Auditing - Different Methods of Charging Depreciation | 12th Auditing : Chapter 7 : Depreciation

Chapter: 12th Auditing : Chapter 7 : Depreciation

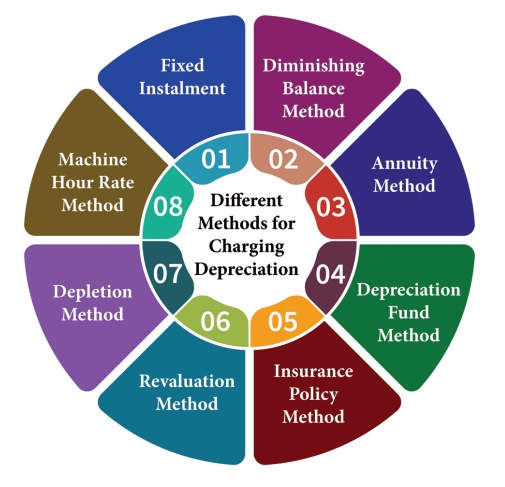

Different Methods of Charging Depreciation

Different Methods of Charging Depreciation

1. Straight Line (Or) Fixed Instalment Method

This is

the oldest and simplest method of charging depreciation. The life of the asset

is estimated and depreciation is written off equally over the life of an asset.

The amount of depreciation is such that the book value of the asset is reduced

to zero at the end of life of the asset. The amount of depreciation is

calculated as follows:

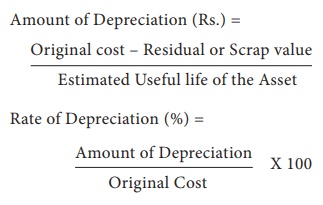

Amount

of Depreciation (Rs.) = Original cost – Residual or

Scrap value / Estimated Useful life of the Asset

Rate of

Depreciation (%) = [ Amount of Depreciation / Original Cost ] X 100

ADVANTAGES

1. Simple to Understand: This

method of calculating depreciation

is very simple to understand.

2. Easy to Calculate: It is

easy to calculate the amount and

rate of depreciation.

3. Accuracy: In this method, the book value of the asset, i.e., cost price

of the asset less depreciation, becomes zero or equal to its scrap value of the

expiry of its useful life.

DISADVANTAGES

1. Difficulty in Calculating Depreciation: Calculation

of depreciation is easy only when life of the original asset and its additions

are similar. When both have varied life calculation becomes difficult and

complicated.

2. No Provision for Replacement of Asset: This

method does not provide any

provision for replacement of asset on the expiry of its useful life.

3. This

method increases the charge to the Profit and Loss Account over the years

because the repairs to an old asset increases.

4. This

method increases the cost of the asset over the years as the amount of

depreciation is fixed over the years.

2. Diminishing or Written Down Value Method

In this

method depreciation is charged at a fixed percentage on the reducing balance of

the asset every year over the useful life of the asset. The amount of depreciation

goes on decreasing every year. This method is very useful for plant and

machinery where additions and extensions take place very often.

ADVANTAGES

1. It is

a simple method of providing depreciation as fixed rate is applied on book

value or written down value of assets.

2. This

method is quite popular.

3. It

provides uniform charge for services of the assets throughout the life.

DISADVANTAGES

1. The

method is slightly complicated.

2. If

the asset has no residual value it is very difficult to calculate the rate.

SUITABILITY

This

method of charging depreciation is suitable when – (a) the possibility of

obsolescence are more, and (b) the amount of repairs and renewals increases as

the asset grows older.

3. ANNUITY METHOD

Annuity

method considers both the value of asset and the amount of interest on the

investment made in the fixed asset. Besides, interest, a fixed amount of

depreciation is calculated on the basis of depreciation from Annuity Table and

is charged to Profit and Loss Account every year. The method is precise and

exact from the point of view of calculations, so it is called a scientific

method.

ADVANTAGES

1. This

method takes interest on capital invested in the asset into account.

2. It is

regarded as most exact and precise from the point of view of calculations and

is therefore most scientific.

DISADVANTAGES

1. The

system is complicated and difficult to understand.

2. The

ultimate consequences being that the net burden on profit and loss account

grows heavier each year.

4. DEPRECIATION FUND METHOD

This

method provides funds for the replacement of the asset at the end of its life.

The amount of depreciation is credited to an account called Sinking Fund or

Depreciation Fund account which is shown on the liabilities side of the balance

sheet. This amount is invested in securities.

