Chapter: Business Science : Human Resource Management : Sustaining Employee Interest

Compensation Plan

Compensation

Plan:

1 Compensation(Meaning and Definition of Compensation)

2 Objectives

of Compensation Planning

3 Factors

Affecting Compensation Planning

4 Various

Modes of Compensation

Compensation Plan

1 Compensation is a tool

used by management for a variety of purpose to further the existence of the company. It is a remuneration

that an employee receives in return for his or her contribution in

theorganisation. So, the employee compensation programs are designed to attract

capable employees to the organisation, to motivate them towards superior

performance and to retain their services over an extended period of time.

Meaning and Definition of

Compensation

In

layman‘s language the word ‗compensation‘ means something, such as money, given

or received as payment for service. The word compensation may be defined as

money received in the performance of work, plus the many kinds of benefits and

services that organization provides their employee. It refers to wide range of

financial and non-financial rewards to employee for their service rendered to

the organization. It is paid in the form of wages, salaries , special allowance

and employee benefits such as paid vacation, insurance, maternity leaves, free

travel facility , retirement benefits etc.

According to Wendell French,‖ Compensation is a comprehensive term

which includes wages, salaries and

all other allowance and benefits.‖

Wages are

the remuneration paid for skilled, semi-skilled and unskilled operative

workforce. Salaryis the remuneration of those employees who provides mental

labour to the employer such as supervisor, office staff, executive etc wages

are paid on daily or hourly basis where as salary is paid on monthly basis.

2 Objectives of Compensation

Planning

The basic

purpose or objective of establishing sound compensation is to establish and

maintain an equitable rewards system. The other aim is the establishment and

maintenance of an equitable compensation structure i.e an optimal balancing of

conflicting personnel interest so that the satisfaction of employees

andemployers is maximised and conflicts minimized, the compensation management

is concerned with the financial aspect of employees need, motivation and

rewards.

A sound

compensation structure tries to achieve these objectives:

To

attract manpower in a competitive market.

To control wages and salaries and labour costs by

determining rate change and frequency of increment.

To

maintain satisfaction of employees by exhibiting that remuneration is fair

adequate and equitable. To induce and improved performance, money is an

effective motivator.

a)To

Employees:

i. Employees

are paid according to requirement of their jobs i.e highly skilled jobs are

paid more compensation than low skilled jobs. This eliminates inequalities.

ii. The

chances of favouritism are minimised.

iii.

Jobs sequence and lines of promotion are

established wherever they are applicable.

iv.

Employee‘s moral and motivation are increased

because of the sound compensation structure.

b)To

Employers:

i. They can

systematically plan for and control the turnover in the organization.

ii. A sound

compensation structure reduces the likelihood of friction and grievance over

remunerations.

iii.

It enhance an employee morale and motivation

because adequate and fairly administrative incentives are basis to his wants

and need.

iv.

It attracts qualified employees by ensuring and

adequate payment for all the jobs.

v. In

dealing with a trade union, they can explain the basis of their wages programme

because it is based upon a systematic analysis of jobs and wages facts.

3 Factors Affecting Compensation

Planning

Factors

determining compensation of an employee considerable amount of guess word and

negotiation are involved. But following are the certain factors which have been

extracted as having an important bearing upon the final decision:

Supply and Demand of Labour:

Whatever the organization produces as commodity they desire services and it must pay a price that of workers acting in

concert. If more the labour is required, such as at war time prosperity, there

will be tendency to increase the compensation; whereas the situation when

anything works to decrease the supply of labour, such as restriction by a

particular labour union, there will be a tendency to increase the compensation.

The reverse of each situation is likely to result in a decrease in employee

compensation, provided, labour union, ability to pay, productivity, government

do not intervene.

b)

Ability

to Pay: Labour Unions has often demanded an increase in compensation on the

basis that the firm is prosperous

and able to pay.

c)

Management’s

Philosophy: Management‘s desire to maintain or improve moral,

attract high calibre employees,

reduce turnover, and improve employees standard of living also affect wages, as

does the relative importance of a given position to a firm.

d)

Legislation:

Legislation

related to plays a vital role in determining internal organization practices. Various acts are prescribed by

government of country for wage hours laws. Wage-hour laws set limits on minimum

wages to be paid and maximum hours to be worked. In India minimum wages act

1948 reflecting the wage policy for an organization and fixation of minimum

rates of wages to workers in sweated industries. In 1976 equal remuneration act

was enacted which prohibits discrimination in matters relating to remuneration

on the basis of religion, region or gender.

