories:

Avoiding losses of sales avoid

non-supply of goods at times demands by understands.

Reducing

ordering costs cost associated with individual order such as typing approving

mailiyet can be reduced.

Achieving

efficient production run Supply of sufficient inventories protects against

shortage of raw materials that may interrupt production operation.

Cost of holding inventories:-

Ordering

cost cost which are associated with placing of orders to purchase raw materials

& components. Salary, rent. “More the order the more will be ordering costs

vice verse”.

Carrying

costs cost involved in holding or

carrying inventories like insurance. Charger for covering risk, thefts. It

includes opportunity cost.

Money

blocked in inventories been invested. It would earn a certain return. Loss of

such return may be considered opportunity cost.

Models of inventory mgt:-

Several

models & methods have been developed in recent past for determing the

optimum level of inventories.

Classified into two types:-

Deterministic models:-

There is

no uncertainty associated with demand supply of inventory.

Probabilistic models:-

It always

some degree of uncertainty associated with demand pattern & lead times of

inventories.

Unusually

deterministic models associated:

Economic

ordering quantity.(EOQ)

ABC

analysis.

Inventory

return over ratio.

EOQ:

Important

decision to be taken by a firm in inventory mgt is how much to buy at a time.

This is called EOQ.

EOQ give

solution to other problem like: How frequently to buy? When to buy? What should

be the reserve stock?

Assumptions:-

EOQ is

based on certain assumption.

The firm

knows how much items of particular inventories will be used or demanded. Use of

inventories/sales made by the firm remains constant, or unchanged.

The

moment inventories reach the zero level, the order of inventory is placed

without delay. These assumptions are also called limitations of EOQ.

Determination of EOQ:-

Ordering cost:

Cost concerned

with the placing of an order to acquire inventories. Yes it way from time to

time depending upon the no of items orders places & no of items ordered in

each order.

Carrying cost:

Cost

related to carrying or keeping inventories in a firm.

Ex: interest

on investment, obsolescence, losses, insurance, premium.

Volume of

inventory & carrying cost.

EOQ can

be determined by an approach.

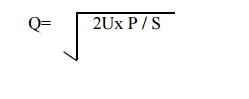

The order-formula approach:-

There are

number of mathematical formula to calculate EOQ. The most frequently used formula

is

Q = EOQ.

U =

Quantity purchased in a year/month.

P = Cost

of placing an order. (ordering cost)

S =

Annual/ monthly cost of storage of one unit known (carrying cost)

Trial & Error Approach:-

Carrying

& ordering cost should be studied “order formula approach”.

Graphic Approach:

EOQ can

found by drawing a graph.

ABC Analysis:-

A – Items

with highest value.

B – Items

with relatively low value.

C – Items

with least valuable.

A – items

maintain bare minimum necessary level of inventories.

B – items

will be kept under reasonable control.

C – items

would be under simple control.

FSN – Fast moving, Slow moving, Non-moving.

Fast

moving in order of have smooth production.High demand – adequate inventory of

these items maintained

Slow

moving items:-Slowly moving indicated by a low turnover ratio needed to

maintain at minimum level.

Dormant/obsolete

items have no demand these should be disposed of a early as possible to curb

further losses caused by them.

Inventory turnover Ratio:

=Cost of

goods consumed or sold during year/ Average inventory during the year x 100

Related Topics