Chapter: Mechanical : Engineering Economics & Cost Analysis : Replacement And Maintenance Analysis

Capital Recovery with Return and Concept of Challenger and Defender

Capital Recovery with Return

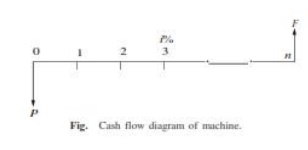

Consider the follow ing data of a machine.

Let

P = purchase priice of the machine,

F = salvage valu e of the machine at the end of machine life,

n = life of the m achine in years, and

i = interest rate,, compounded annually

The corresponding cash flow diagram is shown in Fig

The equation for the annual equivalent amount for the above cash flow diagram is

AE(i) = (P – F ) (A/P, i, n) + F i

This equation represents the capital recovery with return.

Concept of Challenger and Defender

o If an existing equipment is considered for replacement with a new equipment, then the existing equipment is known as the defender and the new equipment is known as challenger.

o Assume that an equipment has been purchased about three years back for Rs. 5,00,000 and it is considered for replacement with a new equipment. The supplier of the new equipment will take the old one for some money, say, Rs. 3,00,000.

o This should be treated as the present value of the existing equipment and it should be considered for all further economic analysis.

o The purchase value of the existing equipment before three years is now known assunk cost, and it should not be considered for further analysis.

EXAMPLE

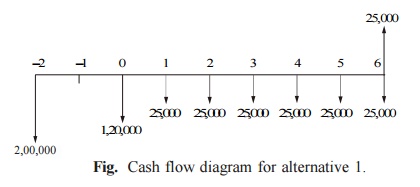

Two years ago, a machine was purchased at a cost of Rs. 2,00,000 to be useful for eight years. Its salvage value at the end of its life is Rs. 25,000. The annual maintenance cost is Rs. 25,000.

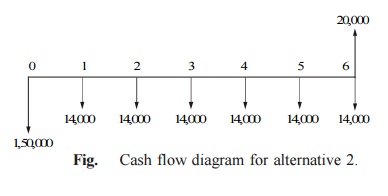

The market value of the present machine is Rs. 1,20,000. Now, a new machine to cater to the need of the present machine is available at Rs. 1,50,000 to be useful for six years. Its annual maintenance cost is Rs. 14,000. The salvage value of the new machine is Rs. 20,000.

Using an interest rate of 12%, find whether it is worth replacing the present machine with the new machine.

Solution

Alternative 1—

Present machine

Purchase price = Rs. 2,00,000

Present value (P) = Rs. 1,20,000

Salvage value (F) = Rs. 25,000

Annual maintenance cost (A) = Rs. 25,000

Remaining life = 6 years

Interest rate = 12%

The cash flow diagram of the present machine is illustrated in Fig.

Fig. Cash flow diagram for alternative 1.

annual maintenance cost for the preceding periods are not shown in this figure. The annual equivalent cost is computed as

AE(12%) = (P – F)(A/P, 12%, 6) + F i + A

= (1,20,000 – 25,000)(0.2432) + 25,000 0.12 + 25,000

= Rs. 51,104

Alternative 2 —

New machine

Purchase price (P) = Rs. 1,50,000

Salvage value (F) = Rs. 20,000

Annual maintenance cost (A) = Rs. 14,000

Life = 6 years

Interest rate = 12%

The cash flow diagram of the new machine is depicted in Fig.

Fig. Cash flow diagram for alternative 2.

The formula for the annual equivalent cost is

AE(12%) = (P – F)(A/P, 12%, 6) + F i + A

= (1,50,000 – 20,000)(0.2432) + 20,000 0.12 + 14,000

= Rs. 48,016

Since the annual equivalent cost of the new machine is less than that of the present machine, it is suggested that the present machine be replaced with the new machine.

Related Topics