Chapter: Business Science : Security Analysis and Portfolio Management : Fundamental Analysis

Measuring and Forecasting Earnings

Measuring

Earnings:

a. Internal Information: Relating to

enterprise

b. External Information: Out side

the company

Financial Indicators:-

Analyze the financial position of the company.

Tools:

a. Income statement

It gives past records of the firm that forms a base for making predictions

of the firm.

b. Balance sheet

It shows the assets and liabilities of a firm along with

shareholder s equity

c. Statement of Cash flows

It shows how a company's cash balance changed from one year to the

next

d. Ratio Analysis

It makes intra firm and inter firm comparisons.

1. Profitability Ratios: a. Return

on Investment:

Earnings before interest and taxes /

Total Assets

b. Leverage

Ratios:

Debt Equity Ratio=Total Debt / Equity

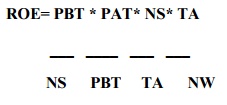

c. ROE Analysis

Non Financial Indicators:

1. Business of the company

2. Top Management

3. Product range

4.

Diversification

5. Foreign collaboration

6.

Availability of cost of

inputs

7. Research and development

8. Governmental regulations

9. Pattern of shareholding and listing

Forecasting

Earnings

1. Identification of variables:

a. Operations and Earnings

Operating cycle of a firm starts with cash converted into

inventory

ROI= EBIT / Investment

b. Financing& Earnings

Debt financing: Provide

leverage to common share holders

Equity financing: Equal

shares

2. Selecting a Forecasting

method:

a. Traditional method

Earnings model: Analysis

EAt & EBT

Market share: Consists of tracking historical record and net income

Projected Financial statements: Projection

of earnings

b. Modern methods:

¸ Regression analysis

It s the

measure of the average relationship between two or more variable in terms of

the original units of the data

¸ Correlation analysis

Its to reduce the range of uncertainty of our prediction

¸ Trend analysis

It refers to collecting information and attempting to spot a

pattern

¸ Decision trees

It used to forecast earnings as security values.

Related Topics