Auditing - Causes for Depreciation | 12th Auditing : Chapter 7 : Depreciation

Chapter: 12th Auditing : Chapter 7 : Depreciation

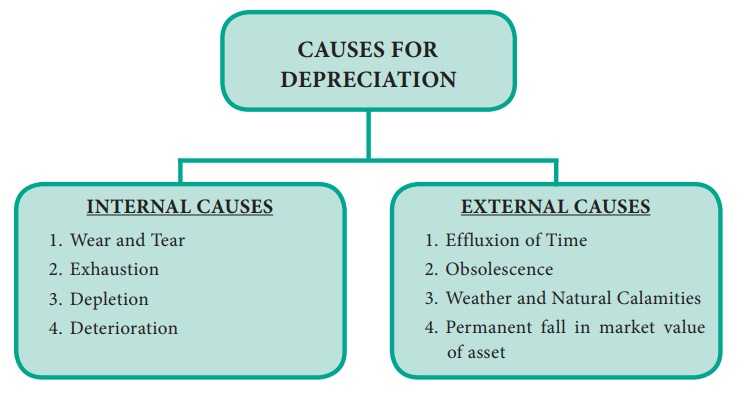

Causes for Depreciation

Causes For Depreciation

The

causes of depreciation can be classified as – (1) Internal causes, and (2)

External causes.

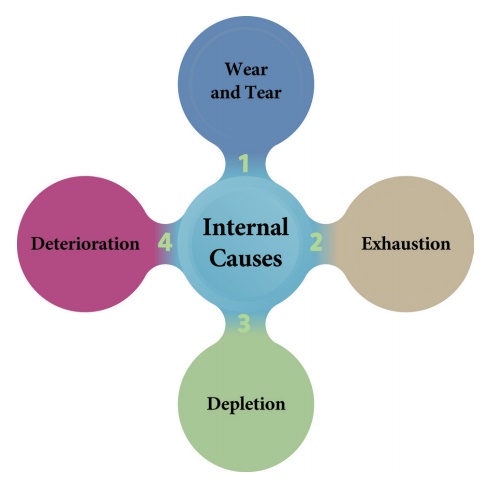

INTERNAL CAUSES

Wear and

tear, exhaustion, depletion, deterioration etc., causes depreciation on assets

which are internal in nature.

1. Wear and Tear: The value of capital assets like plant, machinery, building

etc. decrease in value due to constant use. The wear and tear of an asset

depends on the usage of asset. For example, when machinery is used for three

shifts the wear and tear will be greater than the machinery which is used on a

single shift. The difference between the value of an asset when it was

purchased and its value after being used for some time period represents wear

and tear of the asset.

2. Exhaustion: Certain assets like plantations and livestock loose their

value with lapse of time as they are being used or consumed. These assets have

a definite period of life after which they exhaust in value and become useless.

3. Depletion: Natural resources such as mines, quarries and oil wells are

of a wasting character and are called as wasting asset. These assets loose

their value due to extraction of oil, depletion of minerals and metals. Thus,

the value of wasting assets declines due to gradual exhaustion.

4. Deterioration: Deterioration means erosion in value of those assets which

have a very short period of life. The fall in value of those assets refers to

depreciation.

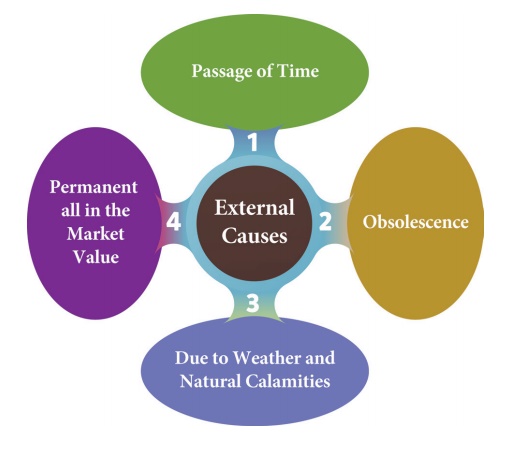

EXTERNAL CAUSES

External

factors which cause depreciation include passage of time, obsolescence,

permanent fall in market value and due to weather and accidental calamities.

These factors are not connected to the inherent nature of the asset.

1. Effluxion or Passage of Time: The utility of some fixed assets like

patents, copyrights, trademarks, leasehold property etc. is confined to a time

frame. The value of the asset decreases after a particular period of time. For

example, asset like lease hold property becomes valueless after the expiry of

the period of lease.

2. Obsolescence: The value of an asset decreases due to – (a) inventions of

new and improved techniques or production methods, for example, old machines

become out dated with the introduction of new machines, (b) decline in market

due to change in taste and fashions, or change in market conditions, for

example, the demand for a product or service falls to such a level that it is

no longer viable to continue with that product or service, (d) legal

restraints, etc. These factors make it economical to replace the assets though

they are still usable.

3. Due to Weather and Natural Calamities: Some

assets lose in value when they are constantly exposed to rain, sun, wind etc.

and certain assets decline in value when they are affected by certain natural

calamities like flood, earth quake, fire etc.

4. Permanent fall in the Market Value: Assets

like investments lose in value due to permanent fall in market value of the

asset. Such a fall in the price of an asset should be treated as depreciation.

Temporary fall in the value of investments should be ignored for calculating

depreciation.

Related Topics