Differences | Accountancy - Cash discount and trade discount | 11th Accountancy : Chapter 7 : Subsidiary Books - II Cash Book

Chapter: 11th Accountancy : Chapter 7 : Subsidiary Books - II Cash Book

Cash discount and trade discount

Cash discount and trade discount

a) Cash discount

Cash discount

is allowed to the parties making prompt payment within the stipulated period of

time or early payment. It is discount allowed (loss) for the creditor and

discount received (gain) for the debtor who makes payment. The discount is

allowed when payment is received or made and hence, the entry for discount is

also passed with the entry of payment. The earlier the payment, the more may be

the discount. Cash discount motivates the debtor to make the payment at an

earlier date to avail discount facility. For example, the terms may be.

“5% discount will be allowed if the payment is made

within one month.

3% discount will be allowed if the payment is made

within two months”.

Discount allowed account will be shown on the debit

side of profit and loss account and discount received account will be shown on

the credit side of profit and loss account. When cash discount is allowed in

respect of sale of goods or services, the seller allows cash discount to the

buyer when payment is made.

b) Trade discount

Trade

discount is a deduction given by the supplier to the buyer on the list price or

catalogue price of the goods. It is given as a trade practice or when goods are

purchased in large quantities. It is shown as a deduction in the invoice. Trade

discount is not recorded in the books of accounts. Only the net amount is

recorded. Example: Suppose the sale of goods for 10,000 was made and 10% was

allowed as trade discount, the entry regarding sales will be made for Rs. 9,000 (10,000 – 10 per

cent of 10,000). In the same way, purchaser of goods will also record purchases

as Rs. 9,000).

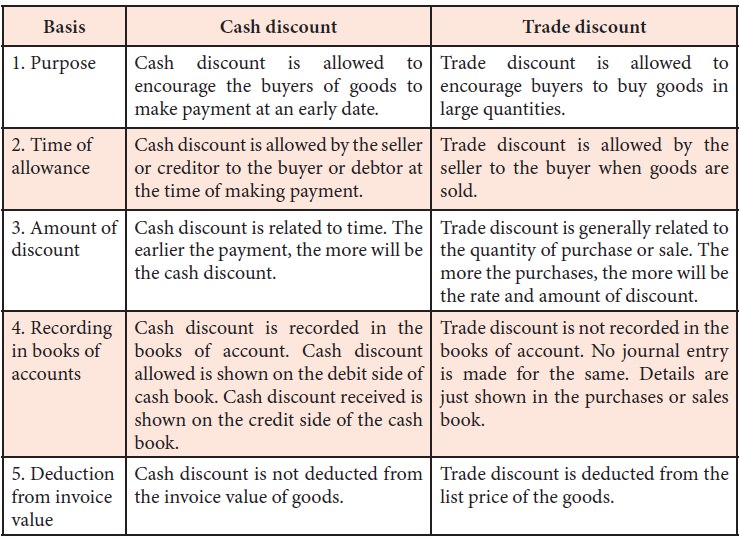

Differences between cash discount and trade discount

Following are the difference between cash discount

and trade discount:

Related Topics