4 Various Modes of Compensation

Various

modes of compensation are as follows-

a)

Wages and

Salary- Wages represent hourly rates of pay and salary refers to monthly rate of

pay irrespective of the number of hours

worked. They are subject to annual increments. They differ from employee to

employee and depend upon the nature of jobs, seniority and merit.

b)

Incentives-

These are

also known as payment by results. These are paid in addition to wages and salaries. Incentive depends upon

productivity, sales, profit or cost reduction efforts. Incentive scheme are of

two types:

Individual incentive schemes.

Group incentive schemes.

c)

Fringe

Benefits- These are given to employees in the form of benefits such as provident

fund, gratuity, medical care,

hospitalization, accident relief, health insurance, canteen, uniform etc.

d)

Non-

Monetary Benefits- They include challenging job responsibilities,

recognition of merit, growth

prospects, competent supervision, comfortable working condition, job sharing

and flexi time.

Incentives

Incentives

are monetary benefits paid to workmen in lieu of their outstanding performance.

Incentives vary from individual to individual and from period to period for the

same individual. They are universaland are paid in every sector. It works as

motivational force to work for their performance as incentive forms the part

total remuneration. Incentives when added to salary increase the earning thus

increase the standard of living. The advantage of incentive payment are reduced

supervision, better utilisation of equipment, reduced scrap, reduced lost time,

reduced absenteeism and turnover & increased output.

According to Burack & Smith, ―An incentive scheme is a plan or

programme to motivate individual or group

on performance. An incentive programme is most frequently built on monitory

rewards ( incentive pay or monetary bonus ), but may also include a variety of

non monetary rewards or prizes.‖

Kinds of Incentives

Incentives

can be classified under the following categories:

1.

Individual and Organizational Incentives

2.

Financial and Non-Financial Incentives

3.

Positive and Negative Incentives

1) Individual and Organizational

Incentives- According to L.G. Magginson, ―Individual

incentives are the extra

compensation paid to an individual for all production over a specified

magnitude which stems from his exercise of more than normal skill, effort or

concentration when accomplished in a predetermined way involving standard

tools, facilities and materials.‖ Individual performance is measured to

calculate incentive where as organizational or group incentive involve

cooperation among employees, management and union and purport to accomplish

broader objectives such as an organization-wide reduction in labour, material

and supply costs, strengthening of employee loyalty to company, harmonious

management and decreased turnover and absenteeism

I) Individual Incentive System is of two types:

a)Time

based System- It includes Halsey Plan, Rowan Plan, Emerson Plan and Bedeaux

Plan

b)Production

based System- it includes Taylor‘s Differential Piece Rate System, Gantt‘s Task

and Bonus Plan

II)Group

Incentive System is of following types

a)Scalon

Plan

b)

Priestman‘s Plan

c) Co-Partnership

Plan

d)

Profit Sharing

Some

important these plans of incentive wage payments are as follows:

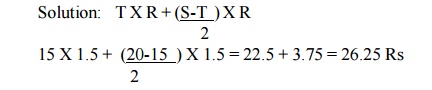

Halsey Plan- Under

this plan a standard time is fixed in advance for completing a work. Bonus is rewarded to the worker who perform

his work in less than the standard time and paid wages according to the time

wage system for the saved time.

The total earnings of the worker

= wages for the actual time + bonus

Bonus =

33.5% of the time saved (standard time set on past experience)

Or

50% of

the time saved (standard are scientifically set)

Example: Time

required to complete job (S) = 20 hours

Actual

Time taken (T) = 15 hours Hourly Rate of Pay (R) = Rs 1.5

Calculate the wage of the worker.

In this

equation 3.75 Rs are the incentives for saving 5 hours.

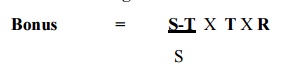

Rowan Plan – Under this method minimum wages

are guaranteed given to worker at the ordinary rate for the time taken to complete the work. Bonus is that

proportion of the wages of the time taken which the time saved bears to the

standard time allowed.

Incentive = Wages for actual time

for completing the work + Bonus where,

Emerson Plan – Under

this system, wages on the time basis are guaranteed even to those workers whose output is below the standard.

The workers who prove efficient are paid a bonus. For the purpose of

determining efficiency, either the standard output per unit of time is fixed,

or the standard time for a job is determined, and efficiency is determined on

the basis of a comparision of actual performance against the standard.

Bedeaux Plan – It

provide comparable standards for all workers. The value of time saved is divided both to the worker and his

supervisor in the ratio of ¾ and ¼ respectively. A supervisor also helps a

worker in saving his time so he is also given some benefit in this method. The

standard time for each job is determined in terms of minutes which are called

Bedeaux points or B‘s. each B represents one minute through time and motion

study. A worker is paid time wages upto standard B‘s or 100% performance. Bonus

is paid when actual performance exceeds standard performance in terms of B‘s.