Every

year the amount set aside for depreciation along with the interest is again

invested. The amount so invested is debited to an account known as Sinking Fund

Investment Account and these investments are shown as an asset in the Balance

Sheet. The amount of depreciation remains the same for the year.

The rate

of interest available from investments and the time required for replacement of

the assets enables determine the amount of depreciation. A reference to Sinking

Fund Table gives the extra amount of depreciation to be charged year after

year. The investments are sold when the asset is due for replacement and the

amount so received is used for purchasing the new asset.

The

value of asset is shown at its original cost in all years. In the last year,

the asset is written off by transferring it to Depreciation Fund Account.

This

method is suitable where intention is not to provide depreciation but also to

provide for its replacement as happens in case of Plant and Machinery and many

wasting assets.

ADVANTAGES

1. This

method sets aside certain amount for replacement of asset by maintaining

separate provision.

2. The

sale proceeds of the investments are useful for replacement of the asset.

3. This

method helps to strengthen financial position of a concern.

DISADVANTAGES

1. This method creates complication and burden on

funds each year as they are invested outside.

2. Prices

of securities may fall at the time when they are to be realized as a result of

which loss may have to be suffered.

5. INSURANCE POLICY METHOD

In this

method an insurance policy is purchased for the value of the asset. This policy

is taken up for the life of the asset and it matures at a time when the asset

is to be replaced. The amount provided for depreciation is paid towards

insurance premium. The amount of premium remains the same in all the years. On

maturity of the policy, insurance company will pay the amount and the amount

will be used for replacing the asset.

ADVANTAGES

1. Funds

are readily available for replacement of the asset.

2. Funds

are not used for other purposes as they are invested outside.

3. There

is no risk in getting back the money as the policy is taken with the insurance

company.

DISADVANTAGES

The

drawback of this method is that it creates an increasing burden on the funds of

each year as they are invested outside.

6. REVALUATION METHOD

In this

method the amount of depreciation is calculated by revaluing the asset at the

end of each year. The difference between the value of the asset at the

beginning and at the end of the period is taken as depreciation. There can be

an appreciation in value too. The amount of appreciation is debited to the

asset and credited to profit and loss account.

ADVANTAGES

·

It is easy to understand and simple to implement.

·

Depreciation is calculated every year in the

opening balance of asset.

·

This method equalizes the yearly burden on

profit and loss account in respect of depreciation.

DISADVANTAGES

·

This method charges heavy amount of

depreciation in earlier years.

·

It is difficult to assess the life of these

assets, calculation of depreciation becomes complicated.

·

The formula to obtain rate of depreciation can

be applied only when there is residual value of the asset.

·

This method has limited applicability.

7. DEPLETION METHOD

This

method is specially used for those assets which deplete with use. The cost of

the assets is divided by total workable deposits. The depreciation rate is

calculated by dividing the cost of the asset by the estimated quantity of

product likely to be available. Annual depreciation will be the quantity

extracted multiplied by the rate per unit.

For

example, If a mine has 2 lakh tons of coal and the value of mine is â‚ą 5 lakhs,

each ton of coal will cost â‚ą 2.50.

The

quantity of coal taken out of the mine in a period will be multiplied by the

rate per ton, i.e., â‚ą 2.50 and the resultant figure will be the amount of

depreciation.

ADVANTAGES

·

It provides a method to charge amortization or

depreciation for the companies dealing in resources, as these assets are

different in nature and consumption from other fixed assets like car, building

etc.

·

The method is easy to understand.

DISADVANTAGES

·

The method is simply used for a periodic

reduction in the cost of the asset.

·

The method is highly subjective especially the

number of units to be extracted is difficult to estimate.

8. MACHINE HOUR RATE METHOD

Under

this method, the life of a machine is estimated in terms of its working hours

instead of years. The total number of hours in which a particular machine will

work efficiently is estimated. The estimated number of hours is then divided by

the cost of the machinery less residual value to ascertain the hourly rate of

depreciation.

This

method is considered more scientific and precise than either the fixed installment

method or the reducing balance method.

ADVANTAGES

·

It helps to compare the relative efficiencies

and cost of operating different machines.

·

It is most scientific, practical and accurate

method of recovery of manufacturing overheads.

·

It provides ready method for measuring the cost

of idle machines.

DISADVANTAGES

·

It involves additional work in assessing the

working hours of machines and thus it is a costly method.

·

It gives inaccurate results if manual labour is

also used.

Related Topics