Chapter: Business Science : Marketing Management : Marketing strategy

Competitor Analysis

Competitor Analysis

In

formulating business strategy, managers must consider the strategies of the

firm's competitors. While in highly fragmented commodity industries the moves

of any single competitor may be less important, in concentrated industries competitor analysis becomes a vital

part of strategic planning.

Competitor

analysis has two primary activities, 1) obtaining information about important

competitors, and 2) using that information to predict competitor behavior. The

goal of competitor analysis is to understand:

with

which competitors to compete,

competitors'

strategies and planned actions,

how

competitors might react to a firm's actions,

how to

influence competitor behavior to the firm's own advantage.

Casual

knowledge about competitors usually is insufficient in competitor analysis.

Rather, competitors should be analyzed systematically, using organized

competitor intelligence-gathering to compile a wide array of information so

that well informed strategy decisions can be made.

1.Competitor Analysis Framework

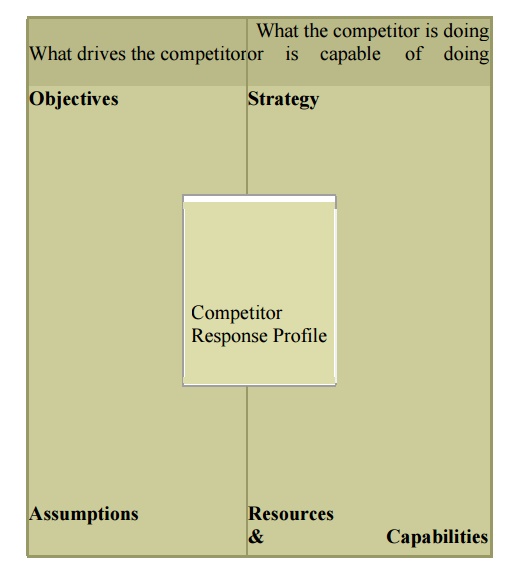

Michael

Porter presented a framework for analyzing competitors. This framework is based

on the following four key aspects of a competitor:

Competitor's

objectives Competitor's assumptions

Competitor's

strategy Competitor's capabilities

Objectives

and assumptions are what drive the competitor, and strategy and capabilities

are what the competitor is doing or is capable of doing. These components can

be depicted as shown in the following diagram:

2.Competitor Analysis Components

A

competitor analysis should include the more important existing competitors as

well as potential competitors such as those firms that might enter the

industry, for example, by extending their present strategy or by vertically

integrating.

3Competitor's Current Strategy

The two

main sources of information about a competitor's strategy is what the

competitor says and what it does. What a competitor is saying about its

strategy is revealed in:

annual

shareholder reports 10K reports

interviews

with analysts statements by managers press releases

However,

this stated strategy often differs from what the competitor actually is doing.

What the competitor is doing is evident in where its cash flow is directed,

such as in the following tangible actions:

hiring activity

R & D projects

capital

investments

promotional

campaigns strategic partnerships

mergers

and acquisitions

4.Competitor's Objectives

Knowledge

of a competitor's objectives facilitates a better prediction of the

competitor's reaction to different competitive moves. For example, a competitor

that is focused on reaching short-term financial goals might not be willing to

spend much money responding to a competitive attack. Rather, such a competitor

might favor focusing on the products that hold positions that better can be

defended. On the other hand, a company that has no short term profitability

objectives might be willing to participate in destructive price competition in

which neither firm earns a profit.

Competitor

objectives may be financial or other types. Some examples include growth rate,

market share, and technology leadership. Goals may be associated with each

hierarchical level of strategy - corporate, business unit, and functional

level.

The

competitor's organizational structure provides clues as to which functions of

the company are deemed to be the more important. For example, those functions

that report directly to the chief executive officer are likely to be given

priority over those that report to a senior vice president.

Other

aspects of the competitor that serve as indicators of its objectives include

risk tolerance, management incentives, backgrounds of the executives,

composition of the board of directors, legal or contractual restrictions, and

any additional corporate-level goals that may influence the competing business

unit.

