Economics - Cost Concepts | 11th Economics : Chapter 4 : Cost and Revenue Analysis

Chapter: 11th Economics : Chapter 4 : Cost and Revenue Analysis

Cost Concepts

Cost

Concepts

1. Money Cost

Production

cost expressed in money terms is called as money cost. In other words, it is

the total money expenses incurred by a firm in producing a commodity. Money

cost includes the expenditures such as cost of raw materials, payment of wages

and salaries, payment of rent, interest on capital, expenses on fuel and power,

expenses on transportation and other types of production related costs. These

costs are considered as out of pocket expenses. Money costs are also called as

Prime Cost or Direct Cost or Nominal Cost or Accounting Cost or Explicit Cost

or Out of Pocket Cost, suiting to context.

2. Real Cost

Real cost

refers to the payment made to compensate the efforts and sacrifices of all

factor owners for their services in production. It includes the efforts and

sacrifices of landlords in the use of land, capitalists to

save and invest, and workers in foregoing leisure. Adam Smith regarded pains

and sacrifices of labour as real cost of production.

3. Explicit Cost

Payment

made to others for the purchase of factors of production is known as Explicit

Costs. It refers to the actual expenditures of the firm to purchase or hire the

inputs the firm needs. Explicit cost includes, wages, ii) payment for raw

material, iii) rent for the building, iv) interest for capital invested, v)

expenditure on transport and advertisement vi) other expenses like license fee,

depreciation and insurance charges, etc. It is also called Accounting Cost or

Out of Pocket Cost or Money Cost.

4. Implicit Cost

Payment

made to the use of resources that the firm already owns, is known as Implicit

Cost. In simple terms, Implicit Cost refers to the imputed cost of a firm’s

self-owned and self-employed resources. A firm or producer may use his own

land, building, machinery, car and other factors in the process of production.

These costs are not recorded under normal accounting practices as no cash

payment takes place. However, the value of the own services are imputed and

considered for preparing the profit and loss accounts. Implicit Cost is also

called as Imputed Cost or Book Cost.

Economic

Cost = Implicit Cost + Explicit Cost

5. Economic Cost

It refers

to all payments made to the resources owned and purchased or hired by the firm

in order to ensure their regular supply to the process of production. It is the

summation of explicit and implicit costs. Economic Cost is relevant to

calculate the normal profit and thereby the economic profit of a firm.

6. Social Cost

It refers

to the total cost borne by the society due to the production of a commodity.

Alfred Marshall defined the term social cost to represent the efforts and

sacrifices undergone by the various members of the society in producing a

commodity. Social

Cost is

the cost that is not borne by the firm, but incurred by others in the society.

For example, large business firms cause air pollution, water pollution and

other damages in a particular area which involve cost to the society. These

costs are treated as social cost. It is also called as External Cost.

7. Opportunity Cost

It refers

to the cost of next best alternative use. In other words, it is the value of

the next best alternative foregone. For example, a farmer can cultivate both

paddy and sugarcane in a farm land. If he cultivates paddy, the opportunity

cost of paddy output is the amount of sugarcane output given up. Opportunity

Cost is also called as ‘Alternative Cost’ or ‘Transfer Cost’.

8. Sunk Cost

A cost

incurred in the past and cannot be recovered in future is called as Sunk Cost.

This is historical but irrelevant for future business decisions. It is called

as sunk because, they are unalterable, unrecoverable, and if once invested it

should be treated as drowned or disappeared. For example, if a firm purchases a

specialized equipment designed for a special plant, the expenditure on this

equipment is a sunk cost, because it has no alternative use and its opportunity

Cost is zero. Sunk cost is also called as ‘Retrospective Cost’.

9. Floating Cost

It refers

to all expenses that are directly associated with business activities but not

with asset creation. It does not include the purchase of raw material as it is

part of current assets. It includes payments like wages to workers,

transportation charges, fee for power and administration. Floating cost is

necessary to run the day-to-day business of a firm.

10. Prime Cost

All costs

that vary with output, together with the cost of administration are known as

Prime Cost. In short, Prime cost = Variable costs + Costs of Administration.

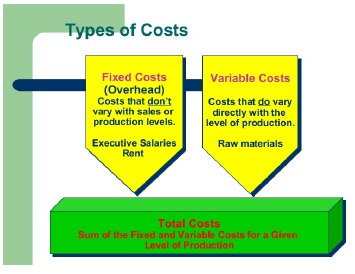

11. Fixed Cost

Fixed

Cost does not change with the change in the quantity of output. In other words,

expenses on fixed factors remain unchanged irrespective of the level of output,

whether the output is increased or decreased or even it becomes zero. For

example, rent of the factory, watchman’s wages, permanent worker’s salary,

payments for minimum equipments and machines insurance premium, deposit for

power, license fee, etc fixed cost is also called as ‘Supplementary Cost’ or

‘Overhead Cost’.

12. Variable Cost

These

costs vary with the level of output. Examples of variable costs are: wages of

temporary workers, cost of raw materials, fuel cost, electricity charges, etc.

Variable

cost is also called as Prime Cost, Special Cost, or Direct Cost.

Related Topics