Auditing - AuditorŌĆÖs Duties with Regard to Depreciation | 12th Auditing : Chapter 7 : Depreciation

Chapter: 12th Auditing : Chapter 7 : Depreciation

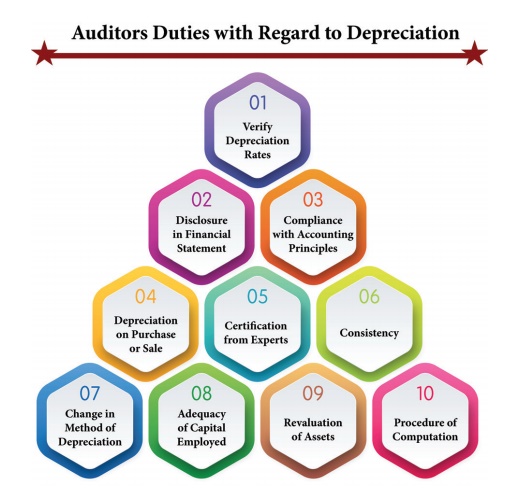

AuditorŌĆÖs Duties with Regard to Depreciation

AuditorŌĆÖs Duties with Regard to Depreciation

An

auditor is not a valuer to determine the value of assets held by the company.

He has to depend on the suggestions and advice given by professional experts in

determining the value and estimated life of the asset. However, the following

are the duties of an auditor in this regard.

1. Verify Depreciation Rates: The auditor

should ensure that depreciation has been provided as per the rates prescribed

by the Companies Act.

2. Disclosure in Financial Statement: He

should ascertain that adequate depreciation is charged and properly disclosed

in the Profit and Loss Account and Balance Sheet.

3. Compliance with Accounting Principles:

He should ensure that relevant accounting principles have been followed while

providing for depreciation.

4. Depreciation on

Purchase or Sale: When assets are purchased or sold

during the year, auditor

should ensure that depreciation is charged on pro-rata

basis taking into account the date of purchase or sale and the accounting

period.

![]() 5. Certification from Experts: In case the depreciation charged is

more than the rates prescribed, he should examine whether same are based on

professional and technical advice.

5. Certification from Experts: In case the depreciation charged is

more than the rates prescribed, he should examine whether same are based on

professional and technical advice.

6. Consistency: Where difference rates are

used for different assets, the same should be consistently applied over the

years.

7. Change in Method of Depreciation: In

case of a change in the method of

accounting for depreciation

it is recalculated from the date

on which asset came into use and deficiency, if any, has been charged to Profit

and Loss Account.

8. Adequacy

of Capital Employed: Auditor should check whether

the capital employed in the assets is being kept intact.

9. Revaluation of Assets: In case of

revaluation of asset during the year he should ensure that depreciation is

charged on revalued amounts.

10. Procedure of Computation: He should ensure that the procedure for

calculating depreciation complies with the provisions of Companies Act and

Income tax Act.

Related Topics