Whether

the competitor is meeting its objectives provides an indication of how likely

it is to change its strategy.

5.Competitor's Assumptions

The

assumptions that a competitor's managers hold about their firm and their

industry help to define the moves that they will consider. For example, if in

the past the industry introduced a new type of product that failed, the

industry executives may assume that there is no market for the product. Such

assumptions are not always accurate and if incorrect may present opportunities.

For example, new entrants may have the opportunity to introduce a product

similar to a previously unsuccessful one without retaliation because incumbant

firms may not take their threat seriously. Honda was able to enter the U.S.

motorcycle market with a small motorbike because U.S. manufacturers had assumed

that there was no market for small bikes based on their past experience.

A

competitor's assumptions may be based on a number of factors, including any of

the following:

beliefs

about its competitive position past experience with a product

regional

factors industry trends rules of thumb

A

thorough competitor analysis also would include assumptions that a competitor

makes about its own competitors, and whether that assessment is accurate.

6.Competitor's Resources and

Capabilities

Knowledge

of the competitor's assumptions, objectives, and current strategy is useful in

understanding how the competitor might want to respond to a competitive attack.

However, its resources and capabilities determine its ability to respond

effectively.

A

competitor's capabilities can be analyzed according to its strengths and

weaknesses in various functional areas, as is done in a SWOT analysis. The

competitor's strengths define its capabilities. The analysis can be taken

further to evaluate the competitor's ability to increase its capabilities in

certain areas. A financial analysis can be performed to reveal its sustainable

growth rate.

Finally,

since the competitive environment is dynamic, the competitor's ability to react

swiftly to change should be evaluated. Some firms have heavy momentum and may

continue for many years in the same direction before adapting. Others are able

to mobilize and adapt very quickly. Factors that slow a company down include

low cash reserves, large investments in fixed assets, and an organizational

structure that hinders quick action.

7.Competitor Response Profile

Information

from an analysis of the competitor's objectives, assumptions, strategy, and

capabilities can be compiled into a response profile of possible moves that

might be made by the competitor. This profile includes both potential offensive

and defensive moves. The specific moves and their expected strength can be

estimated using information gleaned from the analysis.

The

result of the competitor analysis should be an improved ability to predict the

competitor's behavior and even to influence that behavior to the firm's

advantage.

8.ANALYSIS OF CONSUMER &

INDUSTRY MARKETS

What

makes SWOT particularly powerful is that, with a little thought, it can help

you uncover opportunities that you are well placed to exploit. And by

understanding the weaknesses of your business, you can manage and eliminate

threats that would otherwise catch you unawares.

More than

this, by looking at yourself and your competitors using the SWOT framework, you

can start to craft a strategy that helps you distinguish yourself from your

competitors, so that you can compete successfully in your market.

8.1.How to Use the Tool

To carry

out a SWOT Analysis, start by downloading our free template. Then

answer the following questions:

8.2..Strengths:

What

advantages does your company have?

What do

you do better than anyone else?

What

unique or lowest-cost resources do you have access to? What do people in your

market see as your strengths?

What

factors mean that you "get the sale"?

Consider

this from an internal perspective, and from the point of view of your customers

and people in your market. Be realistic: It's far too easy to fall prey to

"not invented here syndrome". (If you are having any difficulty with

this, try writing down a list of your characteristics. Some of these will

hopefully be strengths!)

In

looking at your strengths, think about them in relation to your competitors -

for example, if all your competitors provide high quality products, then a high

quality production process is not a strength in the market, it is a necessity.

8.3.Weaknesses:

What

could you improve? What should you avoid?

What are

people in your market likely to see as weaknesses? What factors lose you sales?

Again,

consider this from an internal and external basis: Do other people seem to

perceive weaknesses that you do not see? Are your competitors doing any better

than you? It is best to be realistic now, and face any unpleasant truths as

soon as possible.