Taylor’s Differential Piece Rate

System - F.W. Taylor, founder of the scientific management evolved this system of wage payment. Under this system, there is

no guarantee of minimum wages. Standard time and standard work is determined on

the basis of time study. The main characteristics of this system is that two

rates of wage one lower and one higher are fixed. Those who fail in attaining

the standard, are paid at a lower rate and those exceeding the standard or just

attaining the standard get higher rate. Under this system, a serve penalty is

imposed on the inefficient workers because they get the wages at lower rates.

The basic idea underlying in this scheme is to induce the worker at least to

attain the standard but at the same time if a worker is relatively less

efficient, he will lose much. For example, the standard is fixed at 40 units

per day and the piece rate are 40 P. and 50 P. per unit. If a worker produces

40 units or more in a day, he will get the wages at the rate of 50 P per unit

and if he produces 39 units will get the wages at 40 paise per unit for the

total output.

Gantt’s Task and Bonus Plan - In this,

a minimum wage is guaranteed. Minimum wage is given to anybody, who completes the job in standard time. If the

job is completed in less time, then there is a hike in wage-rate. This hike

varies between 25% to 50% of the standard rate.

Profit Sharing – It is a

method of remuneration under which an employer pay his employees a share in form of percentage from the

net profits of an enterprise, in addition to regular wages at fixed intervals

of time.

2) Financial and Non-financial Incentives- Individual

or group performance can be measured in financial

terms. It means that their performance is rewarded in money or cash as it has a

great impact on motivation as a symbol of accomplishment. These incentives form

visible and tangible rewards provided in recognition of accomplishment.

Financial incentives include salary, premium, reward, dividend, income on

investment etc. On the other hand, non-financial incentives are that social and

psychological attraction which encourages people to do the work efficiently and

effectively. Non-financial incentive can be delegation of responsibility, lack

of fear, worker‘s participation, title or promotion, constructive attitude,

security of service, good leadership etc..

Positive and Negative Incentives-

Positive

incentives are those agreeable factors related to work situation which prompt an individual to attain or excel the

standards or objectives set for him, where as negative incentives are those

disagreeable factors in a work situation which an individual wants to avoid and

strives to accomplish the standards required on his or her part. Positive

incentive may include expected promotion, worker‘s preference, competition with

fellow workers and own ‗s record etc. Negative incentives include fear of lay

off, discharge, reduction of salary, disapproval by employer etc.

Fringe Benefits

Employees

are paid several benefits in addition to wages, salary, allowances and bonus.

These benefits and services are called ‗fringe benefits‘ because these are

offered by the employer as a fringe. Employees of the organization are provided

several benefits and services by the employer to maintain and promote employee‘s

favorable attitude towards the work and work environment. It not only increases

their morale but also motivate them. These provided benefits and services forms

the part of salary and are generally refereed as fringe benefits.

According to D. Belcher, ―

Fringe benefits are any wage cost not directly connected with the employees productive effort, performance,

service or sacrifice‖. According to

Werther and Davis, ―Fringe embrace a broad range of benefits and services

that employees receive as part of their total compensation, package-pay or

direct compensation and is based on critical job factors and performance‖.

According to Cockman, ―

Employee benefits are those benefits which are supplied by an employer to

or for the benefits of an employee

and which are not in the form of wages, salaries and time rated payments‖.

These are indirect compensation as they are extended condition of employment

and are not related to performance directly.

Kinds of Fringe Benefits

The

various organizations in India offers fringe benefits that may be categorized

as follows:

1)

Old Age

and Retirement Benefits - these include provident fund schemes, pension

schemes, gratuity and medical

benefits which are provided to employee after their retirement and during old

age as a sense of security about their old age.

2)

Workman’s

Compensation - these benefits are provided to employee if they

are got ignored or die under the

working conditions and the sole responsibility is of the employer.

3)

Employee

Security- Regular wage and salary is given to employee that gives a feeling of

security. Other than this

compensation is also given if there is lay-off or retrenchment in an

organization.

4)

Payment

for Time Not Worked – Under this category of benefits, a worker is

provided payment for the work that

has been performed by him during holidays and also for the work done during odd

shifts. Compensatory holidays for the same number in the same month are given

if the worker has not availed weekly holidays.

5)

Safety

and Health – Under this benefit workers are provided conditions

and requirements regarding working

condition with a view to provide safe working environment. Safety and Health

measures are also taken care of in order to protect the employees against

unhealthy working conditions and accidents.

6)

Health

Benefits – Employees are also provided medical services like

hospital facility, clinical facility

by the organization.

Related Topics