Accountancy - Double column cash book (Cash book with cash and discount column) | 11th Accountancy : Chapter 7 : Subsidiary Books - II Cash Book

Chapter: 11th Accountancy : Chapter 7 : Subsidiary Books - II Cash Book

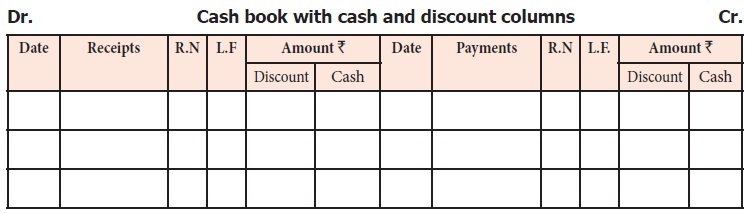

Double column cash book (Cash book with cash and discount column)

Double column cash book (Cash book

with cash and discount column)

It is a cash

book with cash and discount columns. As there are two columns, i.e., discount

and cash columns, both on debit and credit sides, this cash book is known as

‘double column cash book’.

The double

column cash book is prepared on the lines of simple cash book. It has only one

additional column, i.e., discount column on each side. Discount column

represents discount allowed on the debit side and discount received on the

credit side.

In the

discount columns, cash discount, i.e., cash discount allowed and cash discount

received are recorded. The net amount received is entered in the amount column

on the debit side and the net amount paid is entered in the amount column on

the credit side. For the seller who allows cash discount, it is a loss and

hence it is debited and shown on the debit side of the cash book. For the

person making payment, discount received is a gain because less payment is made

and it is credited and shown on the credit side of the cash book.

The cash

columns are balanced. Discount columns are not balanced, since debit represents

discount allowed and credit represents discount received. They are totalled,

separately.

The format of double column cash book is given

below:

Balancing the double column cash book

The cash

columns should be balanced as usual and the balance should be carried forward

to the next date or period.

However,

discount columns are not to be balanced. They are to be totalled on the debit

side and credit side separately. The total of discount column on the debit side

represents total discount allowed to customers and is debited to discount

allowed account. Total of discount column on the credit side represents total

discount received and is credited to discount received account. The periodical

totals of discount columns are posted as under:

·

Debit Discount allowed account as ‘To Sundry

Accounts as per Cash book’, with the periodical total of the discount allowed

column.

·

Credit

Discount received account as ‘By Sundry Accounts as per Cash Book’ with the

periodical total of the discount received column.

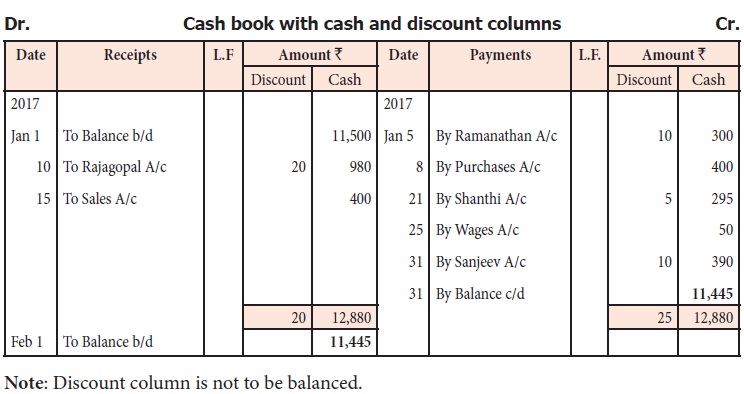

Illustration 3

Enter the following transactions in a cash book

with cash and discount columns:

2017 Rs.

Jan 1 Cash in

hand 11,500

Jan 5 Paid to

Ramanathan by depositing in cash deposit machine 300

Discount

allowed by him 10

Jan 8 Purchased

goods for cash 400

Jan 10 Cash

received from Rajagopal 980

Discount

allowed 20

Jan 15 Sold

goods for cash 400

Jan 21 Paid

cash to Shanthi 295

Discount

received 5

Jan 25 Paid

wages by cash 50

Jan 31 Paid

to Sanjeev Rs. 390 in full settlement of his account 400

Solution

Posting from double column cash book

Following is

the procedure for posting entries from double column cash book:

Cash

columns: Debit the accounts mentioned on the credit side and the credit is to

Cash A/c with the amount mentioned in cash

column; credit the accounts mentioned on the debit side and the debit is for

Cash A/c with the amount mentioned in cash column.

Discount

columns: Debit the concerned personal account mentioned on the credit side and the credit is to Discount received A/c with

the amount mentioned in the discount received column. Credit the concerned

personal account mentioned on the debit side and the debit is for Discount

allowed A/c with the amount entered in the discount allowed column.

Related Topics