8.4..Opportunities:

Where are

the good opportunities facing you?

What are

the interesting trends you are aware of? Useful opportunities can come from

such things as:

Changes

in technology and markets on both a broad and narrow scale. Changes in

government policy related to your field.

Changes

in social patterns, population profiles, lifestyle changes. Local events.

A useful

approach for looking at opportunities is to look at your strengths and ask

yourself whether these open up any opportunities.

Alternatively,

look at your weaknesses and ask yourself whether you could create opportunities

by eliminating them.

8.5Threats:

What

obstacles do you face?

What is

your competition doing that you should be worried about?

Are the

required specifications for your job, products or services changing? Is

changing technology threatening your position?

Do you

have bad debt or cash-flow problems?

Could any

of your weaknesses seriously threaten your business?

Carrying

out this analysis will often be illuminating – both in terms of pointing out what

needs to be done, and in putting problems into perspective.

Strengths and weaknesses are often internal to your

organization.Opportunities and threats often relate to external

factors. For this reason the SWOT Analysis is sometimes called Internal-External Analysis and the SWOT Matrix is sometimes

called an IE Matrix Analysis Tool.

You can

also apply SWOT Analysis to your competitors. As you do this, you'll start to

see how and where you should compete against them.

8.6..Marketing Strategies for

Service Firms

Services

firms require attention additional 3Ps according to Booms and Bitner. The

additional 3Ps are people, physical evidence and process.

The

marketing department or function has a say and a view on these additional Ps.

In a

service business companies employees are in direct contact with the customer

and hence their behavior with the customer has an influence on customer

satisfaction. Ideally employees should exhibit competence, a caring attitude,

responsiveness, initiative, problem solving ability, and goodwill. So they have

to be trained to exhibit appropriate behavior. The employees must have

authority to solve problems that arise in service encounters without much delay

and contacting various levels of supervisors. This is empowerment of service

employees.

The

physical facilities are important because customers come there and have the

service. Hence the design and maintenance of the facility becomes a marketing

issue.

The

processes used to deliver the services are marketing issues. If the customer

does not like the process he will not come back. Hence market research has to

find out the customer‗s likes and dislikes about the processes.

Hence the

idea that service marketing requires internal marketing or involvement of

marketing function in internal aspects of the company or the firm emerged.

Internal marketing describes the work done by the company and marketing

department to convey the needs of the potential customers to the service

employees and the effort to train them and motivate them to provide exceptional

service to customers.

Another

concept in services marketing is interactive marketing. It refers to the skill

of employees to interact with the client in serving the client. Clients judge

services by technical quality as well as the interaction quality. Whether the

surgeon has done the operation properly or not is the technical quality.

Whether he has shown concern and inspired confidence or not is interaction

quality. Service providers must provide high touch along with high tech.

8.7..Managing the Differentiation

What are

sources for differentiating in service businesses?

Service

offer: while the core service could be the primary service package, a firm can

come out with secondary service features that provide differentiation. We

always have to remember that an additional feature added to a product must be

valued by the customer and has to be profitable to the company. Hence marketers

are involved to find those features which are valued by the customers and

operations or process specialists are involved to deliver the feature at a cost

that is profitable to the company.

Delivery:

Reliability in service can be differentiating feature. Many firms find it

difficulty to provide reliability.

Image:

Developing an image that inspires trust is a differentiating feature.

8.8..Managing Service Quality

Quality

is a differentiator. Parasuraman, Zeithaml, and Berry formulated a

service-quality model that highlights the main requirements for delivering high

service quality.

They identified

possible five gaps that result in poor service.

1.

Gap between consumer expectation and management

perception

1.

Gap between management perception and service

quality specification

2.

Gap between service quality specification and

service delivery

3.

Gap between service deliver and external

communication

4.

Gap between perceived service and expected service

The same

researchers identified five determinants of service quality. According to the

order of preference of the variables is:

Reliability

Responsiveness

Assurance

Empathy

Tangibles

Related Topics